When it comes to tax season, one of the most important things to have on hand are IRS forms. These forms are essential for filing your taxes and ensuring that you are in compliance with the law. One commonly used form is the IRS Form 2025, which is available for download and print on the IRS website.

IRS Form 2025 is used for reporting certain types of income, deductions, and credits. It is important to have this form on hand when you are preparing your tax return to ensure that you are accurately reporting your financial information to the IRS. The form is relatively straightforward and can be easily filled out with the necessary information.

When filling out IRS Form 2025, it is important to double-check all information to ensure accuracy. Any mistakes or discrepancies could result in delays in processing your tax return or even potential audits from the IRS. It is always best to take your time and review the form before submitting it to avoid any issues down the line.

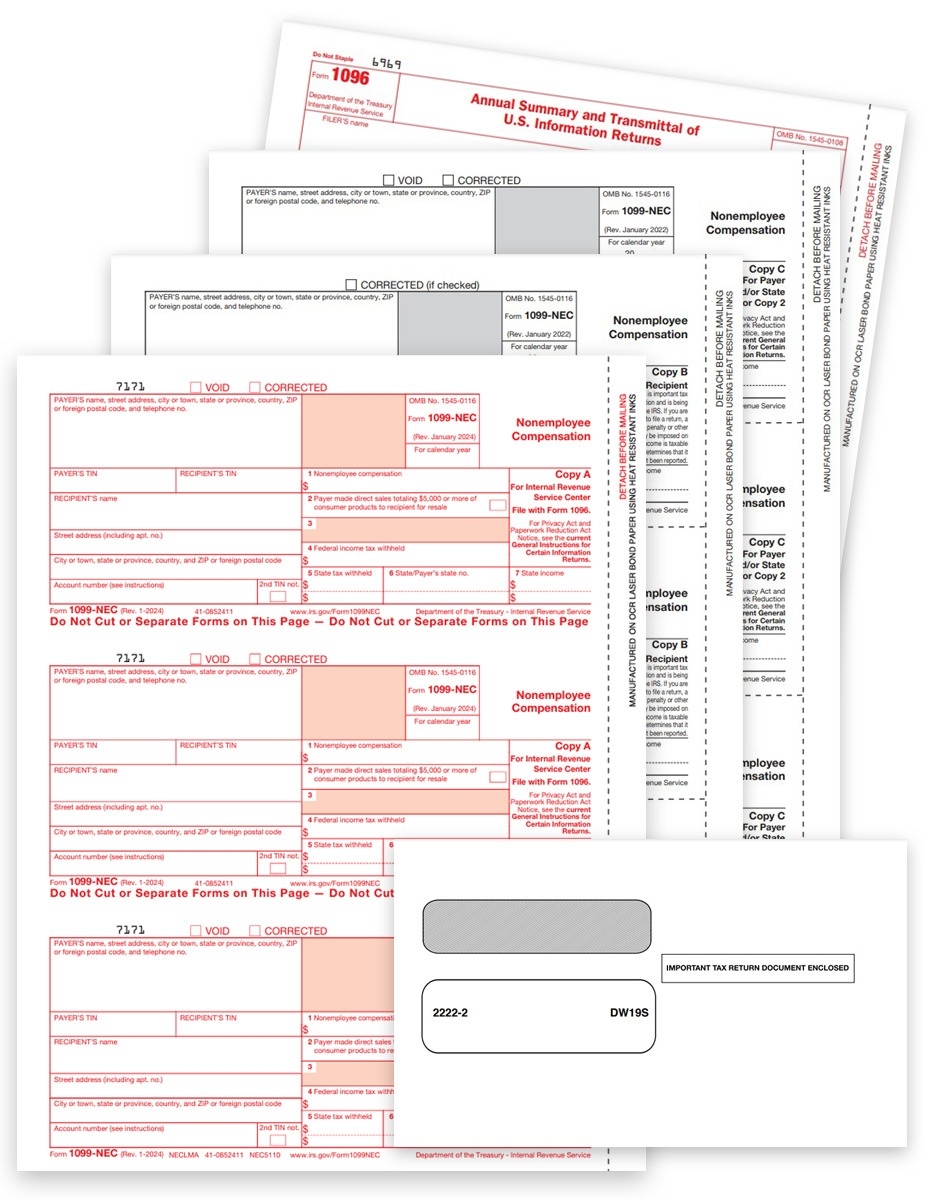

In addition to IRS Form 2025, there are other forms that may be required depending on your individual tax situation. Some common forms that you may need to fill out include W-2 forms for reporting wages, 1099 forms for reporting miscellaneous income, and Schedule A for itemizing deductions. It is important to familiarize yourself with these forms and ensure that you have all the necessary documents to complete them accurately.

Overall, IRS Form 2025 is an essential document for accurately reporting your income, deductions, and credits to the IRS. By ensuring that you have all the necessary forms and information on hand, you can streamline the tax filing process and avoid any potential issues with the IRS. Remember to always double-check your forms for accuracy and seek assistance from a tax professional if needed.

So, if you are in need of IRS Form 2025 or any other tax forms, be sure to visit the IRS website to download and print them for your use. Having all the necessary forms on hand will make the tax filing process much smoother and help you stay in compliance with the law.