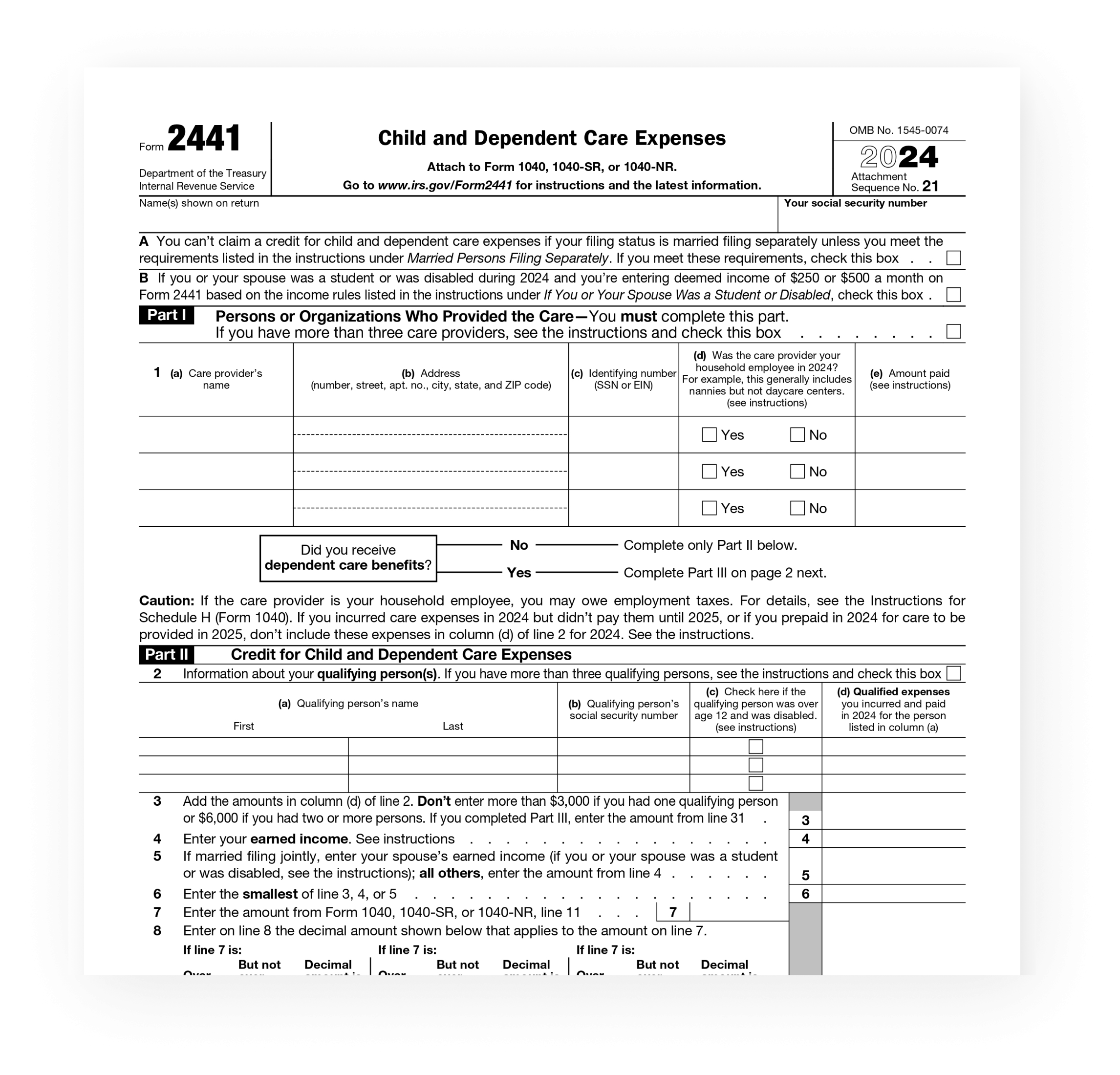

Filing taxes can be a daunting task, especially for those with dependents or childcare expenses. Form 2441, also known as the Child and Dependent Care Expenses form, is a crucial document for individuals who have incurred expenses for the care of a child or dependent. This form allows taxpayers to claim a credit for these expenses, providing some relief from the financial burden of childcare.

For those looking to access a printable version of Form 2441, the Internal Revenue Service (IRS) offers a downloadable PDF on their official website. This printable form can be easily filled out and submitted along with your tax return, ensuring that you receive the appropriate credit for your childcare expenses.

