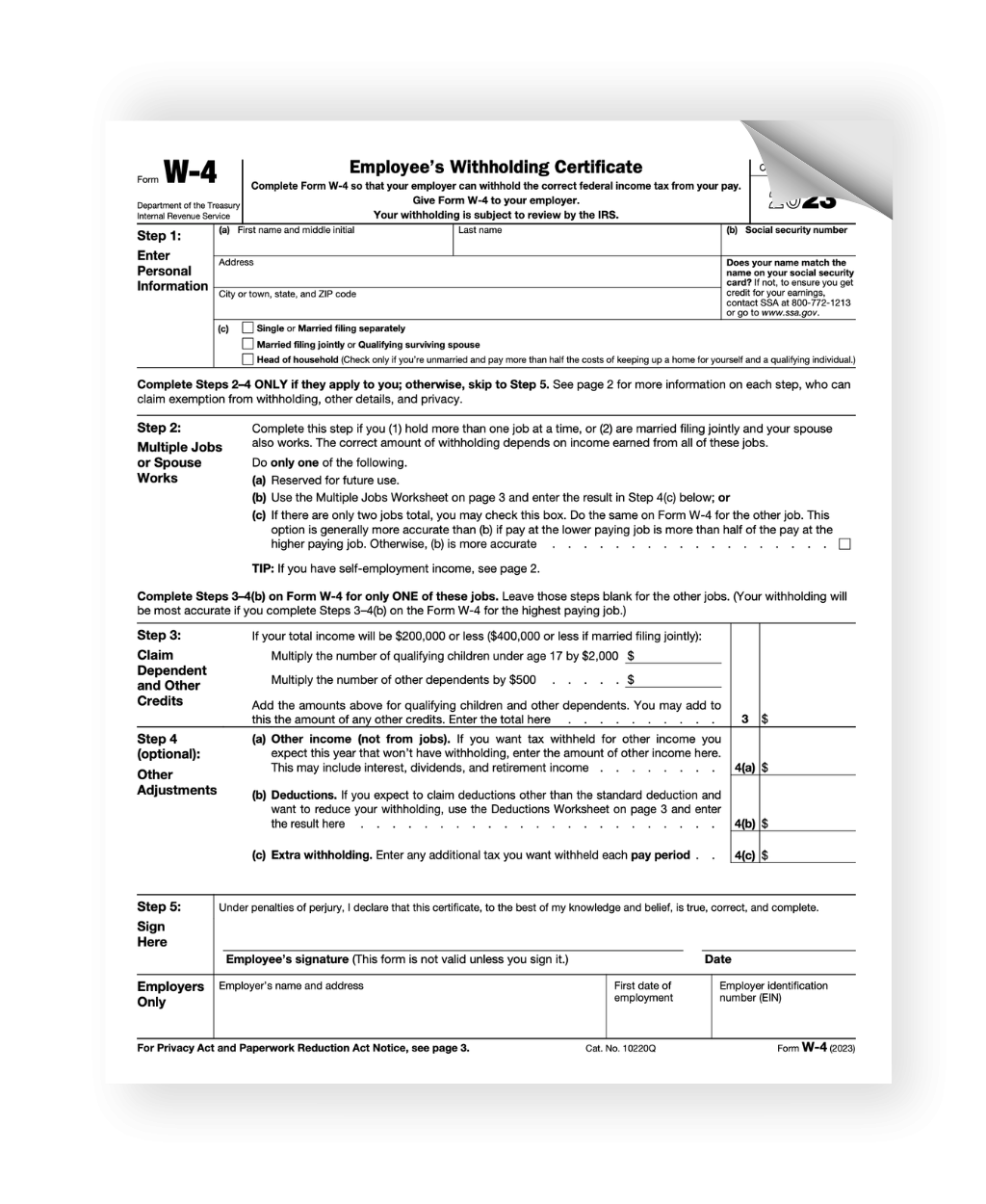

IRS Form W-4T is used by employees to determine the amount of federal income tax that will be withheld from their paychecks. This form is important because it helps ensure that the correct amount of tax is being withheld, which can prevent employees from owing a large sum of money at tax time.

Employees can use the IRS Form W-4T to make adjustments to their withholding allowances if they have had a change in their financial situation, such as getting married, having a child, or starting a new job. By filling out this form, employees can ensure that the right amount of tax is being withheld from their paychecks.

It is important for employees to review their withholding periodically to make sure it is accurate. If too much tax is being withheld, employees may be missing out on money that could be put to better use. On the other hand, if too little tax is being withheld, employees could end up owing a large sum of money come tax time.

