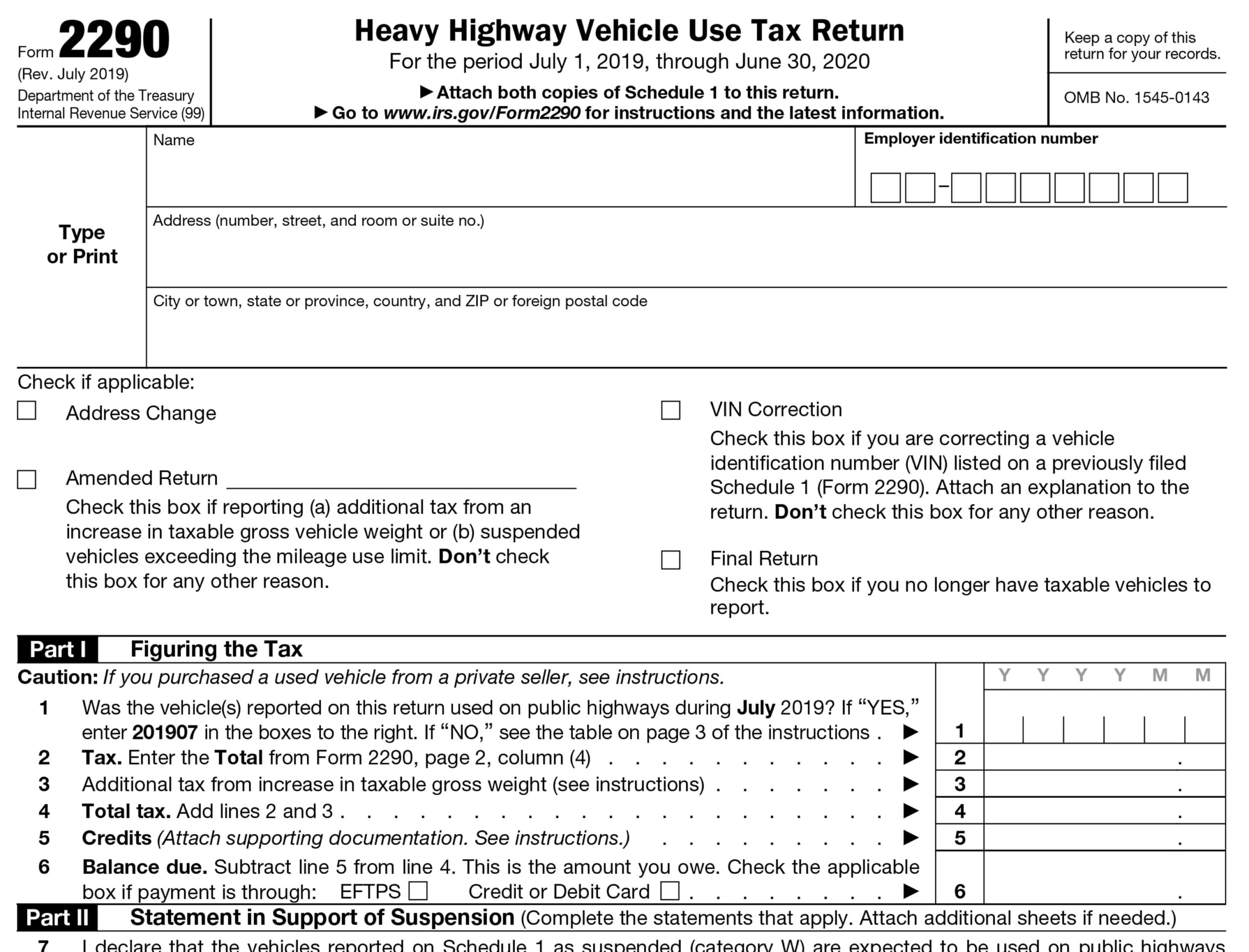

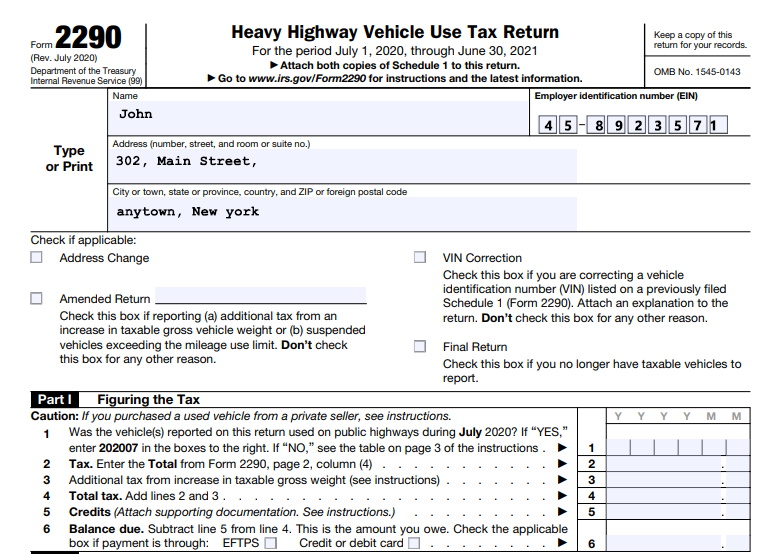

When it comes to filing your heavy highway vehicle use tax, IRS Form 2290 is an essential document that must be completed each year. This form is used by truck owners and operators to report and pay the taxes due on their vehicles with a gross weight of 55,000 pounds or more. While the process of filing Form 2290 may seem daunting, the IRS provides a printable version of the form to make it easier for taxpayers to complete and submit.

One of the key benefits of using the IRS Form 2290 Printable is that it allows truck owners to easily access and fill out the required information offline. This can be particularly helpful for those who may not have consistent access to the internet or prefer to complete their tax forms by hand. The printable version of Form 2290 includes all the necessary fields for reporting vehicle details, taxable gross weight, and any credits or deductions that may apply.

When using the IRS Form 2290 Printable, it is important to ensure that all information is accurate and up to date before submitting the form to the IRS. Any errors or omissions could result in penalties or delays in processing your tax return. Additionally, be sure to keep a copy of the completed form for your records and to reference in case of any future audits or inquiries from the IRS.

Once you have completed the IRS Form 2290 Printable, you can submit it to the IRS either by mail or electronically. If mailing the form, be sure to send it to the appropriate address listed on the IRS website and include any required payment. For electronic filing, there are several approved e-file providers that can assist you in submitting your Form 2290 online quickly and securely.

In conclusion, the IRS Form 2290 Printable is a valuable tool for truck owners and operators who need to report and pay their heavy highway vehicle use tax each year. By utilizing this form, taxpayers can easily access and complete the necessary information offline and ensure that their tax obligations are met in a timely manner. Whether filing by mail or electronically, it is important to follow the instructions provided by the IRS to avoid any potential issues with your tax return.

Quickly Access and Print Irs Form 2290 Printable

Printable payroll template are ideal for teams that prefer paper documentation or need hard copies for staff files. Most forms include fields for staff name, date range, gross pay, taxes, and net pay—making them both comprehensive and easy to use.

Begin streamlining your payroll process today with a trusted printable payroll template. Reduce admin effort, reduce errors, and stay organized—all while keeping your payroll records professional.

