IRS Form 4506-C is a document used by individuals or entities to request a copy of their tax return transcript or other tax information from the Internal Revenue Service (IRS). This form is particularly useful for those who need to provide proof of income or tax information for various purposes, such as applying for a loan or financial aid.

By filling out Form 4506-C, you can obtain a copy of your tax return transcript directly from the IRS, which can be helpful in verifying your income or tax filing status. This form is especially important for individuals who may have misplaced their tax documents or need to access past tax information.

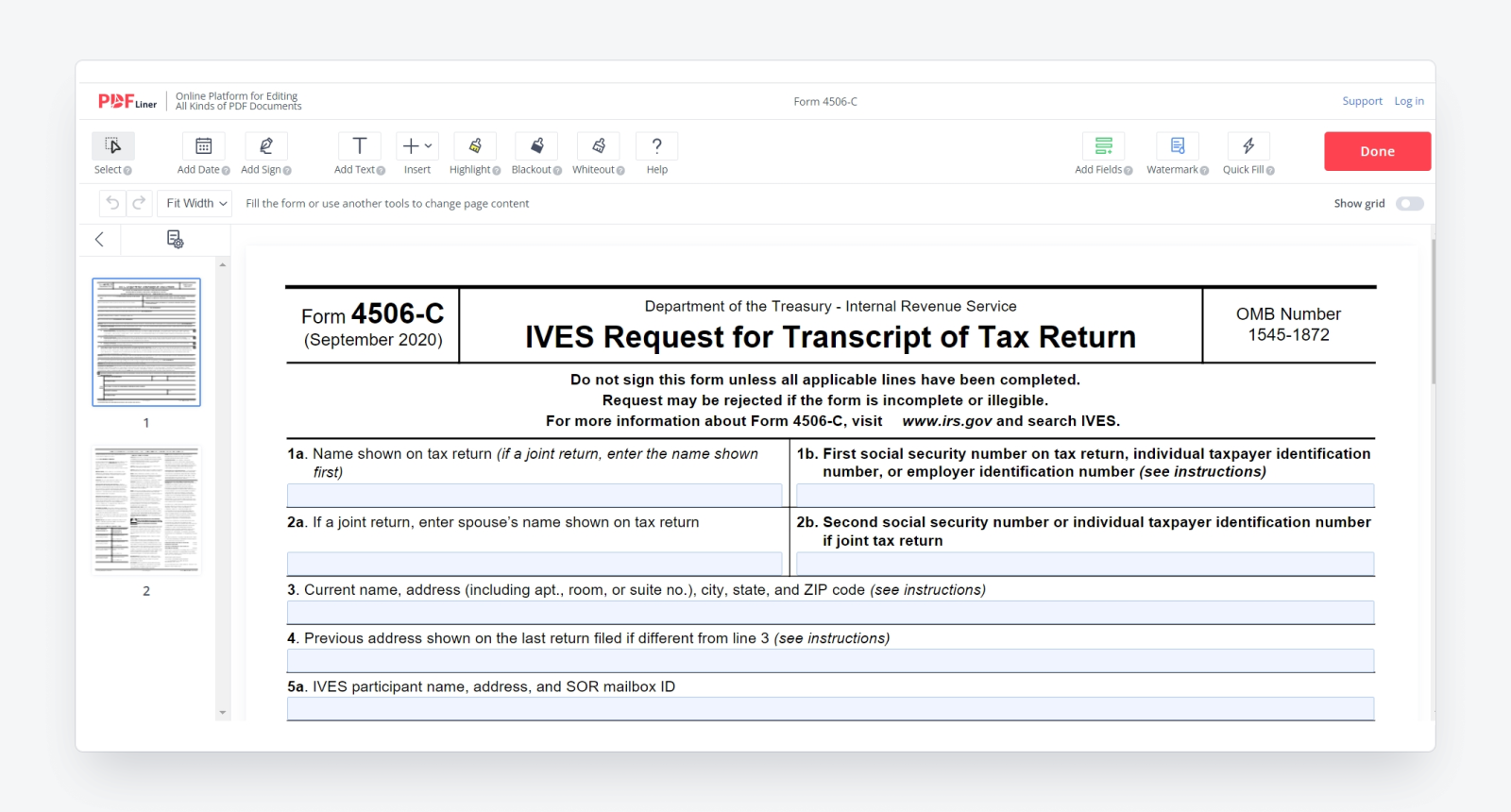

IRS Form 4506-C Printable

IRS Form 4506-C is available in a printable format on the IRS website, making it easy for individuals to access and fill out the form as needed. By downloading the form online, you can quickly complete the necessary information and submit it to the IRS for processing.

When filling out Form 4506-C, be sure to provide accurate and up-to-date information to ensure that the IRS can locate and provide the requested tax documents. It’s important to double-check all details before submitting the form to avoid any delays in processing your request.

Once you have completed Form 4506-C, you can submit it to the IRS by mail or fax, as indicated on the form. The IRS will then process your request and provide you with the requested tax return transcript or other tax information in a timely manner.

In conclusion, IRS Form 4506-C is a valuable tool for individuals and entities in need of tax information for various purposes. By using the printable version of this form, you can easily request and obtain your tax return transcript from the IRS, helping you to meet your financial and documentation needs.