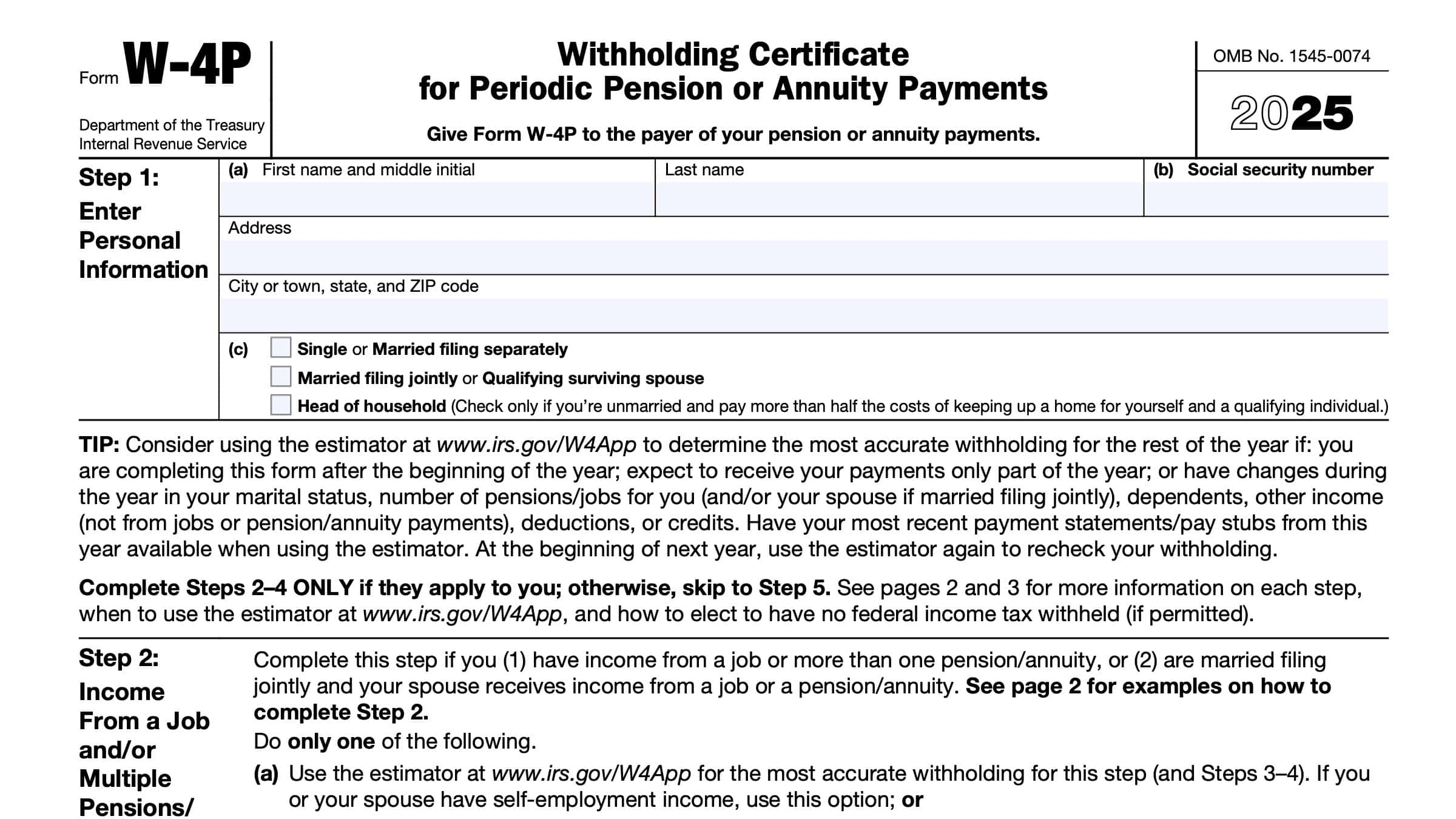

When it comes to managing your taxes, staying organized is key. One important form to be aware of is the IRS Form W-4P, which is used to withhold federal income tax from certain retirement distributions. This form allows individuals to specify how much tax they want withheld from their retirement payments, helping to avoid any surprises come tax season.

For those who receive pension or annuity payments, filling out the IRS Form W-4P is essential. This form allows you to indicate your filing status, as well as any additional withholding amounts you want taken out of your payments. By carefully completing this form, you can ensure that the correct amount of taxes are being withheld throughout the year.

