When it comes to hiring new employees, it is crucial for employers to verify the identity and employment eligibility of their workers. One of the key documents used for this purpose is the Irs I9 Printable Form. This form is required by the U.S. Citizenship and Immigration Services (USCIS) and helps employers ensure that their workforce is legal and authorized to work in the United States.

By completing the Irs I9 Printable Form, employers can collect important information from their employees, such as their full legal name, date of birth, social security number, and immigration status. This information is used to verify the employee’s identity and eligibility to work in the country, and failure to properly complete and retain this form can result in serious penalties for employers.

Irs I9 Printable Form

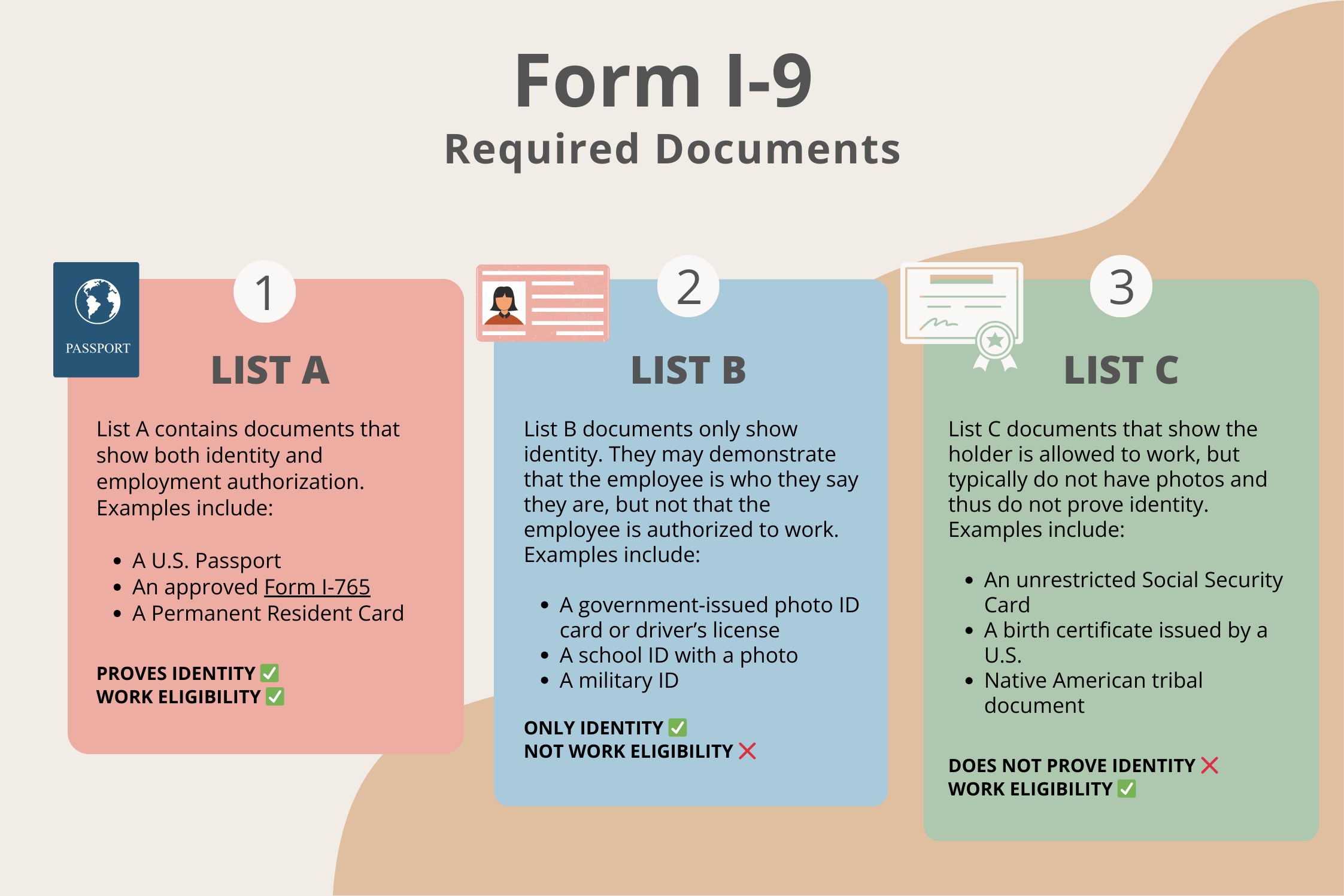

The Irs I9 Printable Form consists of several sections that must be completed by both the employer and employee. The first section requires the employee to provide their personal information, while the second section is completed by the employer, who must verify the employee’s documents and attest to their authenticity.

Employers must ensure that they are using the most recent version of the Irs I9 Printable Form, as updates are periodically made to the document to reflect changes in immigration laws and regulations. It is important to carefully review the instructions provided with the form to ensure that it is completed correctly and in compliance with federal guidelines.

Once the Irs I9 Printable Form has been completed and verified, employers must retain the form for a specified period of time, typically three years from the date of hire or one year after the employee’s employment is terminated, whichever is later. This ensures that the employer has documentation to prove that they have verified their employees’ eligibility to work in the United States.

In conclusion, the Irs I9 Printable Form is a vital document for employers who want to ensure that their workforce is legal and authorized to work in the country. By completing this form accurately and retaining it as required by law, employers can avoid potential penalties and protect their business from legal risks related to unauthorized employment.