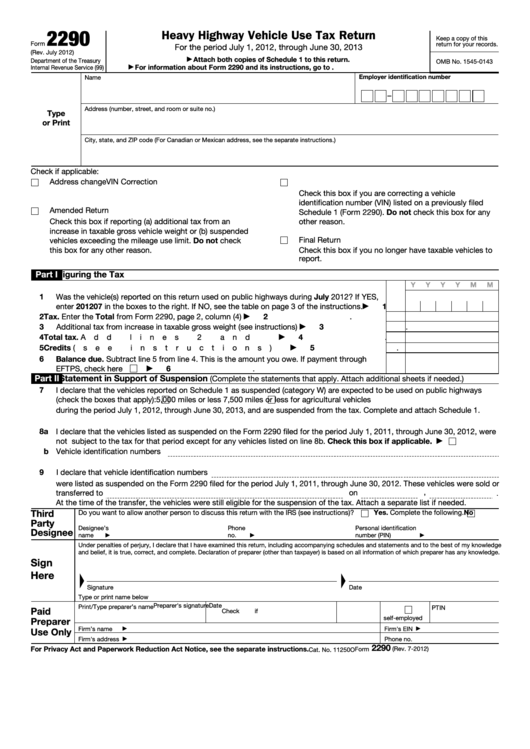

Irs Form 2290 Printable 2023 To 2024

Irs Form 2290 Printable 2023 To 2024

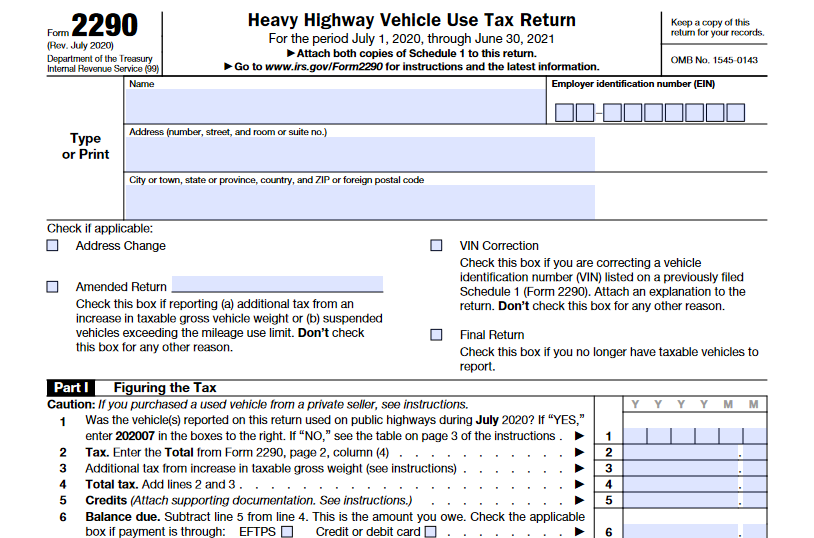

2290 Printable Form Printable Forms Free Online

2290 Printable Form Printable Forms Free Online

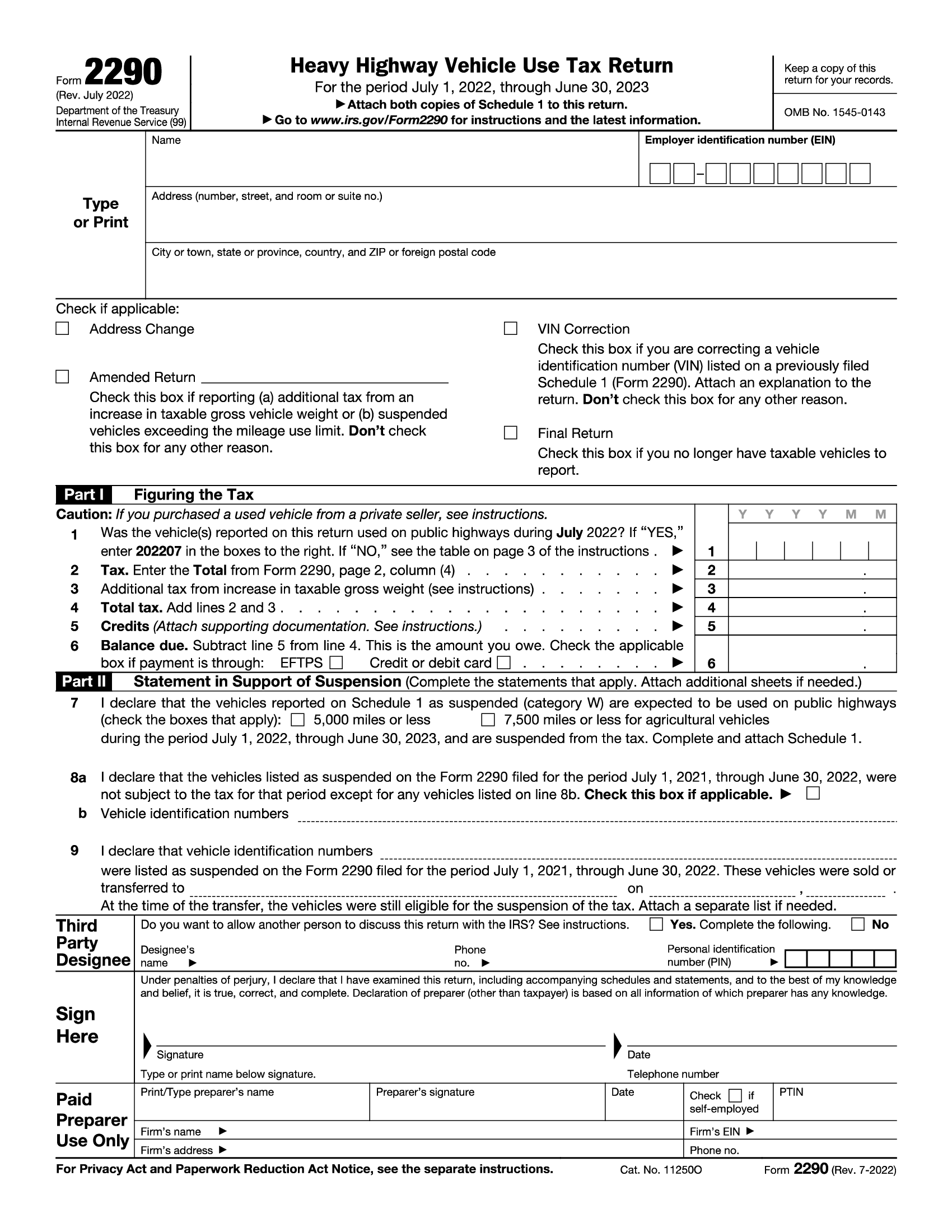

Irs Form 2290 Printable 2022 Pdf Download

Irs Form 2290 Printable 2022 Pdf Download

Managing employee payments doesn’t have to be difficult. A printable payroll template offers a fast, dependable, and straightforward method for tracking employee pay, hours, and taxes—without the need for complex software.

Whether you’re a small business owner, payroll manager, or sole proprietor, using aprintable payroll template helps ensure proper documentation. Simply access the template, print it, and complete it by hand or type directly into the file before printing.