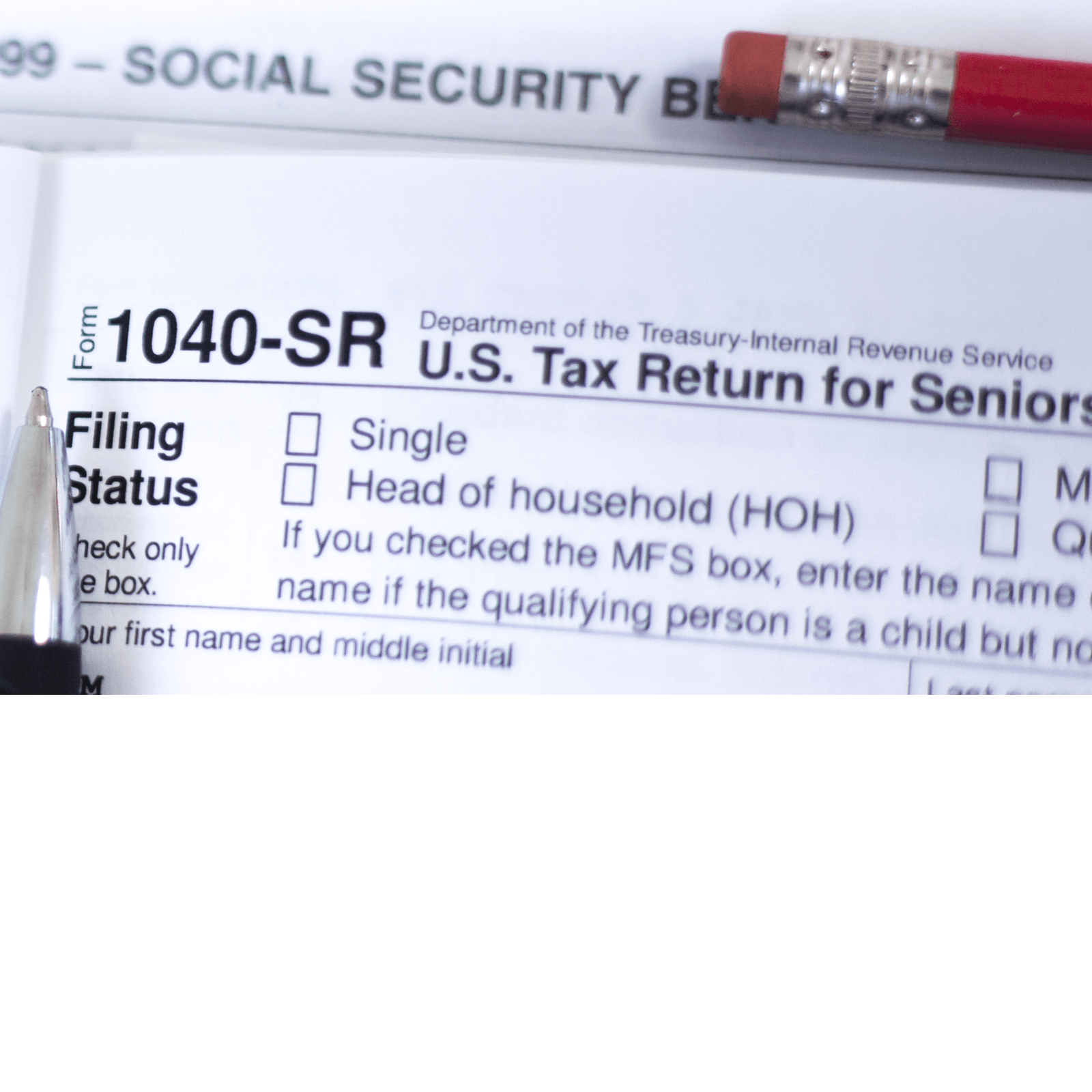

As taxpayers approach retirement age, it’s important to be aware of the tax forms specific to senior citizens. One such form is the IRS Form 1040 SR, designed for individuals aged 65 and older. This form provides specific instructions tailored to the unique tax situations of seniors, making it easier for them to accurately file their taxes.

