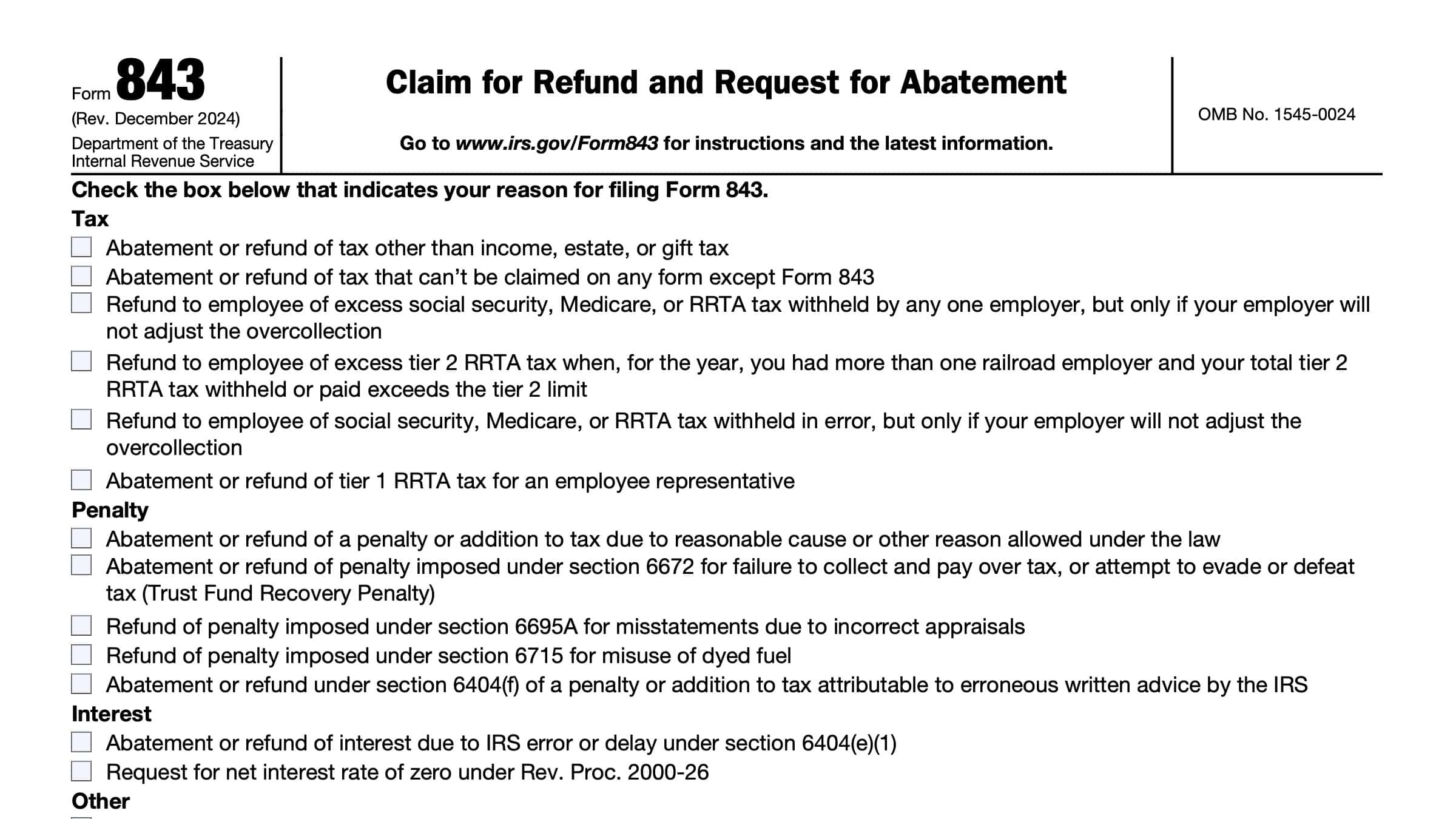

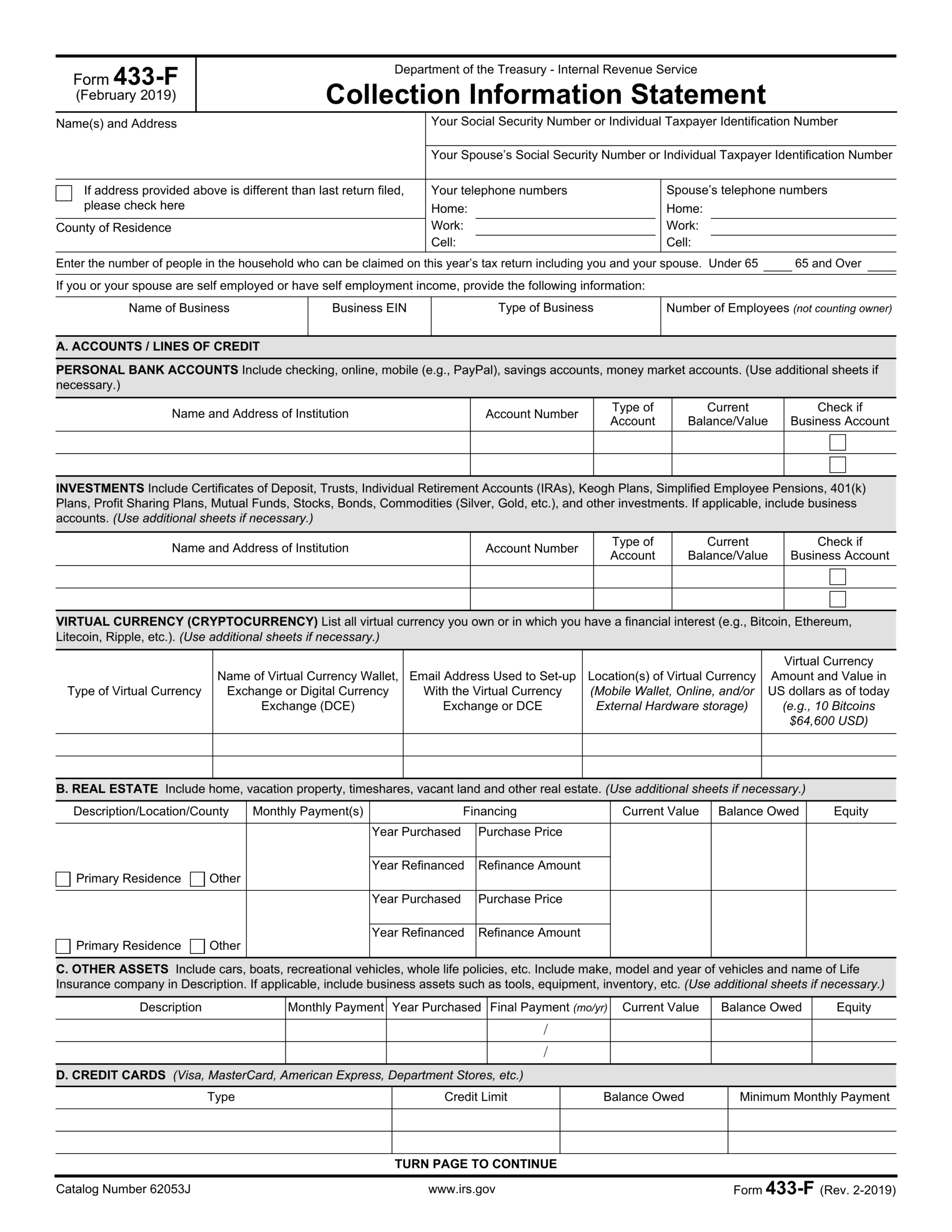

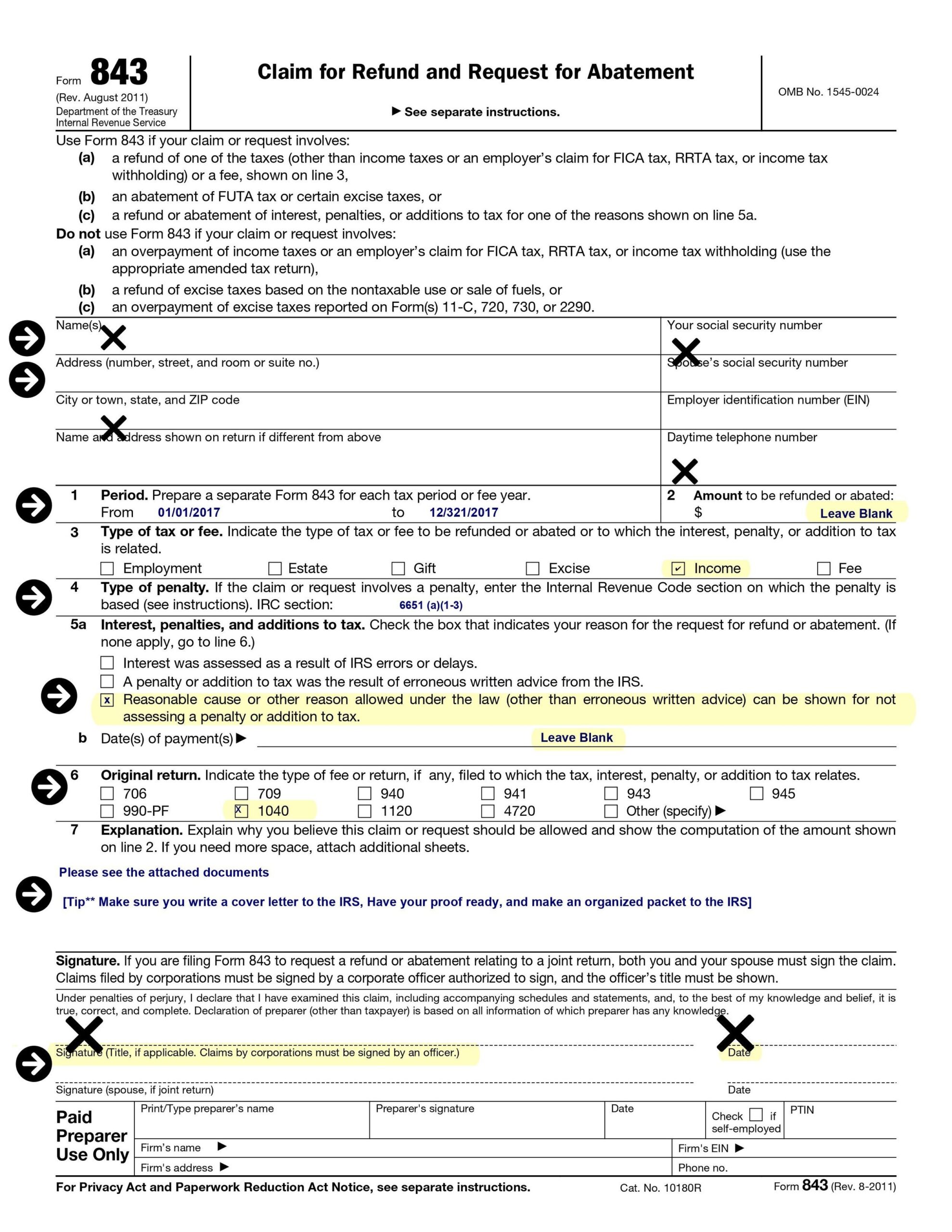

When it comes to dealing with tax issues, it’s important to have the necessary forms and paperwork in order. One such form that taxpayers may need to use is IRS Form 843. This form is used to request abatement or refund of penalties, interest, or taxes. It can be a valuable tool for taxpayers who believe they have been unfairly charged or penalized by the IRS.

