IRS Form W-2 is a tax form that employers are required to send to their employees and the Internal Revenue Service (IRS) at the end of each year. The form reports the employee’s annual wages and the amount of taxes withheld from their paychecks. It is crucial for individuals to have this form in order to accurately file their taxes and report their income to the IRS.

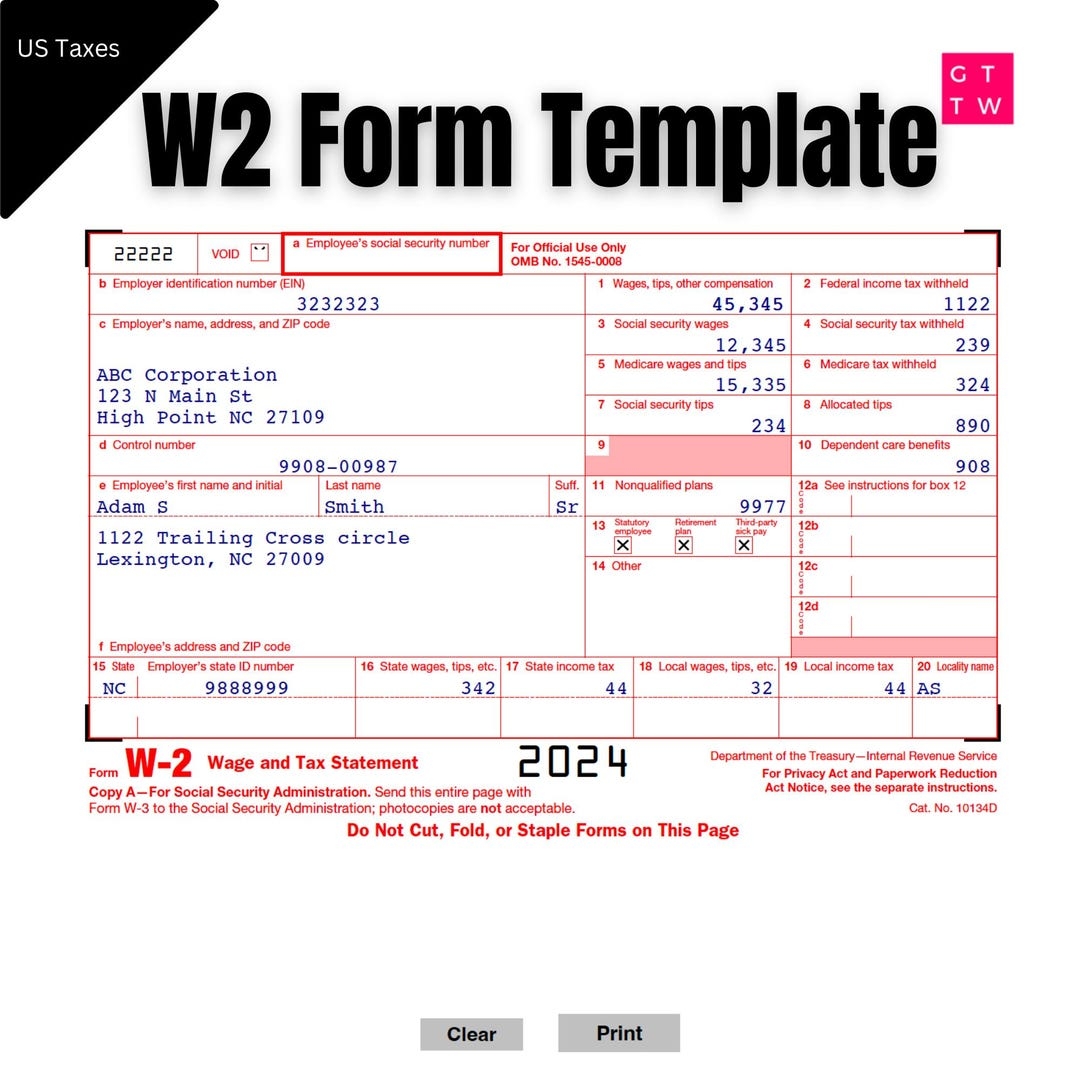

For the year 2024, the IRS has released the updated version of Form W-2 that employers can use to report their employees’ earnings and tax withholdings. This printable form is easily accessible online and can be filled out electronically or manually, depending on the employer’s preference.

Employers must ensure that all the information on the Form W-2 is accurate and up-to-date before distributing it to their employees. This includes the employee’s name, Social Security number, wages earned, taxes withheld, and other relevant information. Any errors or discrepancies on the form can lead to penalties from the IRS, so it is essential to double-check all the details before submission.

Employees can use the information on Form W-2 to file their taxes and claim any refunds they may be eligible for. The form provides a breakdown of their income and taxes paid throughout the year, making it easier for individuals to report their earnings accurately to the IRS. It is important for employees to keep this form safe and secure, as it contains sensitive information that should not be shared with anyone.

Overall, IRS Form W-2 is a vital document for both employers and employees, as it helps ensure that taxes are accurately reported and paid to the government. By utilizing the printable version of the form for the year 2024, individuals can easily access and fill out the necessary information to stay compliant with tax regulations. It is recommended to consult with a tax professional if there are any questions or concerns regarding Form W-2 and its implications for tax filing.

Make sure to download and print the IRS Form W-2 2024 Printable to stay on top of your tax obligations and avoid any potential penalties from the IRS. Remember to review the form carefully and seek assistance if needed to ensure that all information is accurate and complete.