IRS Form 1096 is used by businesses to summarize and transmit forms 1099 to the IRS. This form is required when submitting paper copies of 1099 forms, as it serves as a cover sheet for the documents being sent. Form 1096 is essential for businesses that have made payments to non-employees or vendors, as it helps the IRS to track income and tax liabilities.

For businesses that prefer to file their 1099 forms manually, the IRS provides a printable version of Form 1096 on their website. This allows businesses to easily fill out the form, attach their 1099 forms, and mail them to the IRS. It is important to ensure that all information provided on Form 1096 is accurate and matches the corresponding 1099 forms to avoid any discrepancies or penalties.

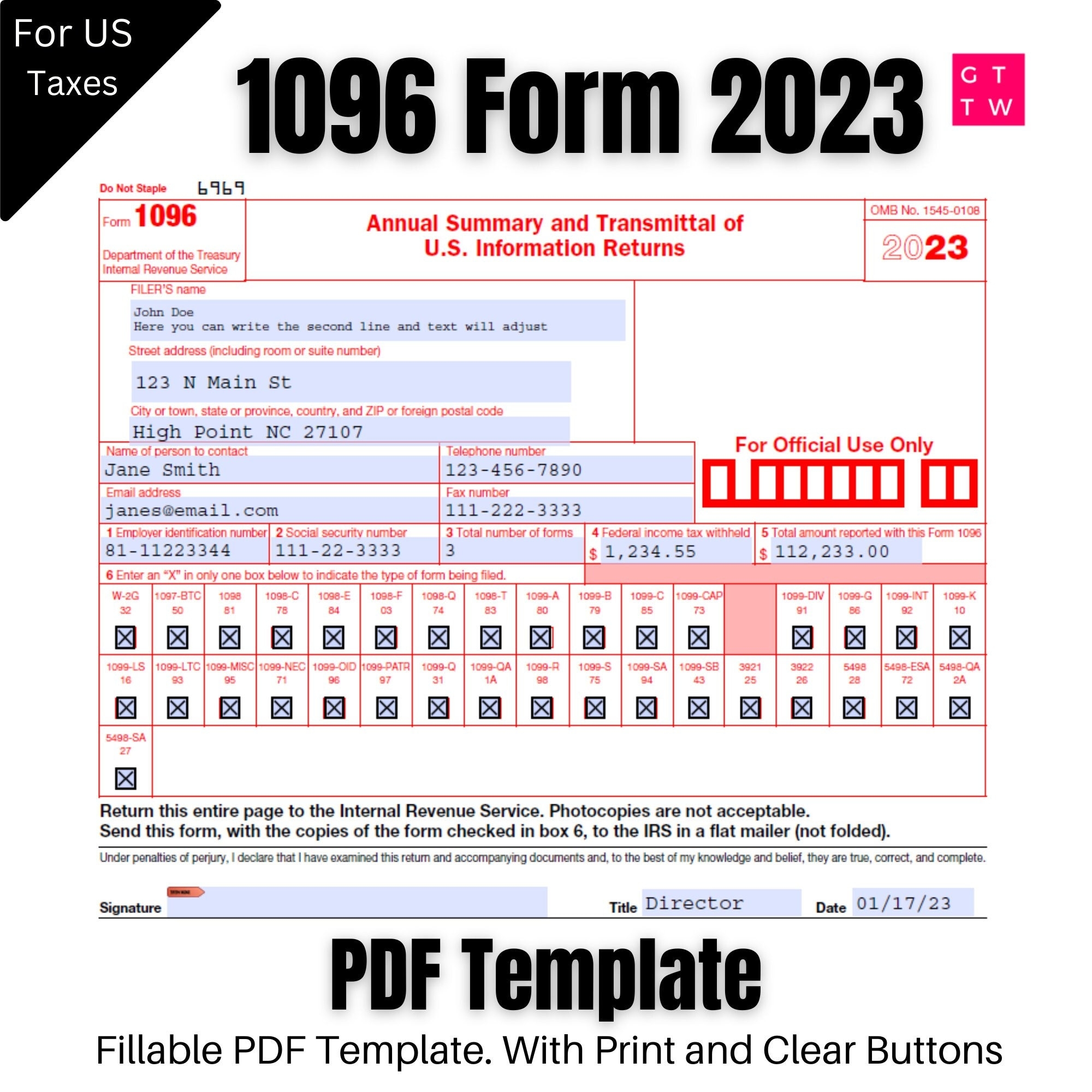

When filling out Form 1096, businesses will need to provide their name, address, taxpayer identification number, and the total number of 1099 forms being submitted. Businesses will also need to indicate the total amount of federal income tax withheld from the payments reported on the 1099 forms. Once the form is completed, it should be signed and dated before being submitted to the IRS.

