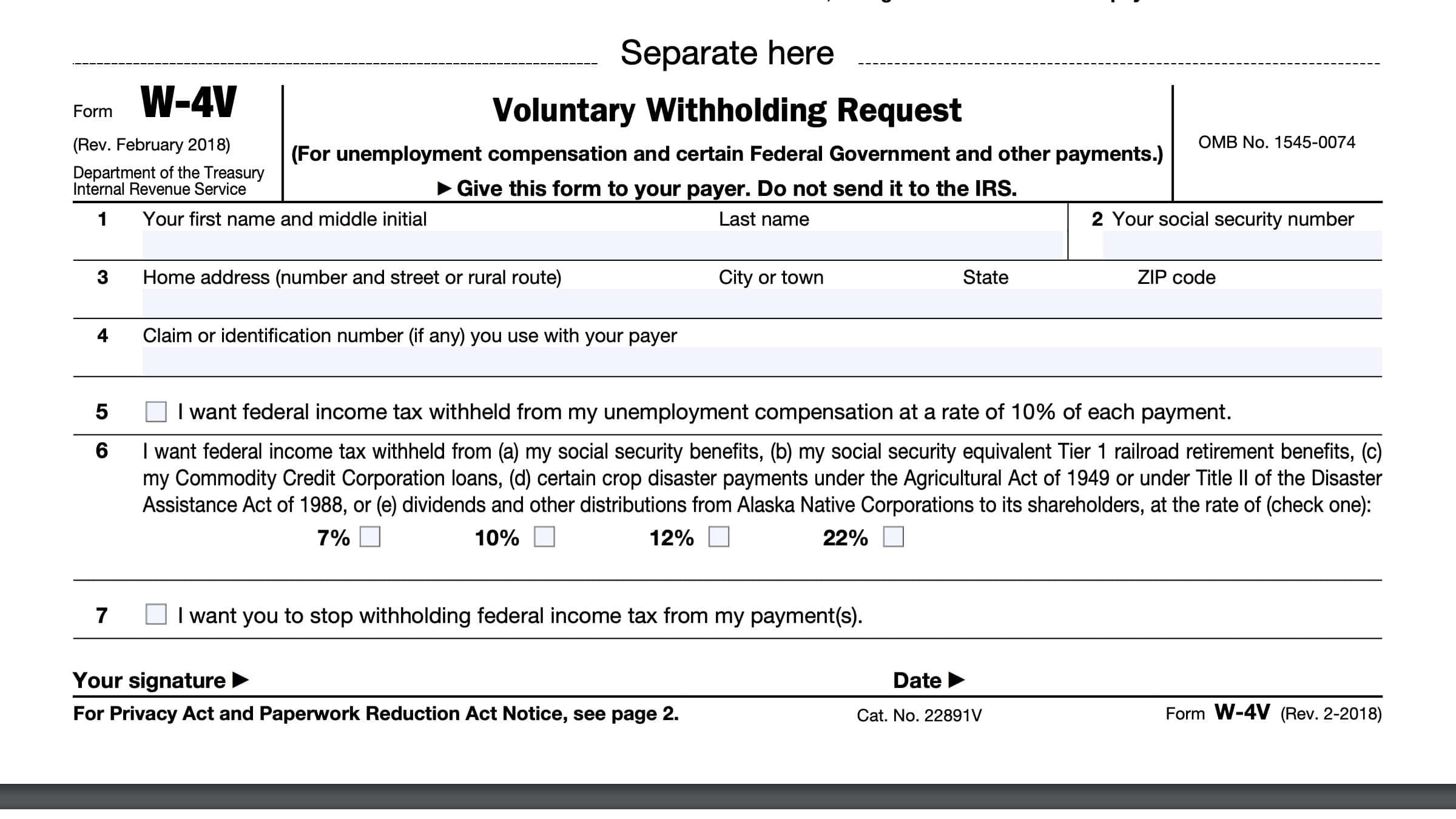

When it comes to managing your taxes, having the right forms is essential. One important form that you may need to use is the IRS Form W-4v. This form is used to request a withholding certificate for pension or annuity payments, allowing you to specify the amount of federal income tax to be withheld from your payments.

For many individuals, having a printable version of the IRS Form W-4v can make the process much easier. By being able to fill out the form online and print it out, you can quickly and efficiently submit your request to the IRS without any hassle. This printable version allows you to easily update your withholding information whenever necessary.