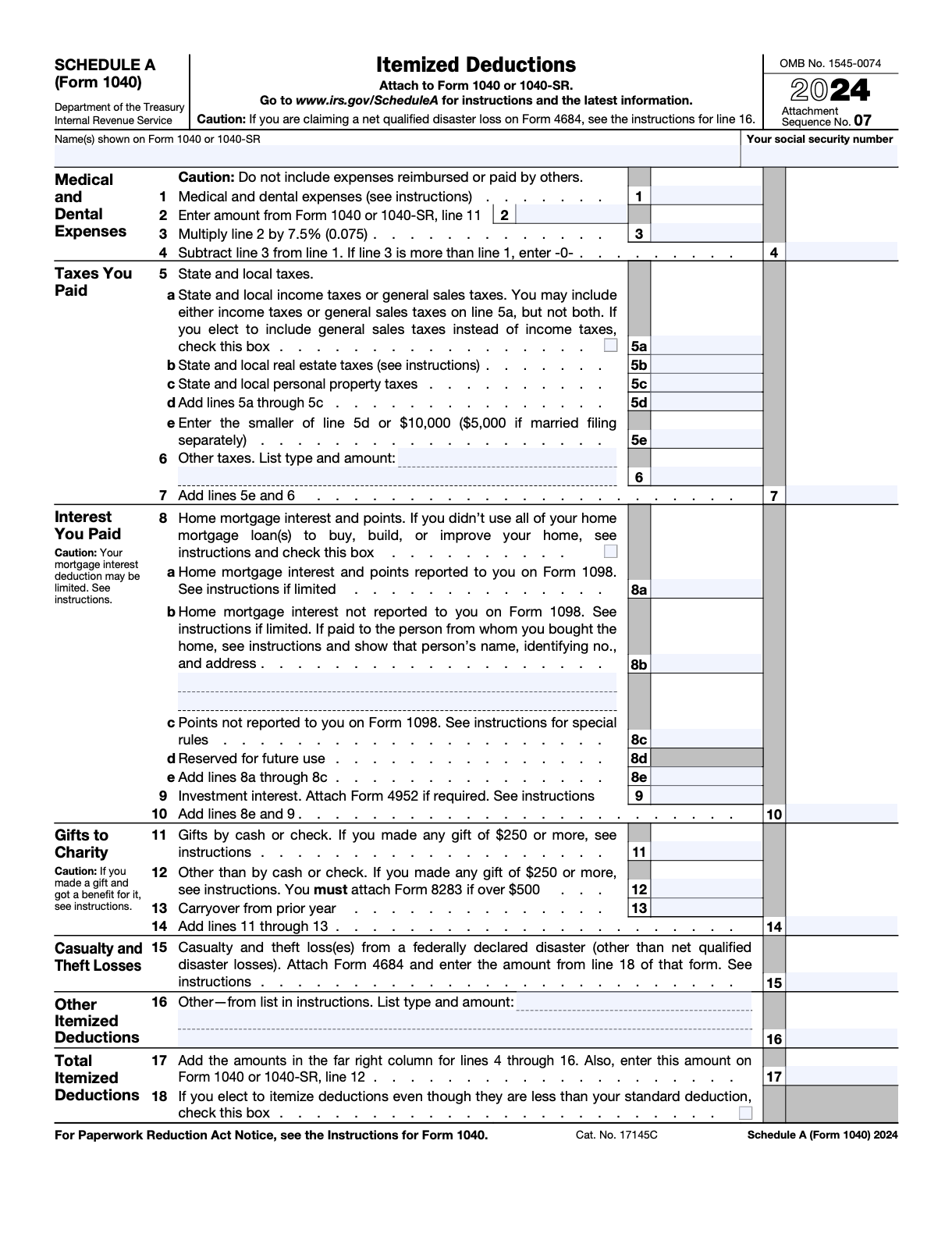

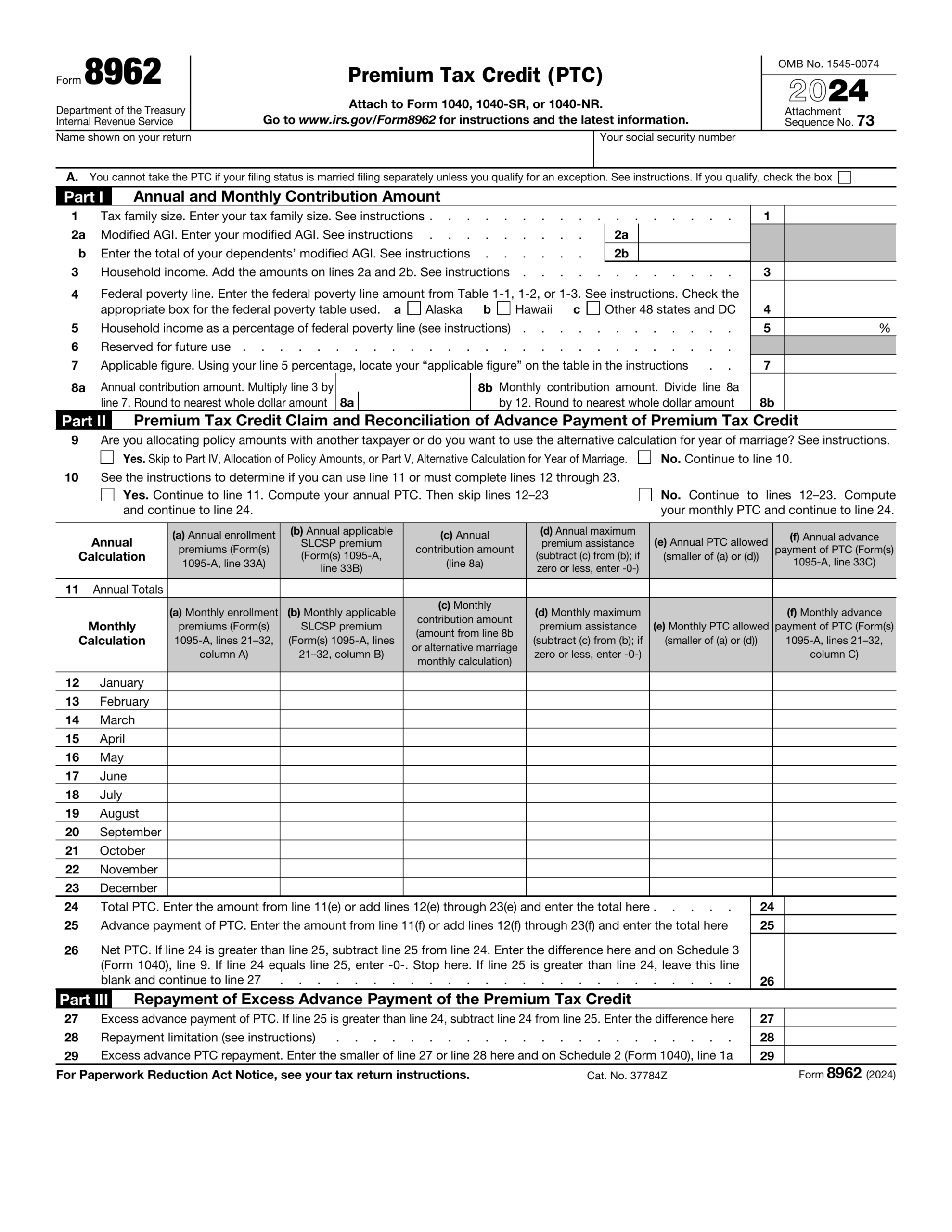

For those who prefer to file their taxes manually, the IRS provides printable instructions for Form 1040 SR. These instructions outline the various sections of the form and provide detailed guidance on how to fill them out correctly. By following these instructions, seniors can ensure that they are claiming all eligible deductions and credits, maximizing their tax savings.

