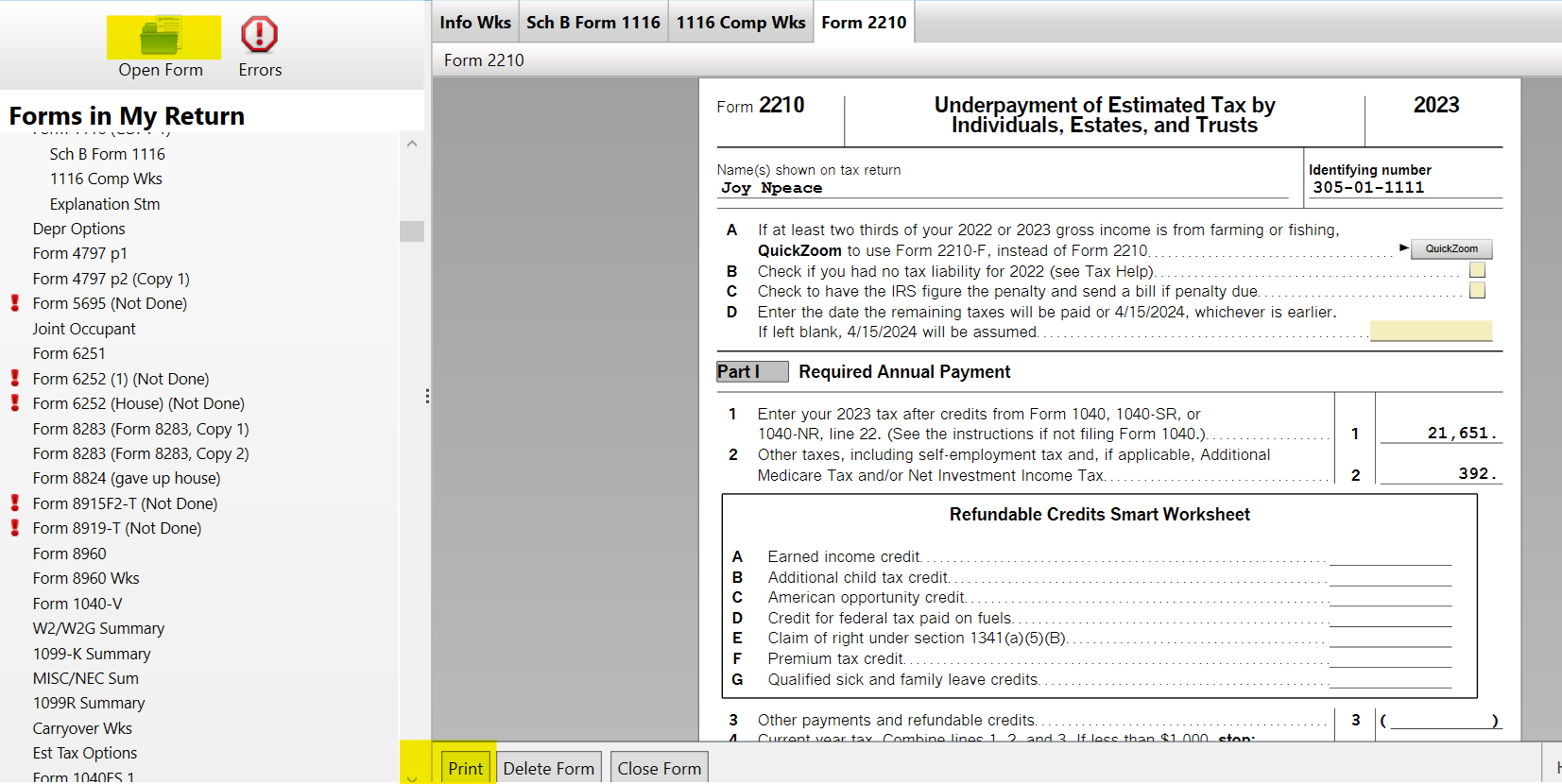

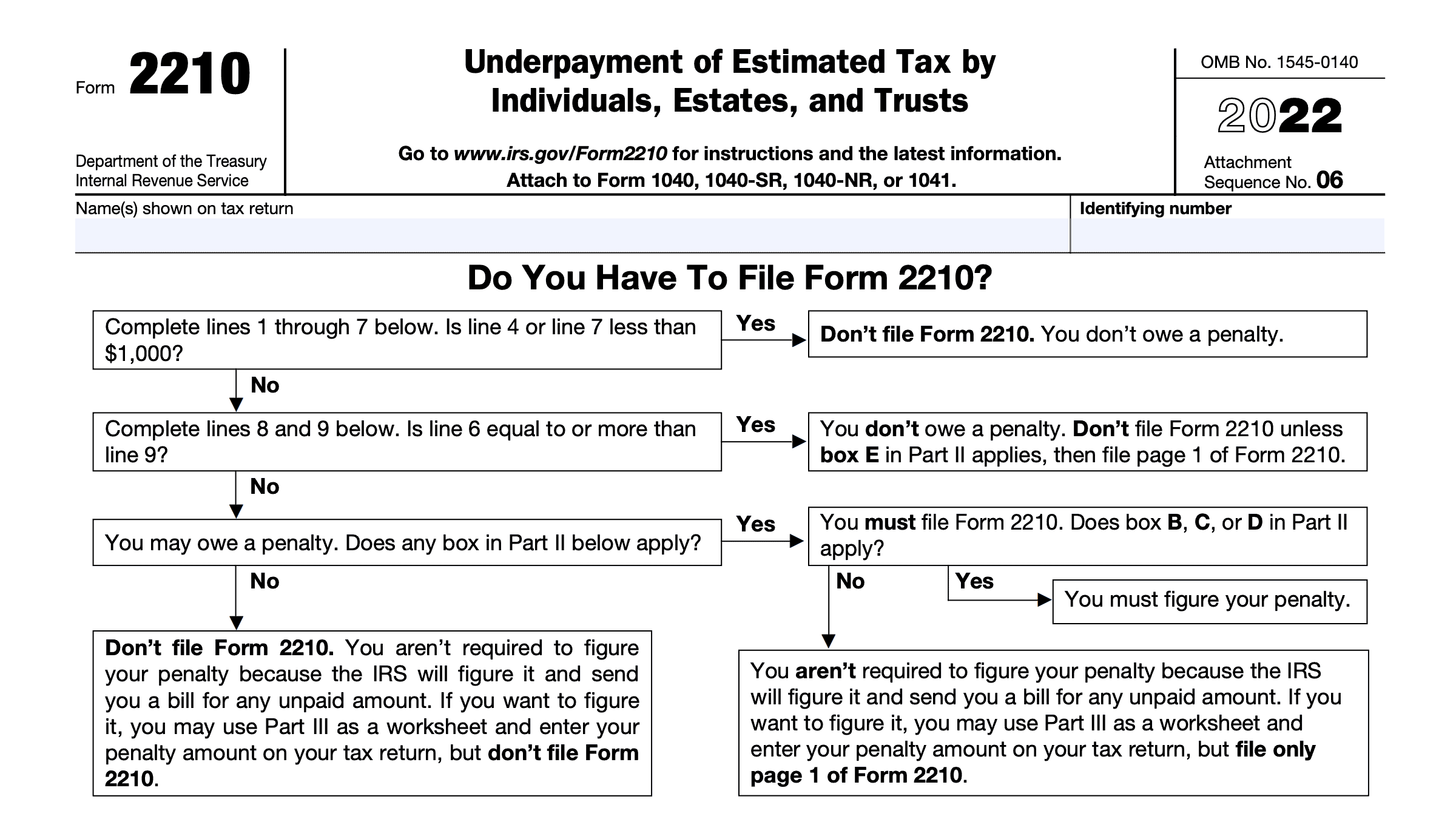

As tax season approaches, it’s important for individuals to familiarize themselves with the various forms they may need to file. One such form is IRS Form 2210, which is used to calculate any penalties for underpayment of estimated tax. For the year 2024, taxpayers can easily access and print a copy of Form 2210 from the IRS website or other reputable tax preparation websites.

Form 2210 is typically used by individuals who did not pay enough tax throughout the year, either through withholding or estimated tax payments. By filling out this form, taxpayers can determine if they owe any additional penalties for not paying enough tax in a timely manner. The form takes into account various factors such as income, deductions, and credits to calculate the penalty amount, if any.

Irs Form 2210 For 2024 Printable

Irs Form 2210 For 2024 Printable

When filling out Form 2210 for the year 2024, taxpayers should carefully review the instructions provided by the IRS to ensure accuracy. It’s important to gather all necessary documentation, such as W-2s, 1099s, and other income statements, to accurately report income and deductions. By accurately completing Form 2210, taxpayers can avoid any potential penalties and ensure compliance with tax laws.

In addition to calculating underpayment penalties, Form 2210 also provides taxpayers with the opportunity to request a waiver of these penalties under certain circumstances. Taxpayers who believe they have a valid reason for not paying enough tax throughout the year can provide an explanation and request relief from penalties. It’s important to provide detailed and accurate information when requesting a waiver to increase the chances of approval.

Overall, IRS Form 2210 for 2024 is an important document for individuals who may have underpaid their taxes throughout the year. By carefully completing this form and following the instructions provided by the IRS, taxpayers can accurately calculate any underpayment penalties and request relief if necessary. Accessing and printing a copy of Form 2210 is easy and convenient, making it simple for taxpayers to stay compliant with tax laws.

