When it comes to paying taxes, sometimes it can be difficult to come up with the full amount owed all at once. The IRS understands this predicament and offers payment plans to help taxpayers manage their tax debt. One way to set up a payment plan with the IRS is by filling out a printable form.

By using the IRS payment plan form, taxpayers can outline the terms of their payment plan, such as the monthly payment amount and the duration of the plan. This form allows individuals to formally request a payment arrangement with the IRS and helps ensure that both parties are on the same page regarding the repayment schedule.

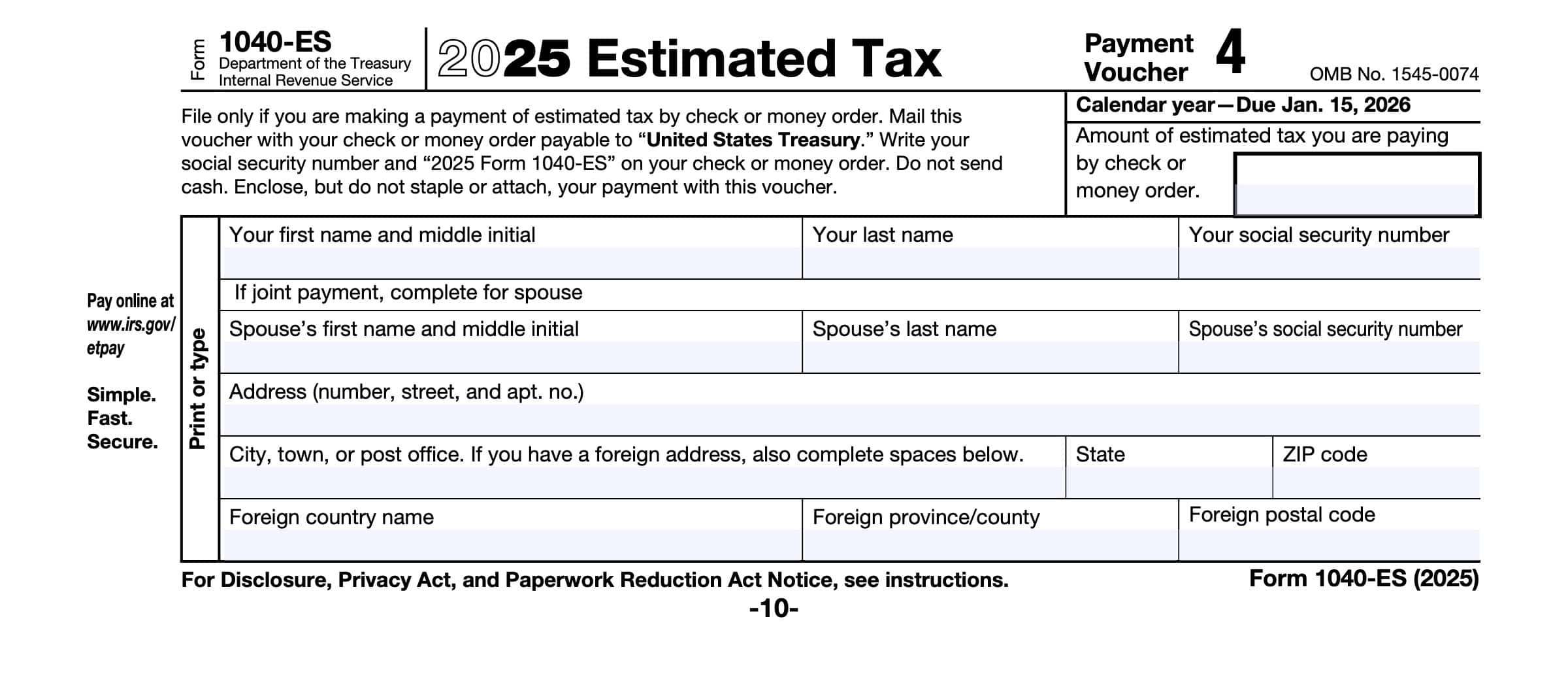

Irs Payment Plan Form Printable

Irs Payment Plan Form Printable

When filling out the IRS payment plan form, it is important to provide accurate information about your financial situation and ability to pay. The IRS will review your request and determine if you qualify for a payment plan based on your income, expenses, and other financial obligations. It is essential to be honest and transparent when completing the form to increase your chances of being approved for a payment plan.

Once the IRS approves your payment plan request, you will receive a confirmation letter outlining the terms of the agreement. It is crucial to adhere to the terms of the plan and make timely payments to avoid any further penalties or interest charges. Keeping up with your payments will help you stay in good standing with the IRS and work towards resolving your tax debt.

If you are struggling to pay your taxes in full, don’t hesitate to explore the option of setting up a payment plan with the IRS. By using the IRS payment plan form, you can formalize your agreement and take control of your tax debt. Remember to be thorough and accurate when completing the form to increase your chances of approval. With dedication and commitment to your payment plan, you can work towards resolving your tax debt and achieving financial peace of mind.

In conclusion, the IRS payment plan form printable is a valuable tool for taxpayers looking to manage their tax debt. By filling out this form and requesting a payment plan, individuals can take control of their finances and work towards resolving their tax obligations. Remember to be honest and diligent in completing the form to increase your chances of approval. With a structured payment plan in place, you can alleviate the burden of tax debt and move towards financial stability.