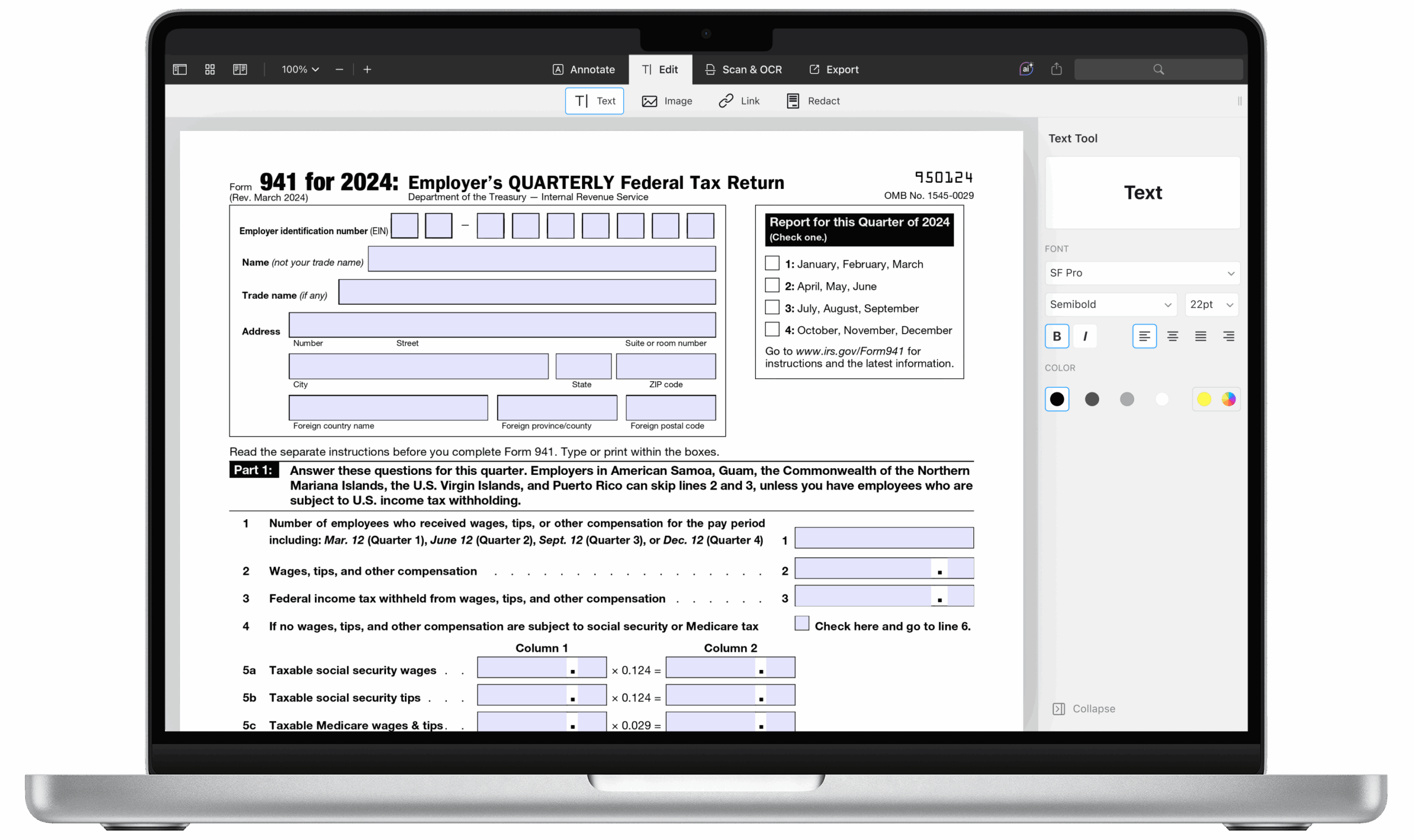

IRS Form 941 is used by employers to report quarterly wages and payroll taxes for employees. It is a crucial form that must be filed accurately and on time to avoid penalties from the IRS. For the year 2024, employers will need to ensure they have the correct form and information to complete their quarterly filings.

Employers can easily access the IRS Form 941 for 2024 printable version online. This form can be downloaded, filled out, and submitted to the IRS as needed. Having the printable version allows employers to have a physical copy on hand for their records and to easily reference when completing their quarterly tax reporting.

Irs Form 941 For 2024 Printable

Irs Form 941 For 2024 Printable

Completing IRS Form 941 for 2024 requires accurate information regarding employee wages, tips, and other compensation, as well as tax withholdings and payments. Employers must also ensure they are using the correct tax rates and calculations for Social Security, Medicare, and other applicable taxes. Filing this form accurately is essential for maintaining compliance with IRS regulations.

Employers should pay close attention to the deadlines for filing IRS Form 941 for 2024. Quarterly deadlines typically fall on the last day of the month following the end of the quarter. Failing to file on time or submitting inaccurate information can result in penalties and fines from the IRS, so it is important to stay organized and informed throughout the year.

Overall, IRS Form 941 for 2024 printable version is a valuable tool for employers to report quarterly wages and taxes for their employees. By ensuring accurate and timely filing, employers can avoid potential issues with the IRS and maintain compliance with tax regulations. It is essential for employers to stay informed and up to date on the requirements for filing this form each quarter.

Employers should consult with a tax professional or utilize resources provided by the IRS to ensure they are completing IRS Form 941 for 2024 accurately. By taking the time to understand the form and its requirements, employers can streamline the process and avoid costly mistakes when reporting their quarterly payroll taxes.