Employers are required to provide employees with a W-4 form when they are hired, but employees can also download the form from the IRS website. The form is easy to fill out and can be submitted to the employer for processing.

Overall, IRS Form W-4T is a valuable tool for employees to ensure that the correct amount of tax is being withheld from their paychecks. By taking the time to review and update their withholding allowances as needed, employees can avoid any surprises when it comes time to file their taxes.

In conclusion, IRS Form W-4T is an important document for employees to use to make sure that the right amount of tax is being withheld from their paychecks. By filling out this form accurately and reviewing it periodically, employees can avoid any potential issues with their taxes and ensure that they are in good standing with the IRS.

Quickly Access and Print Irs Form W 4t Printable

Payroll template are ideal for businesses that prefer physical records or need physical copies for employee records. Most forms include fields for staff name, date range, gross pay, taxes, and final salary—making them both complete and easy to use.

Start simplifying your payroll system today with a trusted printable payroll. Reduce admin effort, minimize mistakes, and maintain clear records—all while keeping your employee payment data organized.

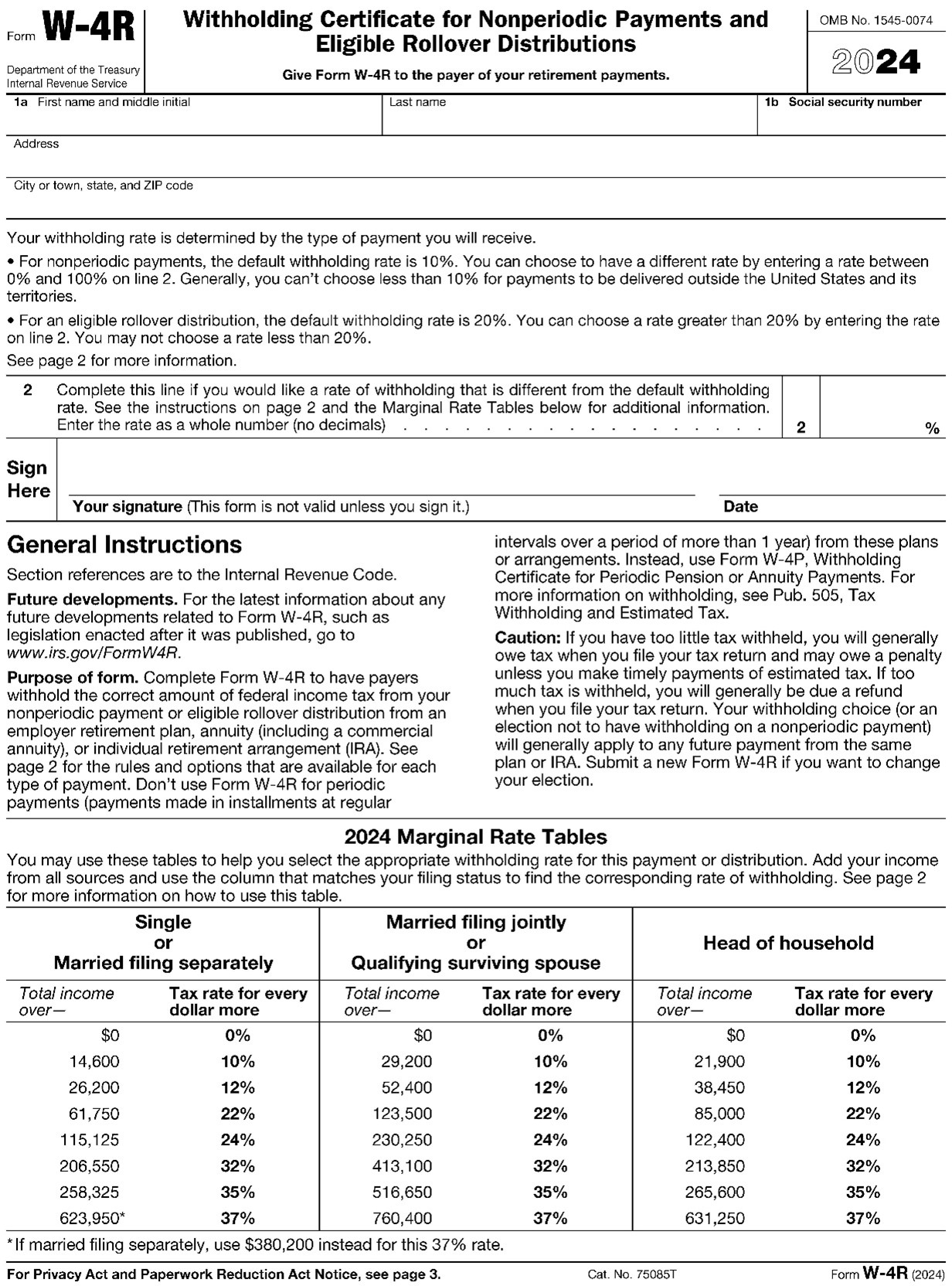

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

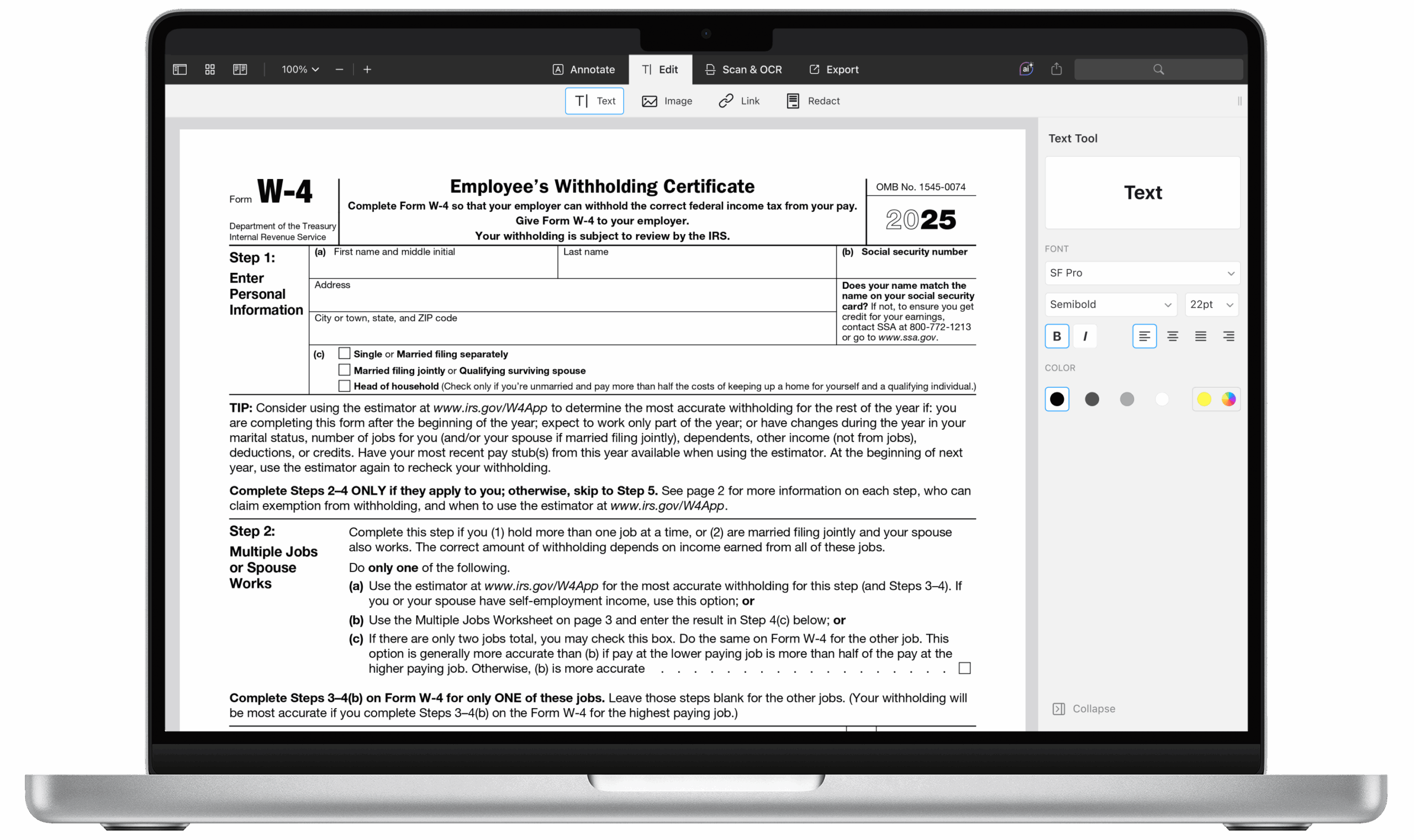

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

W 4T Voluntary Withholding Agreement Details And Instructions

W 4T Voluntary Withholding Agreement Details And Instructions

Managing payroll tasks doesn’t have to be overwhelming. A payroll template offers a speedy, reliable, and user-friendly method for tracking salaries, work time, and withholdings—without the need for digital systems.

Whether you’re a small business owner, administrator, or sole proprietor, using aprintable payroll helps ensure proper documentation. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.