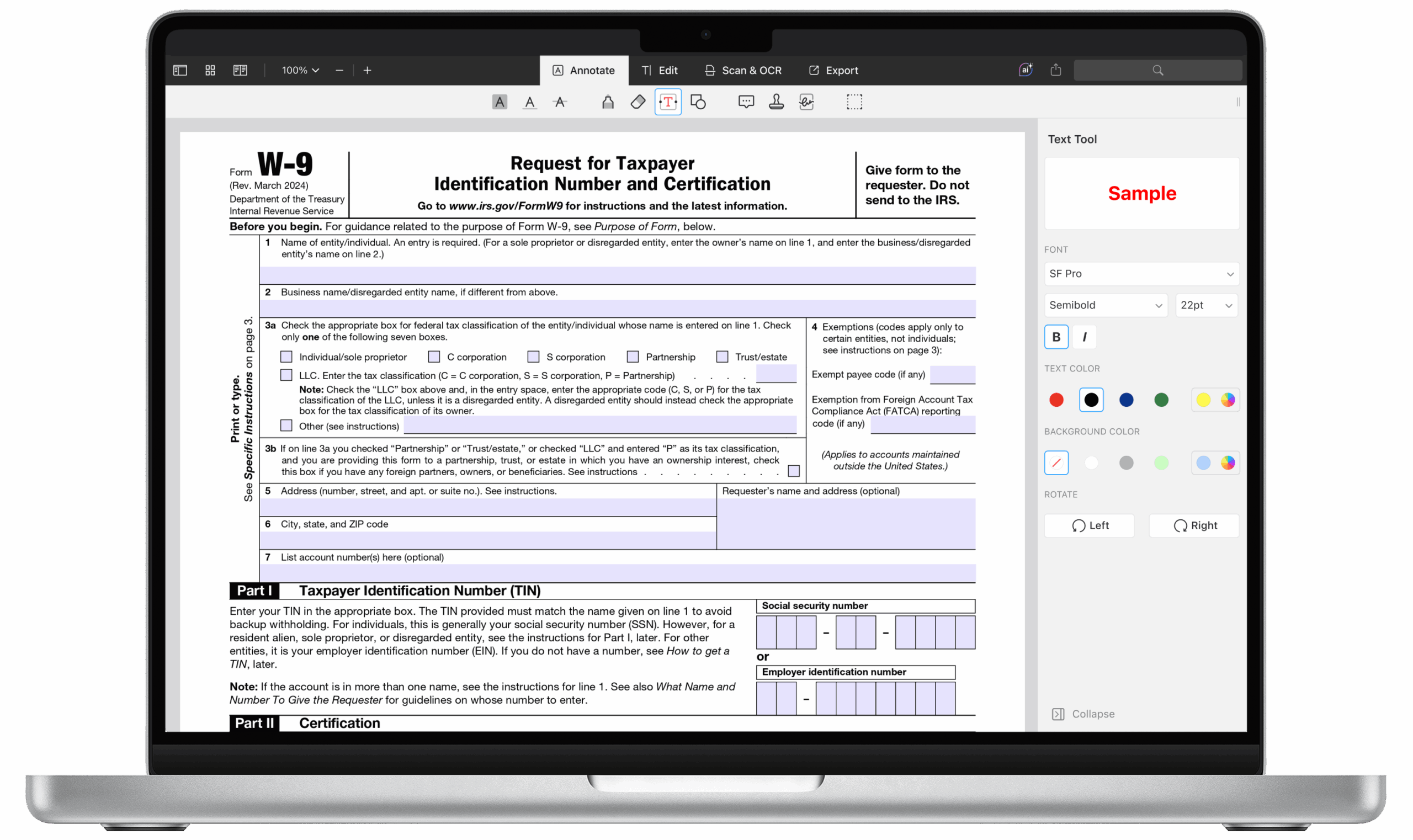

When it comes to tax forms, one of the most commonly used by businesses is the IRS Form W-9. This form is used to request the taxpayer identification number (TIN) of a U.S. person, which is typically an individual or business entity. It is important for companies to have this information on file in order to report payments made to the IRS.

For those who need to provide their TIN to a company, filling out the IRS Form W-9 is a simple process. The form asks for basic information such as your name, address, and TIN, as well as your certification that the information provided is correct. Once completed, you can submit the form to the requesting party.

It is important to note that the IRS Form W-9 is not submitted to the IRS itself, but rather to the company requesting your information. The company will then use the information provided to report any payments made to you to the IRS. This form is crucial for businesses to stay compliant with tax regulations.

When looking for a printable version of the IRS Form W-9, you can easily find it on the IRS website. The form is available in PDF format, making it easy to download, print, and fill out. Having a printable version on hand is convenient for those who need to provide their TIN to multiple companies.

Overall, the IRS Form W-9 is a straightforward document that serves an important purpose for both businesses and individuals. By providing your TIN on this form, you are helping to ensure that your income is properly reported to the IRS. Having a printable version of the form readily available can make the process quick and easy when requested by a company.

Next time you are asked to provide your TIN to a company, remember to fill out the IRS Form W-9. With a printable version easily accessible, you can quickly provide the necessary information and help the company stay compliant with tax regulations.