It’s important to note that the IRS Form W-4P is not a one-time document. If your financial situation changes, such as getting married or having a child, you may need to revisit and update this form to reflect your new tax withholding preferences. By staying proactive and keeping your form up to date, you can avoid any potential underpayment penalties.

When it comes to accessing the IRS Form W-4P, you have the option to print it out directly from the IRS website. The form is readily available in a printable format, making it easy for you to fill it out at your convenience. Simply download the form, complete the necessary sections, and submit it to your retirement plan administrator.

In conclusion, the IRS Form W-4P is a vital tool for ensuring that the correct amount of federal income tax is withheld from your retirement payments. By taking the time to fill out this form accurately and updating it as needed, you can stay on top of your tax obligations and avoid any potential issues down the line. Make sure to utilize the printable version of the form for easy access and convenience.

Save and Print Irs Form W 4p 2024 Printable

Printable payroll are ideal for teams that prefer non-digital systems or need printed versions for employee records. Most forms include fields for employee name, pay period, total earnings, taxes, and final salary—making them both complete and user-friendly.

Start simplifying your payroll process today with a trusted printable payroll template. Save time, reduce errors, and maintain clear records—all while keeping your financial logs organized.

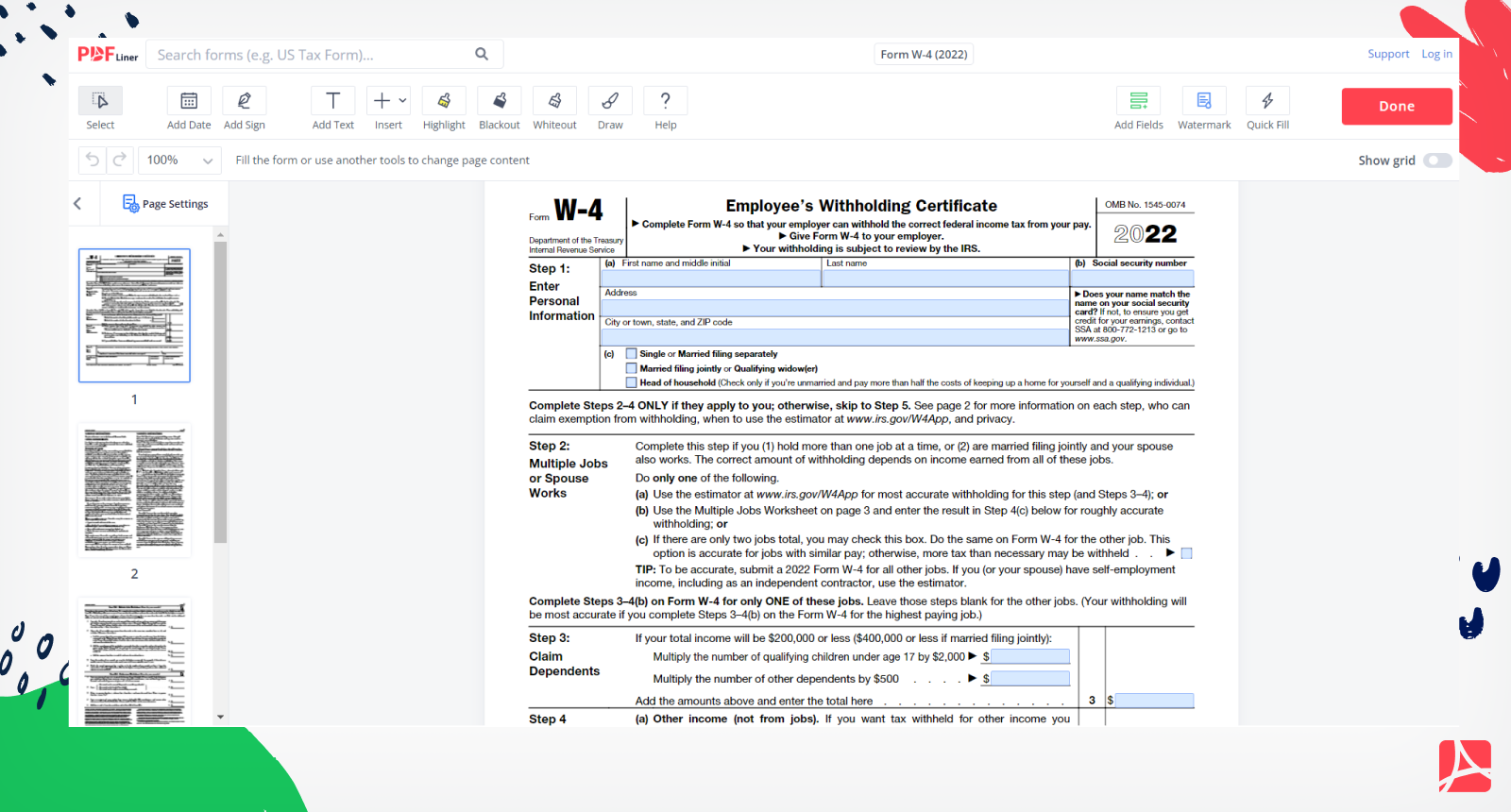

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

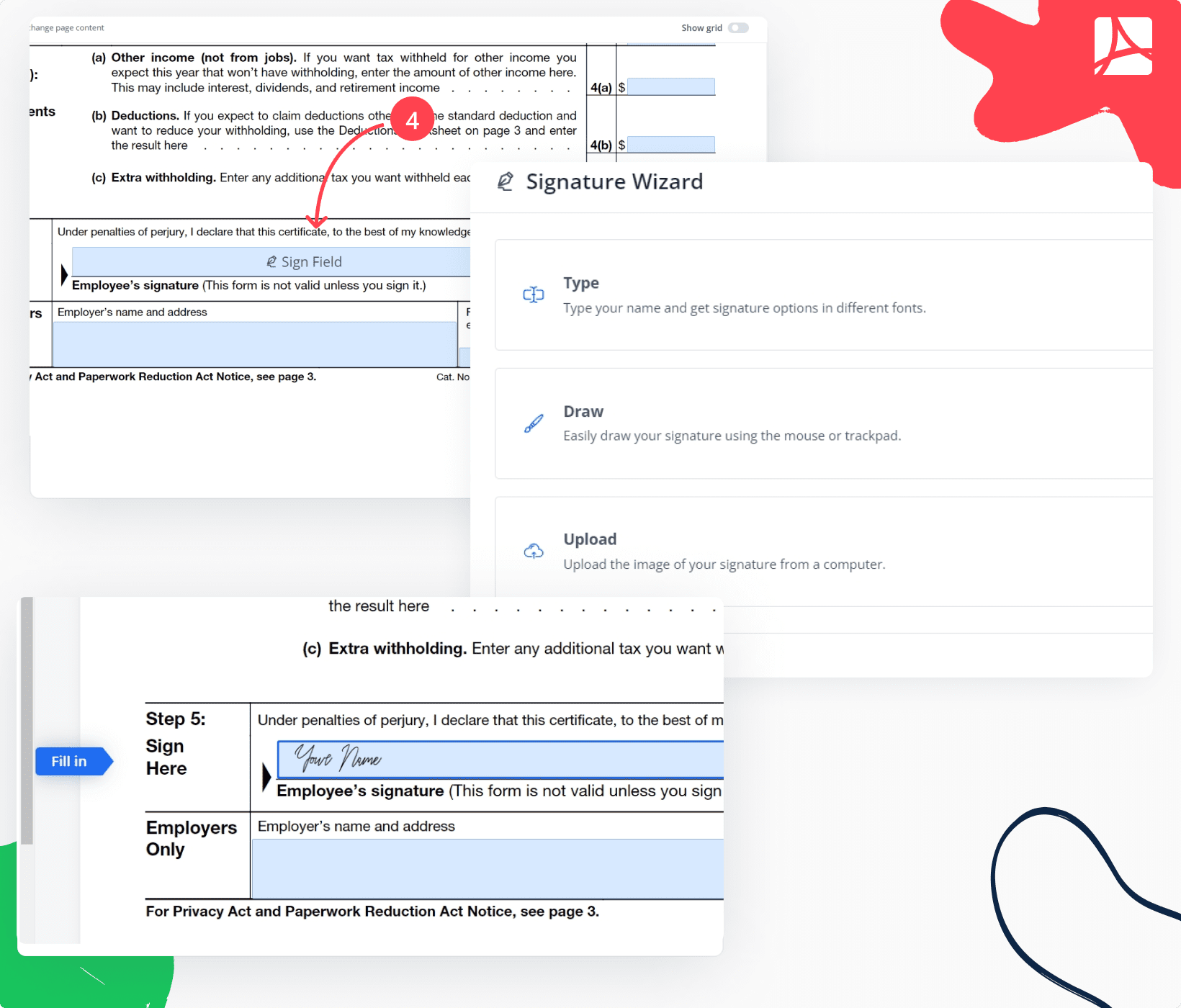

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

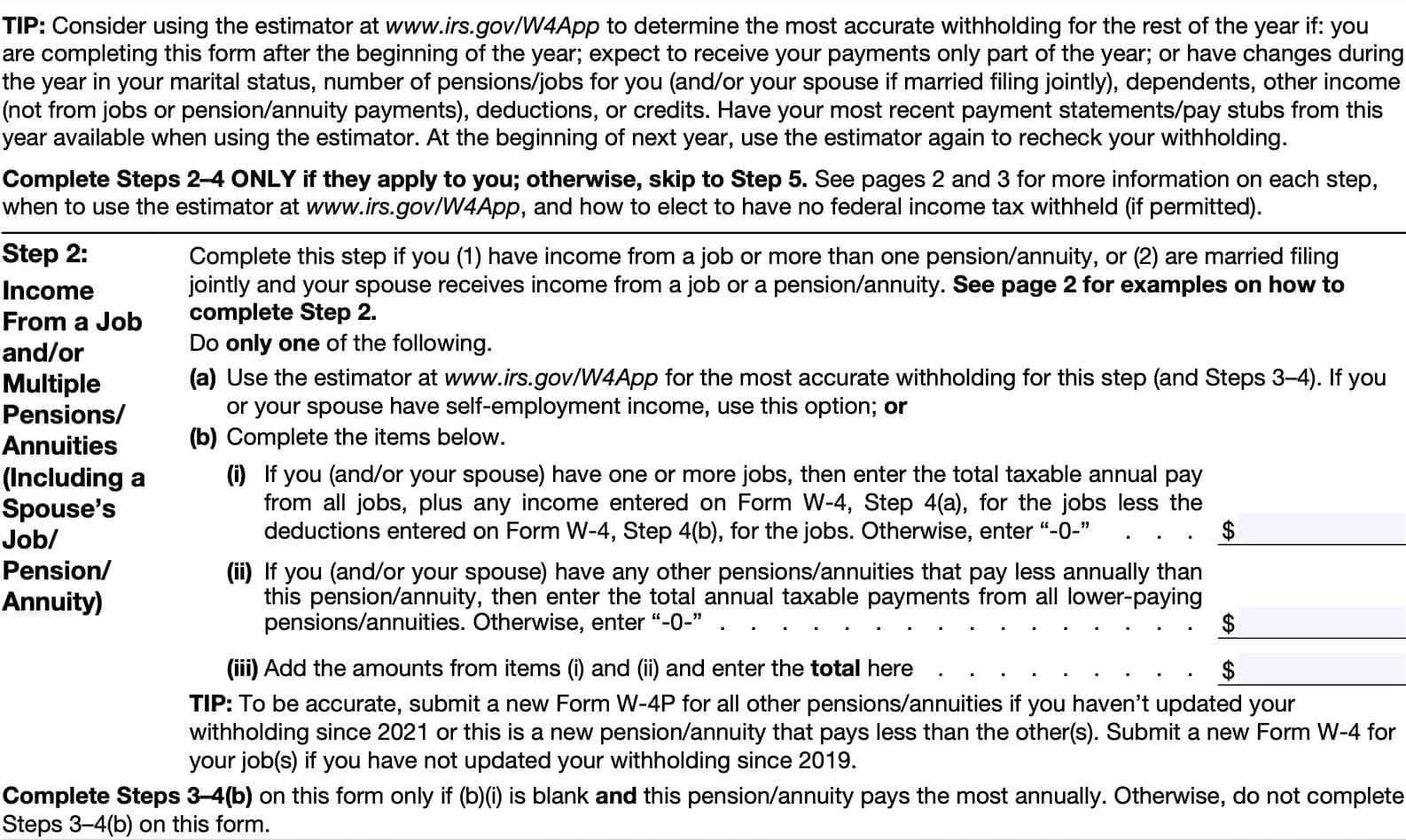

IRS Form W 4P Instructions Pension U0026 Annuity Tax Withholding