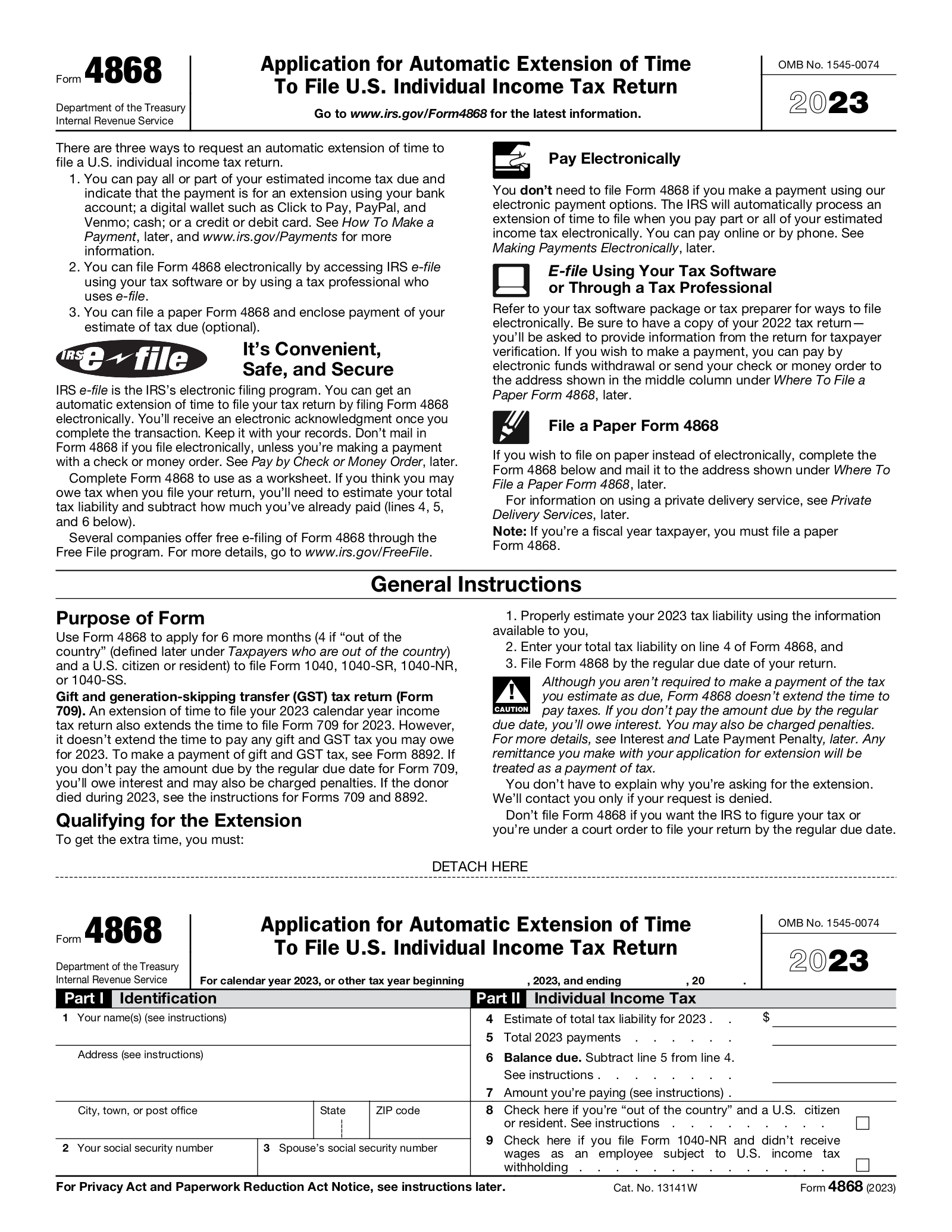

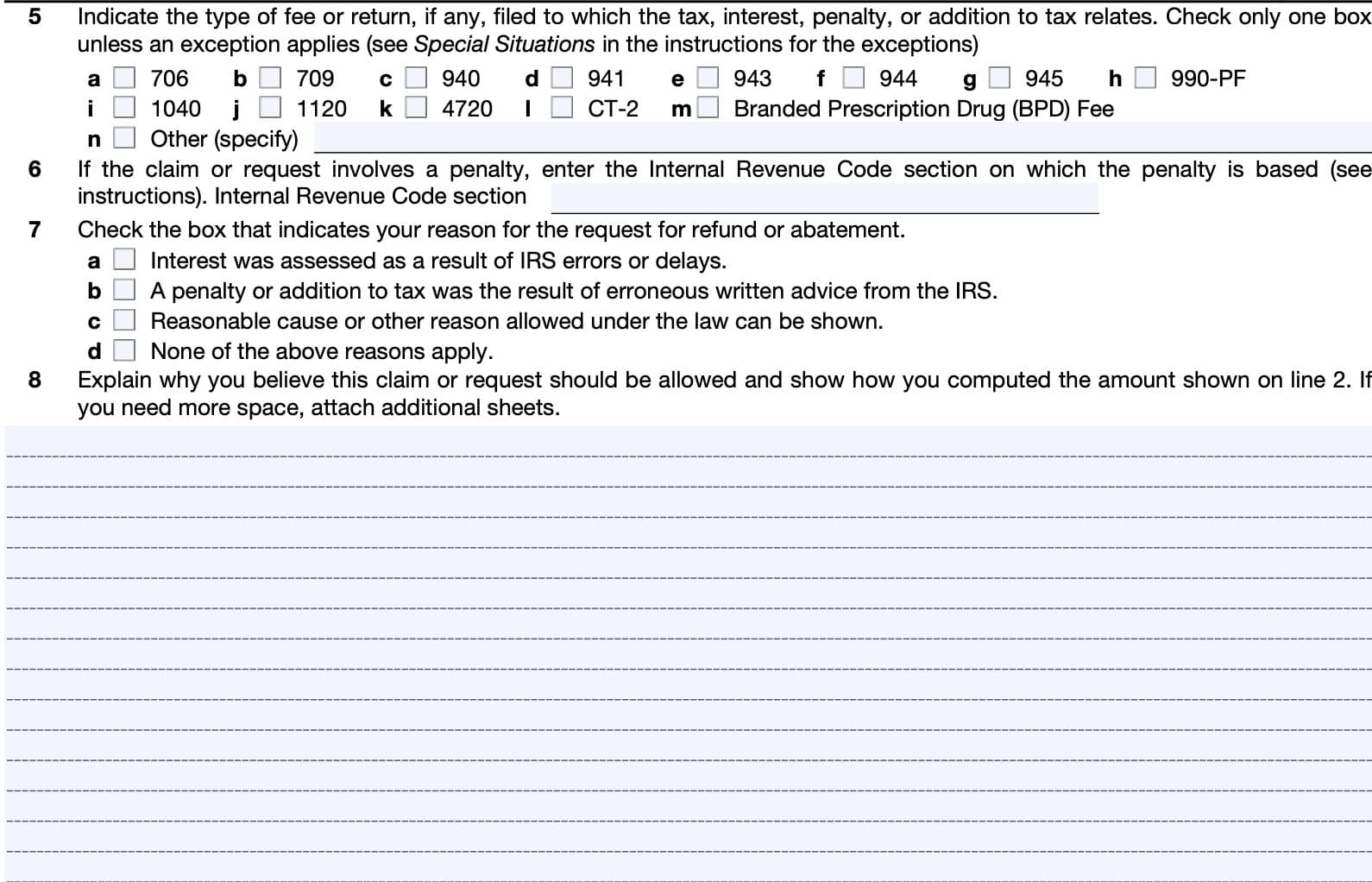

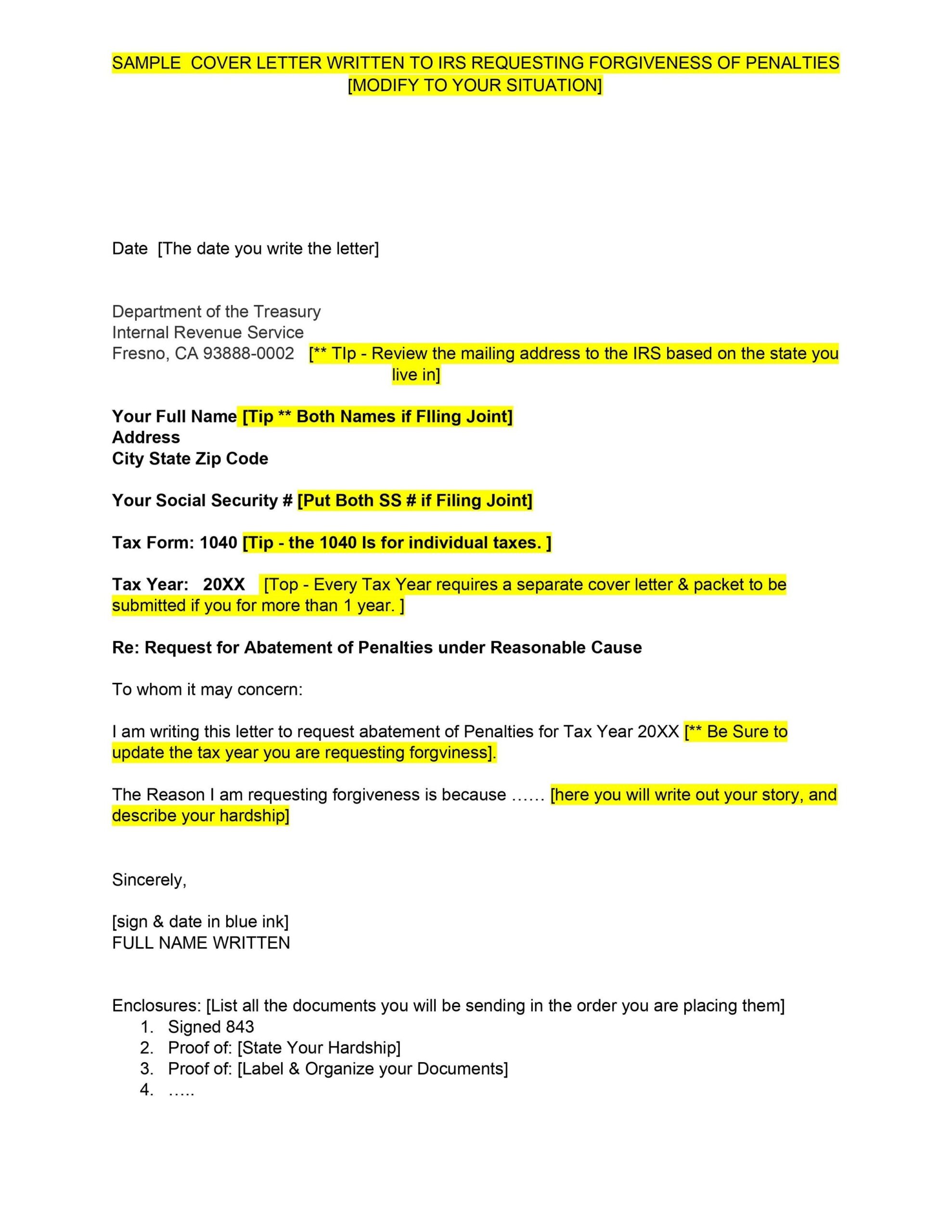

IRS Form 843 is available for download and printing on the IRS website. The form is relatively simple to fill out, requiring basic information such as your name, address, Social Security number, and details of the penalty or interest you are disputing. You will also need to provide a detailed explanation of why you believe the penalty or interest should be abated or refunded.

It’s important to note that filing IRS Form 843 does not guarantee that your request will be granted. The IRS will review your request and make a determination based on the information provided. However, for many taxpayers, filing this form can be a necessary step in resolving tax disputes and potentially saving money on penalties and interest.

Before submitting IRS Form 843, it’s a good idea to gather any supporting documentation that may help bolster your case. This could include letters, receipts, or any other relevant paperwork that supports your claim. The more information you can provide, the better chance you have of successfully having your penalties or interest abated.

