IRS Form 1096 is used to summarize and transmit information returns such as 1099 forms to the Internal Revenue Service (IRS). It is important for businesses and individuals who have filed multiple information returns to submit Form 1096 along with the corresponding forms. The form is typically due at the end of February each year for the previous tax year.

For the year 2024, the IRS has released the printable version of Form 1096 to make it easier for taxpayers to file their information returns. This form can be filled out manually or electronically, depending on the preference of the filer. It is essential to accurately complete Form 1096 to ensure that the IRS processes the information returns in a timely manner.

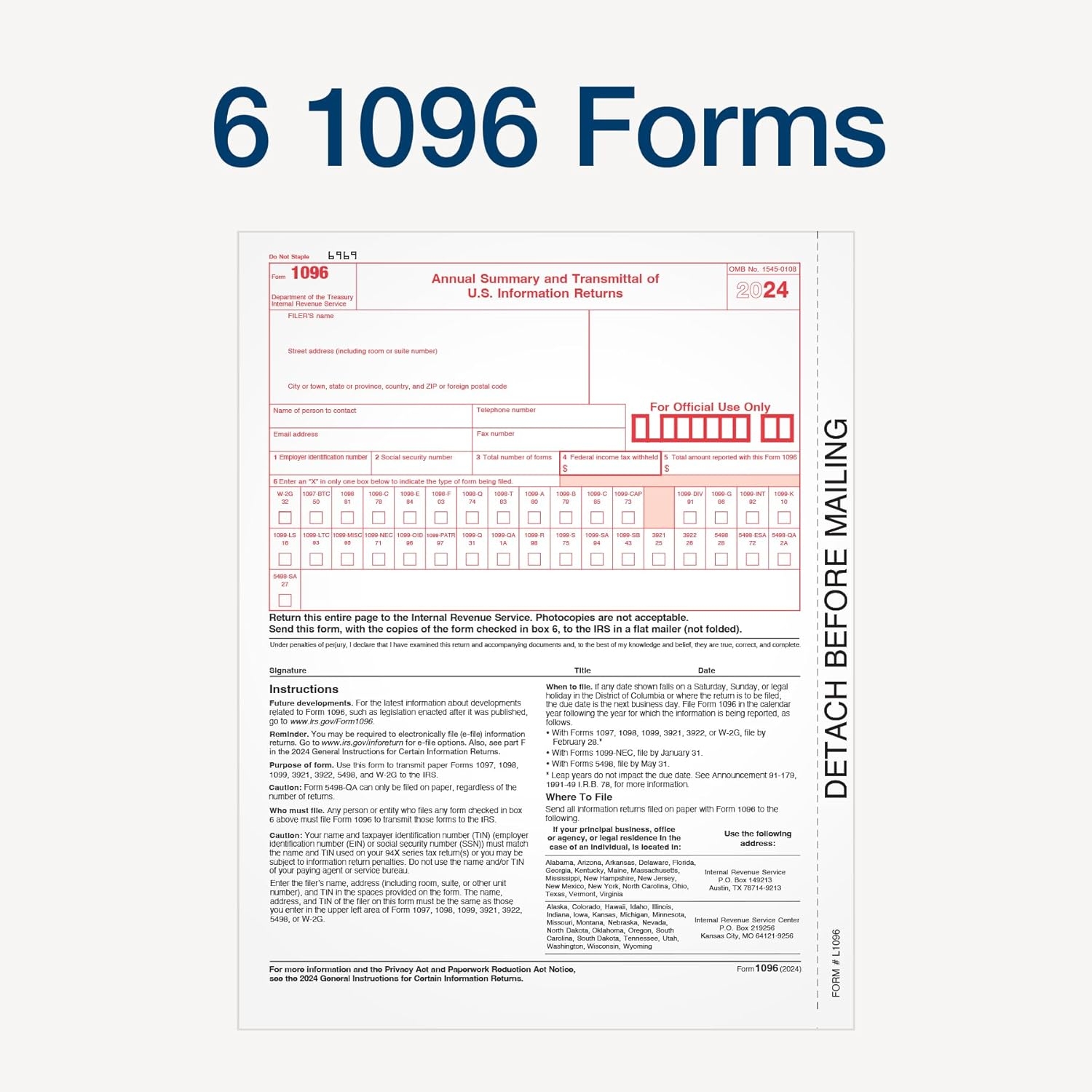

Irs Form 1096 For 2024 Printable

Irs Form 1096 For 2024 Printable

When completing Form 1096, filers must provide their name, address, taxpayer identification number, and the total number of forms being submitted. They must also include a breakdown of the different types of forms being filed, such as 1099-NEC, 1099-MISC, or 1099-INT. Additionally, filers must indicate whether any corrections are being made to previously filed forms.

It is crucial to double-check all information entered on Form 1096 before submitting it to the IRS. Any errors or inaccuracies could result in processing delays or penalties. Filers should also retain a copy of the completed form for their records and proof of submission.

After submitting Form 1096 and the corresponding information returns to the IRS, filers should monitor for any notifications or requests for additional information. It is important to respond promptly to any inquiries from the IRS to avoid potential penalties or fines.

In conclusion, IRS Form 1096 for 2024 is an essential document for summarizing and transmitting information returns to the IRS. By accurately completing and submitting this form, taxpayers can ensure compliance with tax regulations and avoid potential penalties. The printable version of Form 1096 makes the filing process more convenient for filers, and it is important to submit the form by the deadline to avoid any issues with the IRS.