IRS Form 8889 is a crucial document for individuals who have a Health Savings Account (HSA). This form is used to report contributions to and distributions from an HSA, as well as any taxes or penalties associated with these transactions. It is important to accurately complete Form 8889 to ensure compliance with IRS regulations and avoid any potential penalties.

For those who prefer to fill out forms manually, IRS Form 8889 Printable is available online for easy access. This printable version allows individuals to fill out the form by hand and submit it along with their tax return.

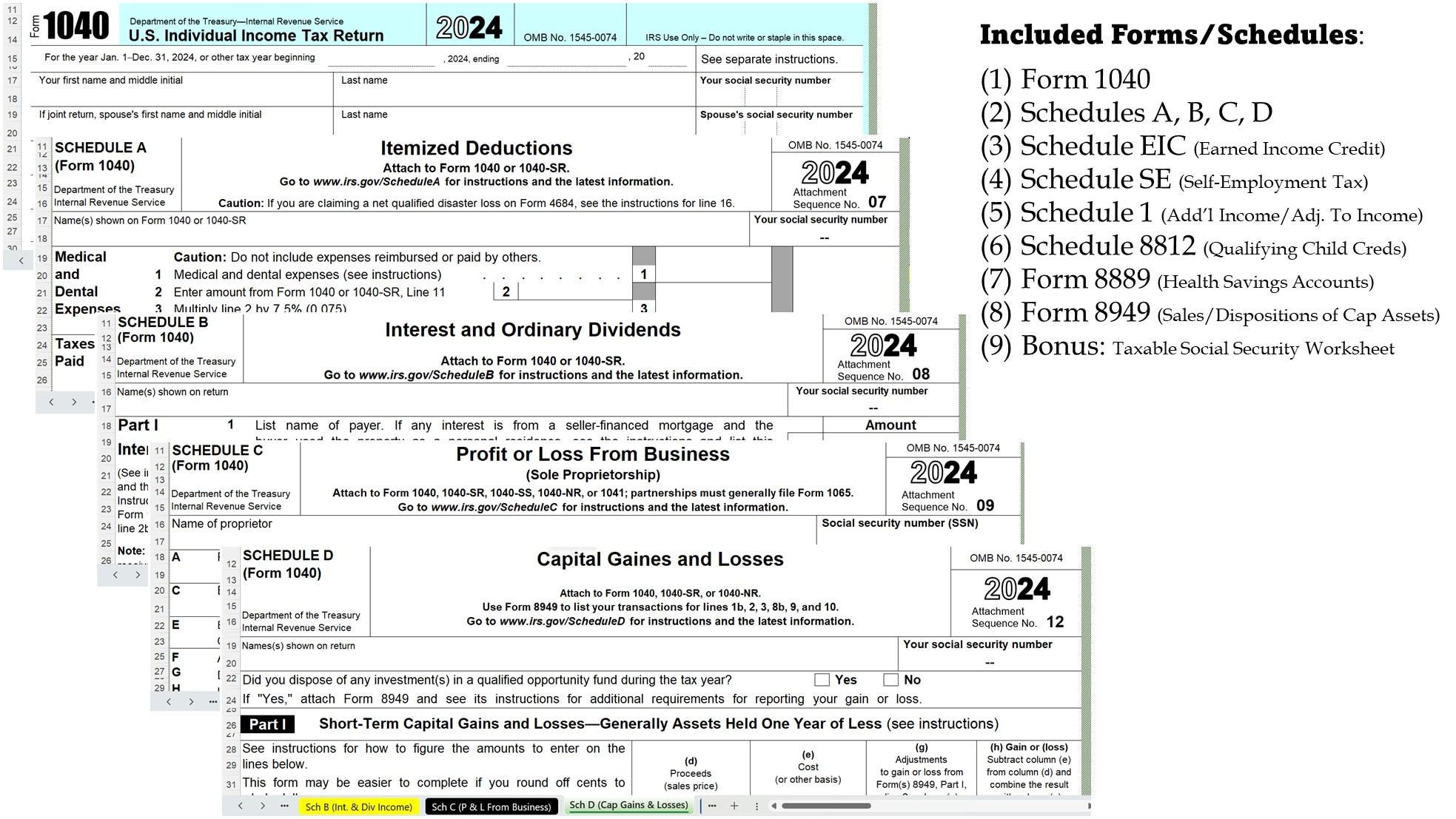

IRS Form 8889 Printable

When completing IRS Form 8889, individuals will need to provide information about their HSA contributions, distributions, and any qualified medical expenses paid with HSA funds. It is important to carefully review the instructions provided with the form to ensure all information is accurately reported.

One of the key sections of Form 8889 is Part I, which covers HSA contributions. Here, individuals will need to report their total contributions to an HSA for the tax year, as well as any contributions made by an employer on their behalf. This information is used to determine the individual’s contribution limit for the year.

Part II of Form 8889 focuses on HSA distributions. Individuals will need to report any distributions they received from their HSA during the tax year, as well as any qualified medical expenses paid with HSA funds. It is important to keep detailed records of these expenses to support the information reported on the form.

Finally, Part III of Form 8889 is used to calculate any additional taxes or penalties owed on HSA transactions. This section may be required if an individual did not use HSA funds for qualified medical expenses or if they made excess contributions to their account. It is important to carefully review this section to ensure compliance with IRS regulations.

In conclusion, IRS Form 8889 Printable is a valuable resource for individuals with HSAs who prefer to fill out forms manually. By accurately completing this form and submitting it along with their tax return, individuals can ensure compliance with IRS regulations and avoid any potential penalties. It is important to carefully review the instructions provided with the form and keep detailed records of HSA transactions to support the information reported on Form 8889.