IRS Form 8863 Printable

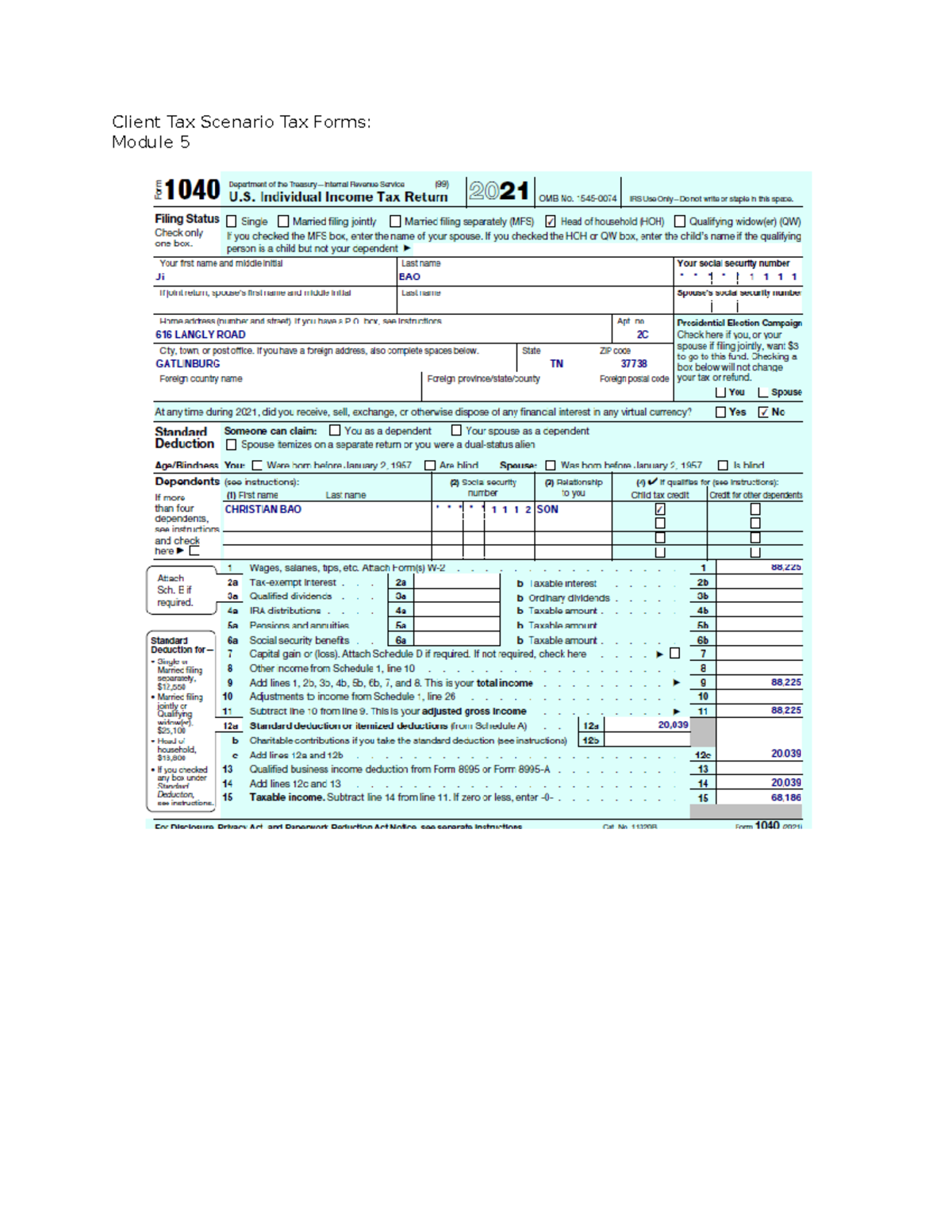

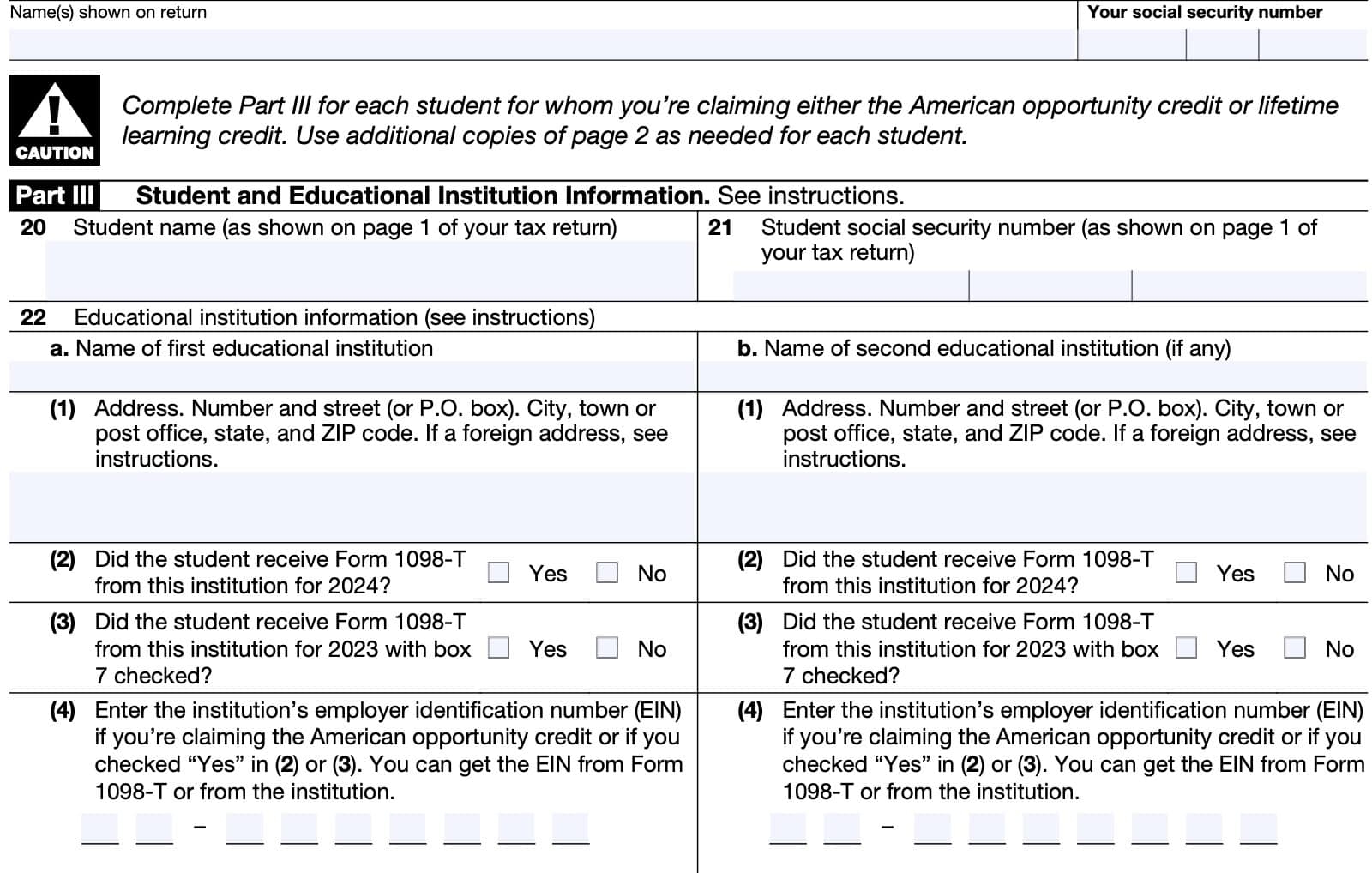

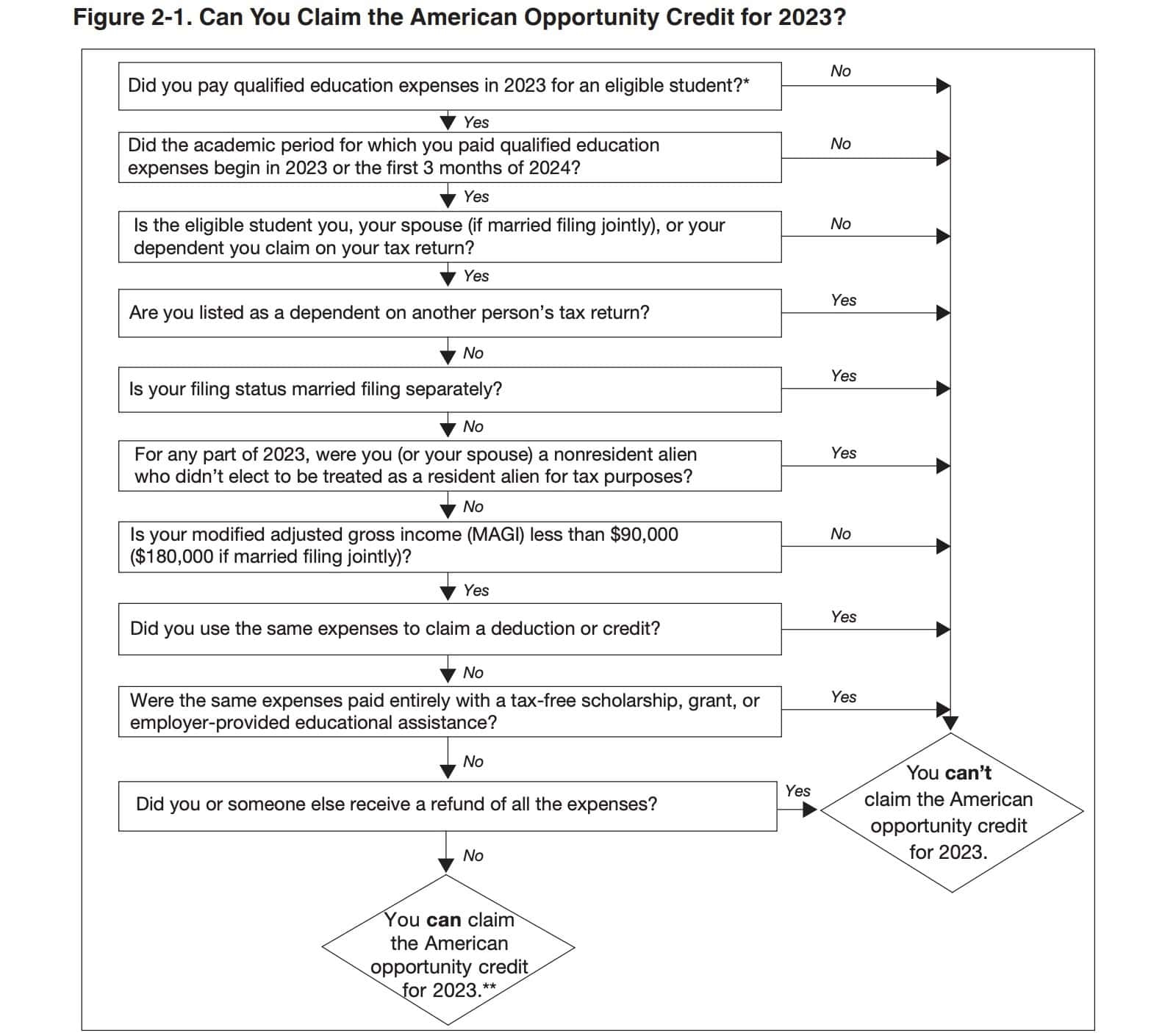

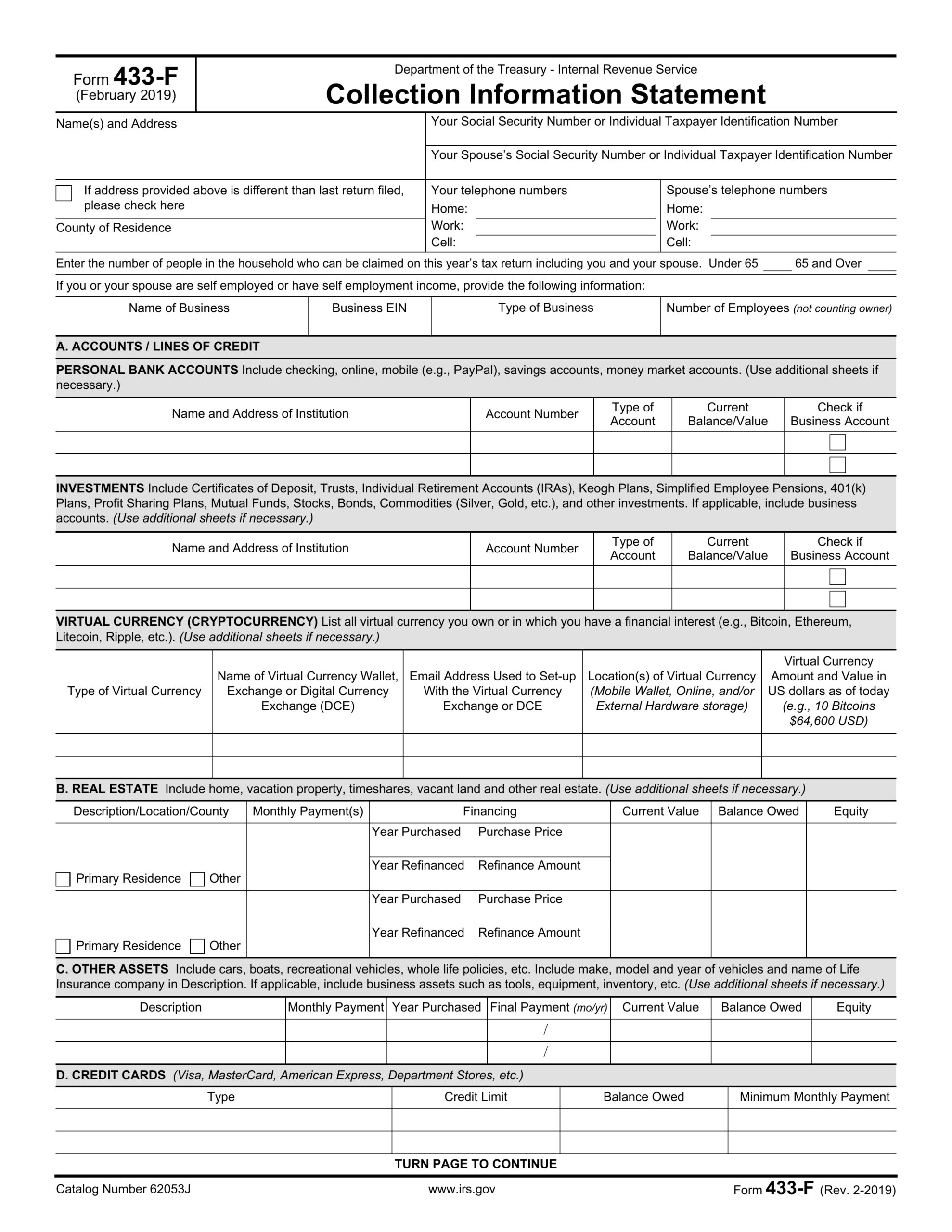

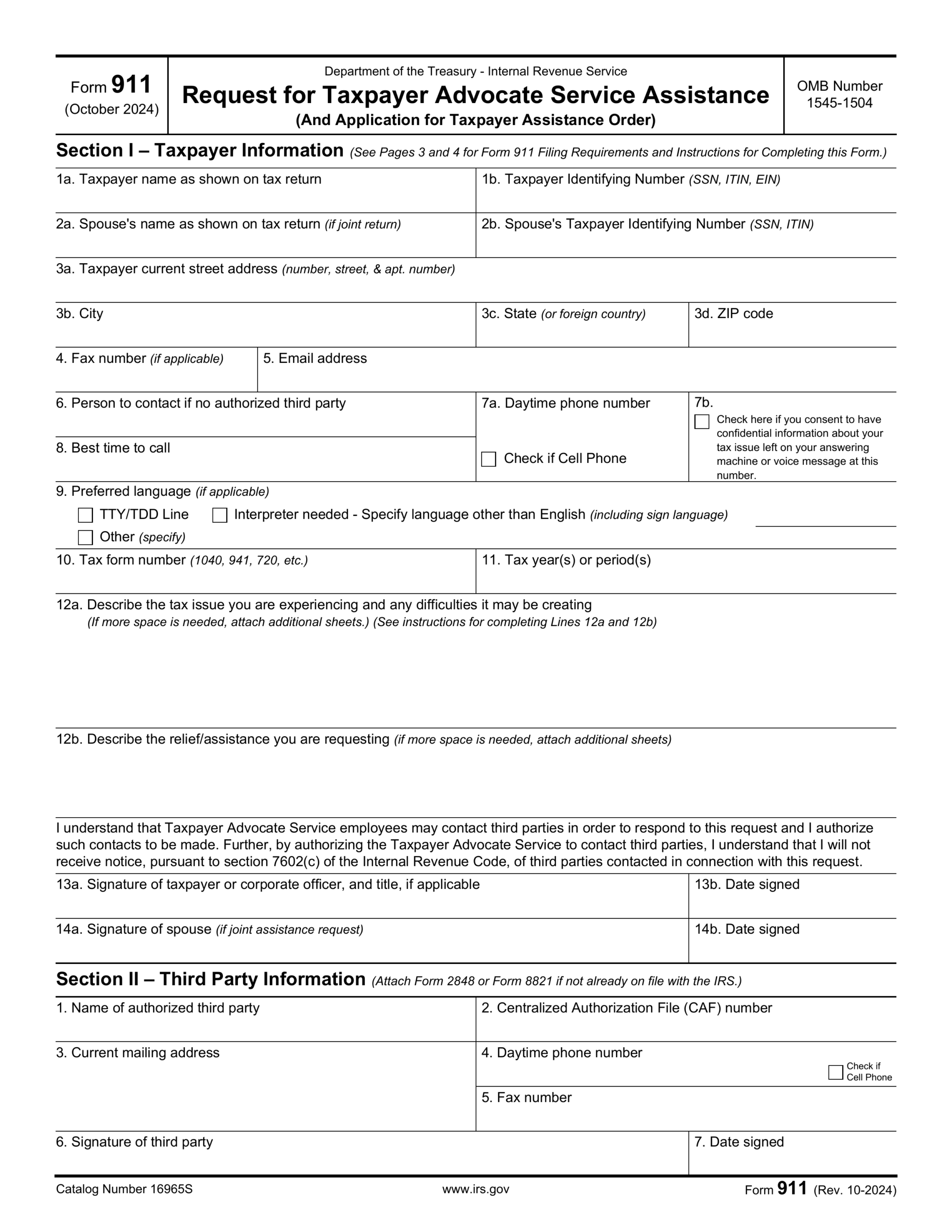

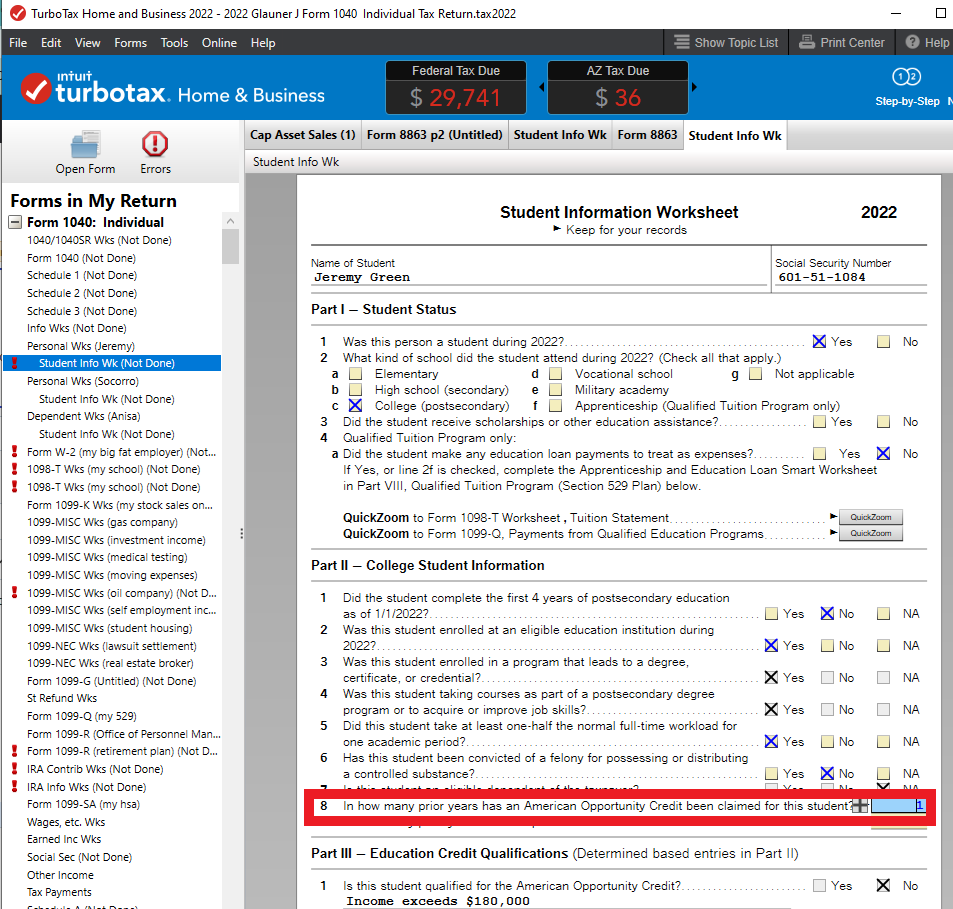

IRS Form 8863 is used by taxpayers to claim education credits such as the American Opportunity Credit and the Lifetime Learning Credit. These credits can help reduce the amount of tax owed or even result in a refund, making it important for taxpayers to accurately complete this form.

