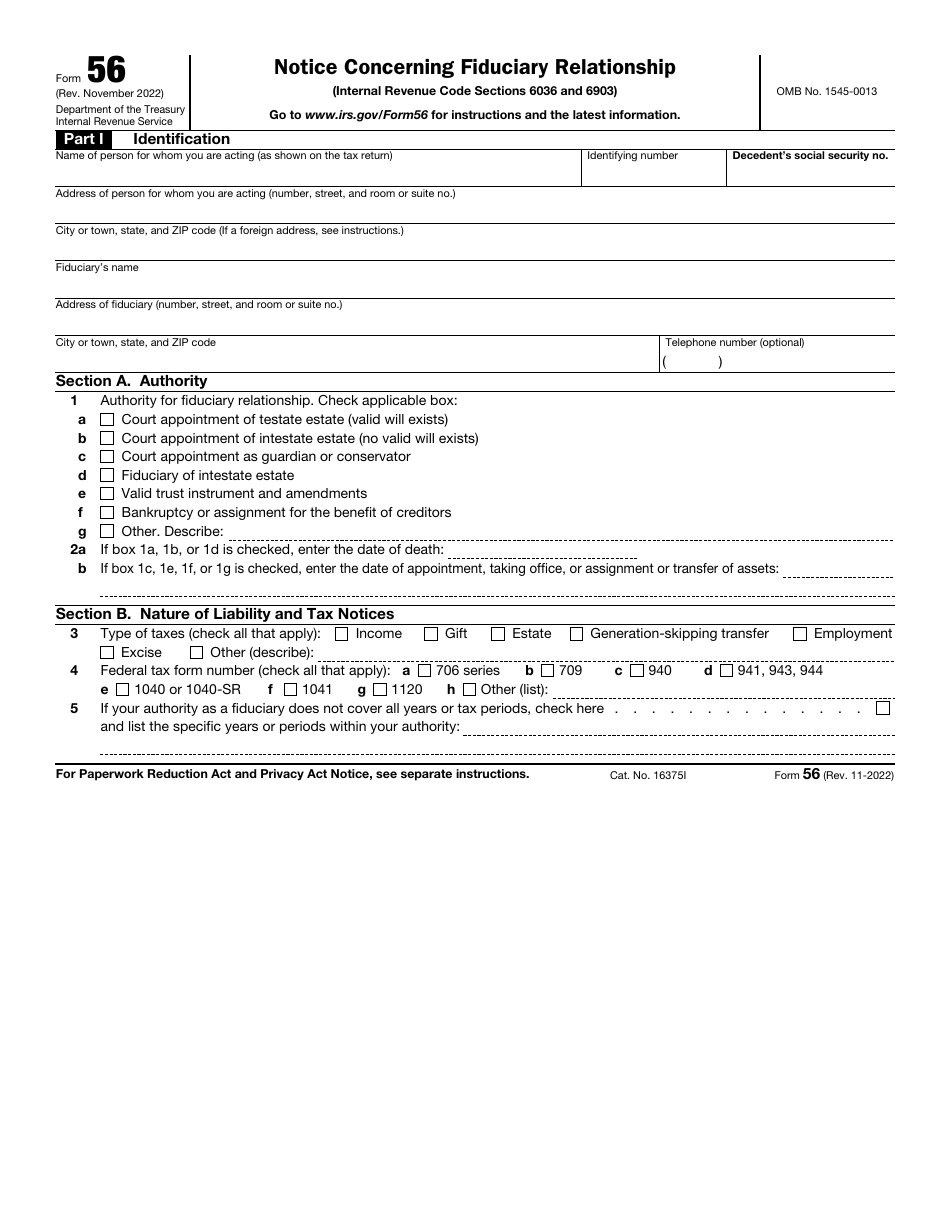

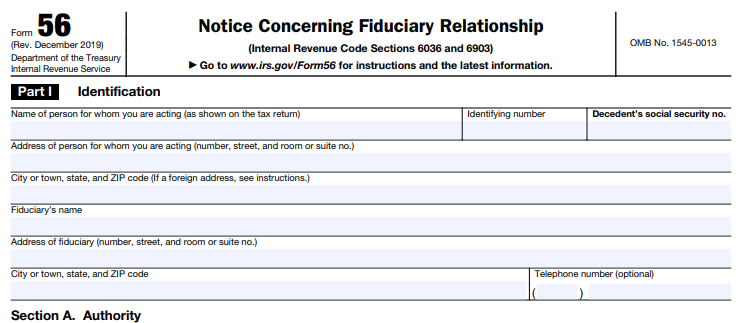

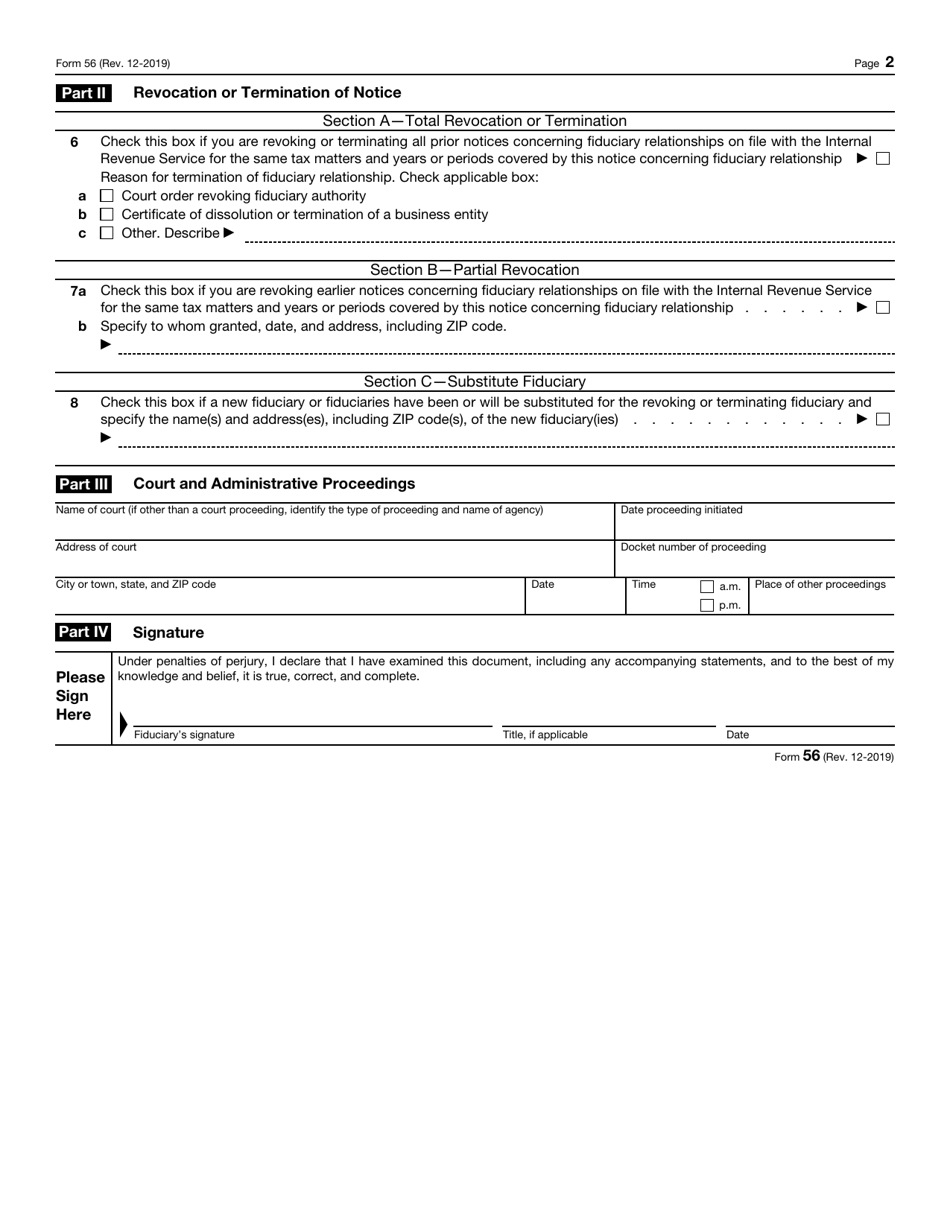

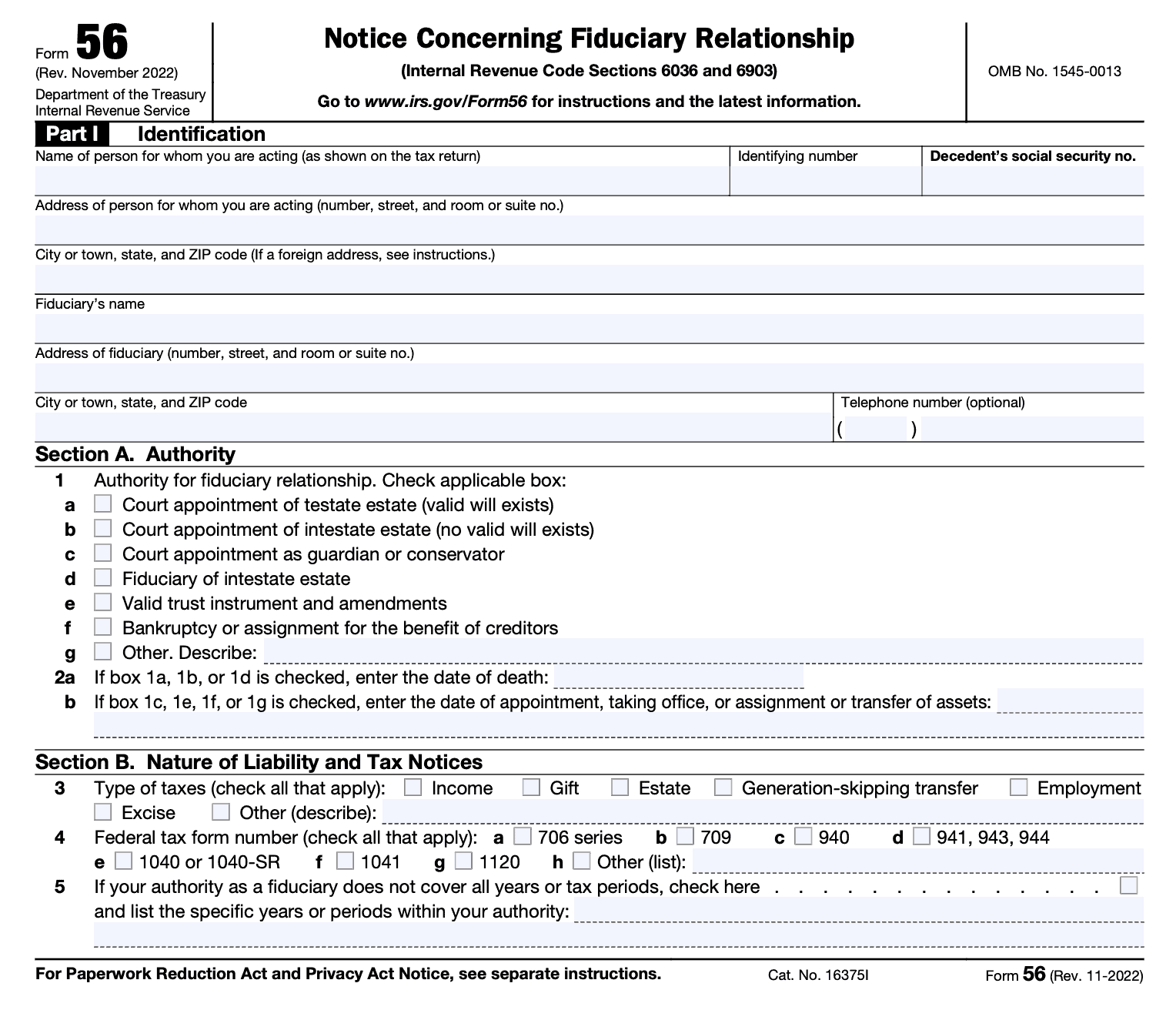

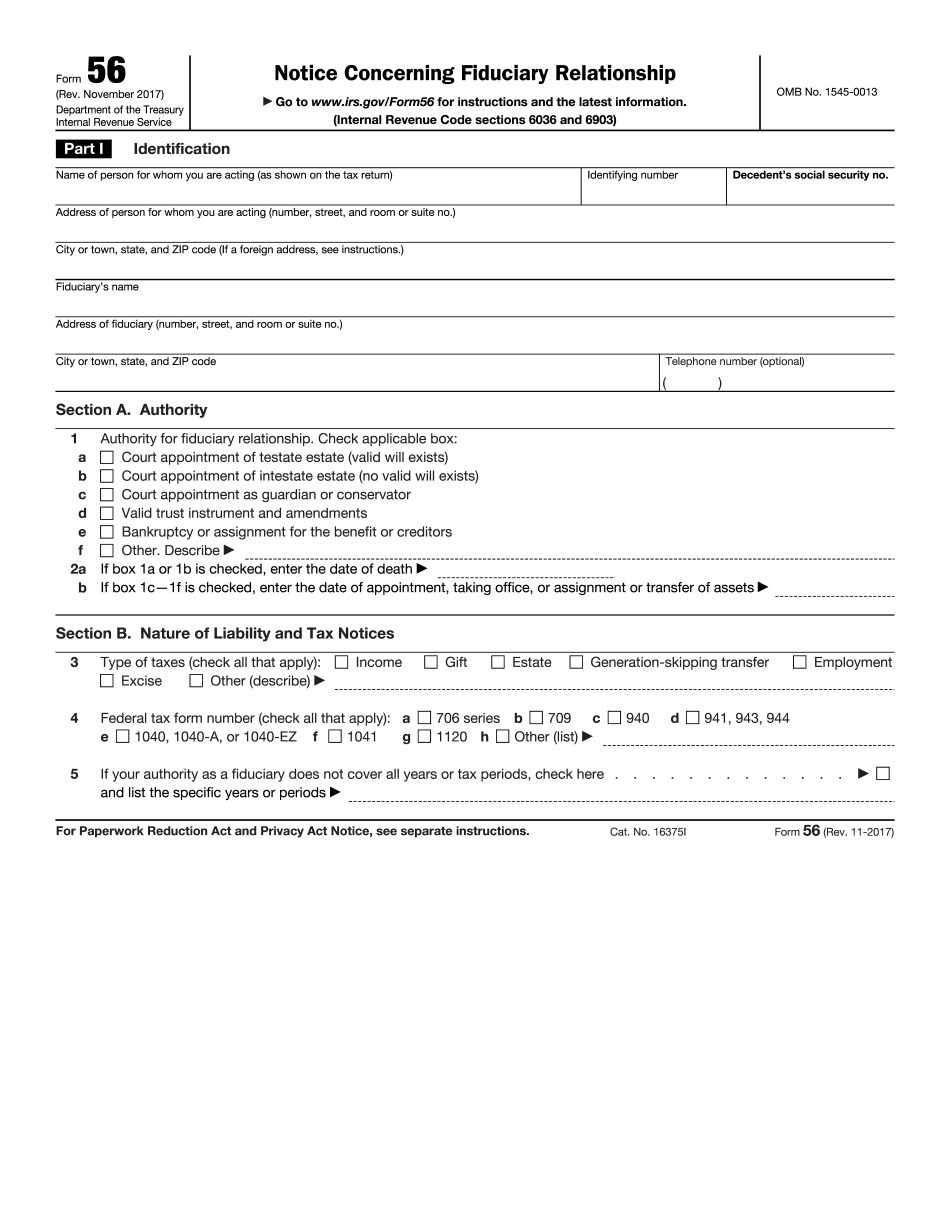

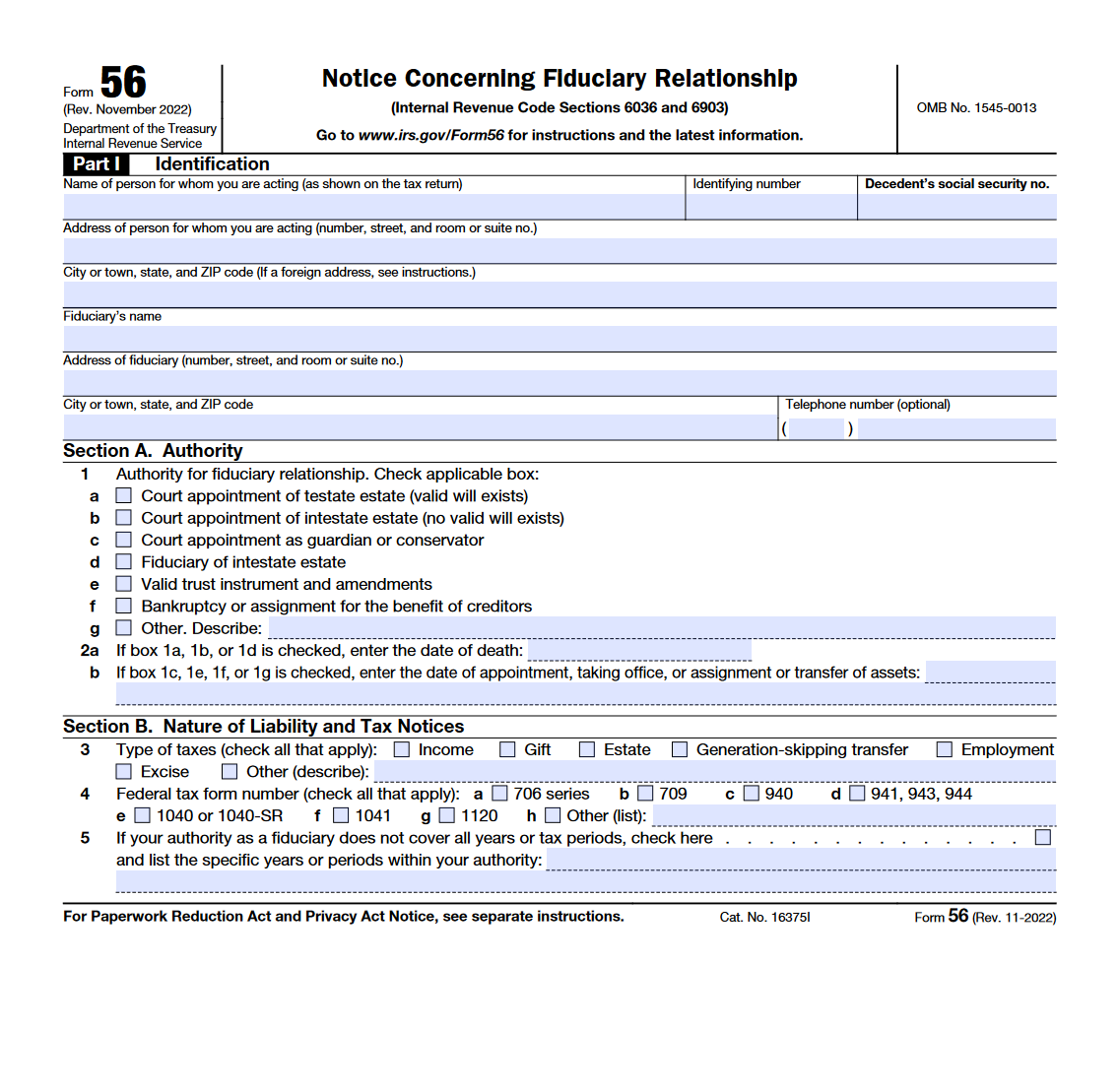

When it comes to managing someone else’s financial affairs, the IRS Form 56 is an essential document to have on hand. This form allows a fiduciary, such as a trustee or executor, to communicate with the IRS on behalf of the taxpayer. It is important to have this form properly filled out and submitted in order to ensure that the fiduciary has the necessary authority to act on behalf of the taxpayer.

One of the key benefits of the IRS Form 56 is that it allows the fiduciary to receive notices and communicate with the IRS regarding the