As tax season approaches, individuals and businesses alike are gearing up to file their taxes. One essential document that plays a crucial role in this process is the IRS Printable 1040 Tax Form. This form is used by taxpayers to report their annual income and calculate the amount of tax they owe to the government.

With the IRS Printable 1040 Tax Form, taxpayers can accurately report their income, deductions, and credits to determine their tax liability. Filing this form correctly and on time is essential to avoid penalties and interest charges from the IRS. It is crucial to fill out this form accurately to ensure compliance with tax laws and regulations.

IRS Printable 1040 Tax Form

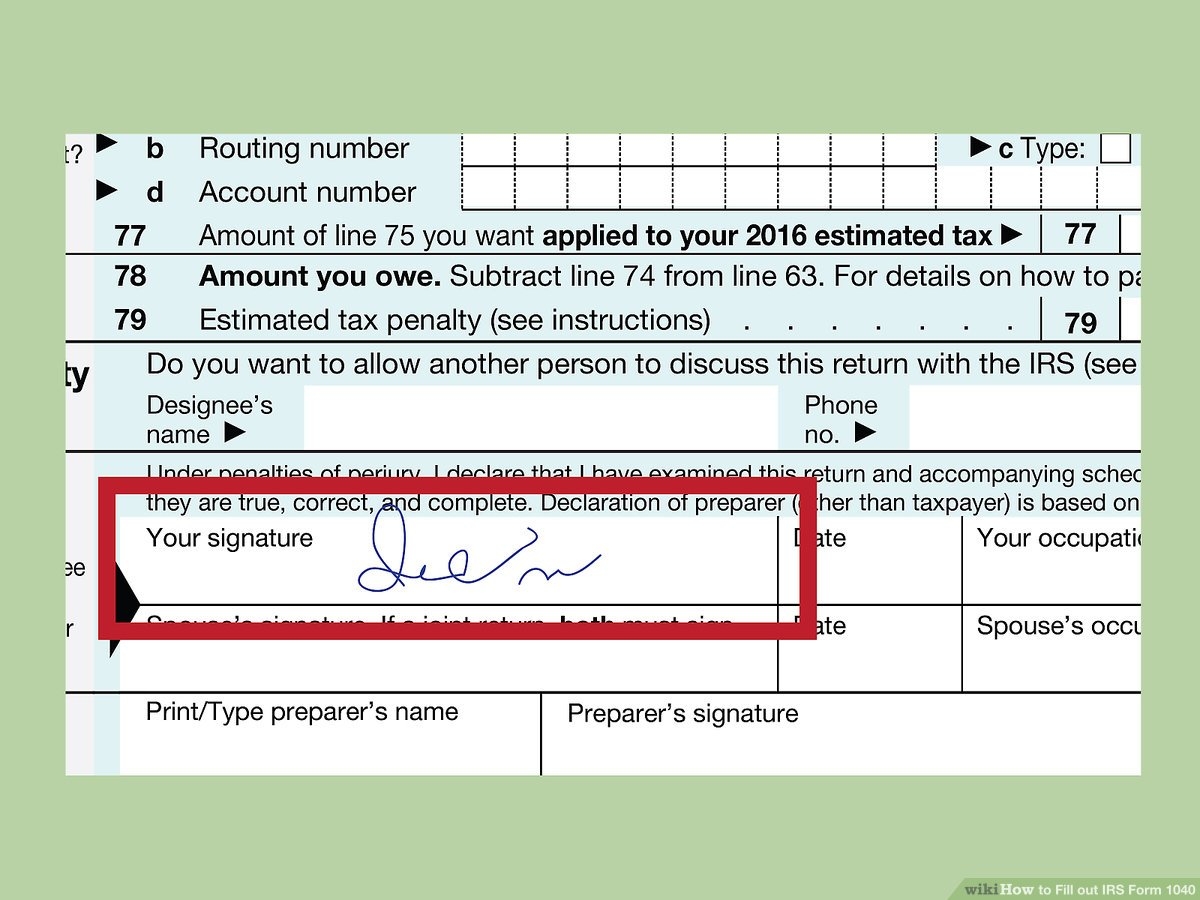

The IRS Printable 1040 Tax Form is a comprehensive document that allows taxpayers to report their income, deductions, and credits. It is divided into various sections, including income, adjustments to income, deductions, and credits. Taxpayers must carefully review each section and provide accurate information to avoid any discrepancies or errors in their tax return.

One of the key benefits of the IRS Printable 1040 Tax Form is its simplicity and user-friendly design. Taxpayers can easily fill out this form by following the instructions provided by the IRS. Additionally, the form can be downloaded and printed from the IRS website, making it convenient for individuals to access and complete their tax return.

It is important for taxpayers to review their completed IRS Printable 1040 Tax Form before submitting it to the IRS. Double-checking all information and calculations can help prevent errors and ensure that the tax return is accurate. By taking the time to review the form, taxpayers can avoid potential audits or inquiries from the IRS.

In conclusion, the IRS Printable 1040 Tax Form is a vital document that all taxpayers must complete during tax season. By accurately reporting their income and deductions, individuals can fulfill their tax obligations and avoid penalties from the IRS. It is important to carefully review and submit this form on time to comply with tax laws and regulations.