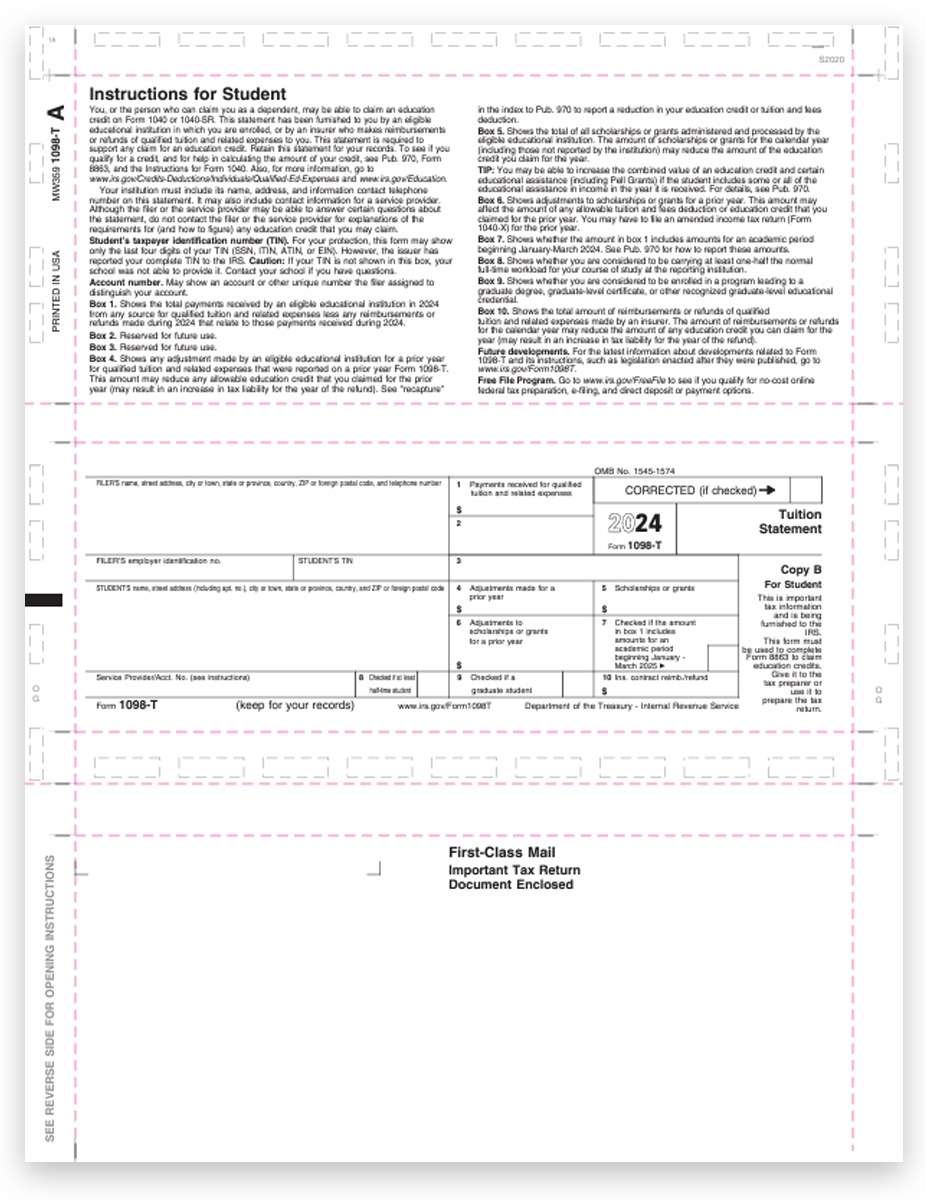

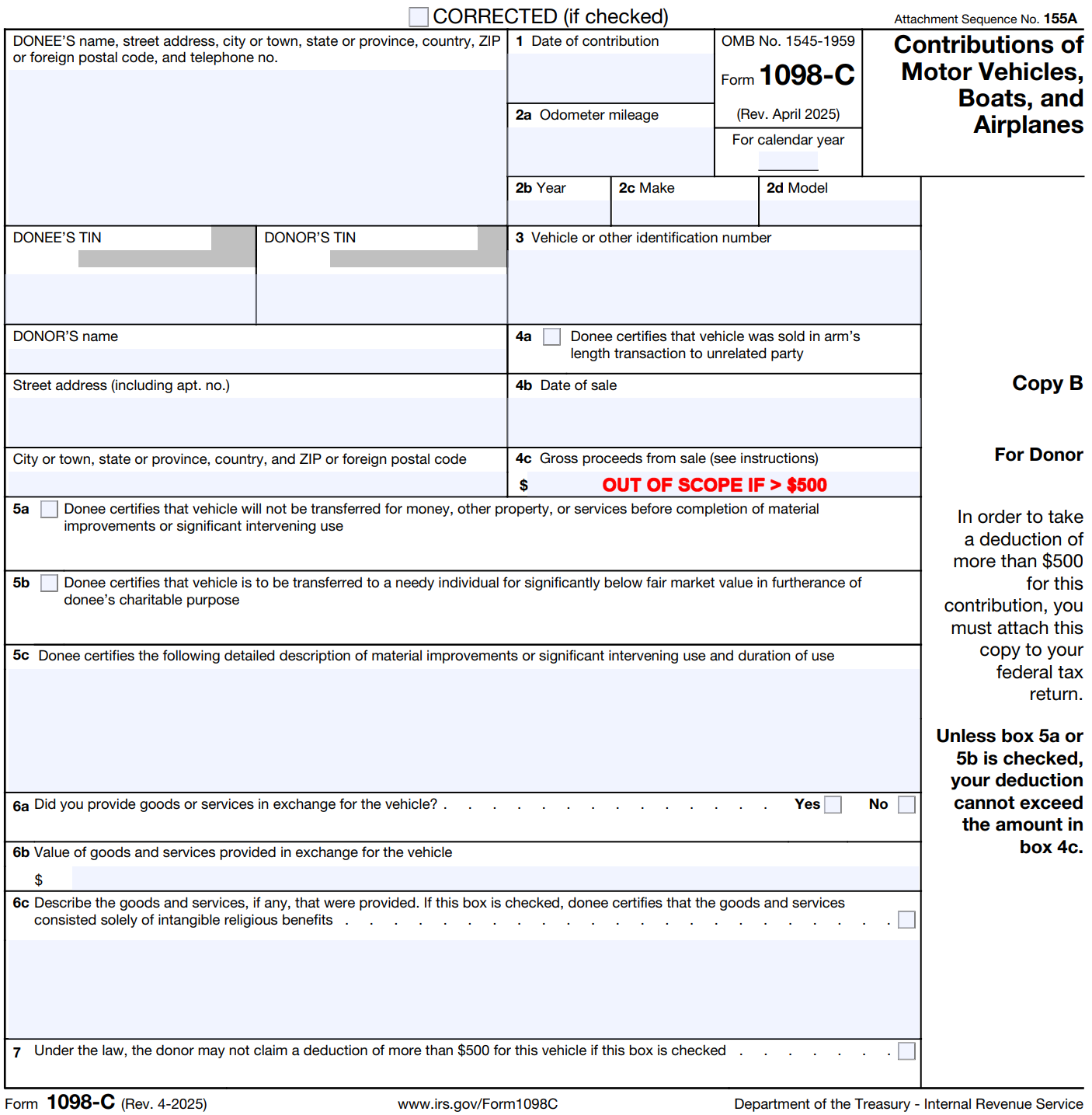

IRS Form 1098-C is used by donors to report information on qualified vehicle donations to charitable organizations. This form is essential for individuals who have donated a vehicle worth more than $500 to a qualified organization. By filling out this form, donors can claim a tax deduction for the fair market value of the donated vehicle.

For those who are looking to make a vehicle donation and need to fill out IRS Form 1098-C, there are printable versions available online. These printable forms can be easily accessed and filled out electronically or by hand. It is important to ensure that all information provided on the form is accurate and complete to avoid any issues with the IRS.

When filling out the IRS Form 1098-C, donors will need to provide details such as the name and address of the charitable organization, the vehicle identification number (VIN) of the donated vehicle, the date of the donation, and a description of the vehicle. Donors will also need to determine the fair market value of the vehicle at the time of the donation.

After completing the form, donors should keep a copy for their records and submit the original form to both the charitable organization and the IRS. The organization will acknowledge the donation by signing the form and providing their own information. Donors should then attach the completed Form 1098-C to their tax return when claiming the deduction.