IRS Form W 4P Instructions Pension U0026 Annuity Tax Withholding

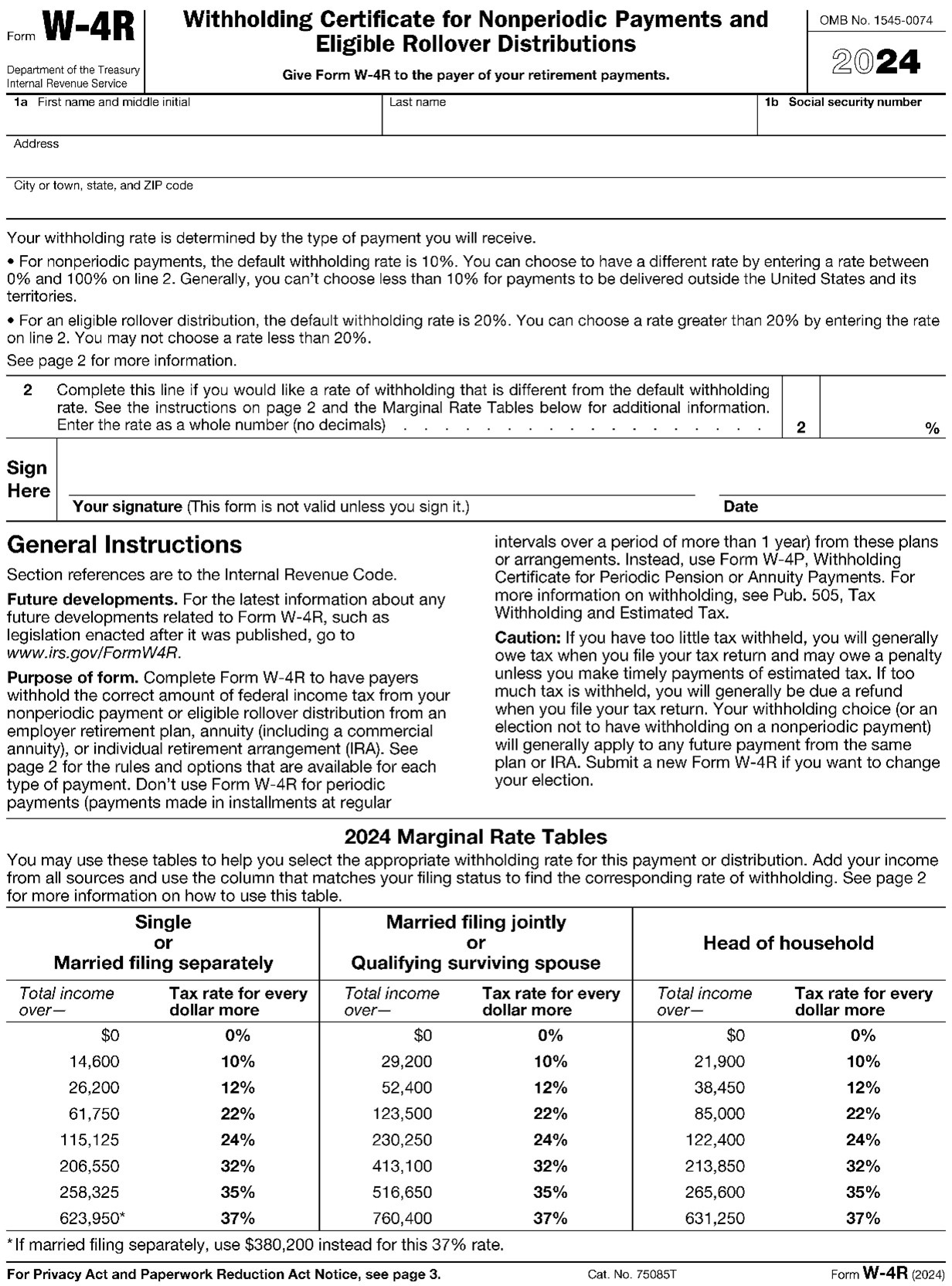

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Form W 4P Instructions Pension U0026 Annuity Tax Withholding

IRS Form W 4P Instructions Pension U0026 Annuity Tax Withholding

Handling staff wages doesn’t have to be overwhelming. A printable payroll template offers a quick, dependable, and user-friendly method for tracking wages, work time, and taxes—without the need for complicated tools.

Whether you’re a startup founder, HR professional, or sole proprietor, using aprintable payroll form helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.