When it comes to tax season, one of the most important forms that businesses and individuals need to be aware of is the IRS Form 1099 NEC. This form is used to report nonemployee compensation, such as payments made to independent contractors, freelancers, and other service providers. It is crucial for both the payer and the recipient to accurately report this income to the IRS to avoid any potential penalties or fines.

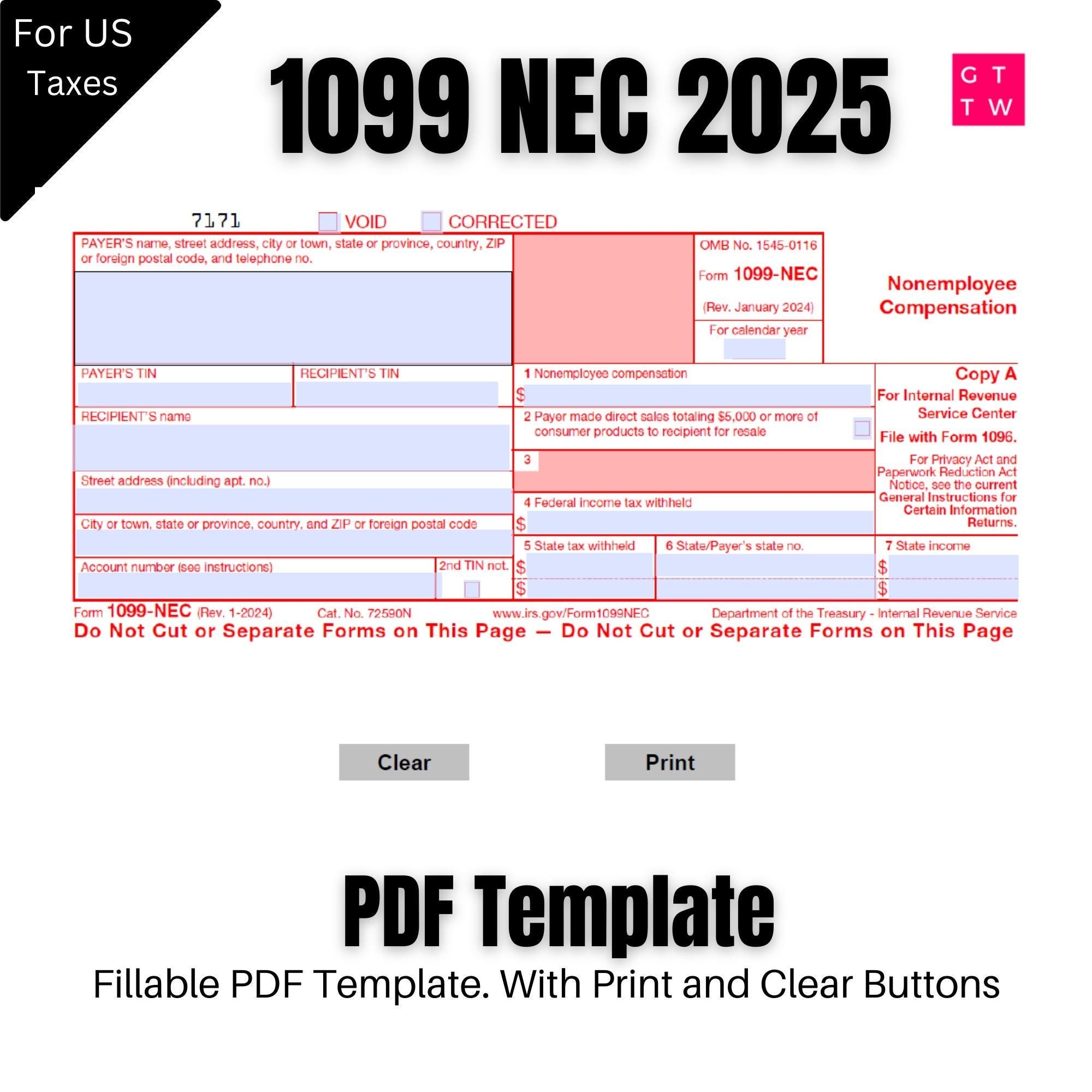

For those who need to file this form, having access to a printable version can be incredibly convenient. Being able to fill out the form online and then print it out for submission can save time and ensure that all the necessary information is accurately recorded. This is where the IRS Form 1099 NEC Printable comes in handy.

With the IRS Form 1099 NEC Printable, individuals and businesses can easily download the form from the IRS website and fill it out electronically. Once completed, they can then print it out and submit it to the IRS along with any other required documentation. This streamlined process makes it easier for taxpayers to meet their reporting obligations and stay in compliance with tax laws.

It is important to note that the IRS Form 1099 NEC Printable is only for informational purposes and should not be submitted to the IRS. The official form must be filed electronically or by mail to the IRS. However, having a printable version can serve as a useful tool for gathering all the necessary information before completing the official form.

Overall, the IRS Form 1099 NEC Printable is a valuable resource for individuals and businesses who need to report nonemployee compensation to the IRS. By using this printable form, taxpayers can ensure that they accurately report their income and avoid any potential issues with the IRS. It is always recommended to consult with a tax professional or accountant for assistance with completing and filing tax forms.

In conclusion, the IRS Form 1099 NEC Printable provides a convenient way for taxpayers to prepare for tax season and fulfill their reporting obligations. By utilizing this printable form, individuals and businesses can streamline the process of reporting nonemployee compensation and avoid any potential penalties for noncompliance.