The form can be quite complex, especially for those who are not familiar with tax laws and regulations. However, there are printable versions available online that can help simplify the process for taxpayers who prefer to fill out the form manually.

Completing IRS Form 8863 requires taxpayers to provide detailed information about their educational expenses, including tuition, fees, and other related costs. It is important to gather all necessary documentation before starting the form to ensure accuracy and prevent delays in processing.

Taxpayers should also be aware of the eligibility requirements for the education credits they are claiming, as not all educational expenses may qualify. Understanding these requirements and consulting with a tax professional if needed can help ensure that the form is filled out correctly.

Once the form is completed, taxpayers can submit it along with their tax return to the IRS. It is important to keep a copy of the form for your records in case of any future inquiries or audits.

In conclusion, IRS Form 8863 Printable is a valuable tool for taxpayers looking to claim education credits on their tax return. By following the instructions carefully and providing accurate information, taxpayers can maximize their tax savings and potentially receive a refund. It is recommended to seek assistance from a tax professional if needed to ensure compliance with tax laws and regulations.

Quickly Access and Print Irs Form 8863 Printable

Payroll printable are ideal for businesses that prefer non-digital systems or need physical copies for employee records. Most forms include fields for staff name, date range, total earnings, withholdings, and final salary—making them both comprehensive and user-friendly.

Begin streamlining your payment tracking today with a trusted printable payroll form. Save time, minimize mistakes, and maintain clear records—all while keeping your payroll records professional.

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Solved TAX ACTIVITY 2 UfeffComplete Form 8863 UfeffForm 8863 Chegg Worksheets Library

Solved TAX ACTIVITY 2 UfeffComplete Form 8863 UfeffForm 8863 Chegg Worksheets Library

Managing payroll tasks doesn’t have to be complicated. A Irs Form 8863 Printable offers a speedy, dependable, and easy-to-use method for tracking employee pay, shifts, and withholdings—without the need for complicated tools.

Whether you’re a small business owner, HR professional, or sole proprietor, using aprintable payroll helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and complete it by hand or type directly into the file before printing.