As tax season approaches, individuals should take the time to familiarize themselves with IRS Form 2210 for 2024 and ensure they have all necessary documentation to accurately complete the form. By staying informed and proactive, taxpayers can avoid potential penalties and ensure a smooth tax filing process.

Get and Print Irs Form 2210 For 2024 Printable

Printable payroll are ideal for businesses that prefer non-digital systems or need physical copies for employee records. Most forms include fields for employee name, pay period, gross pay, taxes, and final salary—making them both detailed and user-friendly.

Start simplifying your payment tracking today with a trusted printable payroll form. Save time, minimize mistakes, and maintain clear records—all while keeping your employee payment data clear.

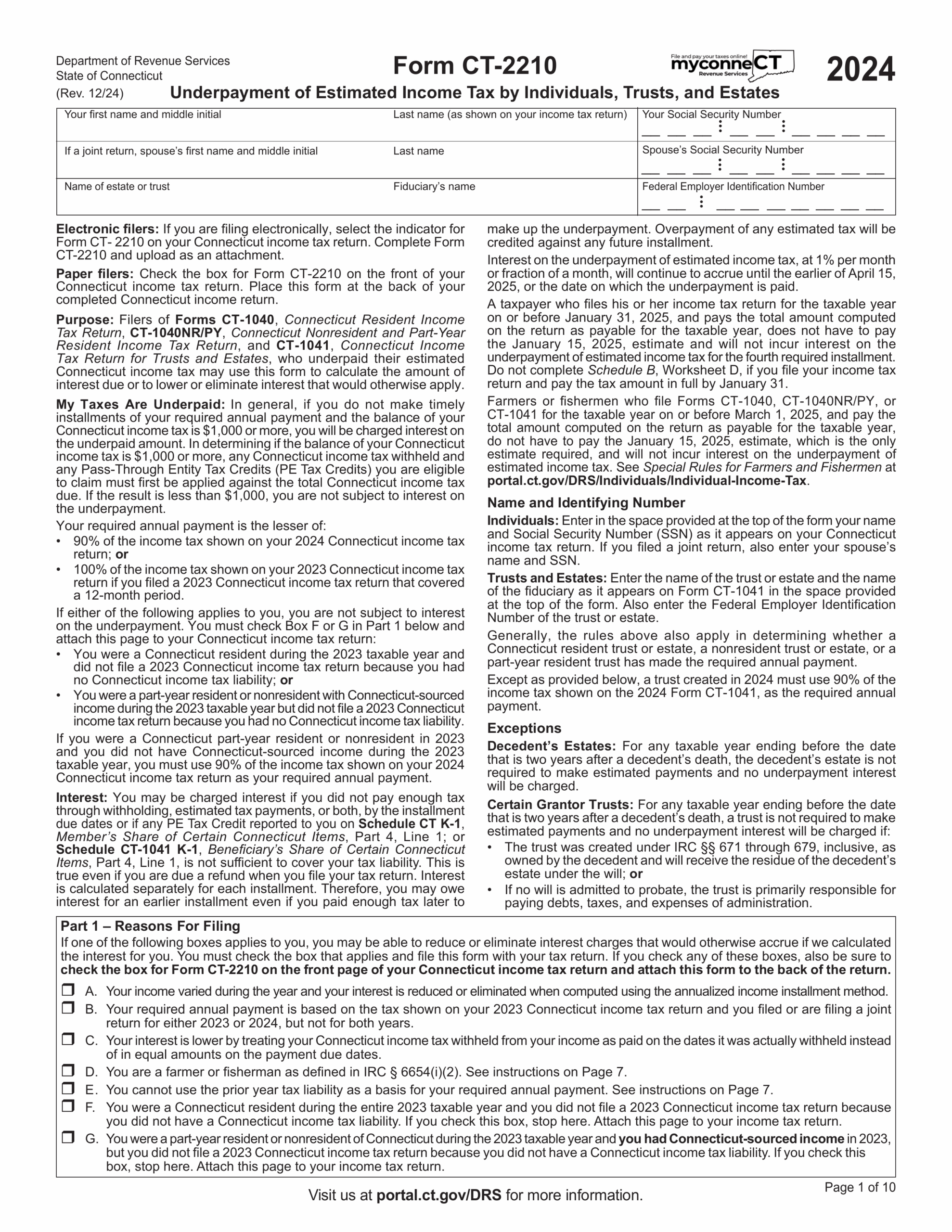

Form CT 2210 2024 2025 Fill Official Forms Online

