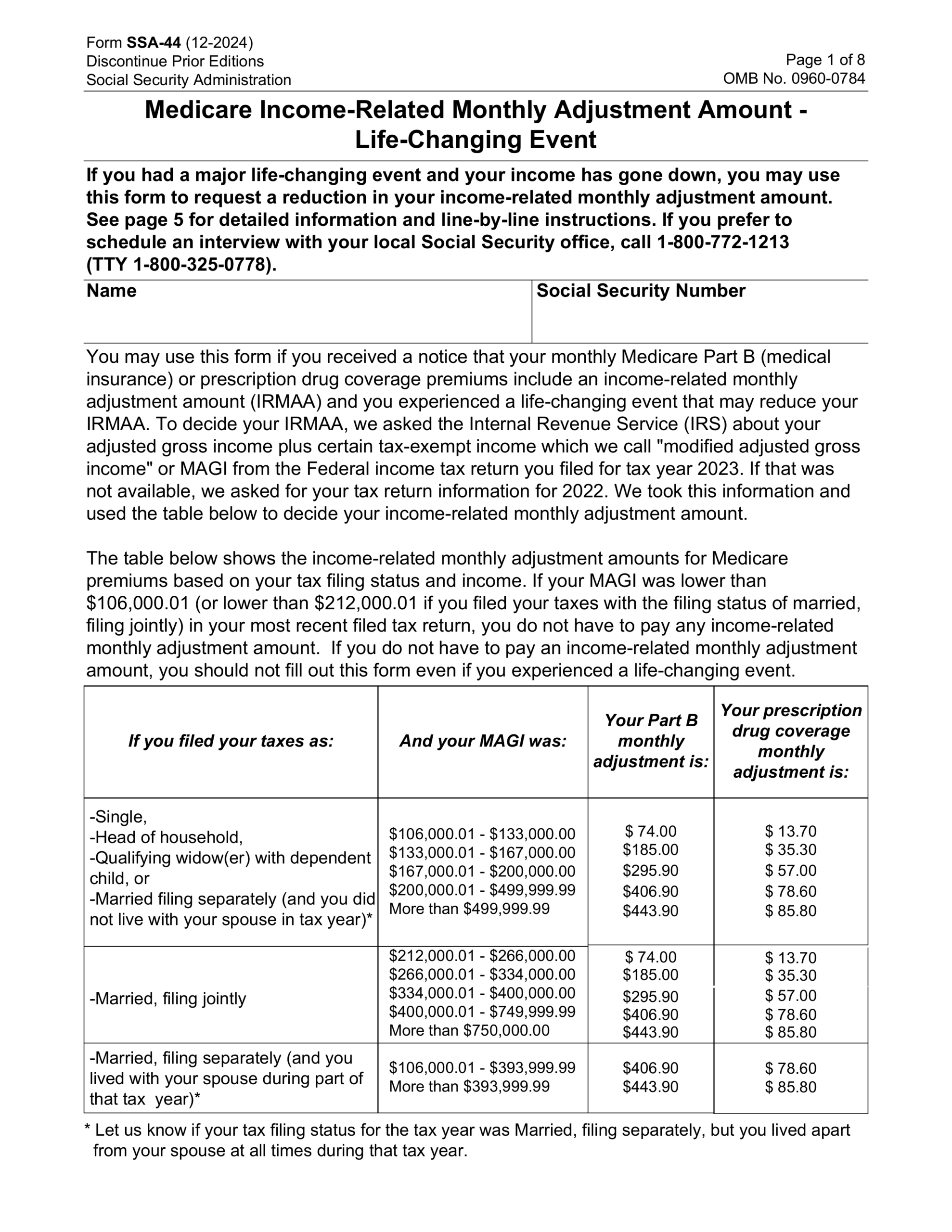

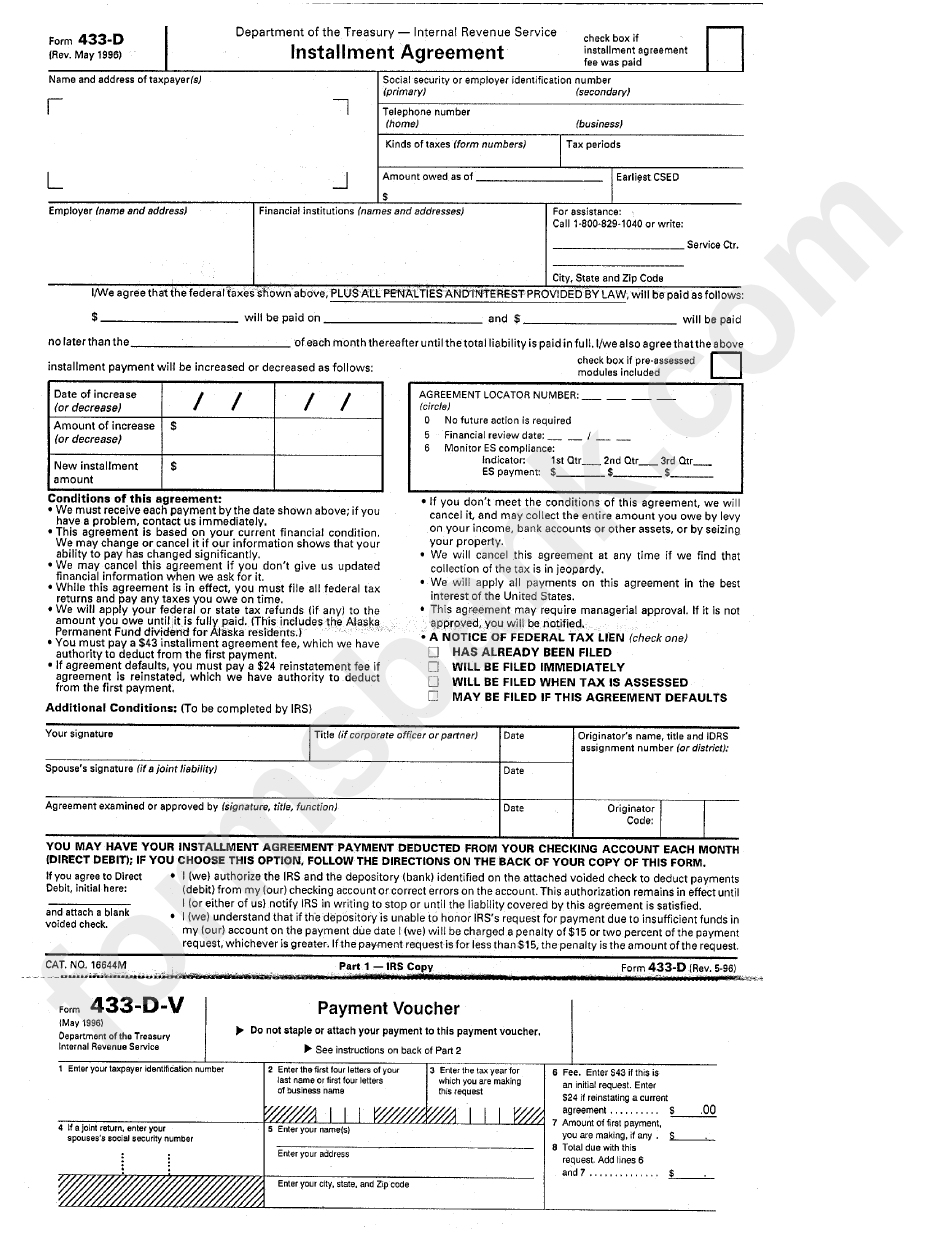

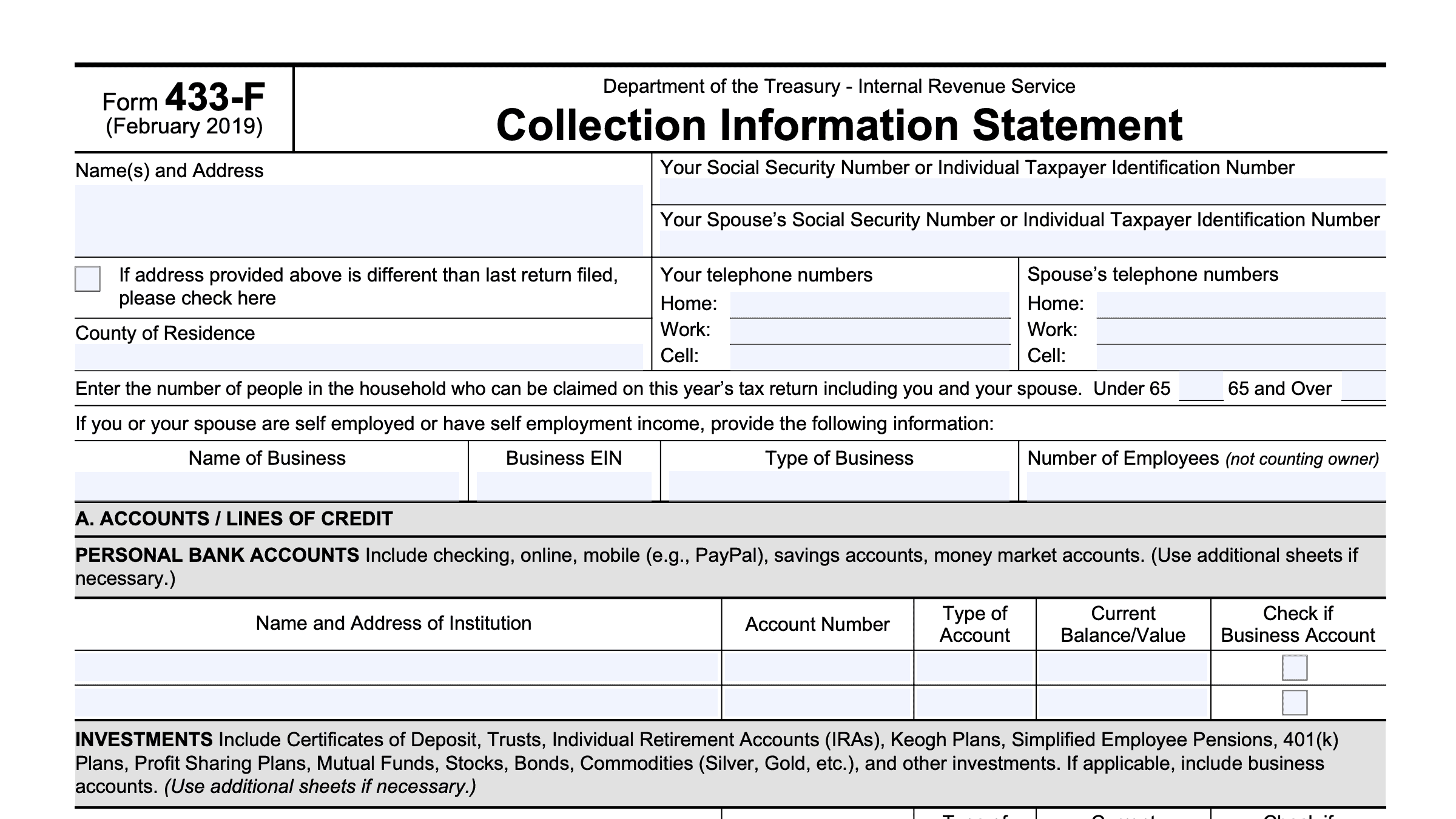

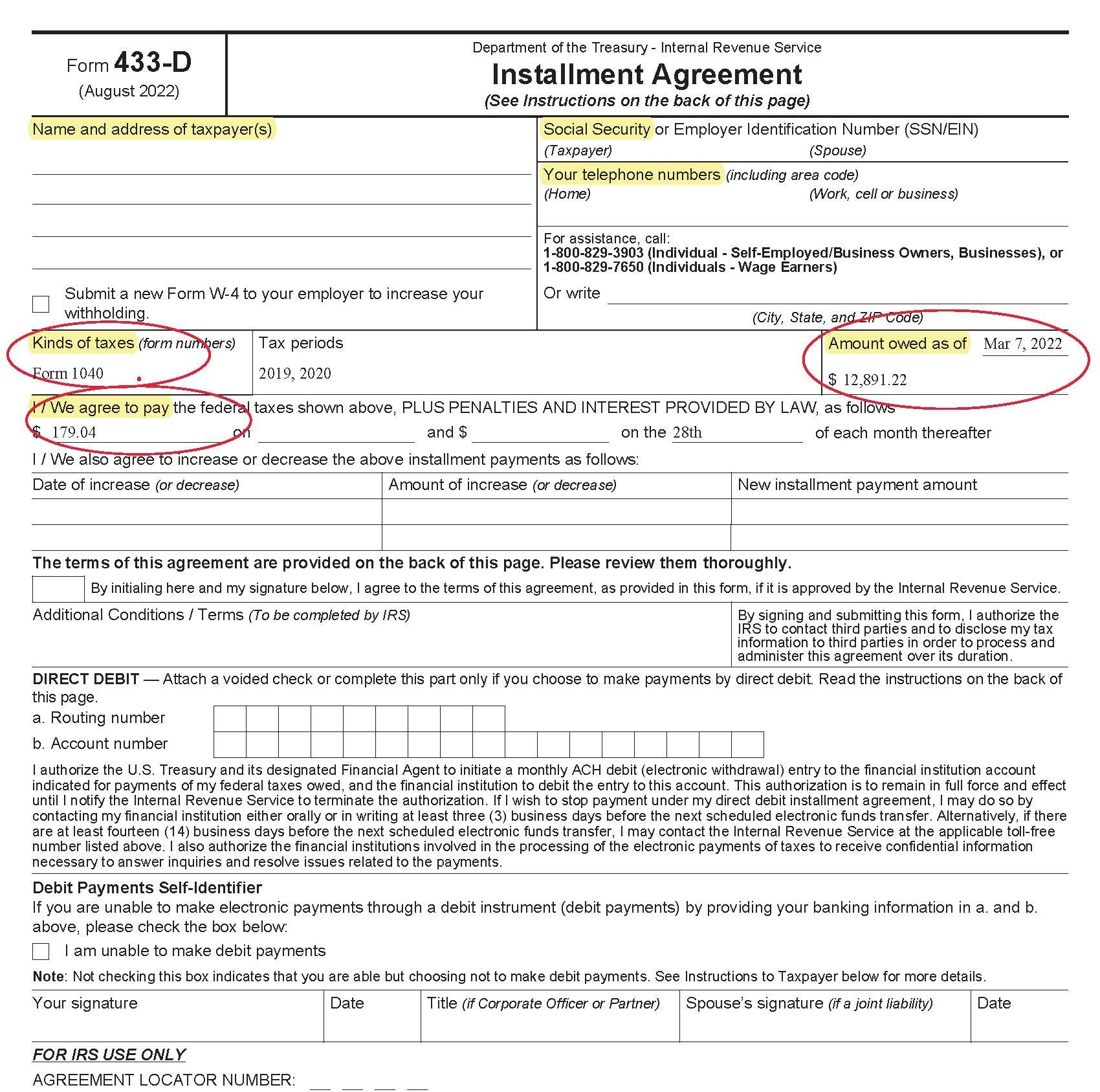

When it comes to dealing with the Internal Revenue Service (IRS), having the right forms and documents is crucial. One important form that individuals may need to complete is Form 433-D. This form is used to provide detailed information about a taxpayer’s financial situation, including their income, expenses, assets, and liabilities. Having a printable PDF version of Form 433-D can make it easier for individuals to fill out the form accurately and submit it to the IRS.

Form 433-D is typically used when an individual or business owes money to the IRS and is unable to pay the full amount all at once. By providing detailed financial information on Form 433-D, taxpayers can work with the IRS to set up a payment plan that is manageable for their financial situation. This form is an important tool for individuals who are facing tax debt and need assistance in resolving their outstanding balance with the IRS.