Irs Form 1040 Sr Instructions 2024 Printable

Irs Form 1040 Sr Instructions 2024 Printable

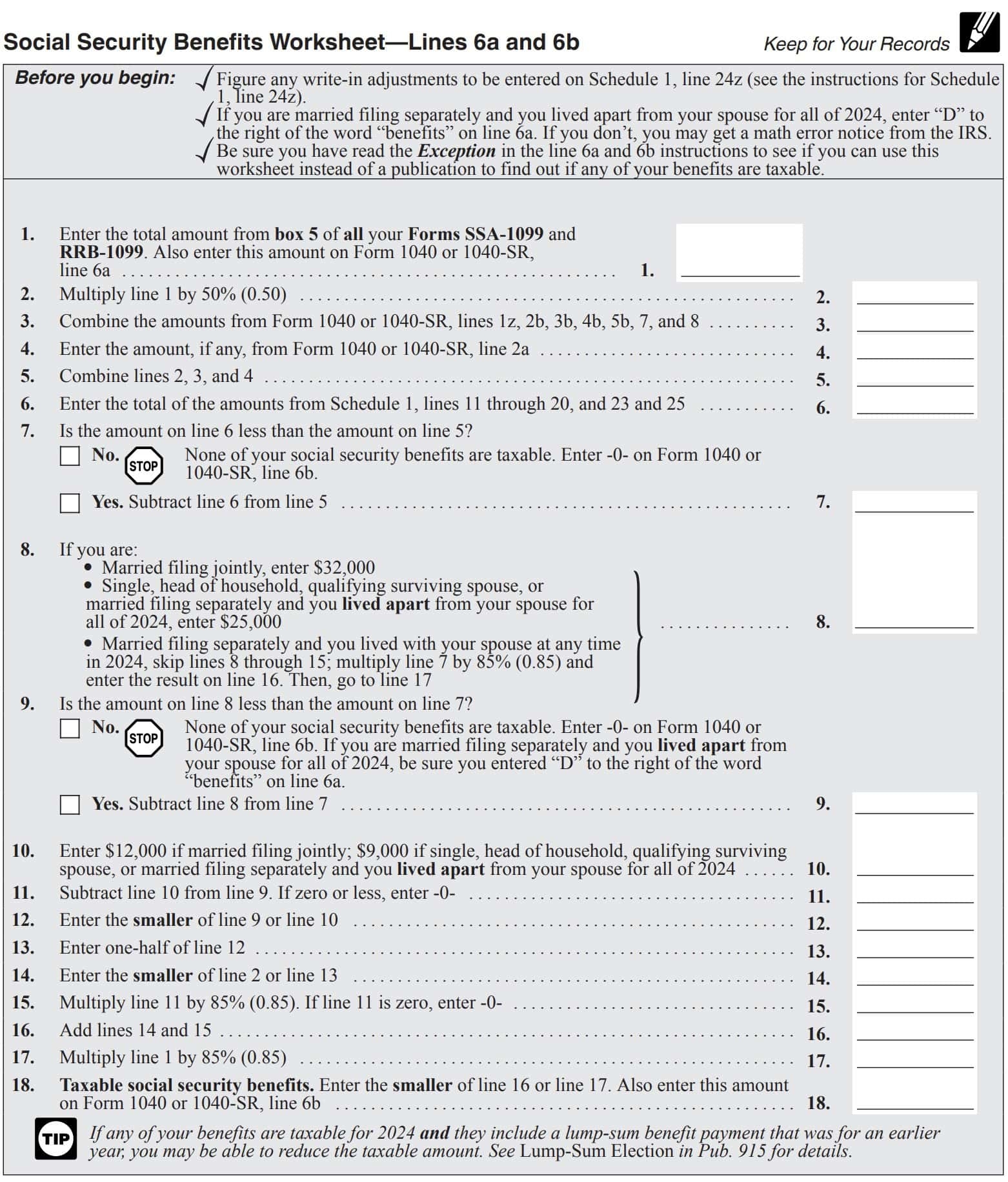

When completing Form 1040 SR, seniors should pay special attention to income sources such as retirement accounts, Social Security benefits, and investment income. The instructions provide clear guidance on how to report these sources of income and calculate any applicable deductions or credits. Additionally, seniors should be aware of any age-related tax provisions that may apply to them, such as the increased standard deduction for taxpayers over 65.

It’s also important for seniors to be aware of any changes to tax laws that may impact their filing status. The instructions for Form 1040 SR will typically include information on any recent updates to the tax code that could affect senior taxpayers. Staying informed about these changes can help seniors avoid costly mistakes and ensure that they are in compliance with current tax regulations.

In conclusion, IRS Form 1040 SR provides a valuable resource for seniors who are preparing to file their taxes. By following the printable instructions provided by the IRS, seniors can navigate the complexities of tax filing with confidence and accuracy. Whether filing independently or seeking assistance from a tax professional, seniors can use Form 1040 SR to ensure that they are taking full advantage of all available tax benefits and credits.

Download and Print Irs Form 1040 Sr Instructions 2024 Printable

Printable payroll form are ideal for businesses that prefer non-digital systems or need physical copies for employee records. Most forms include fields for staff name, date range, total earnings, taxes, and final salary—making them both complete and easy to use.

Begin streamlining your payroll system today with a trusted printable payroll form. Save time, minimize mistakes, and maintain clear records—all while keeping your payroll records professional.

