When tax season rolls around, one of the most important documents you’ll need to have on hand is your W-2 form. This form, provided by your employer, details your earnings and the taxes that have been withheld throughout the year. It’s crucial for accurately filing your tax return and ensuring you receive any refunds you may be owed.

For the year 2024, the IRS has updated the W-2 form to reflect any changes in tax laws or regulations. This updated form will be available for employers to distribute to their employees in early 2025. However, if you prefer to get a head start on your taxes, you can easily access and print a W-2 form for 2024 directly from the IRS website.

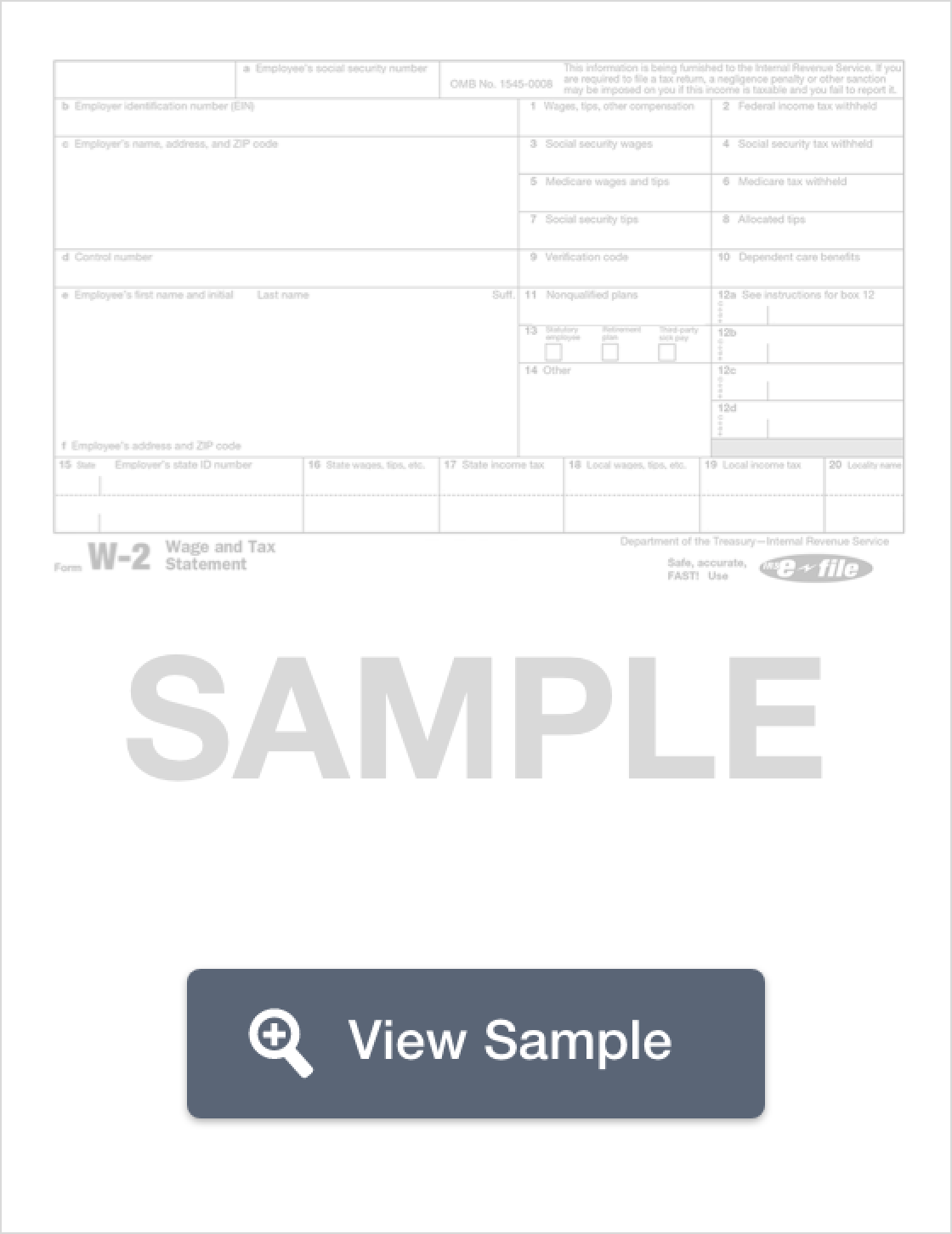

When you visit the IRS website, you’ll be able to find the W-2 form for the year 2024 in a printable format. This form will include all the necessary fields for you to input your personal information, earnings, and tax withholdings. Once you’ve filled out the form, you can simply print it out and include it with your tax return.

It’s important to note that the W-2 form is not only important for filing your federal taxes, but also for state taxes in some cases. Be sure to check the specific requirements for your state to determine if you need to include a copy of your W-2 form with your state tax return as well.

By utilizing the IRS Form W2 2024 Printable, you can streamline the tax filing process and ensure that your information is accurately reported to the IRS. Whether you choose to file your taxes electronically or by mail, having a printed copy of your W-2 form will make the process much smoother and help you avoid any potential discrepancies.

Overall, the IRS Form W2 2024 Printable is a valuable resource for individuals looking to stay organized and compliant with their tax obligations. By taking advantage of this printable form, you can ensure that your tax return is filed accurately and in a timely manner.