When filling out Form 433-D, individuals will need to provide information on their monthly income, expenses, assets, and liabilities. This information is used by the IRS to determine the taxpayer’s ability to pay off their tax debt and to set up a payment plan that works for both parties. Having a printable PDF version of Form 433-D can make it easier for individuals to gather the necessary information and complete the form accurately.

It is important for individuals to carefully review the instructions for Form 433-D before completing the form. This will help ensure that all required information is provided and that the form is filled out correctly. By having a printable PDF version of Form 433-D, individuals can easily reference the instructions and fill out the form accurately, increasing the likelihood of their payment plan being approved by the IRS.

In conclusion, having access to a printable PDF version of Form 433-D can make it easier for individuals to provide the IRS with the necessary financial information to set up a payment plan for their tax debt. By accurately completing Form 433-D, individuals can work towards resolving their tax obligations and avoiding potential penalties and interest charges. If you find yourself in need of Form 433-D, be sure to download the printable PDF version and carefully follow the instructions to ensure that your financial information is accurately reported to the IRS.

Easily Download and Print Irs Form 433 D Printable Pdf

Printable payroll are ideal for businesses that prefer non-digital systems or need hard copies for audit purposes. Most forms include fields for employee name, pay period, gross pay, withholdings, and net pay—making them both detailed and practical.

Begin streamlining your payroll process today with a trusted payroll template. Save time, reduce errors, and stay organized—all while keeping your payroll records professional.

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

IRS Form 433 F Instructions The Collection Information Statement

IRS Form 433 F Instructions The Collection Information Statement

Completing Form 433 D Installment Agreement After IRS Audit Tax

Completing Form 433 D Installment Agreement After IRS Audit Tax

Form 433 D 2024 2025 Fill Edit And Download PDF Guru

Form 433 D 2024 2025 Fill Edit And Download PDF Guru

Managing payroll tasks doesn’t have to be complicated. A printable payroll form offers a speedy, accurate, and user-friendly method for tracking employee pay, hours, and deductions—without the need for digital systems.

Whether you’re a startup founder, payroll manager, or independent contractor, using aIrs Form 433 D Printable Pdf helps ensure compliance with regulations. Simply download the template, print it, and complete it by hand or type directly into the file before printing.