Form CT 2210 2024 2025 Fill Official Forms Online

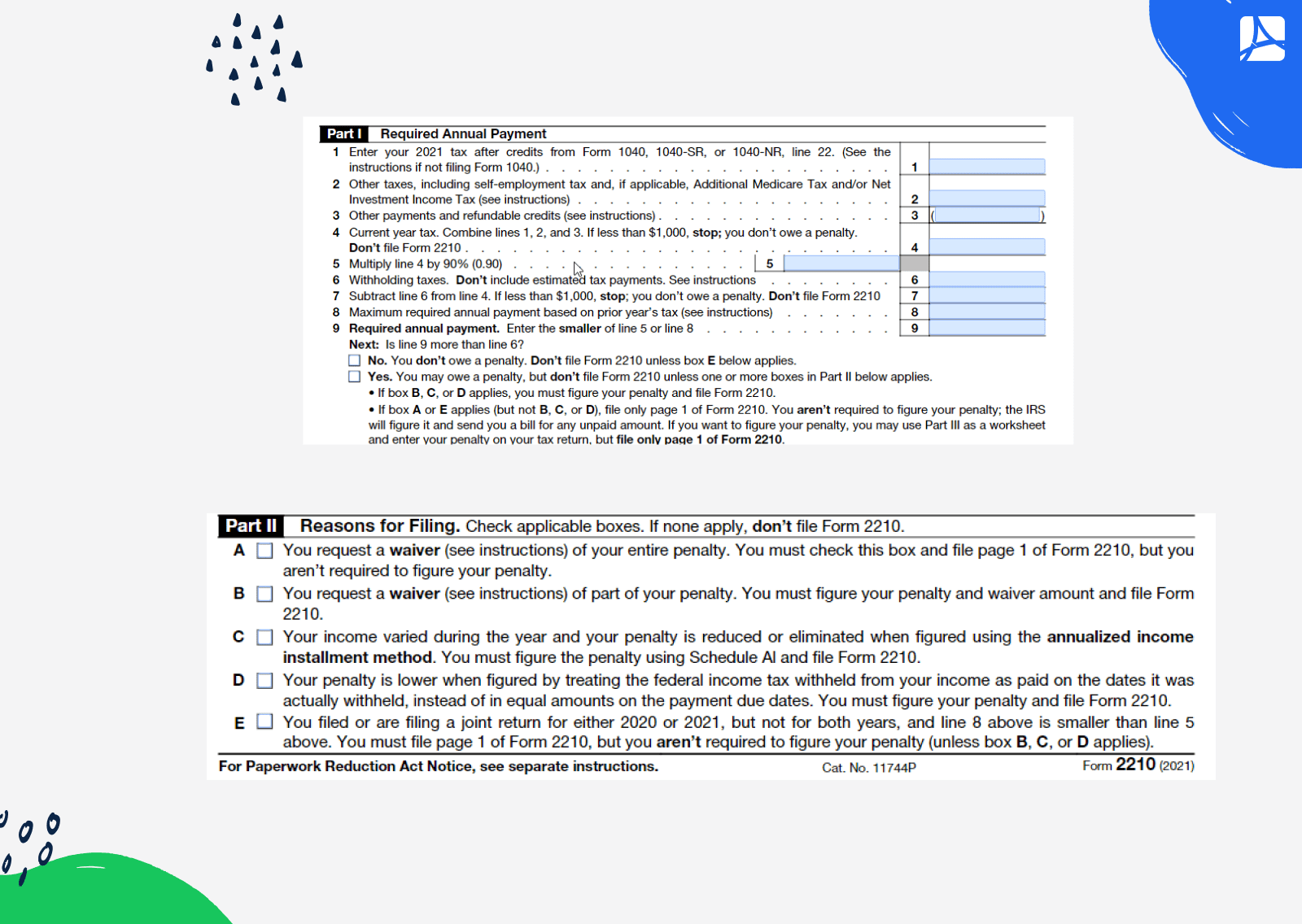

Form 2210 F 2024 2025 Fill Out Official Forms Online

Form 2210 F 2024 2025 Fill Out Official Forms Online

Form 2210 Fillable And Printable Blank PDFline

Form 2210 Fillable And Printable Blank PDFline

Form 2210 Fillable And Printable Blank PDFline

Form 2210 Fillable And Printable Blank PDFline

IRS Form 2210 Instructions Underpayment Of Estimated Tax

IRS Form 2210 Instructions Underpayment Of Estimated Tax

Managing staff wages doesn’t have to be complicated. A Irs Form 2210 For 2024 Printable offers a quick, accurate, and user-friendly method for tracking employee pay, work time, and withholdings—without the need for complex software.

Whether you’re a startup founder, administrator, or independent contractor, using aprintable payroll helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.