Are you looking for a convenient way to file your estimated taxes for the year 2025? The IRS Form 1040ES 2025 Printable is the perfect solution for individuals who need to make quarterly tax payments. By using this form, you can easily calculate and submit your estimated tax payments to the IRS.

It’s important to stay on top of your estimated tax payments to avoid penalties and interest charges. The IRS Form 1040ES 2025 Printable makes it easy to stay organized and compliant with tax laws. Whether you’re self-employed or have other sources of income, this form will help you accurately report your estimated tax liability.

Irs Form 1040es 2025 Printable

Irs Form 1040es 2025 Printable

Irs Form 1040es 2025 Printable

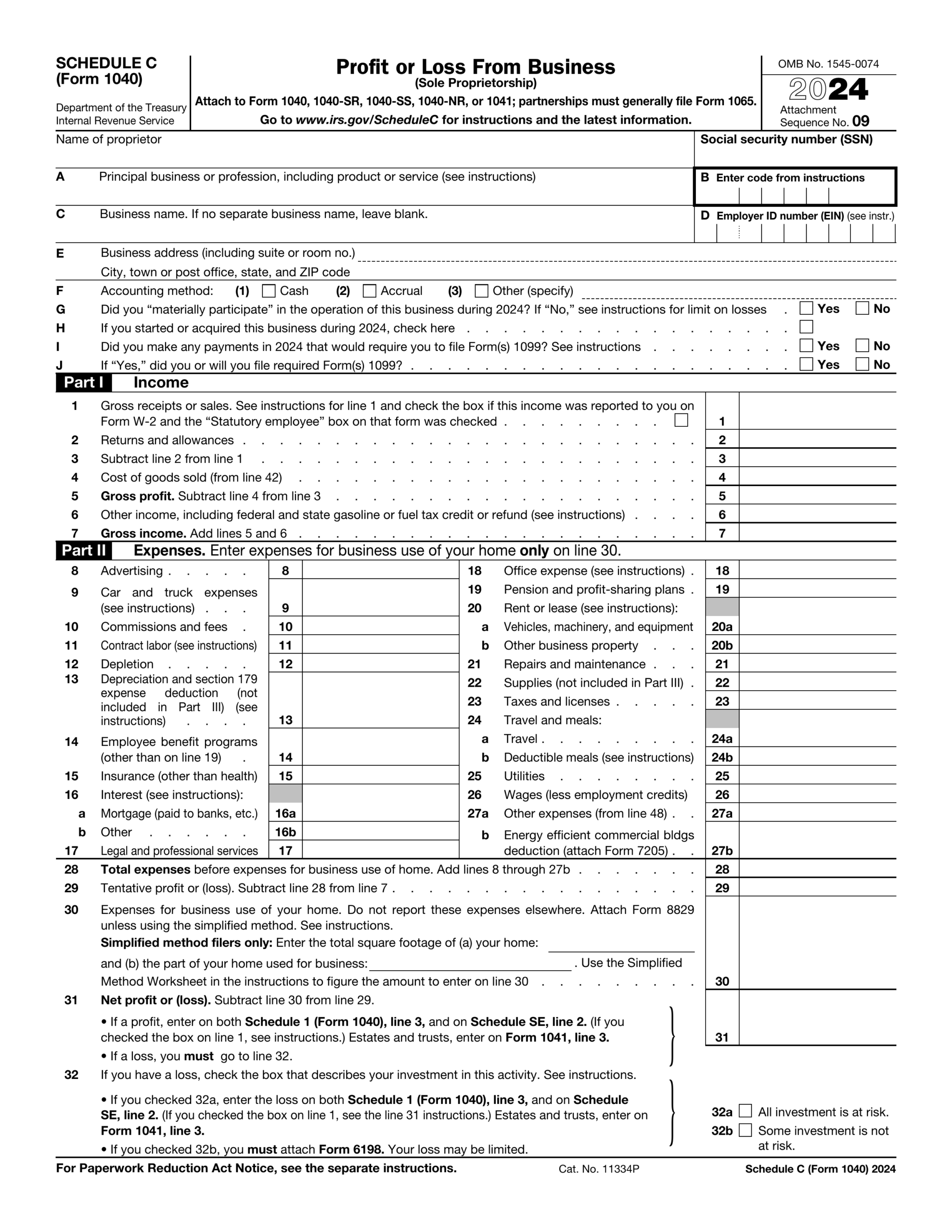

The IRS Form 1040ES 2025 Printable includes sections for you to input your personal information, income, deductions, and credits. You’ll also find worksheets to help you calculate your estimated tax liability based on your expected income for the year. This form is designed to simplify the process of estimating and paying your taxes throughout the year.

By using the IRS Form 1040ES 2025 Printable, you can avoid the stress of scrambling to pay a large tax bill at the end of the year. Instead, you can break up your tax payments into manageable quarterly installments. This can help you budget effectively and ensure that you meet your tax obligations on time.

Remember to keep copies of your completed IRS Form 1040ES 2025 Printable and any payment confirmations for your records. This will come in handy when you file your annual tax return and reconcile your estimated tax payments with your actual tax liability. By staying organized and proactive, you can avoid potential issues with the IRS and enjoy peace of mind when it comes to your taxes.

In conclusion, the IRS Form 1040ES 2025 Printable is a valuable tool for individuals who need to make estimated tax payments throughout the year. By using this form, you can accurately report your income, deductions, and credits to calculate your estimated tax liability. Stay on top of your tax obligations and avoid penalties by utilizing this convenient printable form from the IRS.