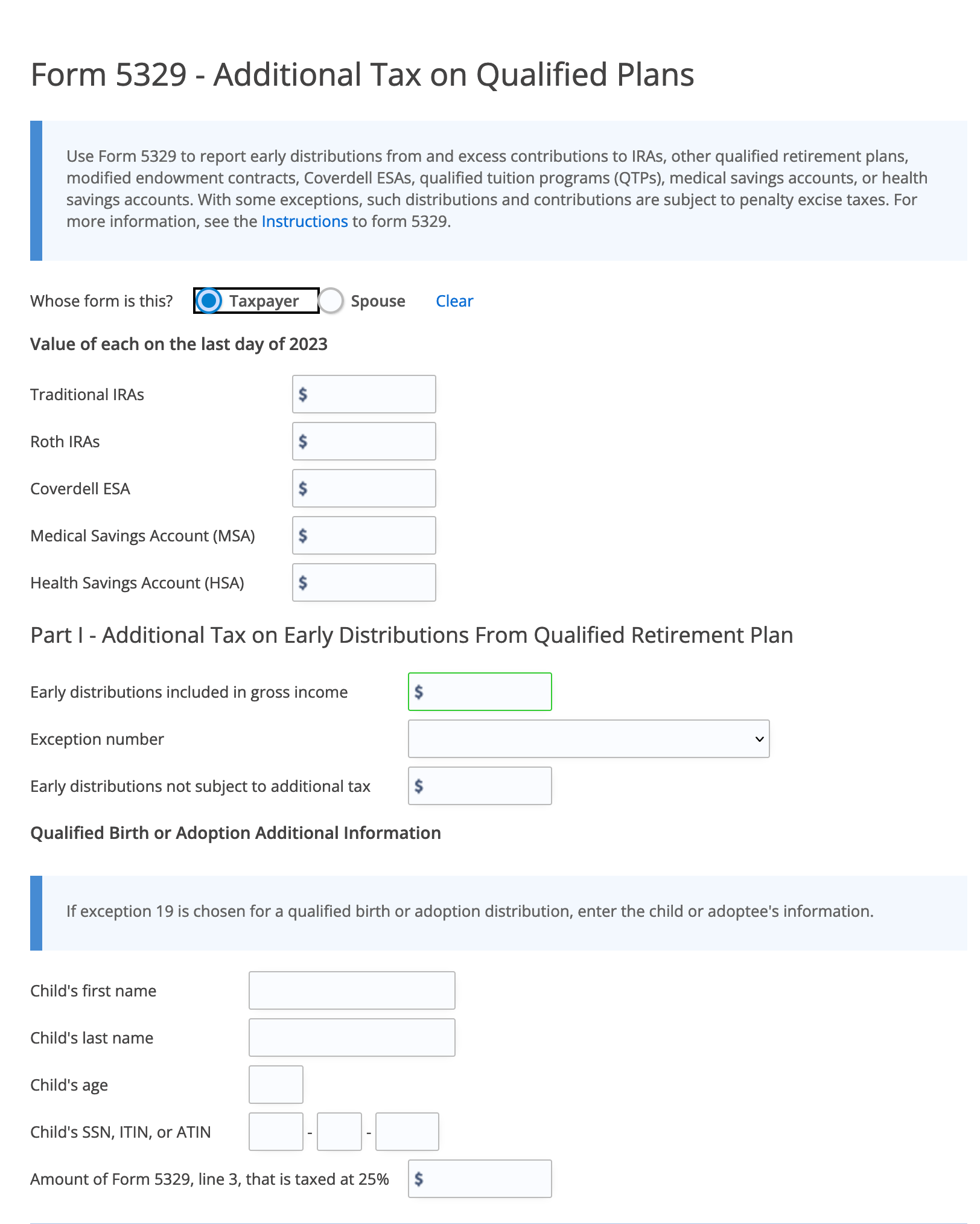

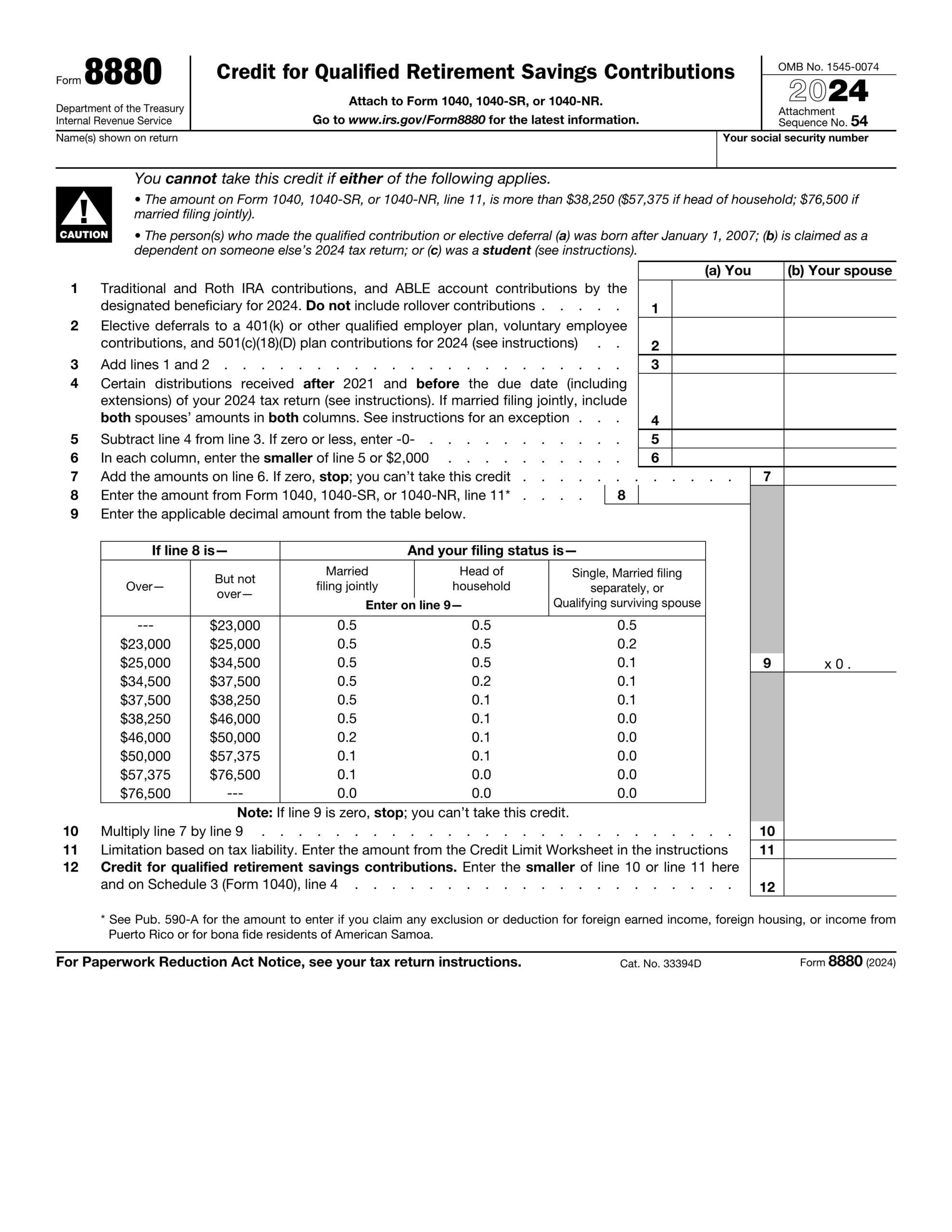

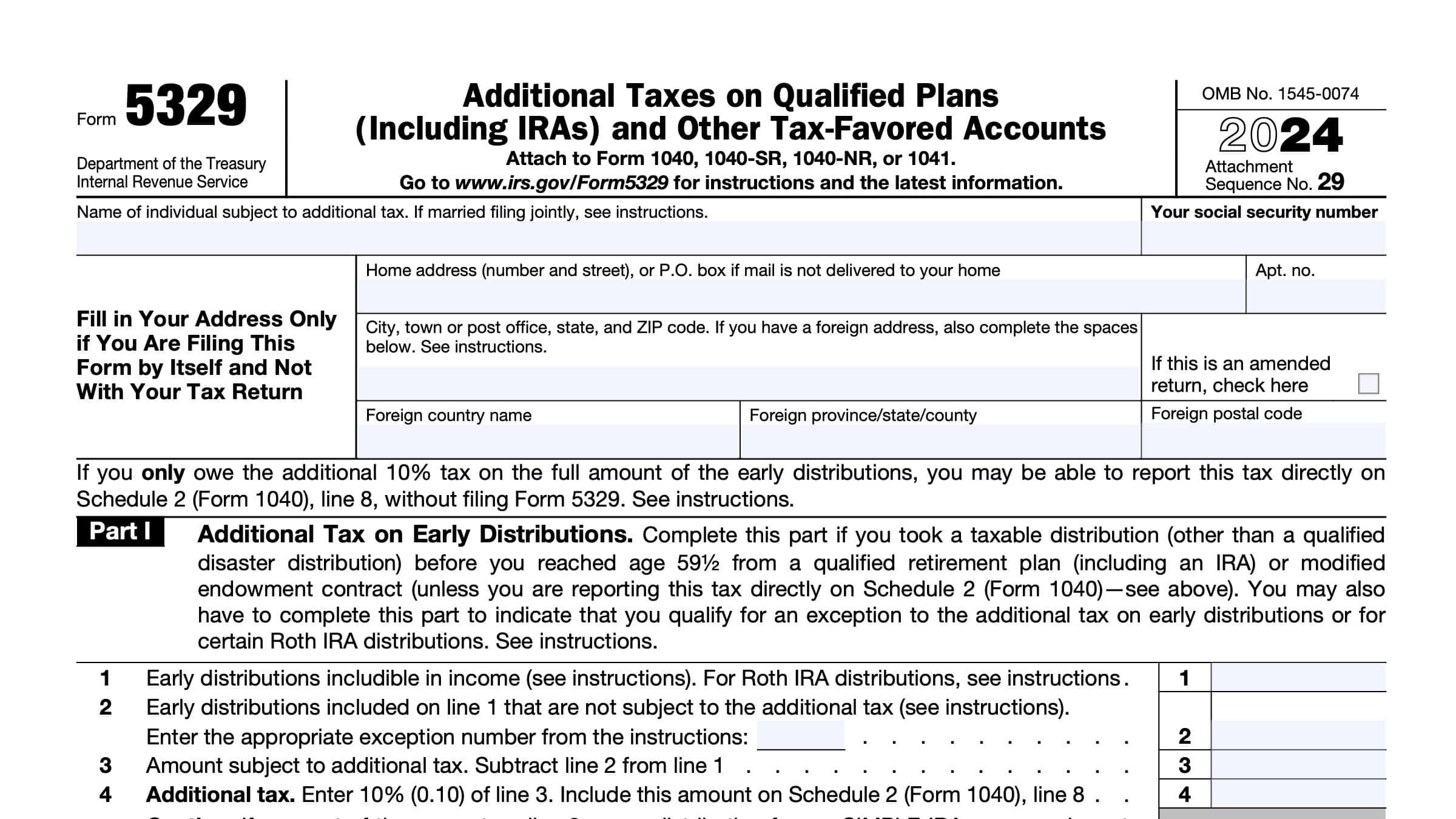

When it comes to taxes, there are numerous forms that individuals need to be aware of in order to properly file their returns. One such form is the IRS Form 5329, which is used to report additional taxes on certain distributions from retirement accounts. For the year 2024, it is important to understand how to properly fill out this form in order to avoid any penalties or fines.

Form 5329 is typically used by individuals who have taken early withdrawals from their retirement accounts, such as IRAs or 401(k)s, and need to report any additional taxes owed. It is important to note that these additional taxes are in addition to any regular income tax that may be owed on the distribution.

Irs Form 5329 For 2024 Printable

Irs Form 5329 For 2024 Printable

When filling out Form 5329 for the year 2024, individuals will need to provide information on the type of retirement account from which the distribution was made, the amount of the distribution, and the reason for the early withdrawal. Additionally, individuals will need to calculate the additional taxes owed based on the specific circumstances of the distribution.

It is important to carefully review the instructions for Form 5329 to ensure that all necessary information is provided and that the calculations are accurate. Failing to properly fill out this form could result in penalties or fines from the IRS, so it is crucial to take the time to understand the requirements and double-check all information before submitting the form.

For individuals who are unsure about how to fill out Form 5329 for the year 2024, it may be helpful to consult with a tax professional or financial advisor. These professionals can provide guidance on the specific requirements of the form and help ensure that it is completed correctly to avoid any potential issues with the IRS.

