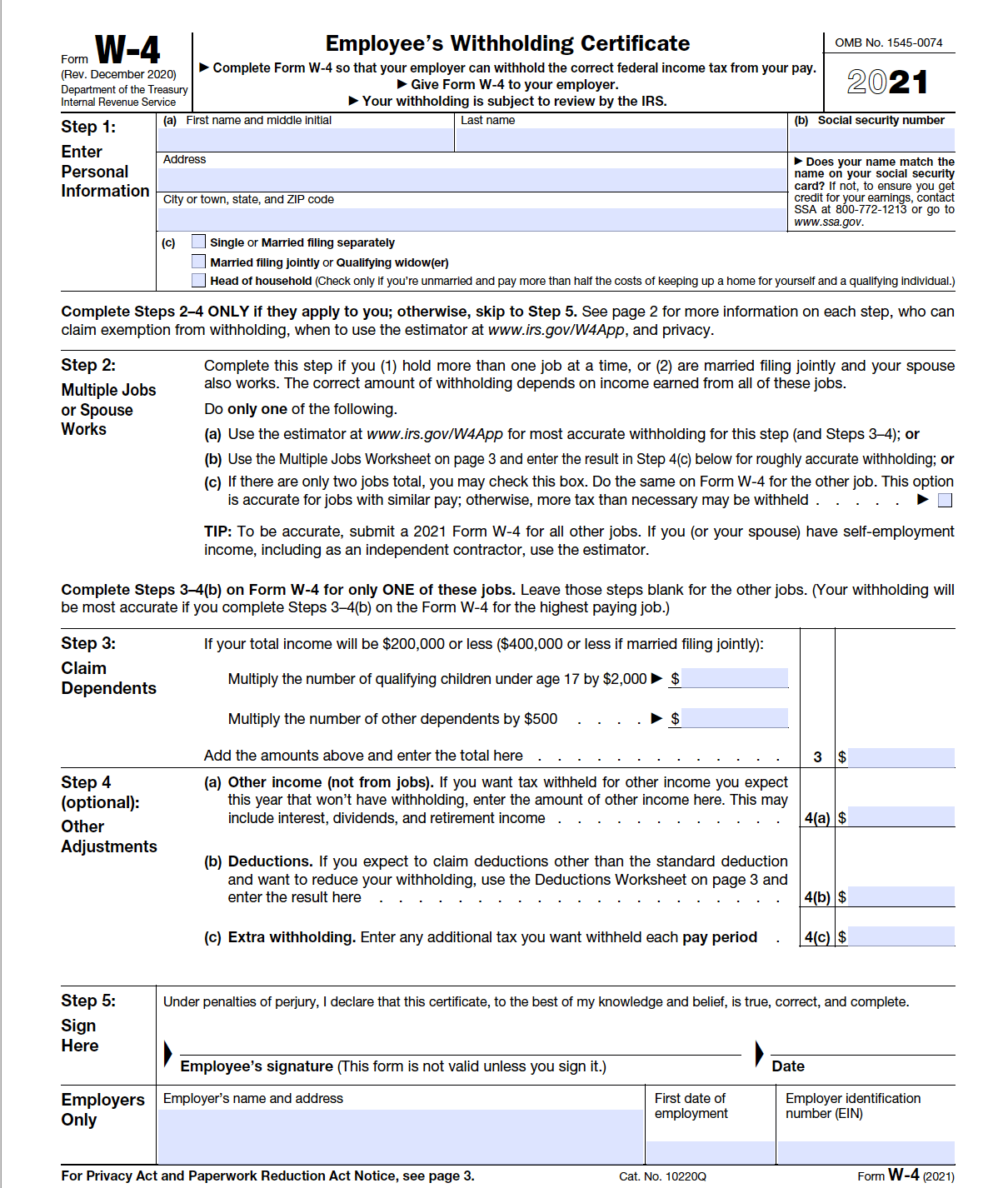

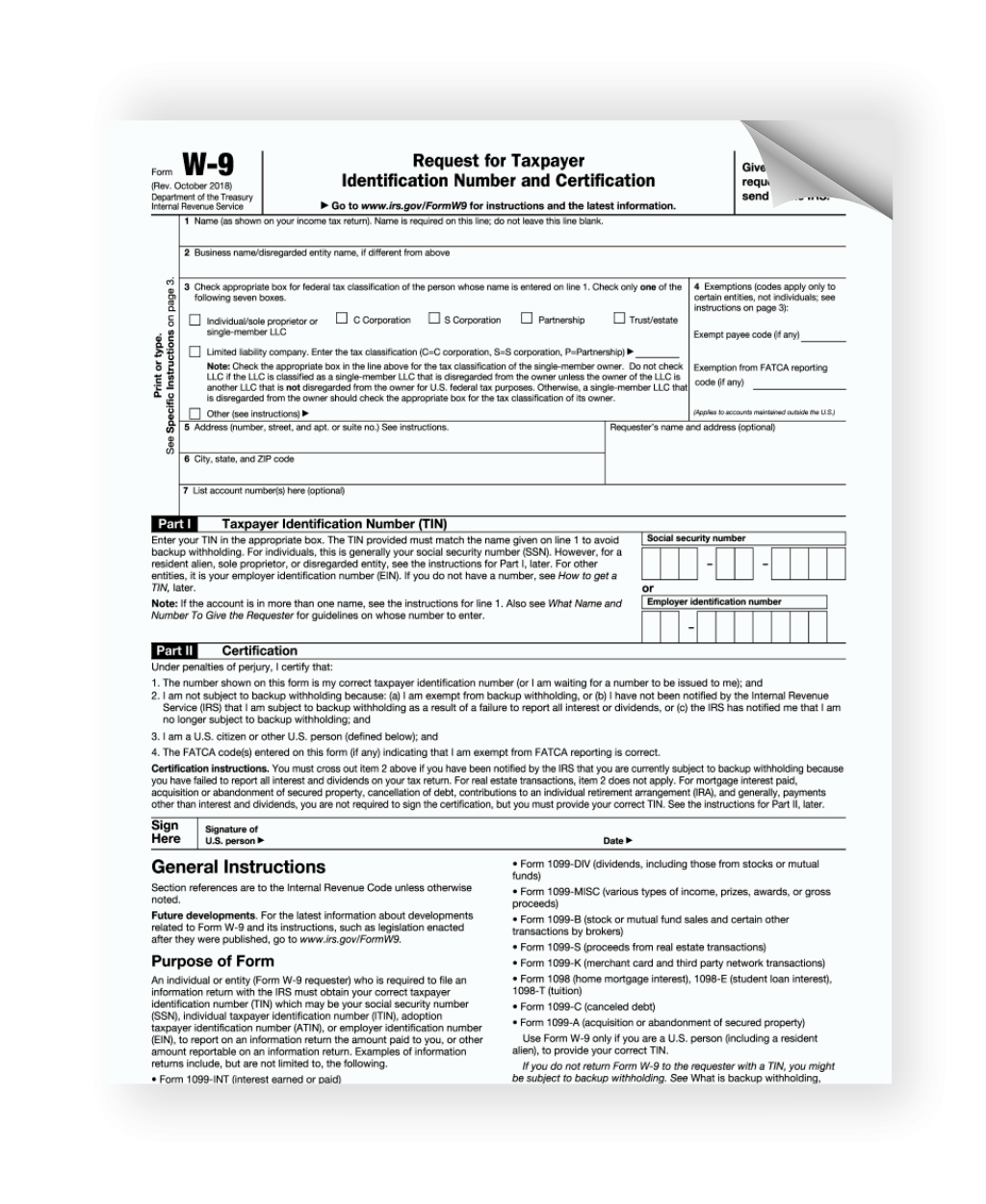

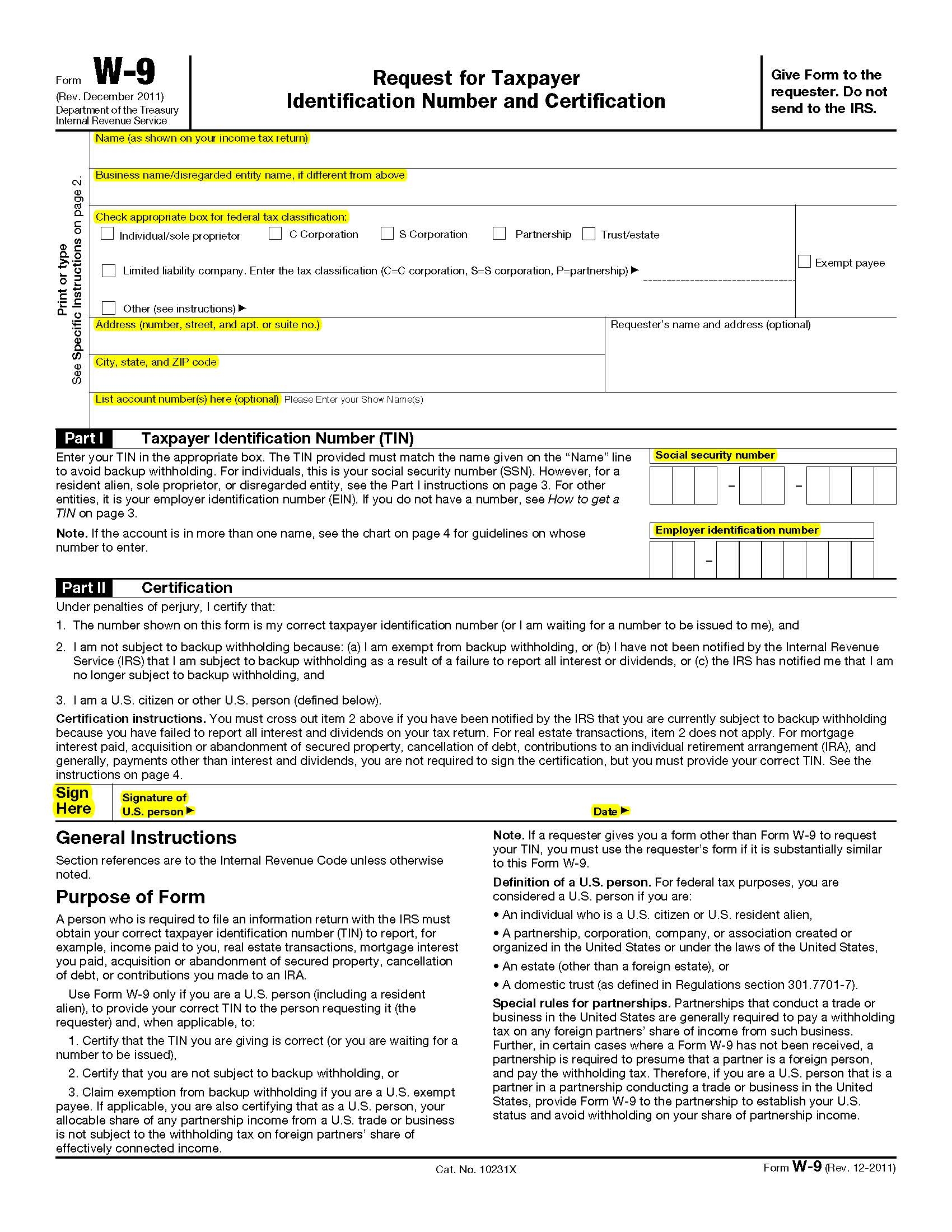

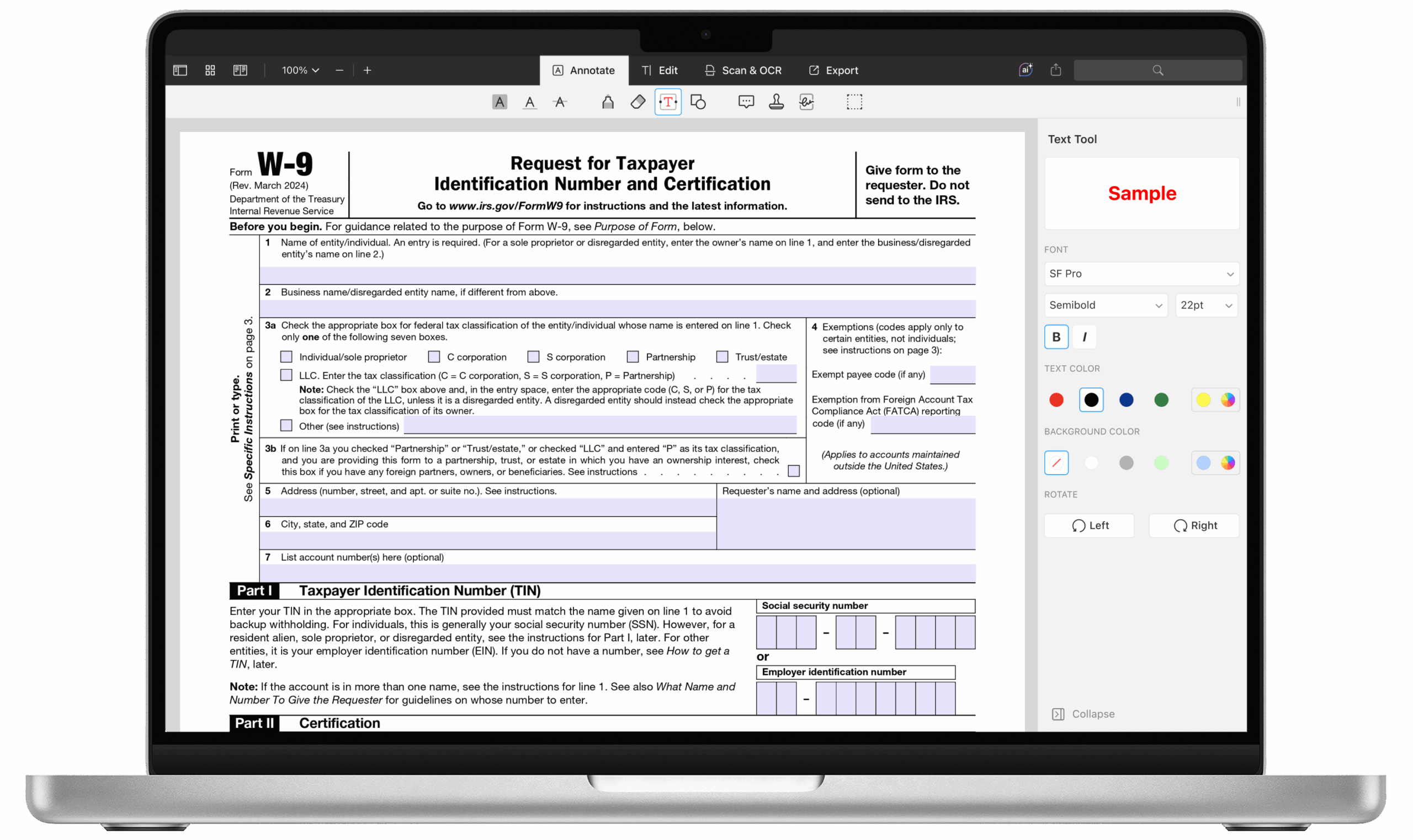

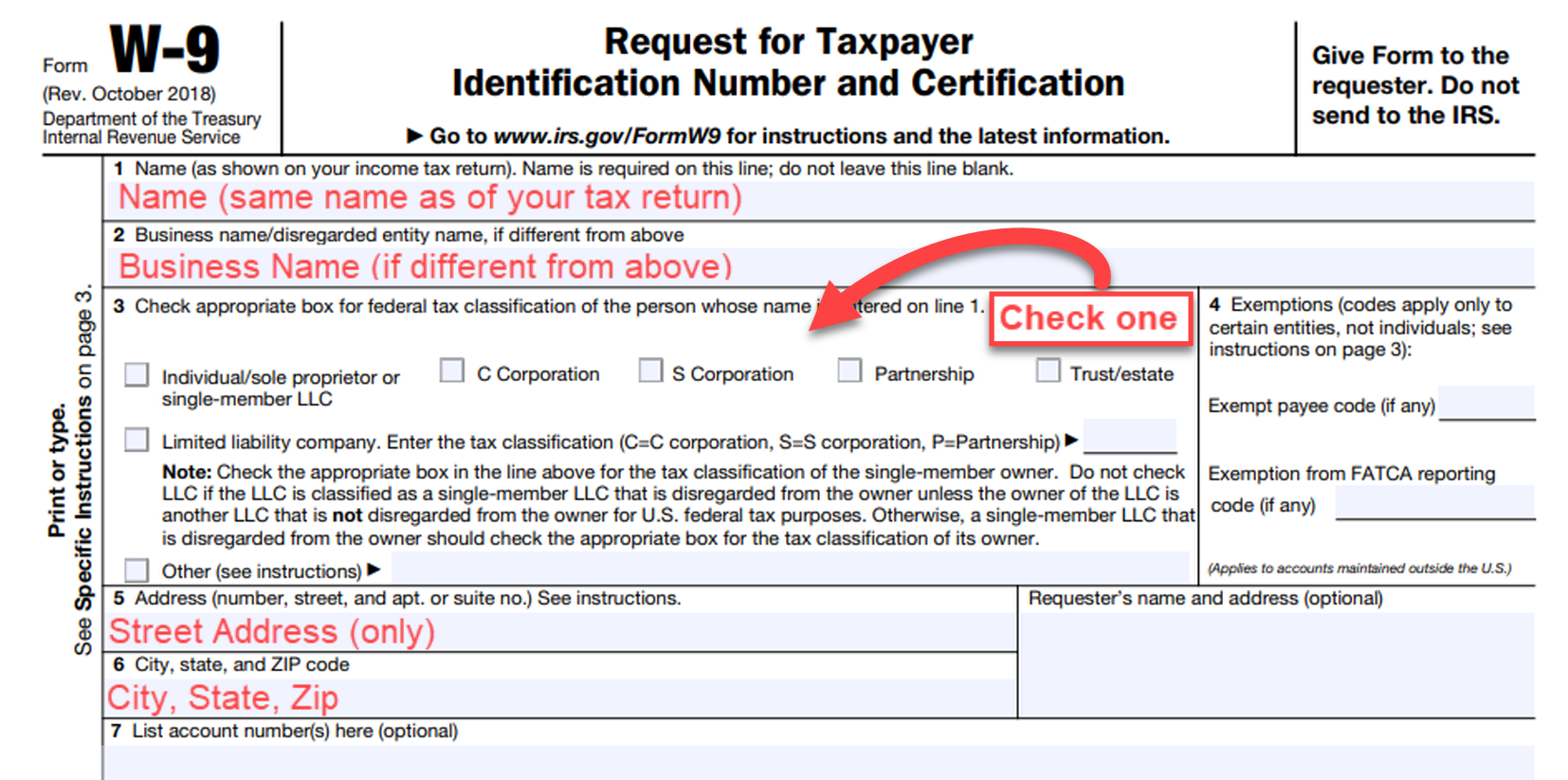

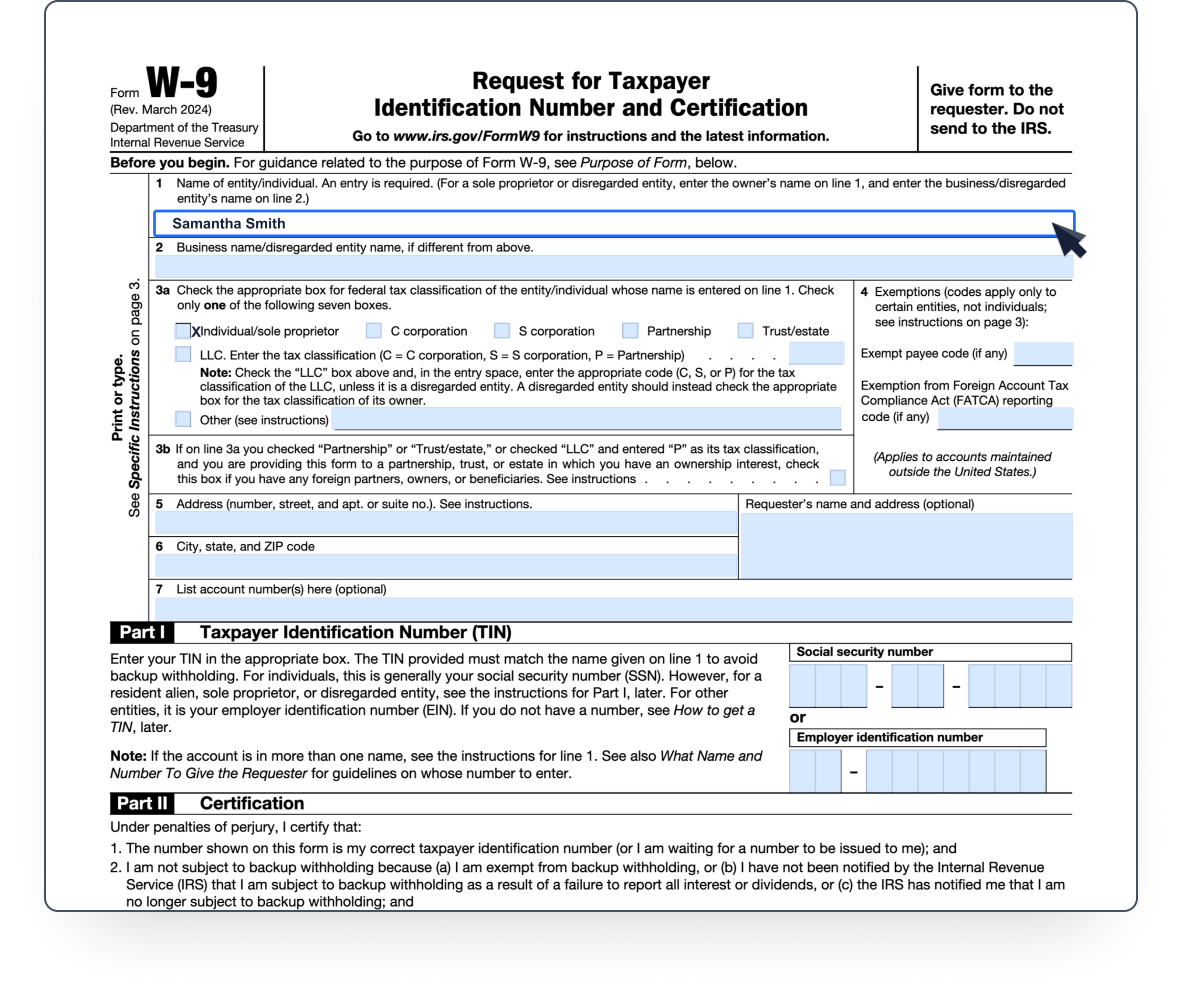

When it comes to tax season, one important form that many individuals and businesses need to be familiar with is the IRS Form W-9. This form is used to provide your taxpayer identification number to companies that you do business with, such as clients or employers. It is essential for ensuring that