When filling out the IRS Form W-4v, you will need to provide your basic personal information such as your name, address, and Social Security number. You will also need to indicate the amount you want withheld from your payments, as well as any additional withholding amounts. Once you have completed the form, you can simply print it out and submit it to the IRS.

Using the printable version of the IRS Form W-4v can save you time and make it easier to manage your tax withholding. Whether you are looking to increase or decrease the amount withheld from your pension or annuity payments, this form allows you to make those changes quickly and efficiently. Make sure to keep a copy of the form for your records and submit it to the IRS as needed.

Overall, having access to the IRS Form W-4v printable version can simplify the process of managing your tax withholding for pension or annuity payments. By filling out the form online and printing it out, you can easily update your withholding information and submit it to the IRS without any hassle. Make sure to take advantage of this convenient option when managing your taxes.

Don’t wait until the last minute to update your withholding information. Use the IRS Form W-4v printable version to make the process quick and easy. Stay on top of your tax obligations and ensure that you are withholding the correct amount from your pension or annuity payments.

Quickly Access and Print Irs Form W 4v Printable

Printable payroll are ideal for businesses that prefer non-digital systems or need hard copies for employee records. Most forms include fields for employee name, pay period, total earnings, withholdings, and final salary—making them both comprehensive and easy to use.

Begin streamlining your payroll system today with a trusted printable payroll. Save time, reduce errors, and stay organized—all while keeping your payroll records organized.

