Nonprofit organizations are required to file an annual information return with the IRS, known as Form 990. This form provides the government and the public with financial information about the organization, including its mission, programs, and finances. For small nonprofits with gross receipts of $50,000 or less, there is a simplified version of Form 990 called Form 990-N, also known as the e-Postcard.

Form 990-N is a short electronic form that must be filed annually by small tax-exempt organizations. It is a way for these organizations to report their basic information to the IRS, including their contact information, any changes to their address or legal name, and whether they have terminated operations. While it is a simplified form, it is still important for small nonprofits to file Form 990-N to maintain their tax-exempt status.

When it comes to filing Form 990-N, it’s important for organizations to ensure that they are accurately reporting their information. The form can be easily completed online through the IRS website, where organizations will need to provide their Employer Identification Number (EIN) and other basic information. It is crucial for nonprofits to file Form 990-N on time, as failing to do so for three consecutive years can result in the loss of tax-exempt status.

For organizations that prefer to file a paper version of Form 990-N, the printable version of the form is available on the IRS website. The form can be downloaded, printed, and completed manually before mailing it to the appropriate IRS address. It is important to note that the IRS strongly encourages organizations to file Form 990-N electronically, as it is a more efficient and secure way to submit the required information.

In conclusion, Form 990-N is a simplified version of the annual information return that small tax-exempt organizations must file with the IRS. By accurately reporting their basic information through this form, nonprofits can maintain their tax-exempt status and stay compliant with IRS regulations. Whether filing electronically or using the printable version of Form 990-N, it is essential for organizations to meet their annual filing requirements to avoid any penalties or consequences.

Get and Print Irs Form 990n Printable

Printable payroll template are ideal for teams that prefer paper documentation or need physical copies for employee records. Most forms include fields for staff name, date range, gross pay, withholdings, and final salary—making them both complete and user-friendly.

Begin streamlining your payroll system today with a trusted printable payroll form. Reduce admin effort, reduce errors, and maintain clear records—all while keeping your payroll records professional.

