When it comes to dealing with losses due to disasters or theft, the IRS Form 4684 Printable is an essential tool for individuals and businesses to report their losses and claim deductions. This form allows taxpayers to document their losses and calculate the amount of their deductible loss, which can help them offset their taxable income.

It is important to note that not all losses are deductible, and there are specific guidelines that must be followed when claiming a deduction for a casualty or theft loss. By using the IRS Form 4684 Printable, taxpayers can ensure that they are following the proper procedures and accurately reporting their losses to the IRS.

IRS Form 4684 Printable

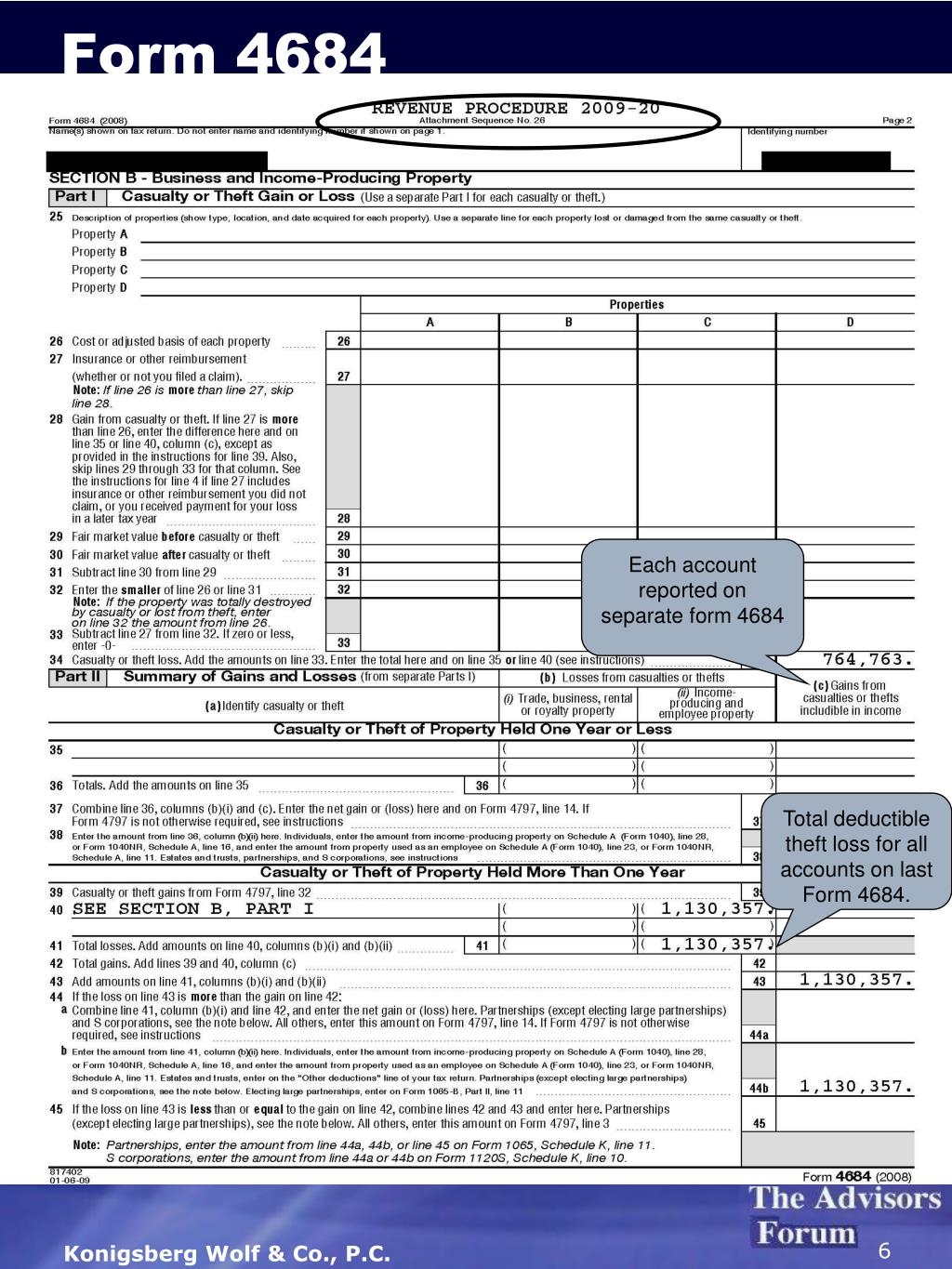

The IRS Form 4684 Printable is divided into two main sections: Part A, which is used to report personal casualty and theft losses, and Part B, which is used to report business casualty and theft losses. Taxpayers must fill out the appropriate section based on the type of loss they have experienced.

When completing the form, taxpayers will need to provide details about the property that was lost or damaged, the date of the loss, the fair market value of the property before and after the loss, and any insurance reimbursements received. By accurately documenting this information, taxpayers can ensure that they are claiming the correct amount of their deductible loss.

It is important to keep in mind that there are certain limitations on the amount of deductible loss that can be claimed on the IRS Form 4684 Printable. Taxpayers should consult with a tax professional or refer to the IRS guidelines to determine the maximum deductible amount for their specific situation.

Once the form has been completed, taxpayers can submit it along with their tax return to the IRS. By providing accurate and detailed information on the IRS Form 4684 Printable, taxpayers can expedite the processing of their claim and ensure that they receive the maximum allowable deduction for their casualty or theft loss.

In conclusion, the IRS Form 4684 Printable is an important tool for individuals and businesses to report their losses due to disasters or theft and claim deductions on their tax returns. By following the guidelines and accurately documenting their losses, taxpayers can ensure that they are in compliance with IRS regulations and maximize their tax savings.