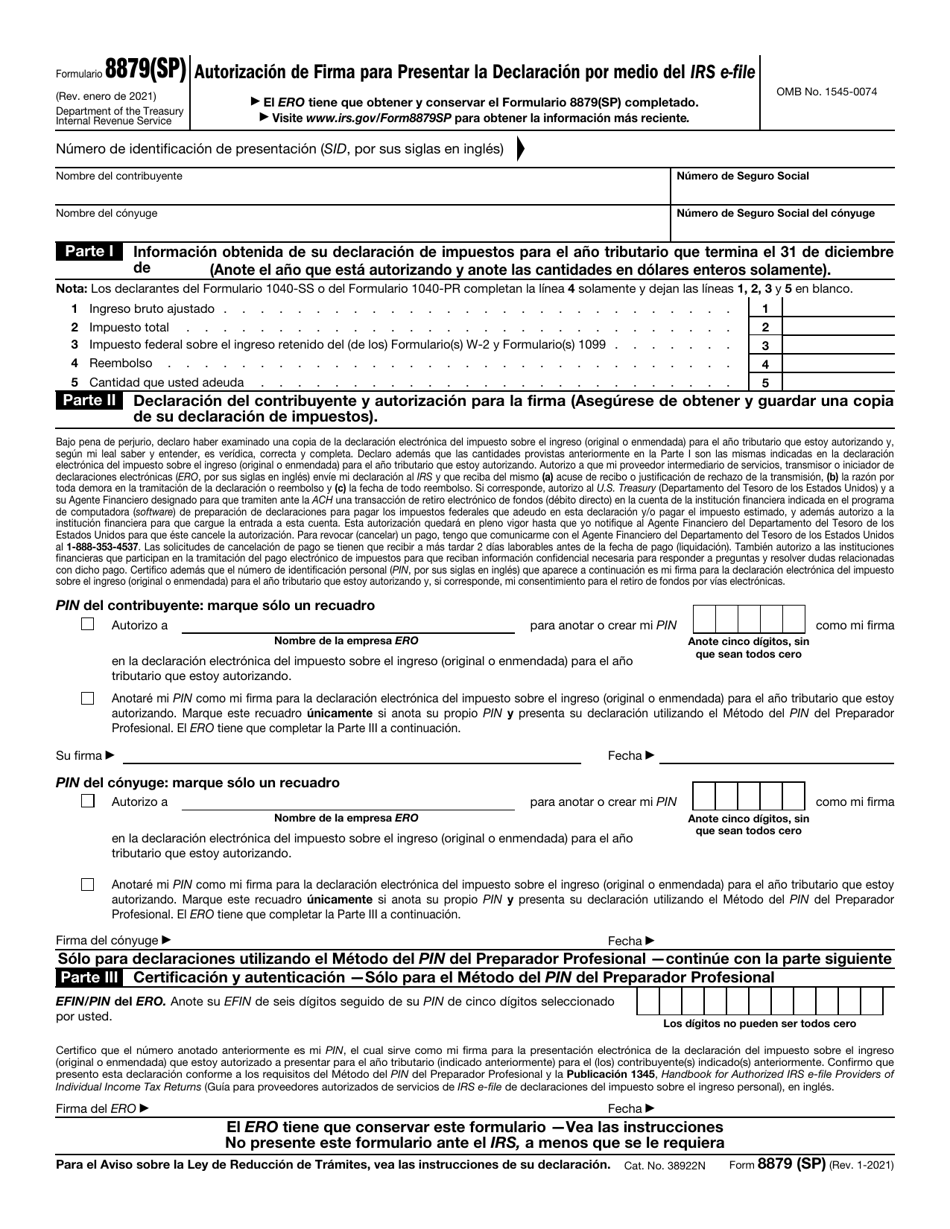

When it comes to filing taxes, it’s important to ensure that all the necessary forms are filled out accurately and submitted on time. One such form that taxpayers may need to use is IRS Form 8879. This form is used to authorize an electronic return originator (ERO) to transmit their client’s electronic tax return to the IRS. It serves as a signature authorization for the taxpayer, giving the ERO permission to e-file their return on their behalf.

IRS Form 8879 is a crucial document in the e-filing process, as it provides the IRS with the necessary authorization to accept the electronic submission of a taxpayer’s return. The form requires the taxpayer to verify their identity and sign off on the accuracy of the information provided in their tax return. While the form can be completed electronically, having a printable version can be convenient for those who prefer to fill it out by hand.

Using IRS Form 8879 printable allows taxpayers to carefully review the information provided before submitting it to the IRS. It also serves as a physical copy of the authorization, which can be kept for record-keeping purposes. Additionally, having a printed copy of the form can serve as a backup in case there are any issues with the electronic submission of the return.

It’s important to note that IRS Form 8879 must be signed by the taxpayer before it is submitted to the ERO. Without a valid signature, the ERO will not be able to e-file the return on behalf of the taxpayer. This is why it’s crucial for taxpayers to ensure that they have completed all sections of the form accurately and have signed it before submitting it.

In conclusion, IRS Form 8879 is a critical document in the e-filing process, as it authorizes the ERO to transmit the taxpayer’s return to the IRS electronically. Having a printable version of the form can be beneficial for those who prefer to fill it out by hand and keep a physical copy for their records. By using IRS Form 8879 printable, taxpayers can ensure that their electronic tax return is submitted accurately and on time.