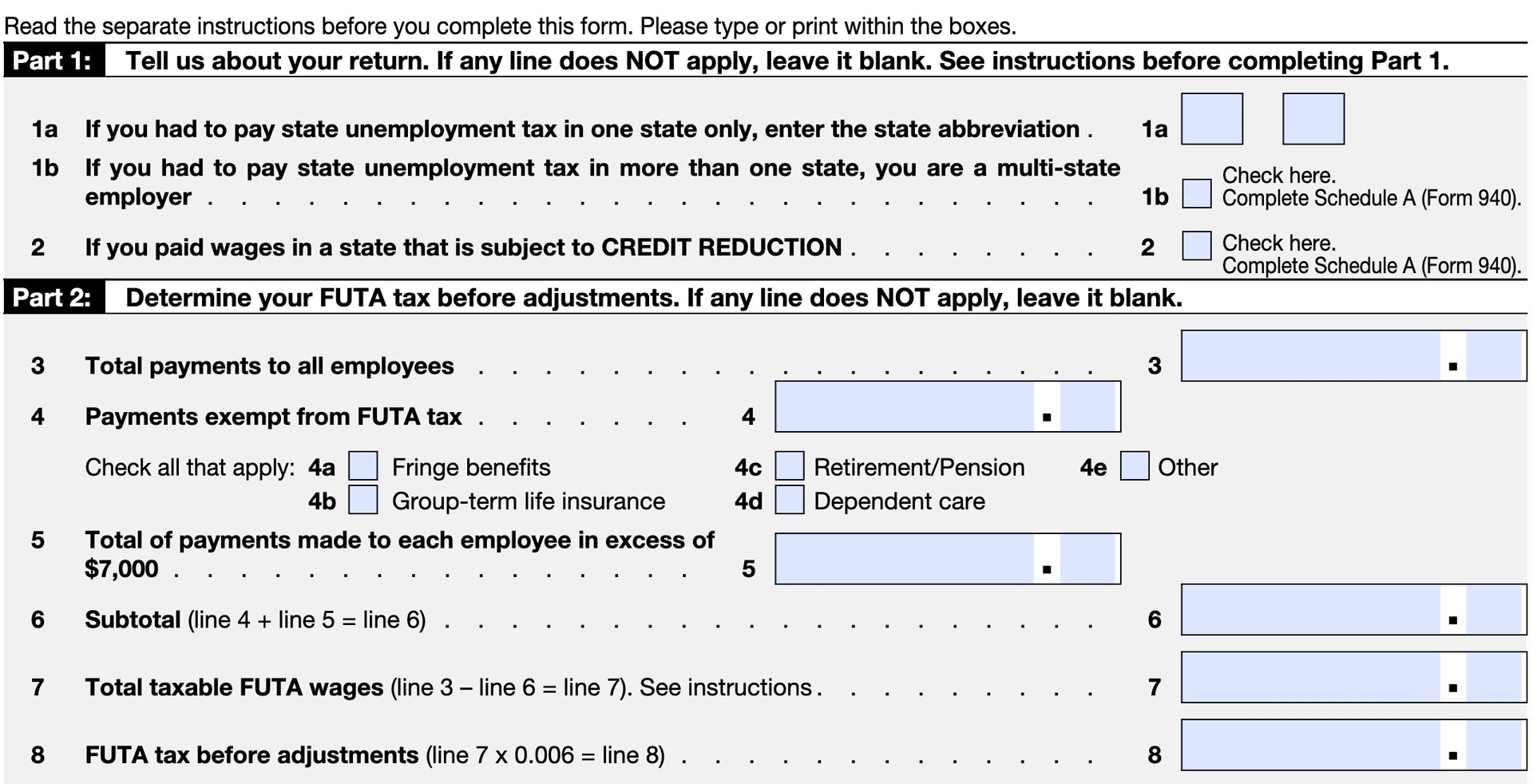

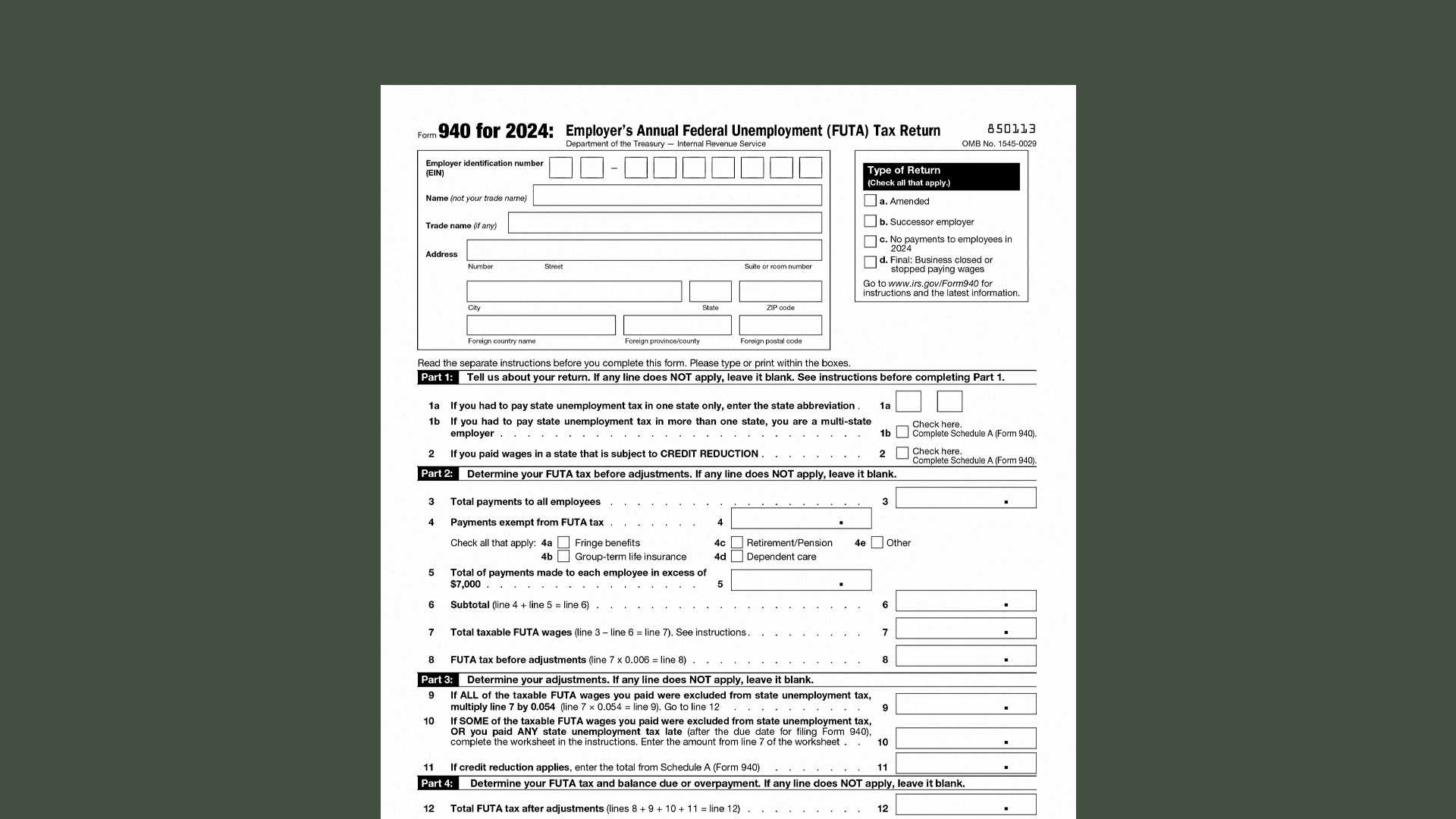

When it comes to tax season, staying organized is key. One important form that businesses must fill out is Form 940, which is used to report annual Federal Unemployment Tax Act (FUTA) tax. For the year 2025, it is essential to have a printable version of this form on hand to ensure accurate reporting and compliance with IRS regulations.

Form 940 for 2025 will include information about the employer’s unemployment tax liability for the year, as well as any credits that may apply. It is important to carefully review the instructions and guidelines provided by the IRS to ensure that the form is filled out correctly.

Irs Form 940 For 2025 Printable

Irs Form 940 For 2025 Printable

As you prepare to file your taxes for the year 2025, having a printable version of Form 940 readily available can save you time and ensure that you meet all necessary deadlines. By staying organized and keeping accurate records, you can avoid potential errors and penalties.