Businesses should keep a copy of Form 1096 for their records, as well as copies of the 1099 forms that were submitted. This will help businesses to easily reference the information provided to the IRS in the event of an audit or inquiry. It is also recommended to send Form 1096 and the corresponding 1099 forms via certified mail to ensure that they are received by the IRS.

Overall, Form 1096 is an essential document for businesses that need to report payments made to non-employees or vendors. By utilizing the printable version of Form 1096 provided by the IRS, businesses can easily comply with reporting requirements and avoid any potential penalties. It is important to accurately fill out the form and submit it in a timely manner to ensure that all income and tax liabilities are properly reported to the IRS.

In conclusion, businesses can use the IRS Form 1096 Printable to summarize and transmit their 1099 forms to the IRS. By following the instructions provided on the form and ensuring accuracy in reporting, businesses can effectively fulfill their tax reporting obligations and avoid any potential penalties.

Get and Print Irs Form 1096 Printable

Payroll template are ideal for businesses that prefer paper documentation or need physical copies for staff files. Most forms include fields for employee name, pay period, total earnings, withholdings, and net pay—making them both comprehensive and practical.

Take control of your payroll process today with a trusted payroll printable. Reduce admin effort, reduce errors, and stay organized—all while keeping your employee payment data organized.

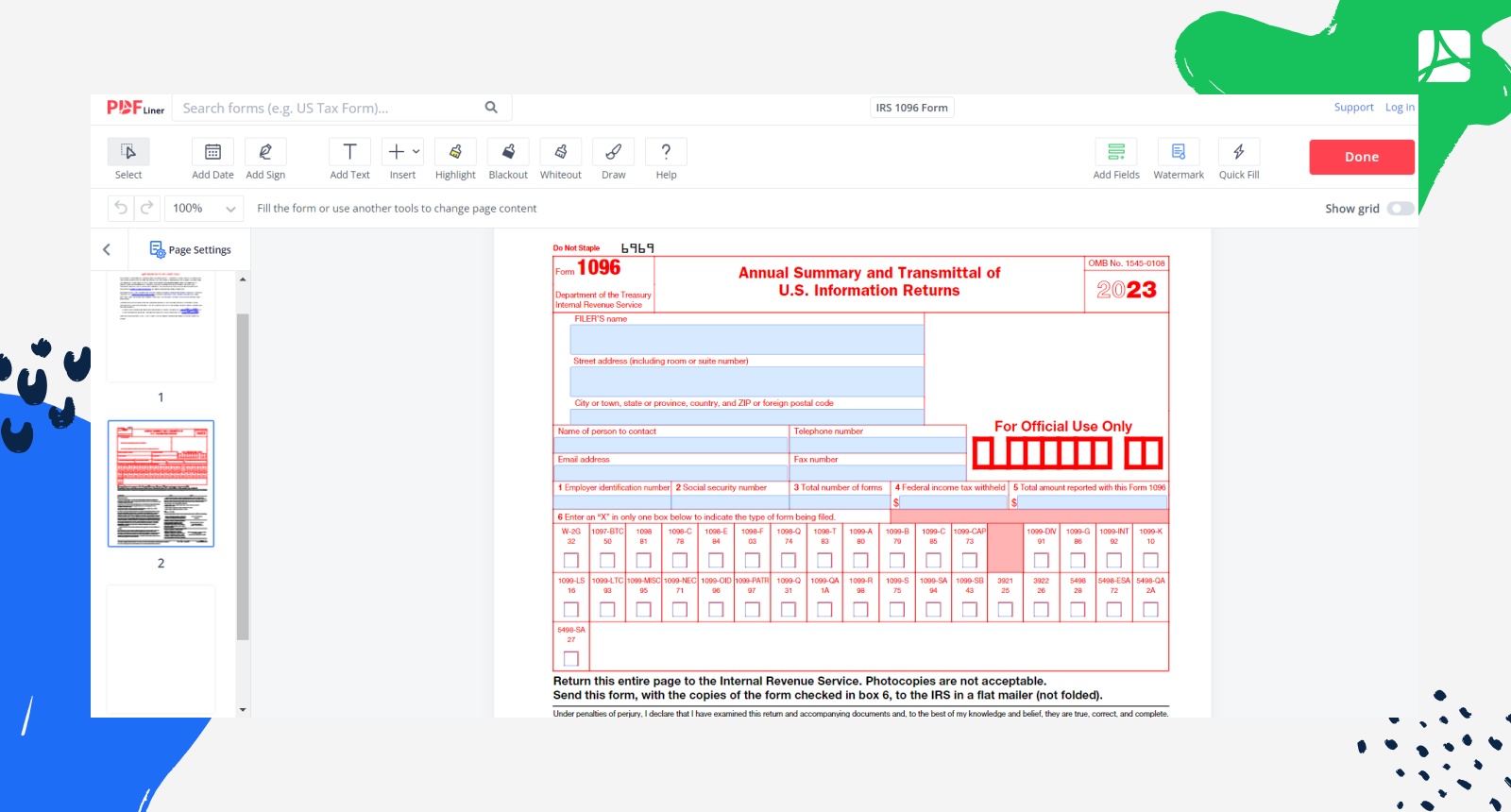

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

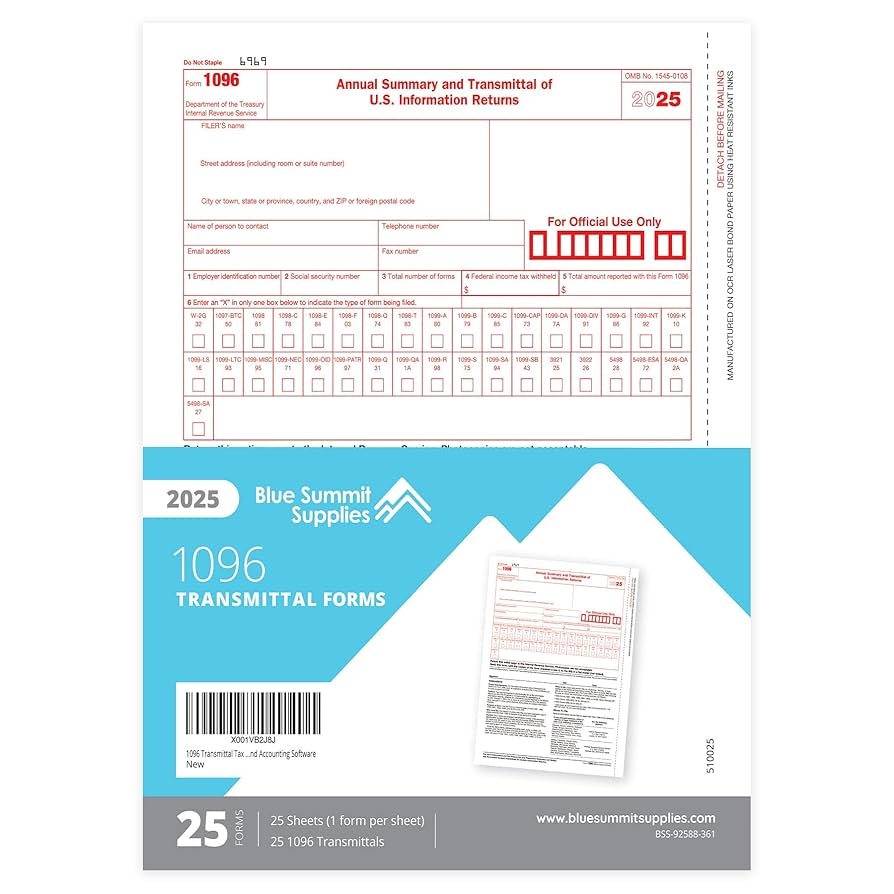

Amazon 1096 Transmittal 2025 Tax Forms 25 Pack Of 1096 Summary Laser Forms Compatible With QuickBooks And Accounting Software Office Products