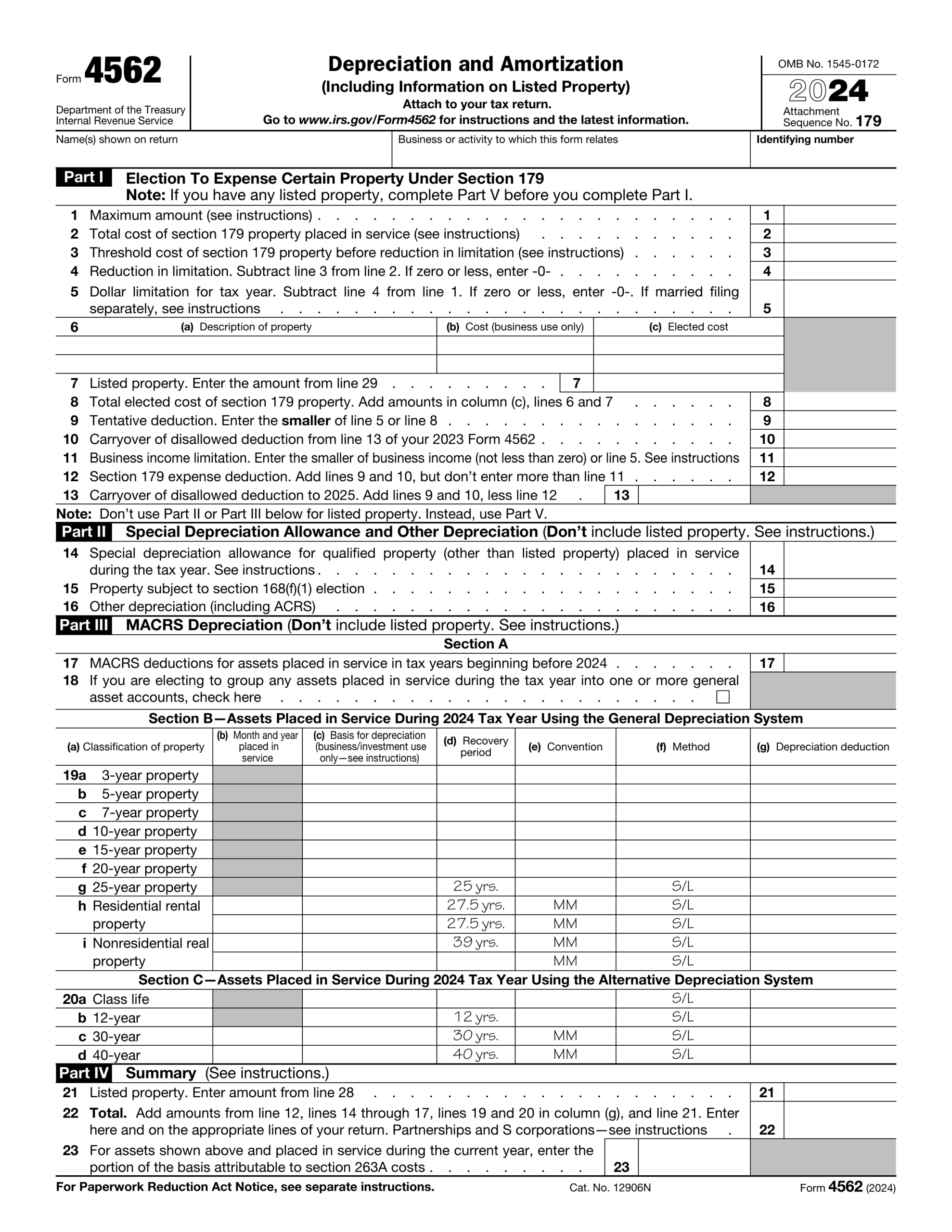

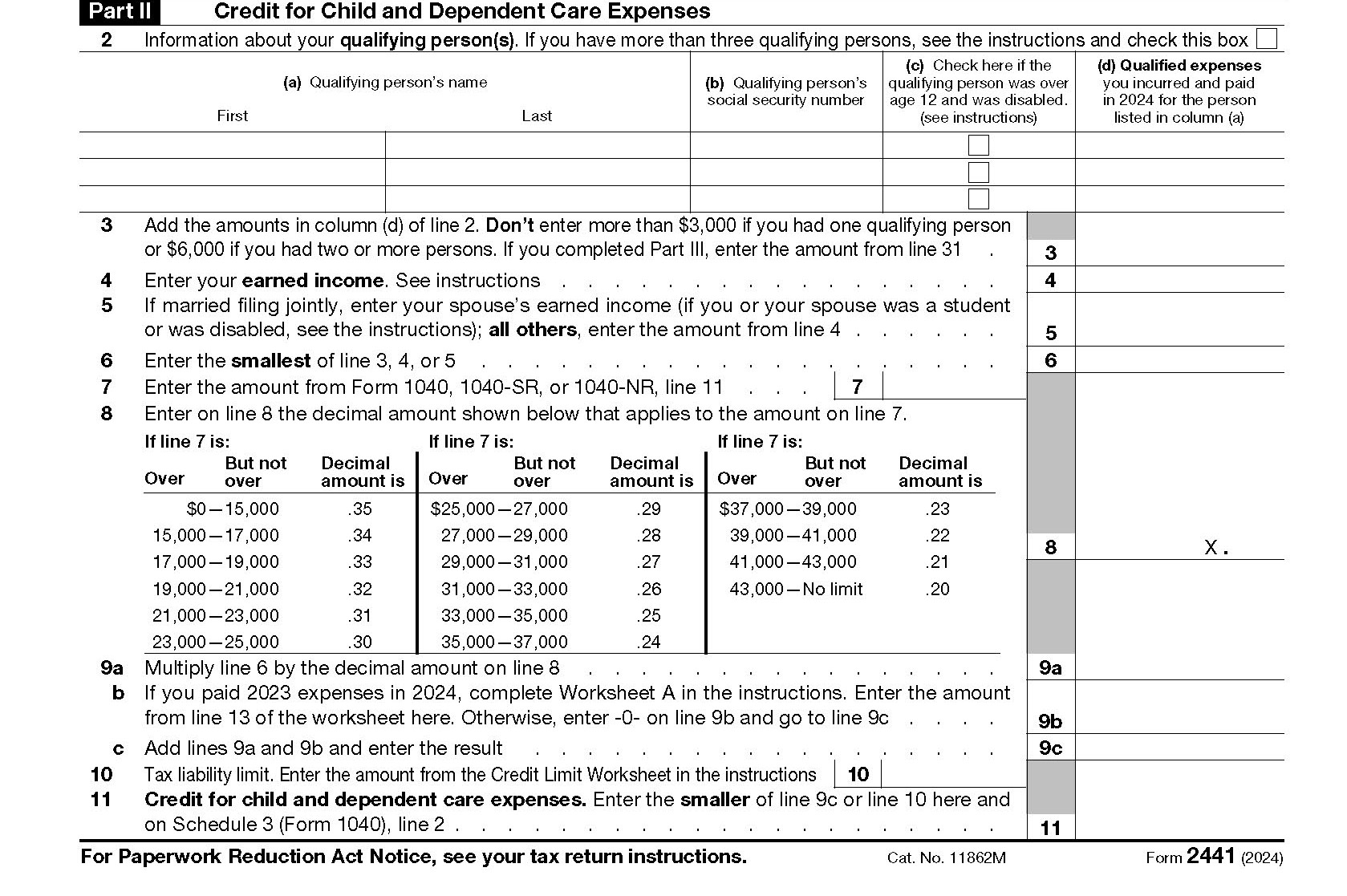

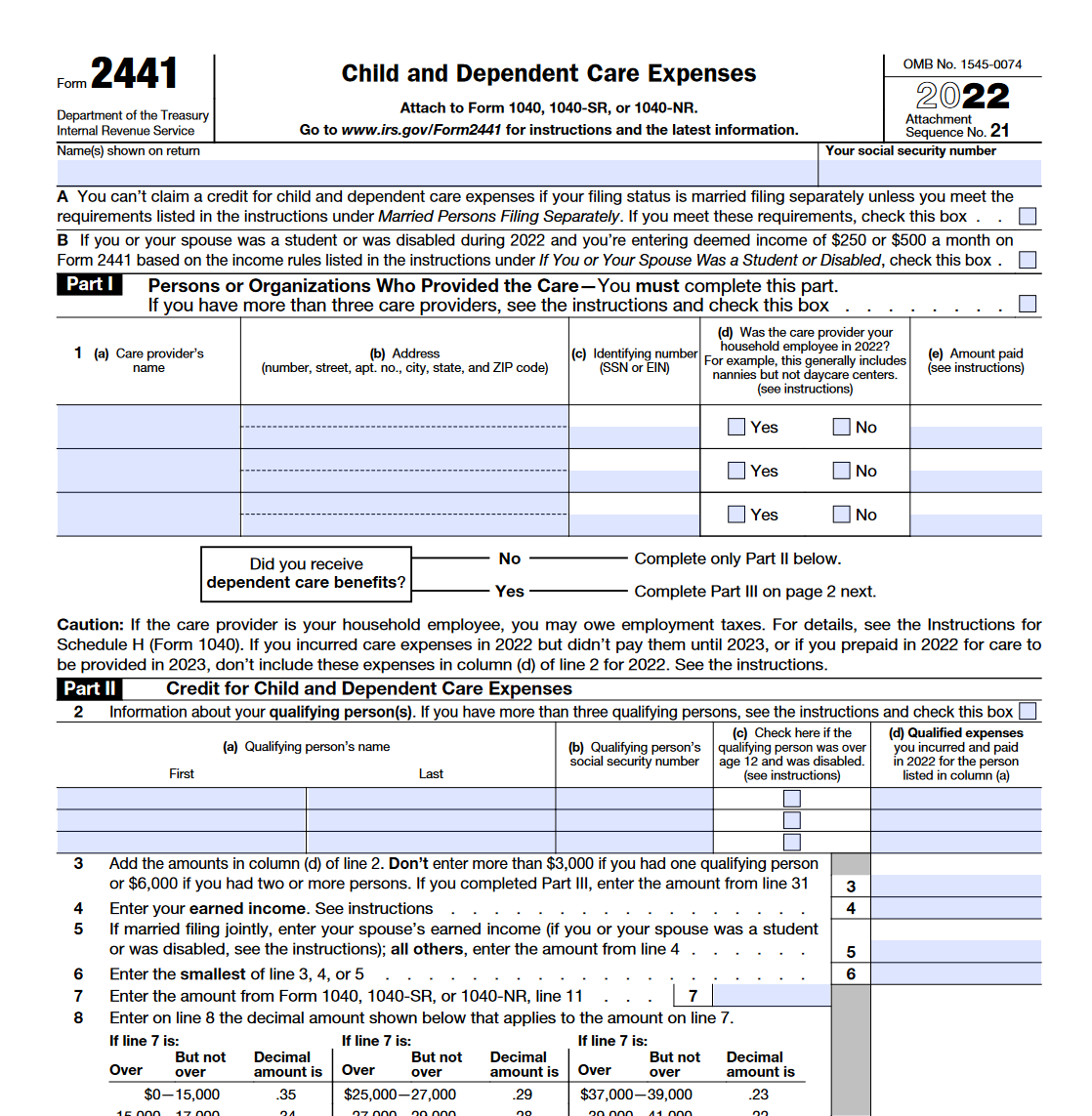

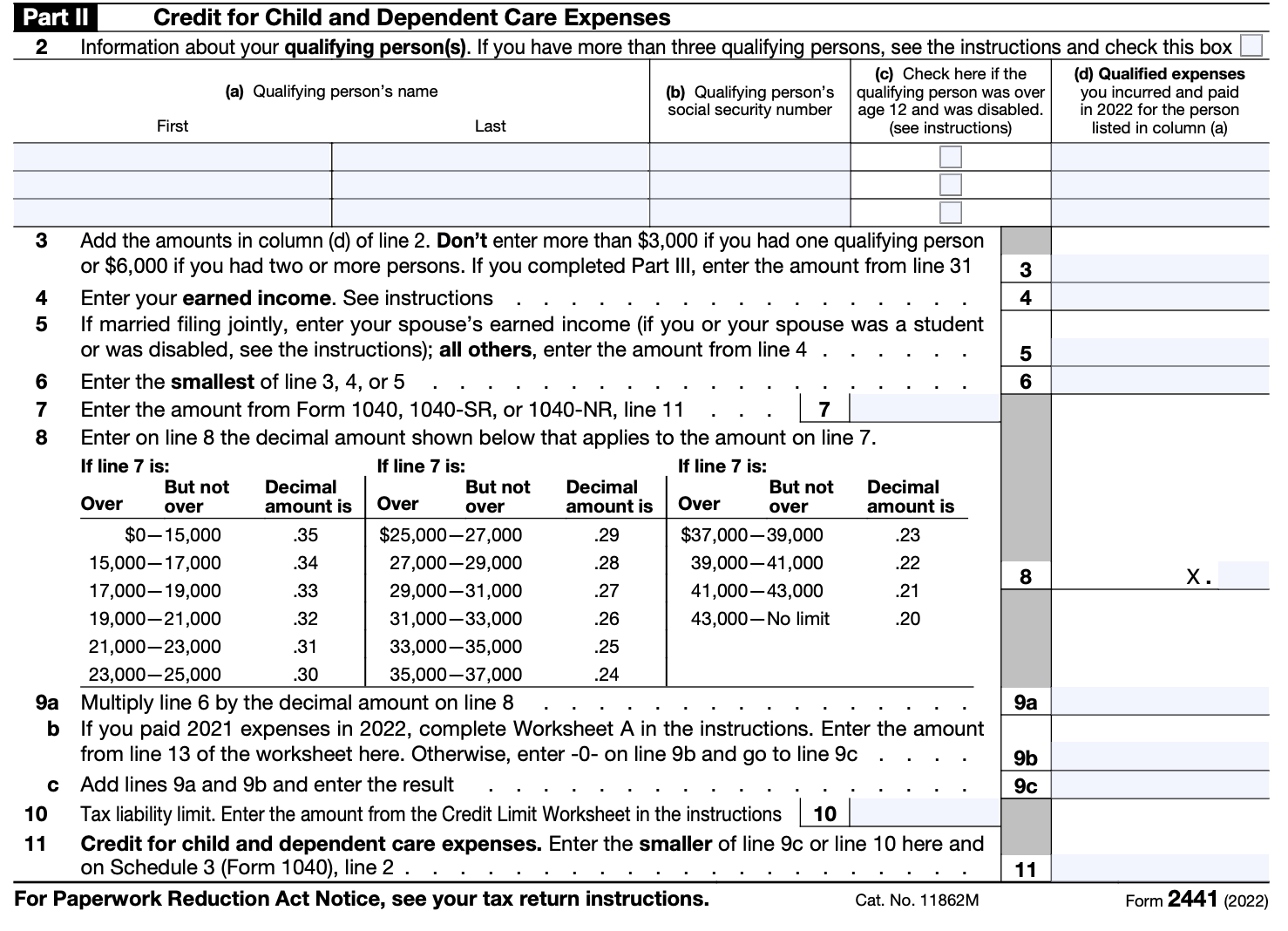

When filling out Form 2441, taxpayers will need to provide information about the childcare provider, the amount of expenses incurred, and the Social Security number or Taxpayer Identification Number of the child or dependent. It is important to accurately report these details to avoid any discrepancies or delays in receiving the credit.

Additionally, taxpayers will need to calculate the credit they are eligible for based on their adjusted gross income and the amount of childcare expenses incurred. The IRS provides instructions on how to complete this calculation, making it easier for individuals to accurately determine the credit they qualify for.

Once the form is completed, taxpayers can submit it along with their tax return to the IRS. It is important to keep a copy of the form for your records in case of any future audits or inquiries. By utilizing the printable version of Form 2441, individuals can easily access and complete the necessary documentation to claim the credit for their childcare expenses.

In conclusion, Form 2441 is a valuable tool for individuals who have incurred childcare expenses and are looking to claim a credit on their tax return. By accessing the printable version of this form, taxpayers can ensure that they accurately report their expenses and receive the appropriate credit. Filing taxes may be complex, but with the right tools and resources, individuals can navigate the process efficiently and effectively.

Get and Print Irs Form 2441 Printable

Payroll printable are ideal for companies that prefer paper documentation or need physical copies for audit purposes. Most forms include fields for employee name, date range, gross pay, taxes, and final salary—making them both complete and easy to use.

Start simplifying your payroll process today with a trusted printable payroll template. Save time, reduce errors, and stay organized—all while keeping your financial logs clear.