Business owners should also be aware of any changes to the tax laws or regulations that may impact their FUTA tax liability for the year 2025. Staying informed and seeking guidance from a tax professional can help ensure that you are in compliance with the latest requirements.

Overall, having a printable version of Form 940 for 2025 is essential for businesses to accurately report their FUTA tax liability. By staying organized, reviewing instructions carefully, and seeking guidance when needed, you can navigate the tax filing process with confidence and peace of mind.

As tax season approaches, be sure to download and print Form 940 for 2025 to ensure that you are prepared to report your FUTA tax liability accurately and on time. By staying organized and informed, you can avoid potential errors and penalties and focus on growing your business.

Get and Print Irs Form 940 For 2025 Printable

Printable payroll are ideal for companies that prefer physical records or need physical copies for employee records. Most forms include fields for staff name, date range, gross pay, withholdings, and final salary—making them both complete and practical.

Begin streamlining your payment tracking today with a trusted printable payroll template. Reduce admin effort, reduce errors, and maintain clear records—all while keeping your payroll records professional.

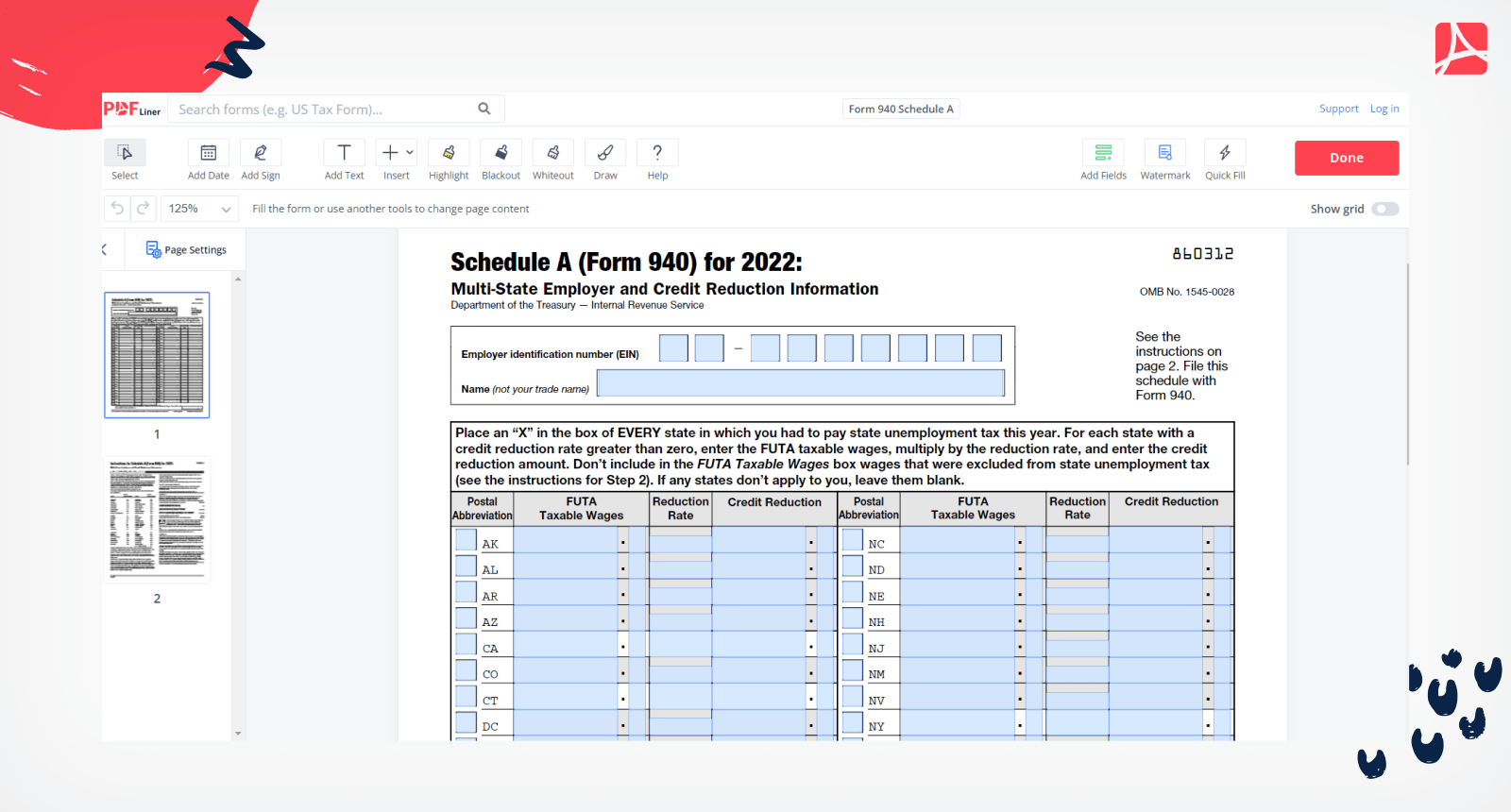

Form 940 Schedule A Printable Form 940 Schedule A Blank

Form 940 Schedule A Printable Form 940 Schedule A Blank

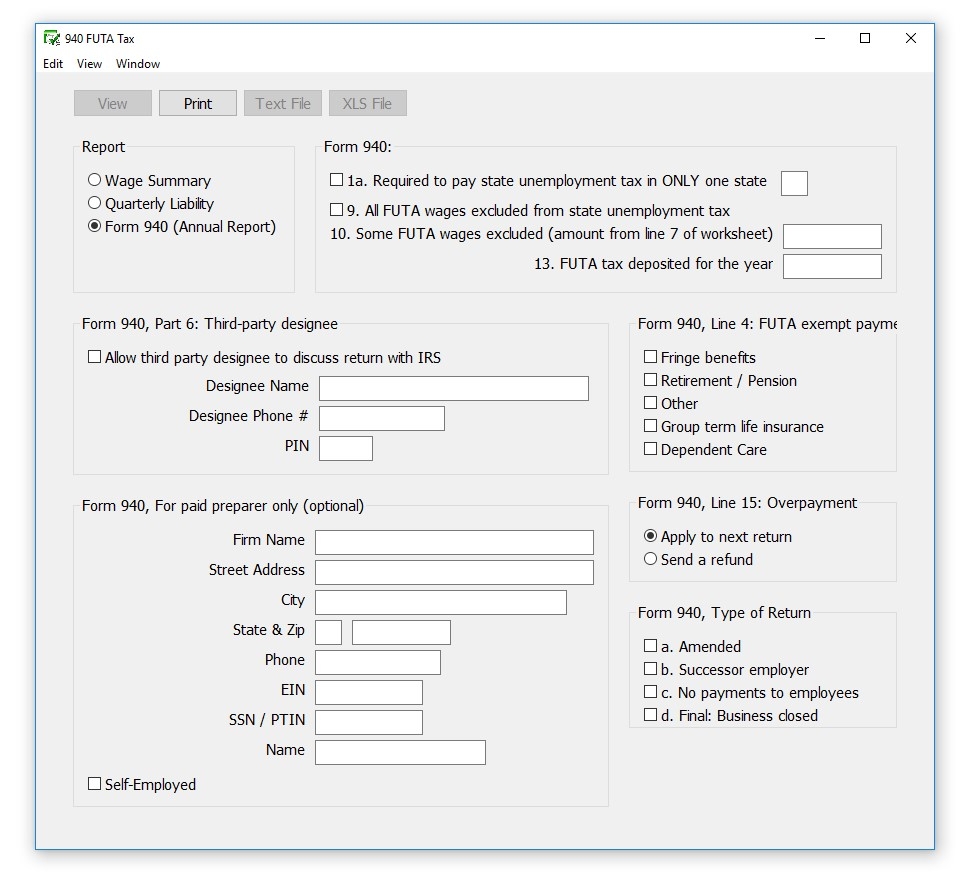