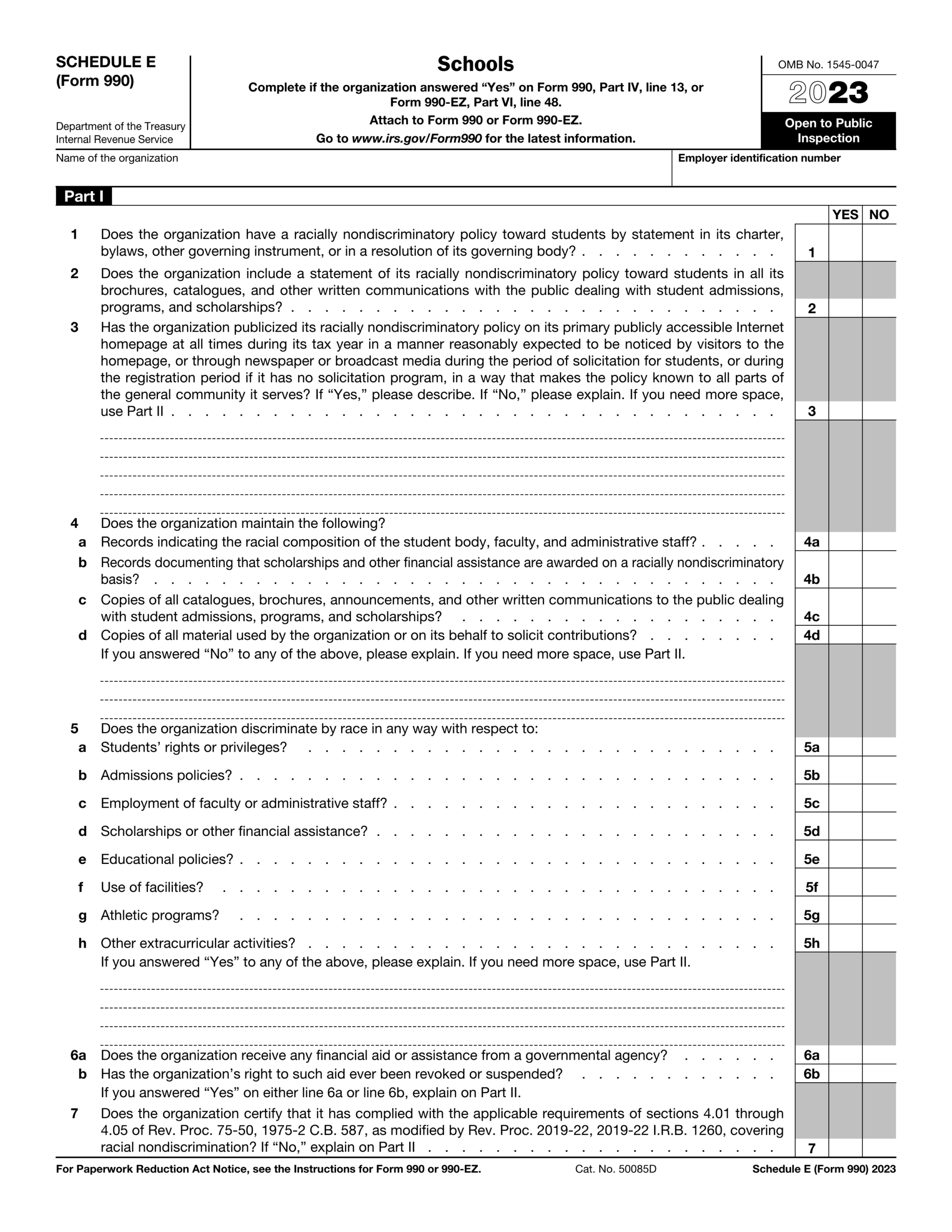

Fill Schedule E Form 990 2024 2025 Create Edit Forms Online

Fill Schedule E Form 990 2024 2025 Create Edit Forms Online

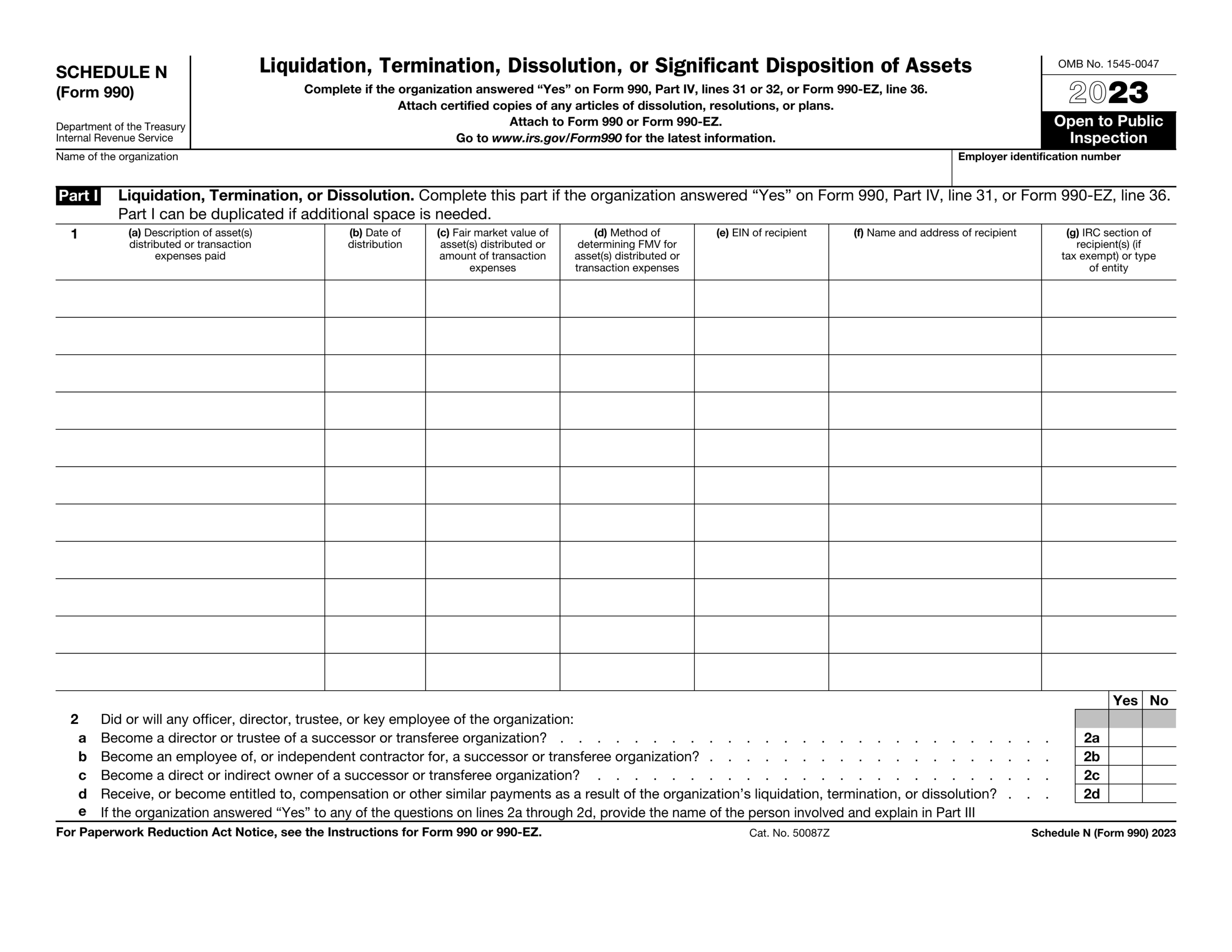

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

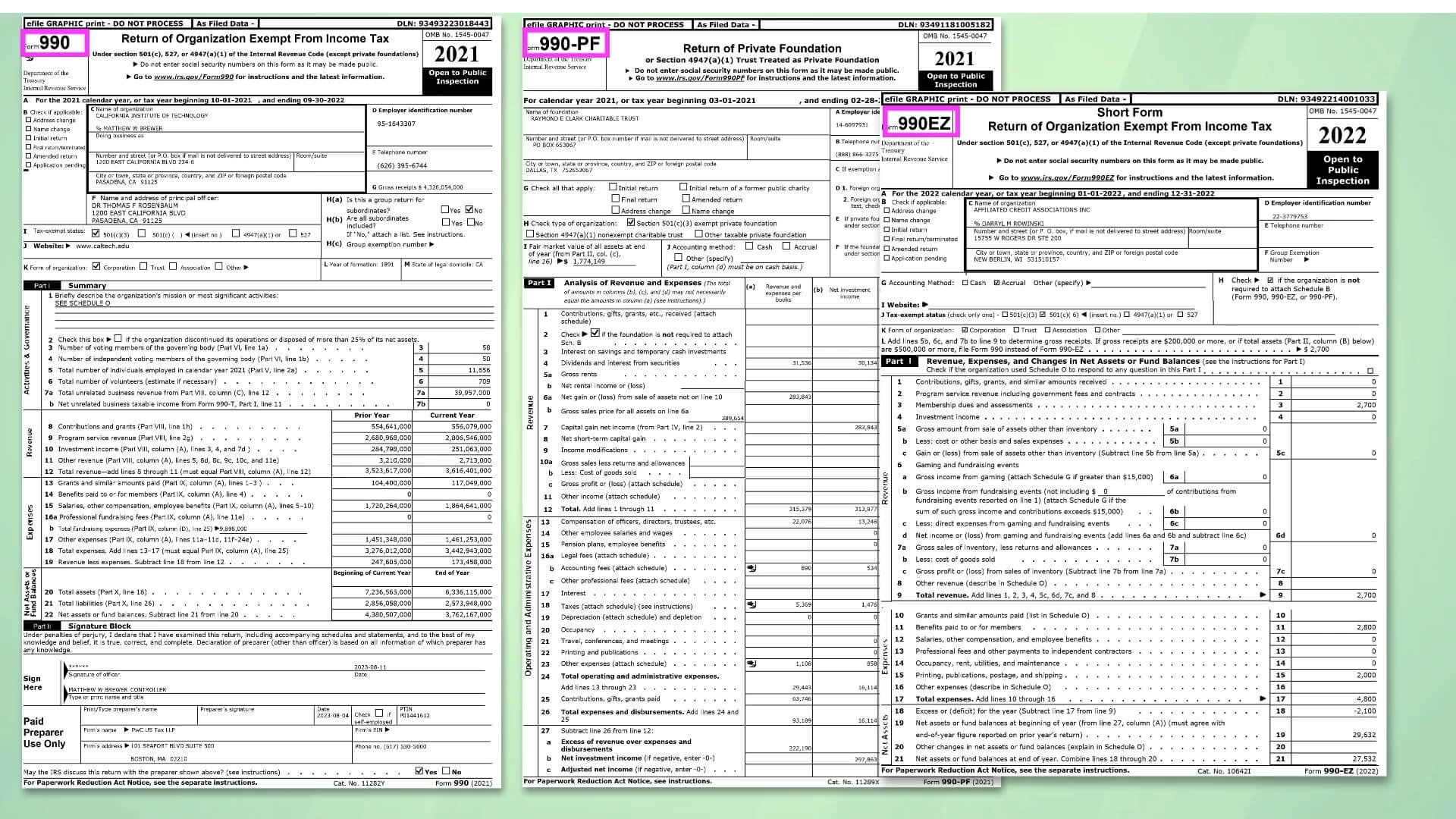

2021 IRS Form 990 By Ozarks Food Harvest Issuu

2021 IRS Form 990 By Ozarks Food Harvest Issuu

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

Schedule N Form 990 2024 2025 Fill Forms Online PDF Guru

Processing staff wages doesn’t have to be complicated. A printable payroll offers a fast, accurate, and straightforward method for tracking salaries, hours, and withholdings—without the need for complex software.

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll helps ensure proper documentation. Simply get the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.