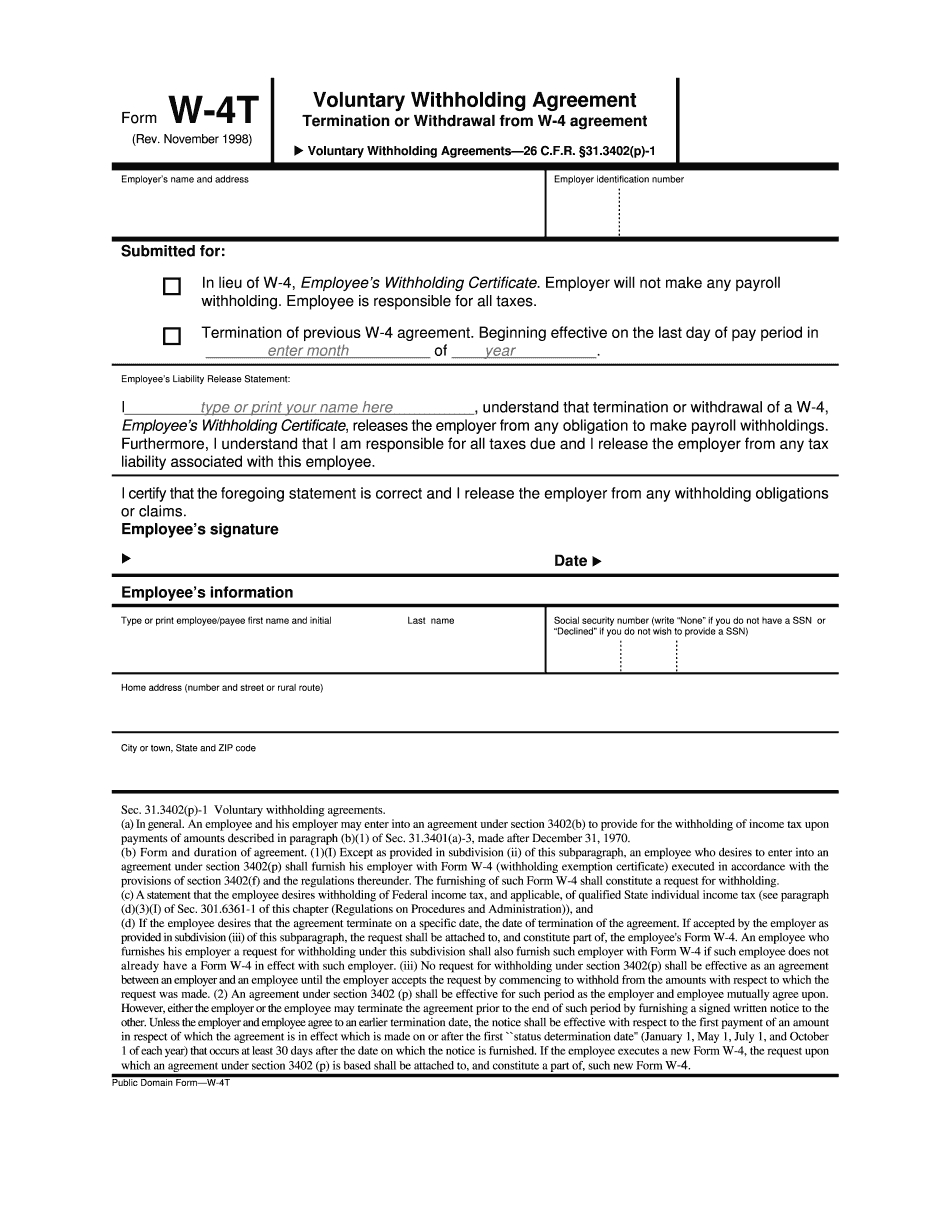

Fillable Form W 4V Edit Sign U0026 Download In PDF PDFRun

Fillable Form W 4V Edit Sign U0026 Download In PDF PDFRun

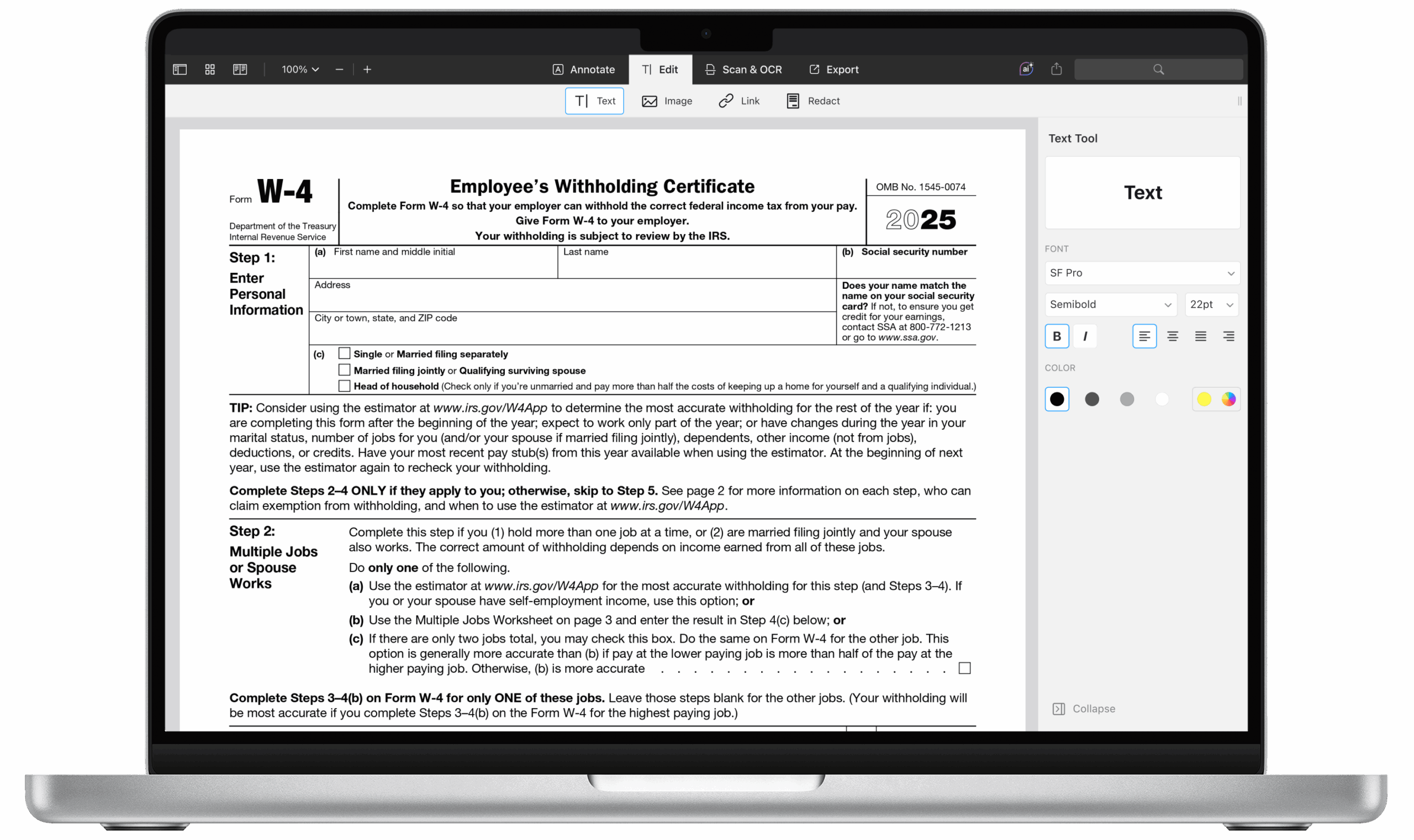

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

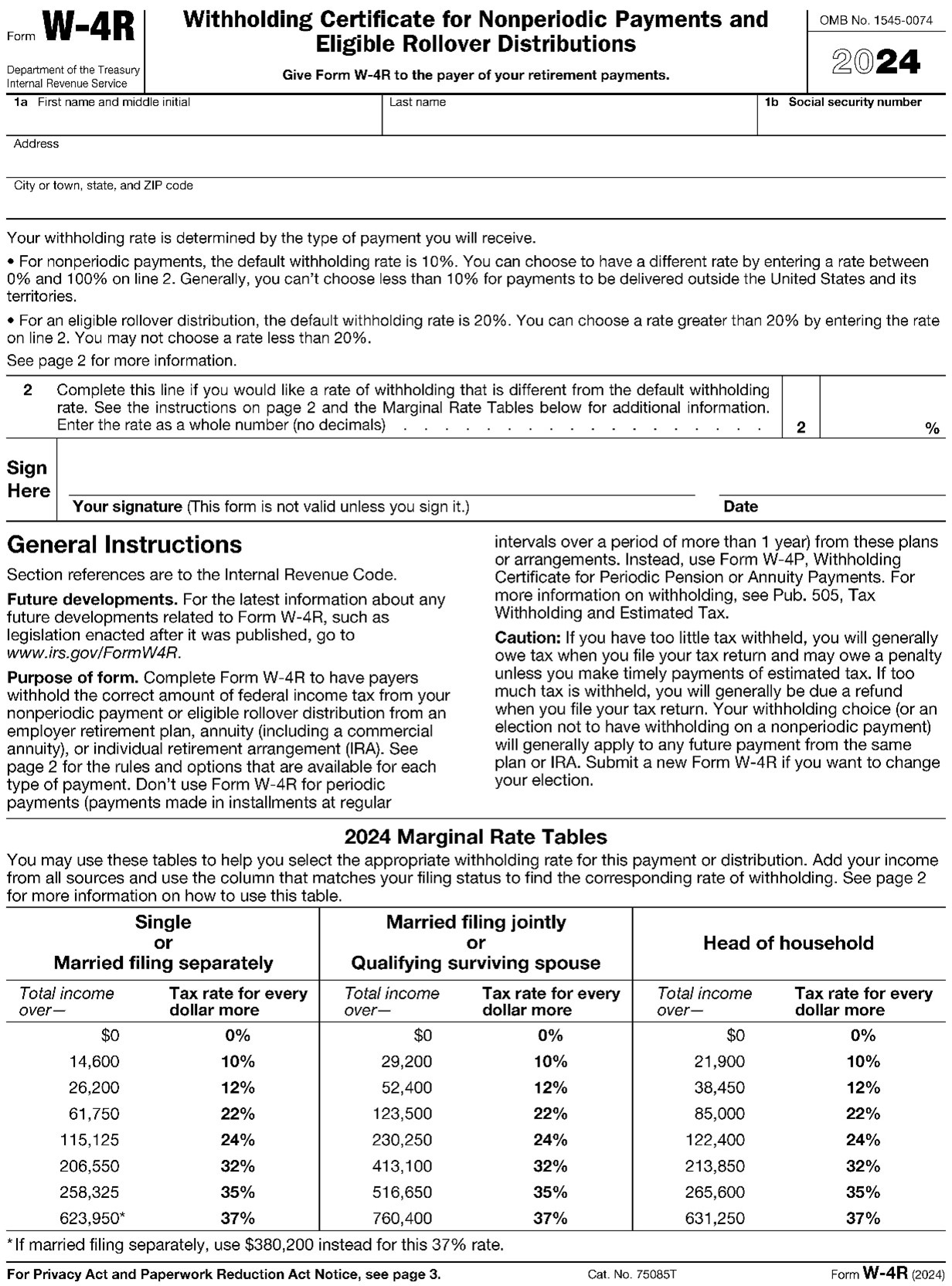

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Form W 4V Instructions Voluntary Withholding Request

IRS Form W 4V Instructions Voluntary Withholding Request

Managing staff wages doesn’t have to be complicated. A payroll template offers a quick, reliable, and straightforward method for tracking salaries, work time, and deductions—without the need for digital systems.

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll helps ensure compliance with regulations. Simply access the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.