you are properly reported for tax purposes and that the appropriate taxes are withheld.

IRS Form W-9 is a simple one-page document that requires basic information such as your name, address, and taxpayer identification number. It is important to fill out this form accurately and completely to avoid any potential issues with your tax filings. The form can easily be downloaded and printed from the IRS website, making it convenient for individuals and businesses to access.

One of the key benefits of the IRS Form W-9 is that it is printable, allowing you to easily fill it out and provide it to the necessary parties. This form is commonly used in various situations, such as when you are hired as an independent contractor or when you receive certain types of income that require reporting to the IRS. Having a printable version of the form makes it quick and efficient to provide the necessary information.

When filling out the IRS Form W-9, it is important to double-check all information to ensure accuracy. Any errors or omissions could result in delays in processing your tax information or even potential penalties from the IRS. By taking the time to carefully complete the form and provide accurate information, you can help streamline the tax reporting process and avoid any unnecessary complications.

In conclusion, the IRS Form W-9 is a vital document for individuals and businesses to provide their taxpayer identification number to companies they do business with. The fact that this form is printable makes it easy to access and complete, ensuring that you can quickly provide the necessary information when needed. By understanding the importance of this form and filling it out accurately, you can help ensure that your tax information is properly reported and avoid any potential issues with the IRS.

Save and Print Irs Forms W 9 Printable

Payroll template are ideal for businesses that prefer non-digital systems or need printed versions for audit purposes. Most forms include fields for employee name, pay period, total earnings, taxes, and final salary—making them both complete and practical.

Start simplifying your payroll process today with a trusted printable payroll. Reduce admin effort, minimize mistakes, and maintain clear records—all while keeping your employee payment data professional.

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

Handling payroll tasks doesn’t have to be difficult. A printable payroll form offers a speedy, accurate, and user-friendly method for tracking salaries, shifts, and taxes—without the need for digital systems.

Whether you’re a freelancer, administrator, or independent contractor, using apayroll printable helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.