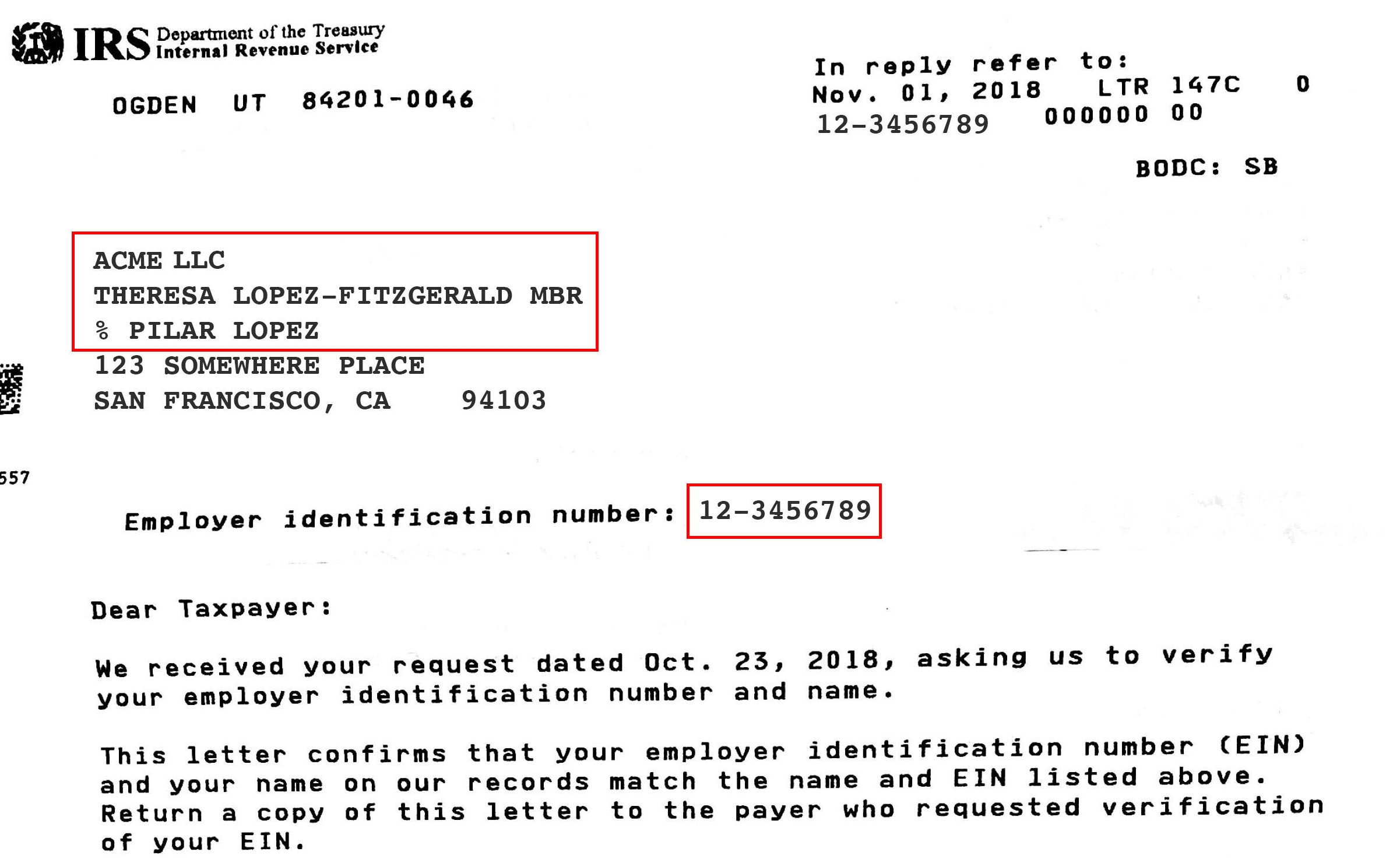

IRS Form 147c is a document issued by the Internal Revenue Service (IRS) that verifies the taxpayer identification number (TIN) of a business entity. This form is often requested by third parties, such as banks or vendors, to confirm the TIN of a business for tax purposes. The form contains important information such as the legal name of the business, the TIN, and the type of entity.

Obtaining a copy of IRS Form 147c is crucial for businesses to ensure compliance with tax laws and regulations. It is important to keep this form on file and provide it to third parties when requested. The form is available in printable PDF format, making it easy to access and fill out as needed.

When filling out IRS Form 147c, it is essential to provide accurate and up-to-date information to avoid any discrepancies or delays in processing. The form must be signed and dated by an authorized individual within the business to certify the information provided.

Business owners can easily download and print IRS Form 147c from the IRS website or other online sources. Having a printable PDF version of the form allows for convenient access and quick distribution when needed. It is recommended to keep a digital copy of the form as well for future reference.

Overall, IRS Form 147c is a vital document for businesses to verify their taxpayer identification number and ensure compliance with tax regulations. By keeping a copy of the form on hand and providing it to third parties as requested, businesses can demonstrate their commitment to accurate record-keeping and tax compliance.

In conclusion, IRS Form 147c is an essential tool for businesses to verify their taxpayer identification number and comply with tax laws. By utilizing the printable PDF version of the form, businesses can easily access and distribute the necessary information when needed. It is important for businesses to keep accurate records and provide requested documentation to third parties in a timely manner.