It is important to note that IRS Form 1098-C must be filed by the donor within 30 days of the sale of the donated vehicle by the charitable organization. Failure to submit the form in a timely manner can result in penalties and may affect the donor’s ability to claim the tax deduction. By using the printable version of IRS Form 1098-C, donors can easily fulfill their reporting requirements and ensure that they receive the appropriate tax benefits for their charitable contributions.

In conclusion, IRS Form 1098-C is a crucial document for donors who have made qualified vehicle donations to charitable organizations. By utilizing the printable version of this form, donors can accurately report their donations and claim the tax benefits they are entitled to. It is important to fill out the form correctly and submit it on time to avoid any issues with the IRS.

Save and Print Irs Form 1098-C Printable

Irs Form 1098-C Printable are ideal for businesses that prefer paper documentation or need hard copies for audit purposes. Most forms include fields for staff name, pay period, gross pay, taxes, and final salary—making them both detailed and practical.

Take control of your payroll system today with a trusted printable payroll form. Save time, reduce errors, and stay organized—all while keeping your payroll records professional.

Fill Form 1098 C 2024 2025 Create Edit Official Forms

Fill Form 1098 C 2024 2025 Create Edit Official Forms

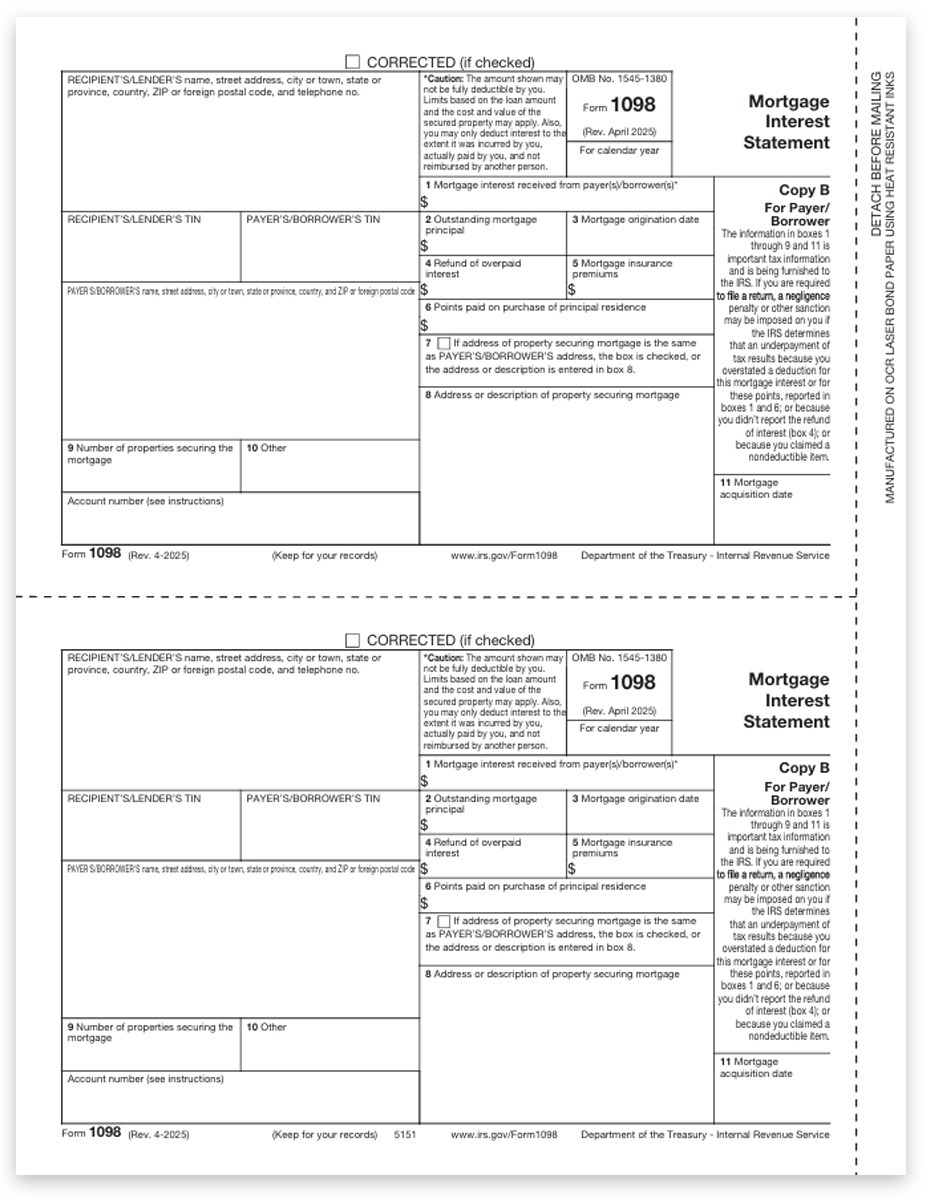

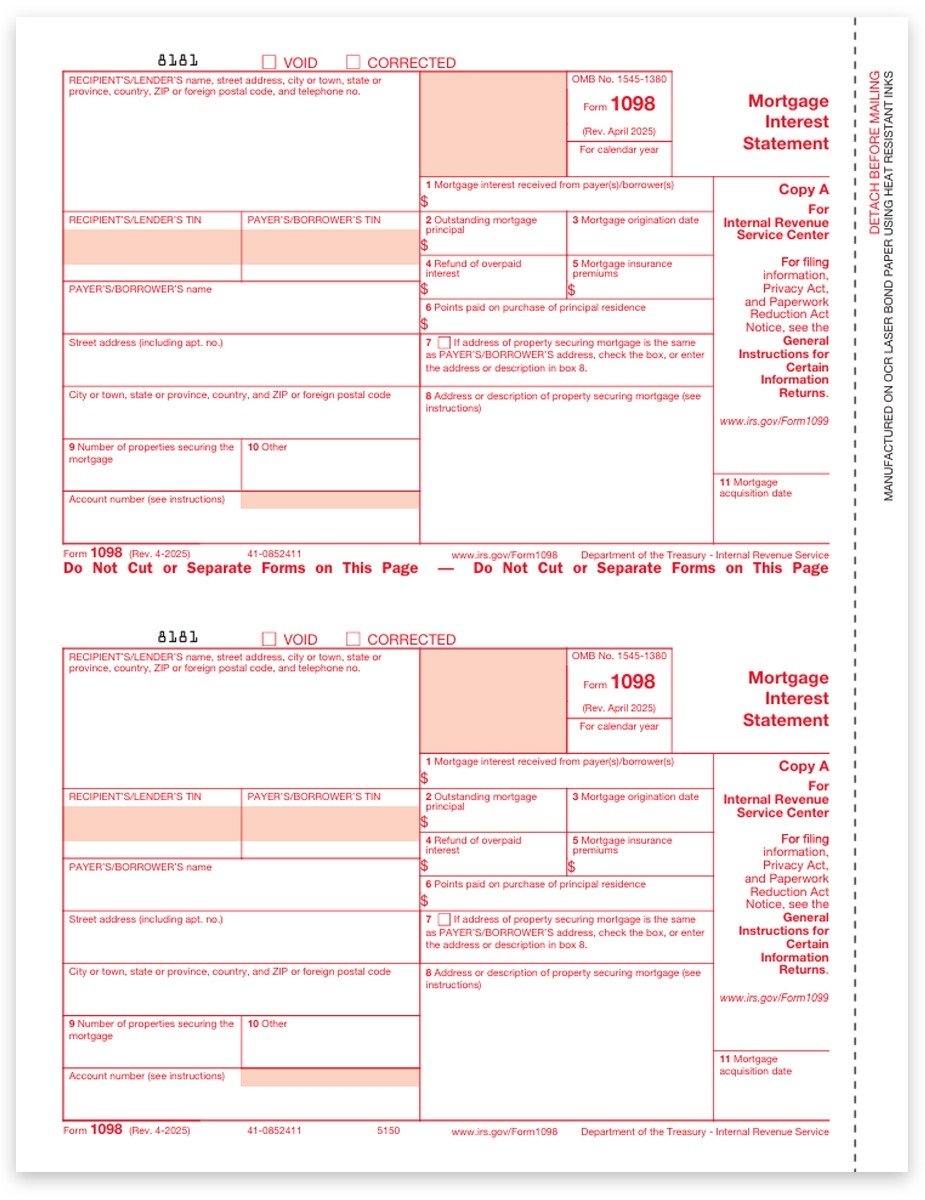

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

Processing employee payments doesn’t have to be difficult. A printable payroll form offers a fast, dependable, and straightforward method for tracking wages, work time, and taxes—without the need for digital systems.

Whether you’re a small business owner, administrator, or sole proprietor, using aprintable payroll helps ensure accurate record-keeping. Simply download the template, print it, and complete it by hand or type directly into the file before printing.