How To Create 940 Reports In CheckMark Payroll Software

How To Create 940 Reports In CheckMark Payroll Software

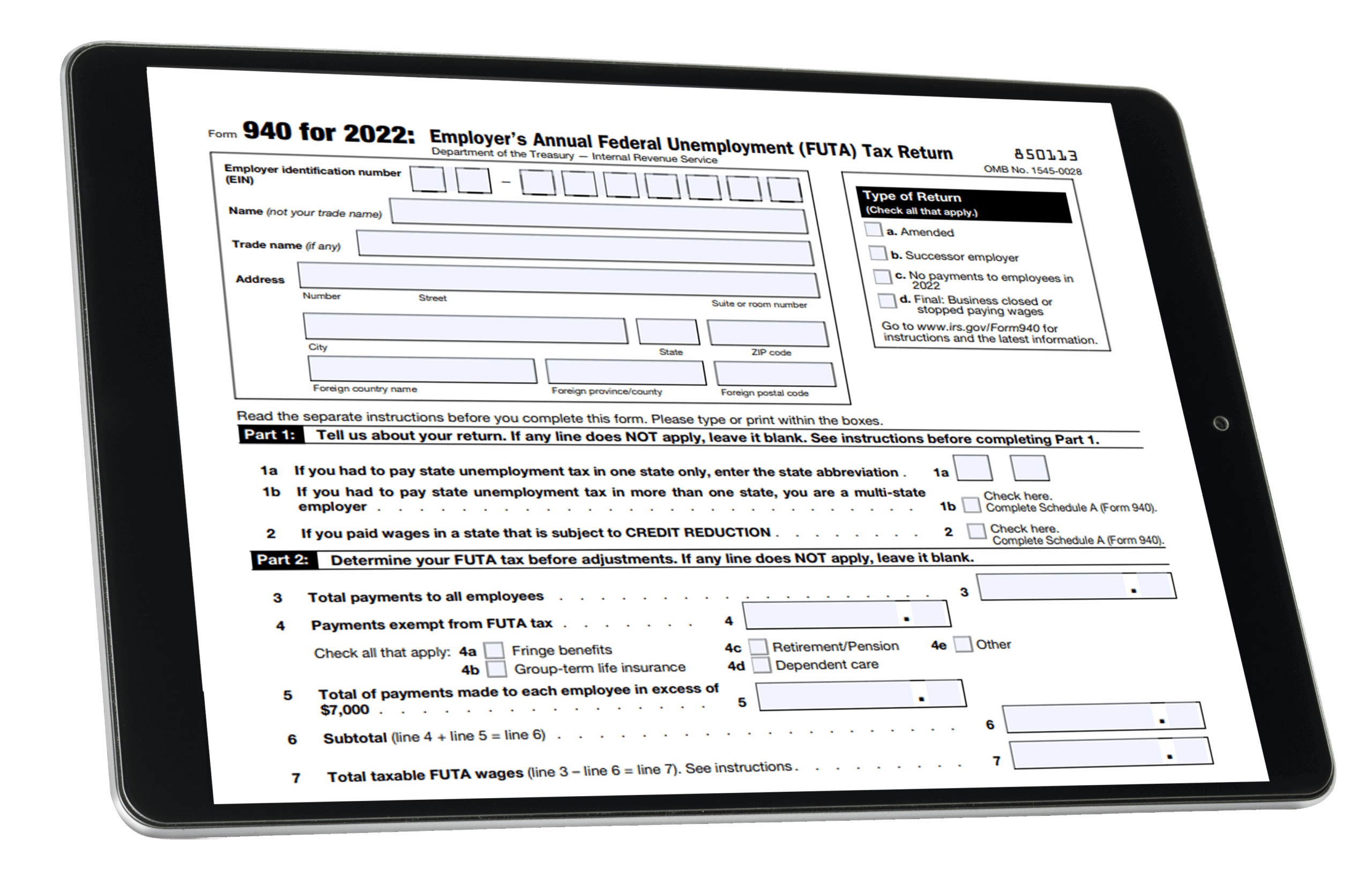

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

How To File Form 940 The Employer S Annual Federal Unemployment

How To File Form 940 The Employer S Annual Federal Unemployment

Managing payroll tasks doesn’t have to be difficult. A printable payroll form offers a quick, dependable, and easy-to-use method for tracking employee pay, work time, and deductions—without the need for complex software.

Whether you’re a small business owner, payroll manager, or sole proprietor, using aprintable payroll template helps ensure proper documentation. Simply access the template, produce a hard copy, and complete it by hand or edit it digitally before printing.