Amazon 1096 Transmittal 2025 Tax Forms 25 Pack Of 1096 Summary Laser Forms Compatible With QuickBooks And Accounting Software Office Products

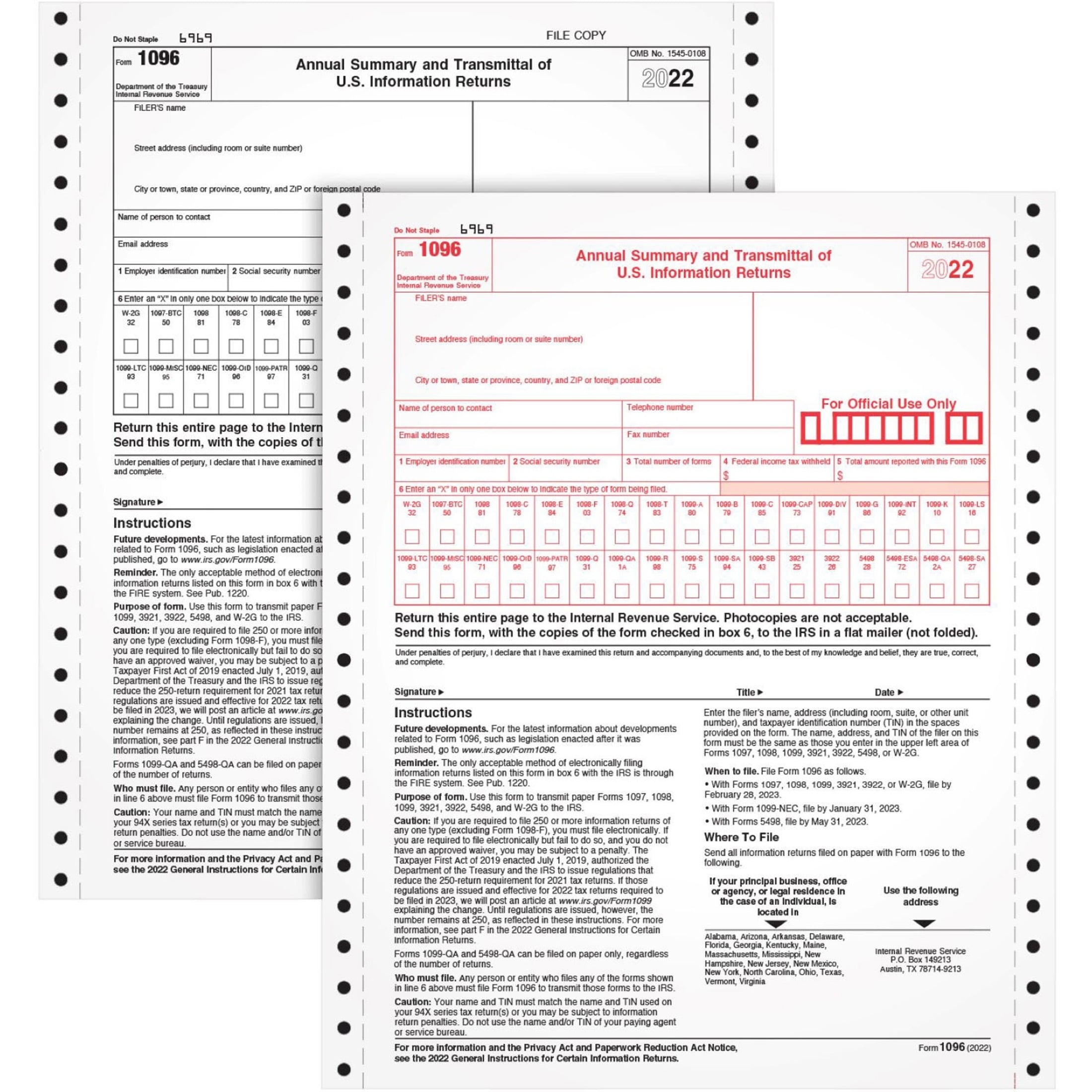

TOPS TOP2202 1096 Tax Form 10 Pack White Walmart

TOPS TOP2202 1096 Tax Form 10 Pack White Walmart

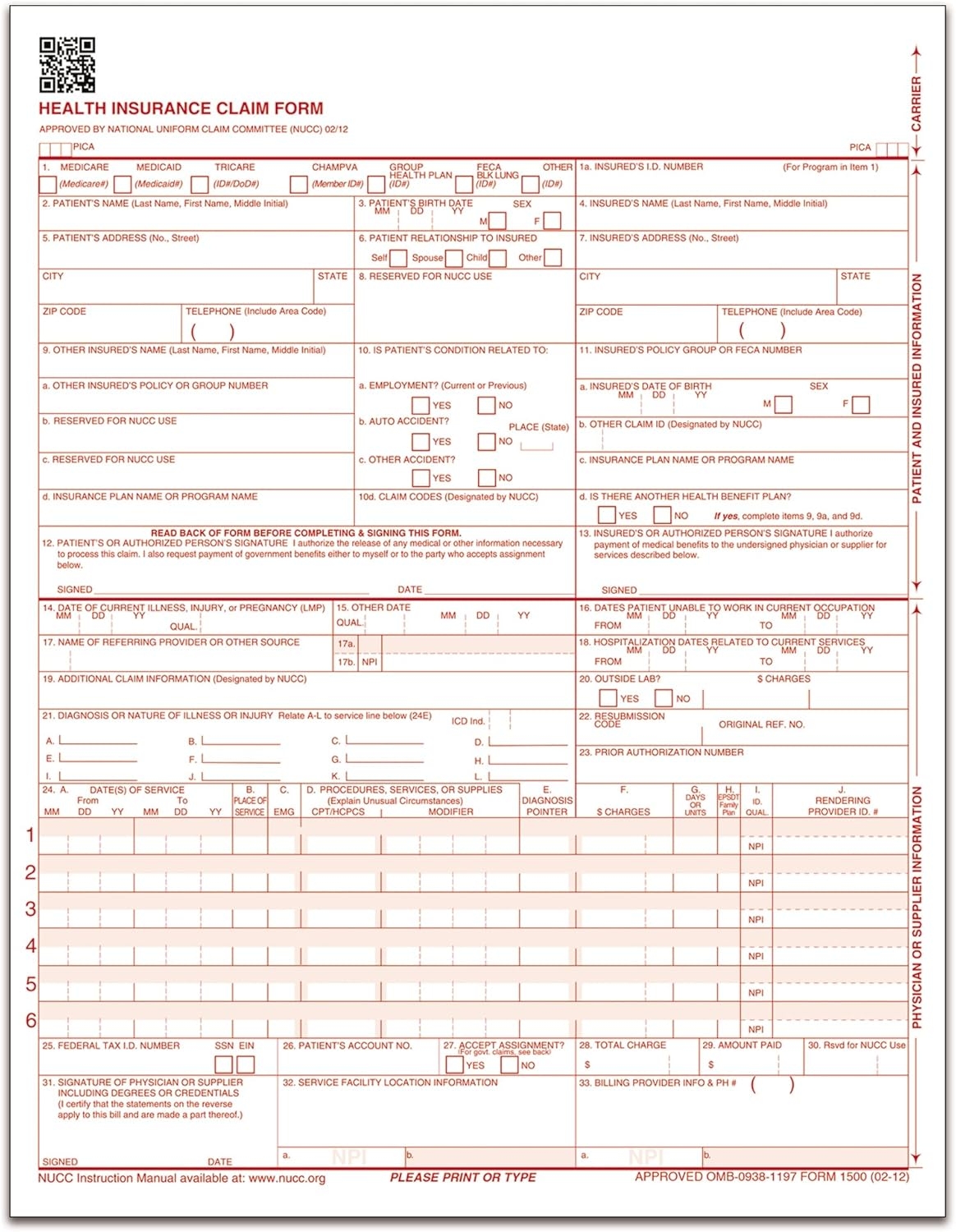

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

1096 IRS PDF Fillable Template 2023 2024 With Print And Clear Buttons Courier Font Digital Download Etsy

1096 IRS PDF Fillable Template 2023 2024 With Print And Clear Buttons Courier Font Digital Download Etsy

Managing payroll tasks doesn’t have to be difficult. A Irs Form 1096 Printable offers a speedy, reliable, and user-friendly method for tracking wages, work time, and deductions—without the need for digital systems.

Whether you’re a small business owner, payroll manager, or independent contractor, using aprintable payroll form helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and complete it by hand or edit it digitally before printing.