IRS Form 2441 Child And Dependent Care Expenses

IRS Form 2441 Child And Dependent Care Expenses

IRS Form 2441 Child And Dependent Care Expenses Forms Docs 2023

IRS Form 2441 Child And Dependent Care Expenses Forms Docs 2023

All About IRS Form 2441 SmartAsset Worksheets Library

All About IRS Form 2441 SmartAsset Worksheets Library

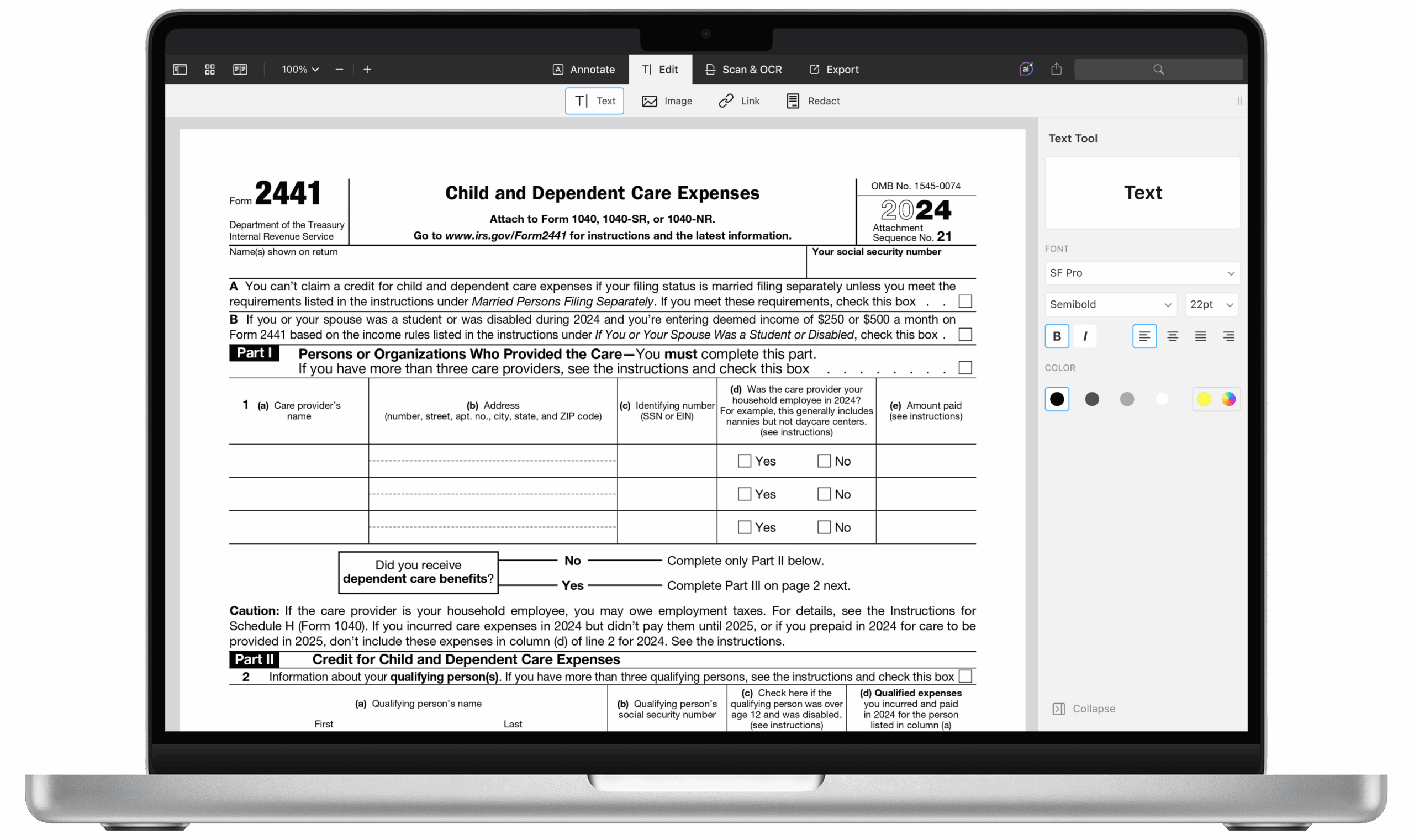

How To Fill Out IRS 2441 Form PDF 2024 2025 PDF Expert

How To Fill Out IRS 2441 Form PDF 2024 2025 PDF Expert

How To Fill Out IRS 2441 Form PDF 2024 2025 PDF Expert

How To Fill Out IRS 2441 Form PDF 2024 2025 PDF Expert

Managing payroll tasks doesn’t have to be complicated. A payroll template offers a quick, accurate, and easy-to-use method for tracking wages, hours, and taxes—without the need for complicated tools.

Whether you’re a startup founder, HR professional, or sole proprietor, using aprintable payroll helps ensure proper documentation. Simply download the template, print it, and complete it by hand or type directly into the file before printing.