IRS Form 3911 is a document used to request a refund for a lost, stolen, or destroyed U.S. Treasury check. This form is essential for individuals who have not received their refund check or have misplaced it. By filling out Form 3911, you can ensure that you receive the money owed to you in a timely manner.

It is important to note that Form 3911 is only used for U.S. Treasury checks, not for direct deposits or other payment methods. If you are in possession of your U.S. Treasury check but it is damaged or unreadable, you can also use Form 3911 to request a replacement check.

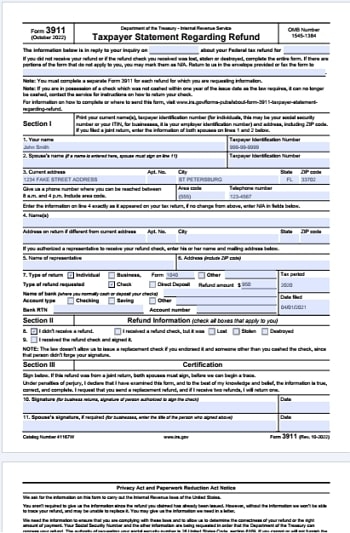

When filling out Form 3911, you will need to provide details such as your name, address, Social Security Number, the date the check was issued, and the reason for requesting a new check. Once the form is completed, you can mail it to the address provided on the form or submit it electronically through the IRS website.

It is important to ensure that all information on Form 3911 is accurate and up to date to prevent any delays in processing your refund. Additionally, be sure to keep a copy of the form for your records in case you need to reference it in the future.

If you are unable to access Form 3911 online, you can request a printable version by contacting the IRS directly. The IRS also provides assistance for individuals who need help filling out the form or have questions about the process.

Overall, IRS Form 3911 is a valuable tool for individuals who need to request a refund for a lost, stolen, or damaged U.S. Treasury check. By following the instructions provided on the form and submitting it in a timely manner, you can ensure that you receive the money owed to you without any unnecessary delays.