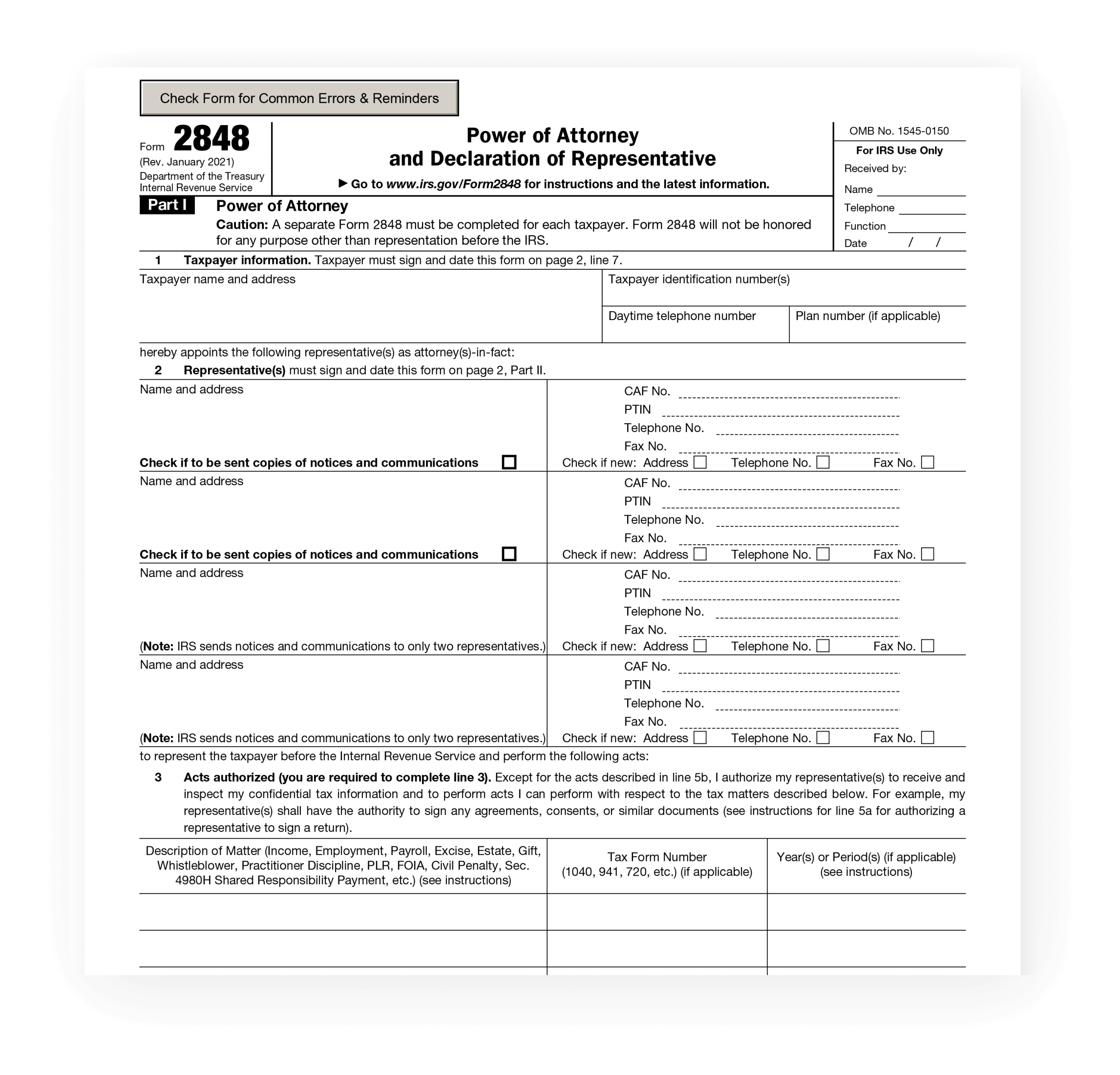

IRS Form 2848, also known as Power of Attorney and Declaration of Representative, is a document that allows an individual or entity to authorize someone else to represent them before the Internal Revenue Service (IRS). This form is essential for those who need assistance with their tax matters but are unable to personally handle them.

By filling out Form 2848, a taxpayer can appoint a representative to act on their behalf in dealings with the IRS. This representative could be a tax professional, attorney, accountant, or any other qualified individual. The form grants the representative the authority to receive and inspect confidential tax information, represent the taxpayer in meetings with the IRS, and sign agreements on their behalf.

When completing IRS Form 2848, it is crucial to provide accurate and detailed information to ensure that the representative can effectively assist with the taxpayer’s needs. The form requires the taxpayer’s personal information, the representative’s information, and details about the specific tax matters the representative is authorized to handle. Once completed, the form must be signed by both the taxpayer and the representative.

After filling out Form 2848, the taxpayer can submit the form to the IRS either electronically or by mail. It is important to keep a copy of the form for personal records and to confirm that the IRS has received it. The representative will also receive a copy of the form, acknowledging their authorization to act on behalf of the taxpayer.

Overall, IRS Form 2848 is a valuable tool for individuals and entities who require assistance with their tax matters. By appointing a representative through this form, taxpayers can ensure that their interests are protected and that their tax affairs are handled professionally and efficiently.

Whether you are an individual or a business entity, IRS Form 2848 is a crucial document that can help you navigate the complexities of tax matters with the assistance of a qualified representative. Make sure to fill out the form accurately and submit it promptly to ensure that your tax affairs are in good hands.