Filing taxes can be a daunting task for many individuals and businesses. However, with the right tools and resources, the process can be made easier. One important form that employers need to be familiar with is IRS Form 941. This form is used to report quarterly wages paid to employees and the amount of taxes withheld from their paychecks.

For the year 2025, the IRS has made available a printable version of Form 941 on their website. This allows employers to easily access and fill out the form, ensuring that they are in compliance with tax regulations. The printable version can be downloaded and printed for convenience.

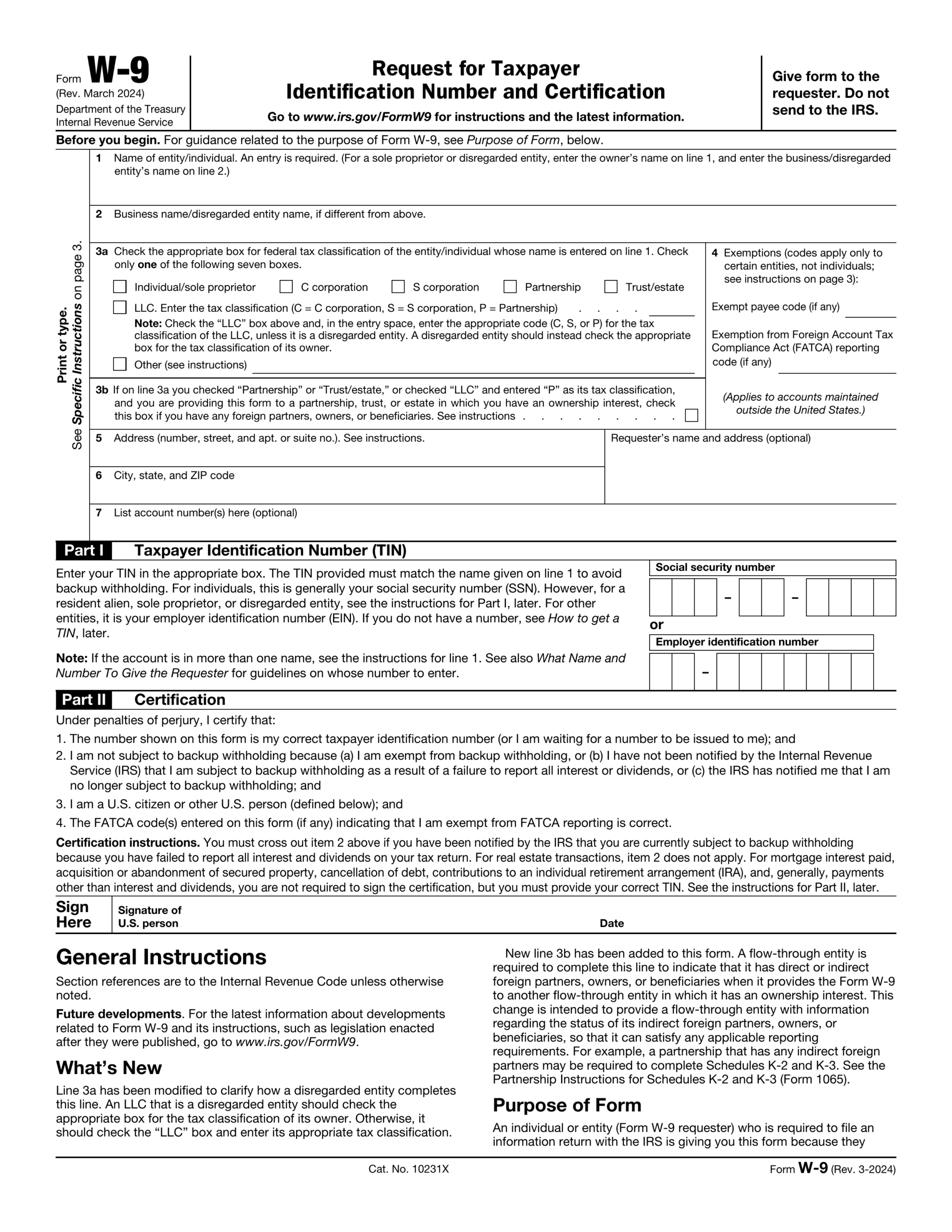

Irs Form 941 For 2025 Printable

Irs Form 941 For 2025 Printable

When filling out Form 941 for 2025, employers will need to provide information such as the total number of employees, wages paid, federal income tax withheld, and the amount of taxes owed. It is important to accurately report this information to avoid any penalties or fines from the IRS. Employers should also ensure that they submit the form by the quarterly deadline to avoid any issues.

Employers can also make use of online resources and tools to help them fill out Form 941 accurately. There are software programs available that can streamline the process and ensure that all information is reported correctly. This can save time and reduce the chances of errors on the form.

In conclusion, IRS Form 941 for 2025 is an important document that employers need to be familiar with. By using the printable version available on the IRS website and leveraging online resources, employers can ensure that they are compliant with tax regulations and avoid any penalties. It is crucial to accurately report the information required on the form and submit it by the deadline to stay in good standing with the IRS.

Make sure to download and print the printable version of Form 941 for 2025 to stay on top of your tax obligations and keep your business in good standing with the IRS.