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

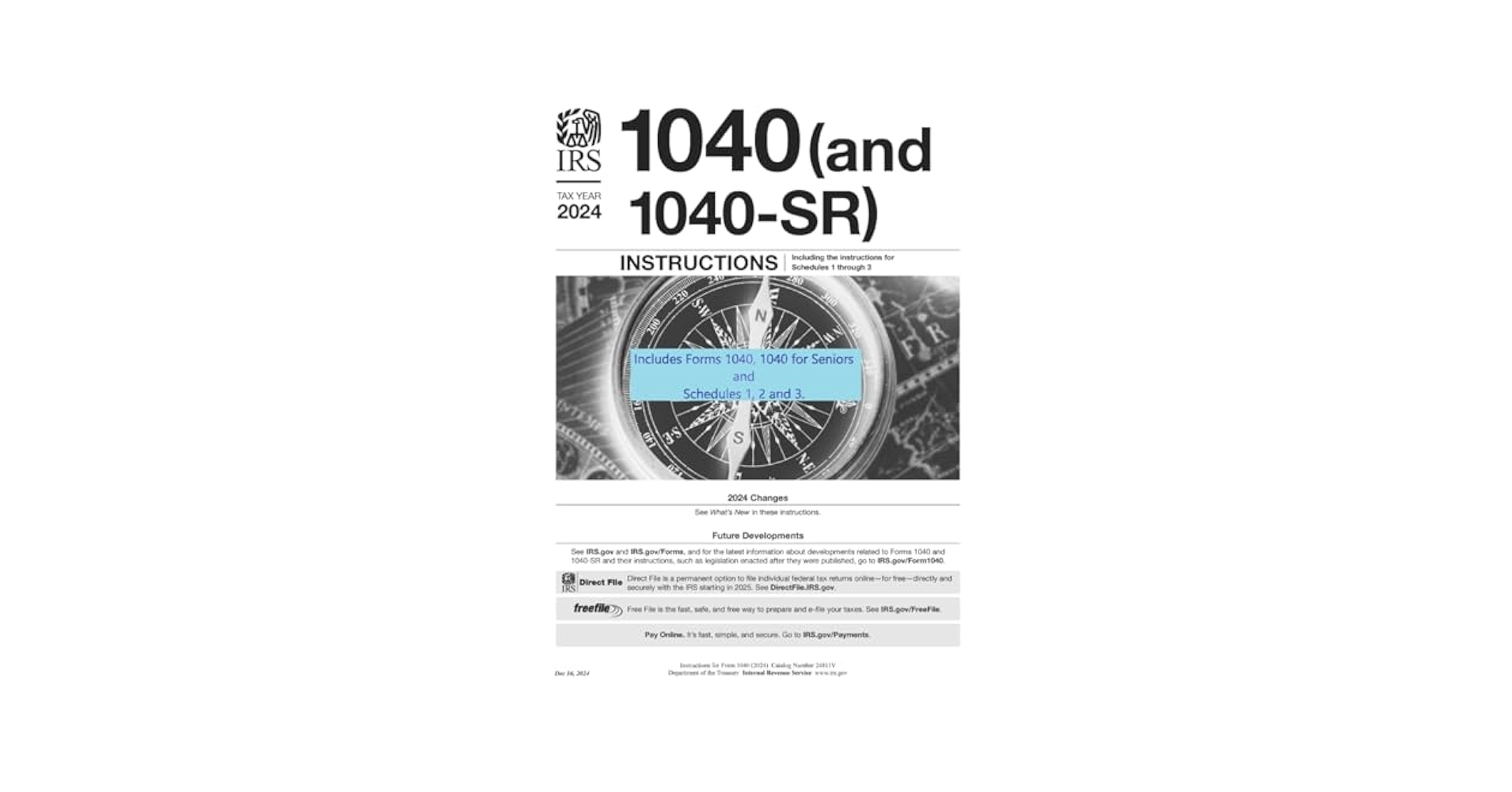

Year 2024 1040 And 1040 SR Instructions And Forms For Filing 1040 1040 For Seniors And Schedules 1 2 And 3 Also Known As Publication 17 With Filing Forms IRS 9798304376488 Amazon Books

Year 2024 1040 And 1040 SR Instructions And Forms For Filing 1040 1040 For Seniors And Schedules 1 2 And 3 Also Known As Publication 17 With Filing Forms IRS 9798304376488 Amazon Books

2024 Form 1040 Instructions Your Complete Federal Tax Filing Solution With 1040 SR Schedules 1 2 3 And IRS Publication 17 Explained Step By Step 9798304477109 1040 2024 Form Books Amazon

2024 Form 1040 Instructions Your Complete Federal Tax Filing Solution With 1040 SR Schedules 1 2 3 And IRS Publication 17 Explained Step By Step 9798304477109 1040 2024 Form Books Amazon

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

Processing staff wages doesn’t have to be difficult. A printable payroll template offers a speedy, dependable, and user-friendly method for tracking salaries, work time, and deductions—without the need for digital systems.

Whether you’re a small business owner, administrator, or sole proprietor, using aprintable payroll template helps ensure compliance with regulations. Simply access the template, print it, and complete it by hand or edit it digitally before printing.