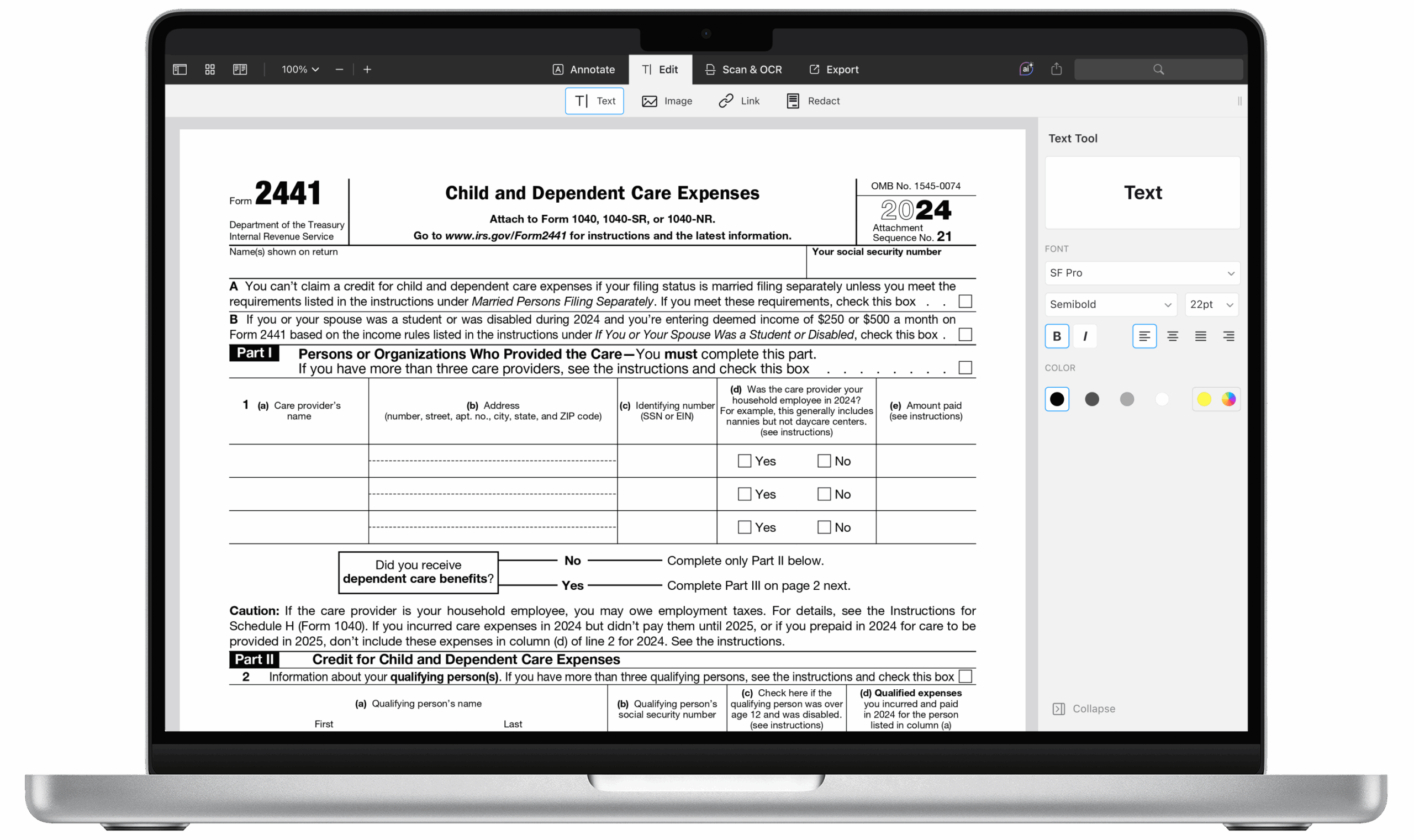

When it comes to filing taxes, it’s essential to have all the necessary forms in order to accurately report your income and deductions. One important form that many taxpayers may need is the IRS Forms 2024. These forms are used to report various types of income, deductions, and credits that can affect your tax liability.

IRS Forms 2024 Printable are readily available online for taxpayers to download and print from the comfort of their own homes. This makes it convenient for individuals to access the forms they need without having to visit an IRS office or wait for them to be mailed out.

Once you have the IRS Forms 2024 Printable in hand, it’s important to carefully review the instructions and fill out the form accurately. Any mistakes or omissions could result in delays in processing your tax return or even potential penalties from the IRS.

One of the benefits of using the IRS Forms 2024 Printable is that they are designed to be user-friendly and easy to understand. The forms are laid out in a clear and concise manner, making it simple for taxpayers to input their information and calculate their tax liability.

It’s important to note that not all taxpayers will need to use IRS Forms 2024. Depending on your individual tax situation, you may need to file additional forms or schedules in order to fully report your income and deductions. Consulting with a tax professional can help ensure that you are filing the correct forms and maximizing your tax savings.

In conclusion, IRS Forms 2024 Printable are a valuable resource for taxpayers who need to accurately report their income and deductions to the IRS. By downloading and printing these forms, individuals can easily complete their tax returns and avoid potential errors that could lead to penalties. Remember to review the instructions carefully and seek assistance if needed to ensure compliance with tax laws.