Completing your taxes can be a daunting task, but having the right forms can make the process much easier. One important form to be aware of is the IRS Form 1040 V, which is used to submit your payment for taxes owed. This form ensures that your payment is properly credited to your account and helps prevent any potential issues with the IRS.

For the year 2025, it is crucial to have the most up-to-date version of the IRS Form 1040 V to ensure accuracy and compliance with tax laws. By having access to the printable version of this form, you can easily fill it out and submit your payment without any delays or errors.

Irs Form 1040 V 2025 Printable

Irs Form 1040 V 2025 Printable

Irs Form 1040 V 2025 Printable

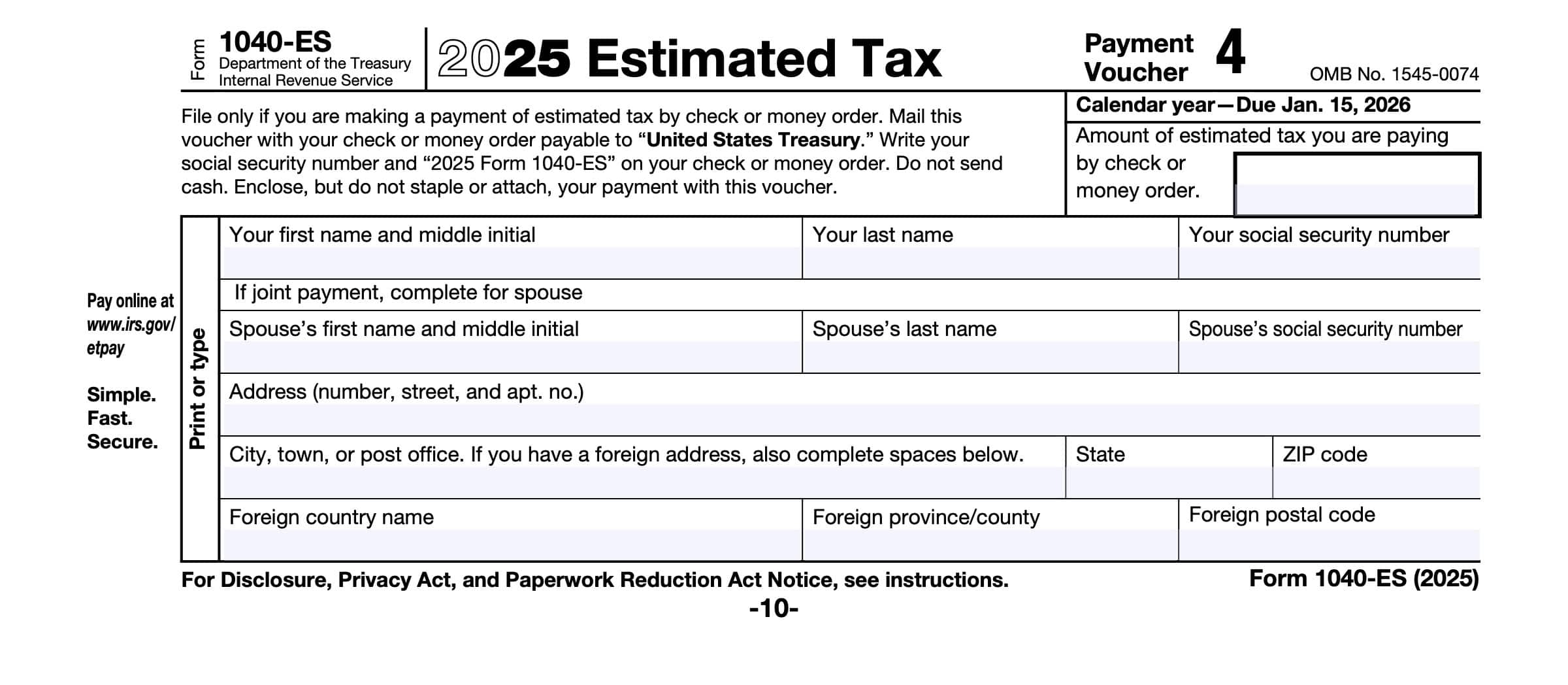

The IRS Form 1040 V is a payment voucher that is used when you are sending a check or money order to the IRS for any taxes owed. This form includes important information such as your name, address, Social Security number, the tax year, and the amount of payment being made. By using the printable version of this form, you can easily fill in the required information and submit your payment in a timely manner.

It is important to note that the IRS Form 1040 V is not used to file your tax return, but rather to submit your payment. This form should be used in conjunction with your completed tax return to ensure that your payment is properly credited. By utilizing the printable version of this form, you can streamline the payment process and avoid any potential issues with the IRS.

Having access to the IRS Form 1040 V 2025 Printable can help simplify the tax payment process and ensure that your payment is accurately credited to your account. By filling out this form correctly and submitting your payment on time, you can avoid penalties and interest charges from the IRS. It is important to stay informed about the latest tax forms and requirements to stay in compliance with tax laws.

In conclusion, the IRS Form 1040 V 2025 Printable is an essential tool for submitting your tax payment accurately and on time. By utilizing this form, you can ensure that your payment is properly credited and avoid any potential issues with the IRS. Make sure to have the most up-to-date version of this form and submit your payment in a timely manner to stay in compliance with tax laws.