Overall, IRS Form 843 can be a valuable resource for taxpayers who find themselves in disputes with the IRS over penalties, interest, or taxes. By filling out the form accurately and providing as much supporting documentation as possible, you can increase your chances of having your request granted. If you believe you have been unfairly charged by the IRS, don’t hesitate to utilize this form to request relief.

In conclusion, IRS Form 843 is an important tool for taxpayers who are seeking relief from penalties, interest, or taxes. By following the necessary steps and providing detailed information, taxpayers can potentially save money and resolve disputes with the IRS. If you find yourself in a situation where you believe you have been unfairly charged, consider using IRS Form 843 to request abatement or refund.

Quickly Access and Print Irs Form 843 Printable

Payroll printable are ideal for teams that prefer physical records or need printed versions for employee records. Most forms include fields for employee name, date range, total earnings, withholdings, and final salary—making them both complete and user-friendly.

Begin streamlining your payroll process today with a trusted payroll printable. Reduce admin effort, reduce errors, and maintain clear records—all while keeping your payroll records professional.

How To Remove IRS Tax Penalties Semper Tax Relief IRS Tax Problems Business Bookkeeping

How To Remove IRS Tax Penalties Semper Tax Relief IRS Tax Problems Business Bookkeeping

Form 843 For 2024 2025 How To Fill And Edit PDF Guru

Form 843 For 2024 2025 How To Fill And Edit PDF Guru

How To Remove IRS Tax Penalties Semper Tax Relief IRS Tax Problems Business Bookkeeping

How To Remove IRS Tax Penalties Semper Tax Relief IRS Tax Problems Business Bookkeeping

Managing staff wages doesn’t have to be difficult. A payroll template offers a fast, reliable, and easy-to-use method for tracking employee pay, hours, and taxes—without the need for digital systems.

Whether you’re a startup founder, HR professional, or independent contractor, using aprintable payroll template helps ensure compliance with regulations. Simply access the template, produce a hard copy, and complete it by hand or type directly into the file before printing.