In conclusion, Form 5329 for the year 2024 is an important document for individuals who have taken early withdrawals from their retirement accounts. By understanding the requirements of the form and carefully filling it out, individuals can avoid penalties and fines from the IRS and ensure that their tax returns are filed accurately.

Get and Print Irs Form 5329 For 2024 Printable

Irs Form 5329 For 2024 Printable are ideal for companies that prefer physical records or need physical copies for audit purposes. Most forms include fields for employee name, pay period, gross pay, taxes, and final salary—making them both detailed and user-friendly.

Start simplifying your payroll process today with a trusted printable payroll form. Reduce admin effort, reduce errors, and stay organized—all while keeping your employee payment data clear.

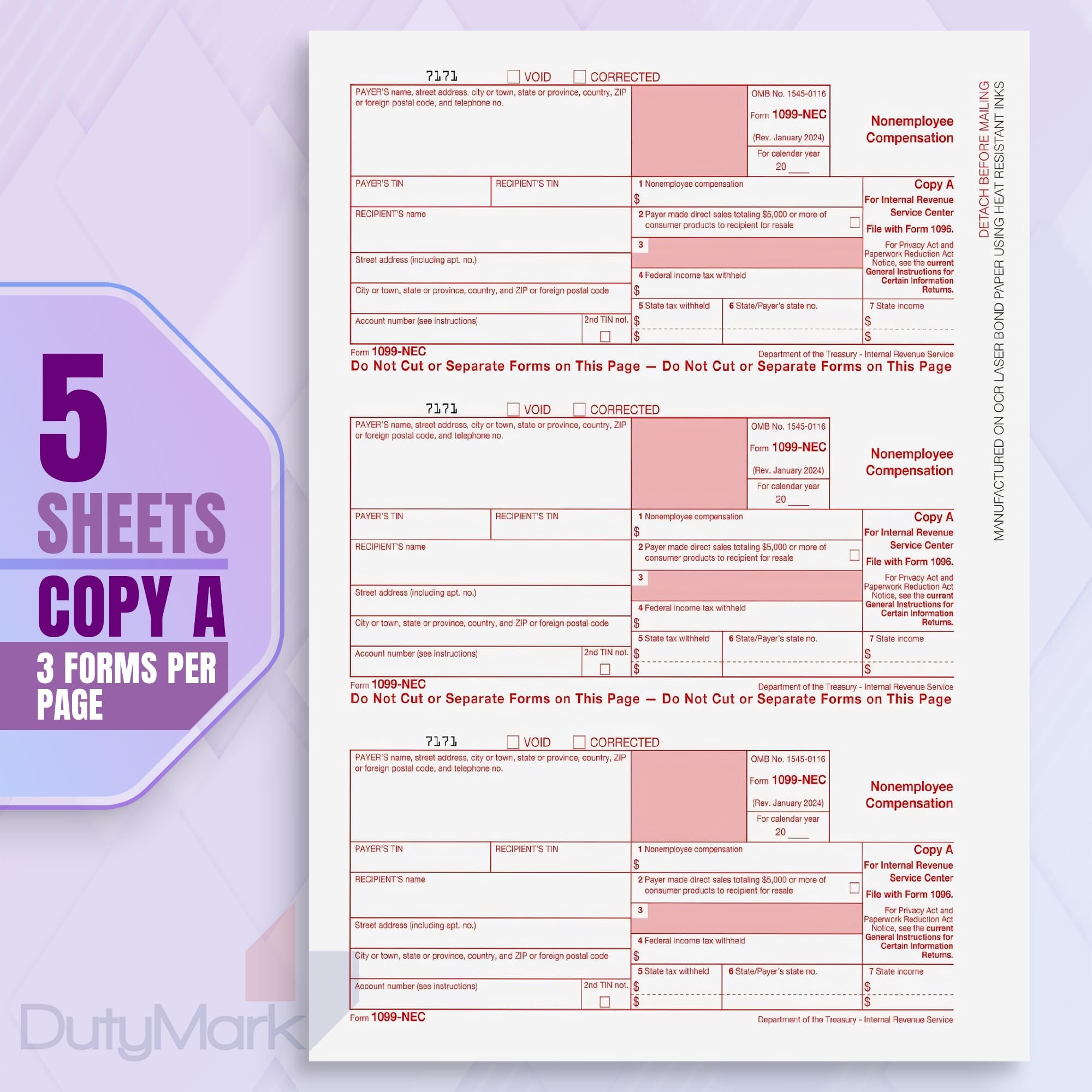

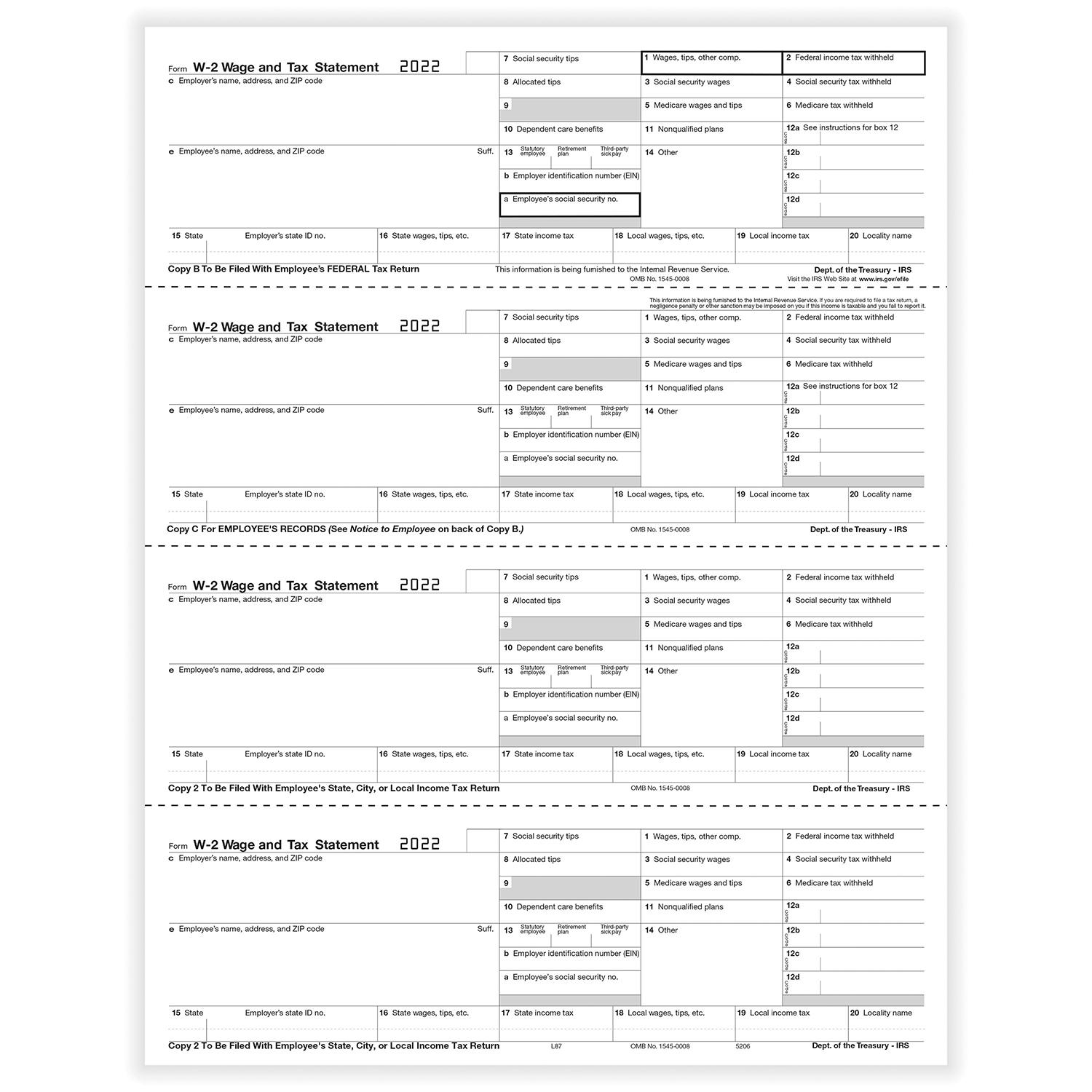

W 2 Perforated Paper Form 5329 2024 IRS Approved 1099 R Tax Forms

W 2 Perforated Paper Form 5329 2024 IRS Approved 1099 R Tax Forms

Form 5329 2024 2025 Fill Edit And Download PDF Guru

Form 5329 2024 2025 Fill Edit And Download PDF Guru

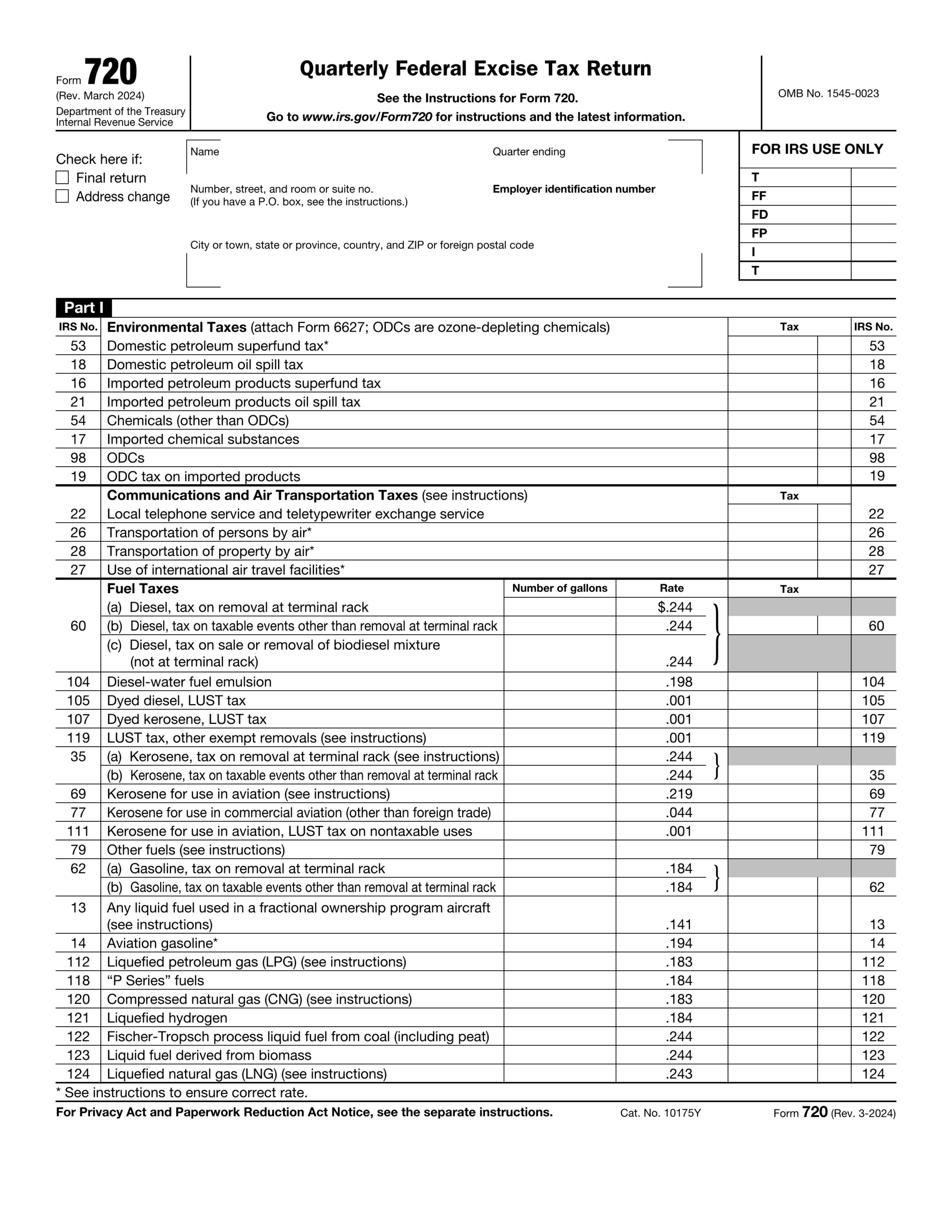

When To File Form 5329 To Calculate Taxes On Qualified Plans

When To File Form 5329 To Calculate Taxes On Qualified Plans

Form 5329 2024 2025 Fill Edit And Download PDF Guru

Form 5329 2024 2025 Fill Edit And Download PDF Guru

IRS Form 5329 Instructions A Guide To Additional Taxes

IRS Form 5329 Instructions A Guide To Additional Taxes

Handling staff wages doesn’t have to be overwhelming. A payroll printable offers a quick, dependable, and user-friendly method for tracking salaries, hours, and deductions—without the need for complex software.

Whether you’re a freelancer, HR professional, or sole proprietor, using aIrs Form 5329 For 2024 Printable helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and complete it by hand or type directly into the file before printing.