When it comes to tax season, it’s important to have all the necessary forms in order to accurately report your income and expenses. One such form that is crucial for many individuals and businesses is the 1099 form. This form is used to report various types of income, such as freelance earnings, rental income, and more. Having a printable 1099 form from the IRS can make this process much easier and ensure that you are complying with tax laws.

The IRS provides printable 1099 forms on their website for individuals and businesses to use. These forms are essential for reporting income that is not typically included on a W-2 form, such as income from freelance work, rental properties, or investments. By using the IRS printable 1099 form, you can accurately report this income and avoid any potential penalties or audits from the IRS.

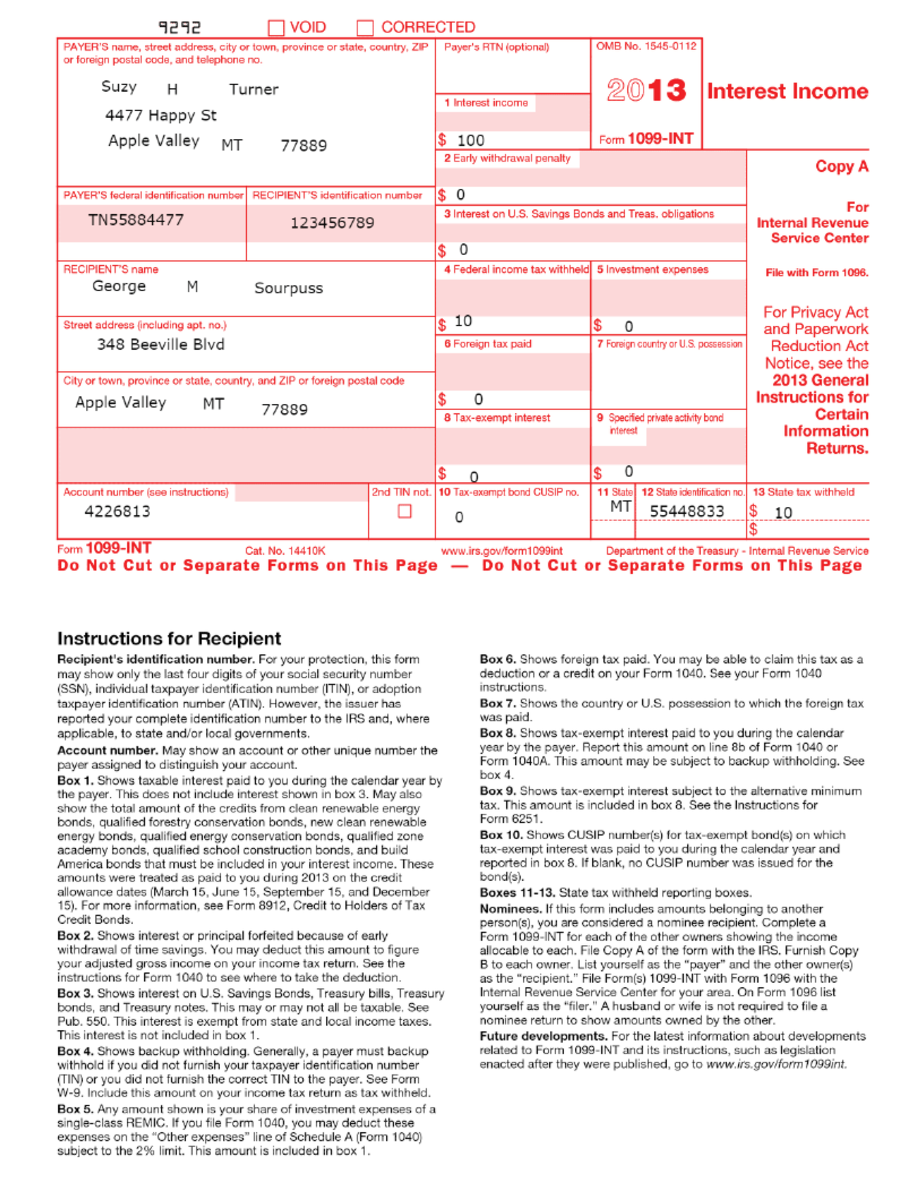

It’s important to note that there are different types of 1099 forms, such as the 1099-MISC for miscellaneous income and the 1099-INT for interest income. Each form serves a specific purpose, so it’s crucial to use the correct form when reporting your income. The IRS website provides instructions on how to fill out each form, making it easy for individuals and businesses to accurately report their income.

By using the IRS printable 1099 form, you can streamline the process of reporting your income and ensure that you are complying with tax laws. These forms are easy to access and download from the IRS website, making it convenient for individuals and businesses to file their taxes accurately. Whether you are a freelancer, landlord, or investor, having a printable 1099 form from the IRS is essential for tax season.

In conclusion, the IRS printable 1099 form is a valuable tool for individuals and businesses to accurately report their income and comply with tax laws. By using these forms, you can avoid potential penalties and audits from the IRS and ensure that your taxes are filed correctly. Make sure to download the appropriate 1099 form from the IRS website and follow the instructions provided to accurately report your income this tax season.