taxpayer’s account. This can be particularly helpful in situations where the taxpayer is incapacitated or otherwise unable to handle their own financial affairs. By having this form in place, the fiduciary can ensure that the taxpayer’s tax obligations are met and that any necessary actions are taken on their behalf.

It is important to note that the IRS Form 56 is not a one-size-fits-all document. Depending on the specific circumstances of the taxpayer’s situation, there are different versions of the form that may need to be used. For example, there are separate versions of the form for individual taxpayers, businesses, and estates. It is crucial to ensure that the correct version of the form is used in order to avoid any potential complications or issues with the IRS.

Additionally, it is essential that the IRS Form 56 is properly filled out and submitted in a timely manner. Any errors or omissions on the form could lead to delays or other issues with the taxpayer’s account. Working with a knowledgeable tax professional can help ensure that the form is completed accurately and submitted correctly, giving the fiduciary the authority they need to act on behalf of the taxpayer.

In conclusion, the IRS Form 56 is a valuable tool for fiduciaries who need to manage another person’s financial affairs. By having this form in place, the fiduciary can communicate with the IRS on behalf of the taxpayer and ensure that their tax obligations are met. It is important to use the correct version of the form and to fill it out accurately to avoid any potential complications. With proper attention to detail, the IRS Form 56 can help facilitate the smooth management of a taxpayer’s financial affairs.

Easily Download and Print Irs Form 56 Printable

Irs Form 56 Printable are ideal for teams that prefer paper documentation or need physical copies for employee records. Most forms include fields for staff name, date range, total earnings, taxes, and net pay—making them both complete and practical.

Begin streamlining your payroll system today with a trusted payroll template. Reduce admin effort, reduce errors, and stay organized—all while keeping your employee payment data clear.

What Is Irs Form 56 How To Fill It Out Accounts Confidant

What Is Irs Form 56 How To Fill It Out Accounts Confidant

IRS Form 56 Fill Out Sign Online And Download Fillable PDF

IRS Form 56 Fill Out Sign Online And Download Fillable PDF

Irs Form 56 Fillable Pdf Printable Forms Free Online

Irs Form 56 Fillable Pdf Printable Forms Free Online

Irs Form 56 Instructions Fill Online Printable Fillab Vrogue Co

Irs Form 56 Instructions Fill Online Printable Fillab Vrogue Co

Irs Form 56 Fillable Pdf Printable Forms Free Online

Irs Form 56 Fillable Pdf Printable Forms Free Online

Processing employee payments doesn’t have to be complicated. A Irs Form 56 Printable offers a speedy, reliable, and easy-to-use method for tracking wages, work time, and withholdings—without the need for digital systems.

Whether you’re a small business owner, payroll manager, or sole proprietor, using aprintable payroll template helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.