When tax season rolls around, it’s important to have all the necessary forms in order to accurately file your taxes. The IRS offers a variety of printable tax forms that can be easily accessed and filled out online. These forms cover a wide range of tax situations, from individual tax returns to business taxes.

Whether you’re a first-time filer or a seasoned tax pro, having access to printable tax forms can make the process much smoother. Instead of having to wait for forms to arrive in the mail or pick them up from a local IRS office, you can simply download and print the forms you need right from the IRS website.

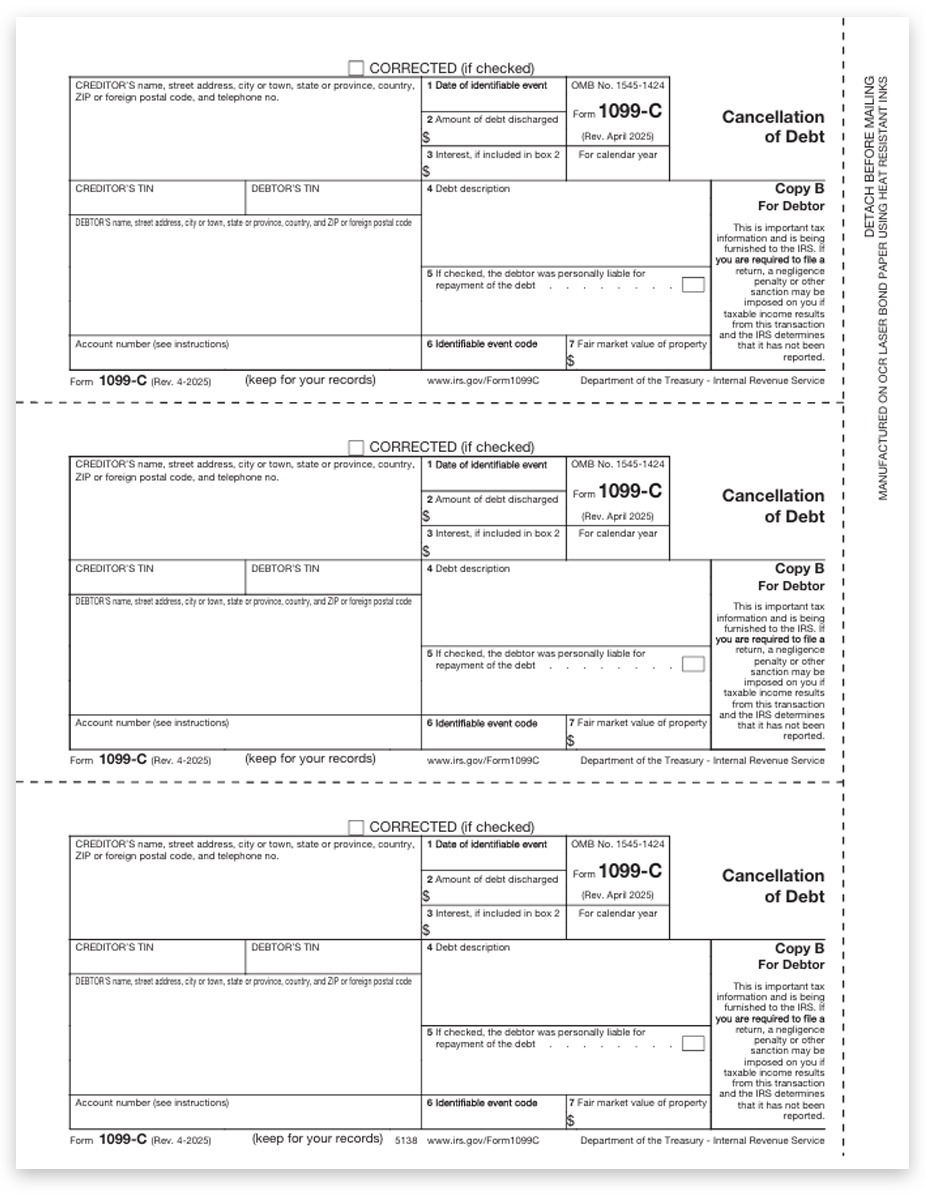

One of the most commonly used printable tax forms is the 1040 form, which is used by individuals to report their annual income and calculate their tax liability. Other popular forms include the W-2 form, which reports wages and salary information, and the 1099 form, which reports miscellaneous income like freelance earnings.

In addition to individual tax forms, the IRS also offers printable forms for businesses, including the 1120 form for corporations and the 1065 form for partnerships. These forms are essential for reporting business income, deductions, and credits to ensure compliance with tax laws.

Before filling out any printable tax forms, it’s important to gather all necessary documentation, such as W-2s, 1099s, and receipts for deductions. This will ensure that you have all the information you need to accurately complete your tax return and avoid any potential errors or delays in processing.

In conclusion, having access to printable tax forms from the IRS can make the tax filing process much more convenient and efficient. By utilizing these forms, you can ensure that you accurately report your income and deductions, ultimately helping you avoid any potential issues with the IRS. So next time tax season rolls around, be sure to visit the IRS website to download and print the forms you need to stay compliant with tax laws.