As we approach tax season, it is essential to stay informed about the latest updates and changes to tax forms. One such form is the IRS Form 1040 SR 2025, specifically designed for senior citizens aged 65 and older. This form aims to simplify the tax filing process for older individuals and make it easier for them to report their income and deductions.

Senior citizens may find the IRS Form 1040 SR 2025 to be more straightforward to fill out compared to the standard Form 1040. It includes larger font sizes and clearer instructions, making it easier for older adults to navigate through the form. Additionally, the form may include specific lines and checkboxes related to common tax deductions and credits that seniors often claim.

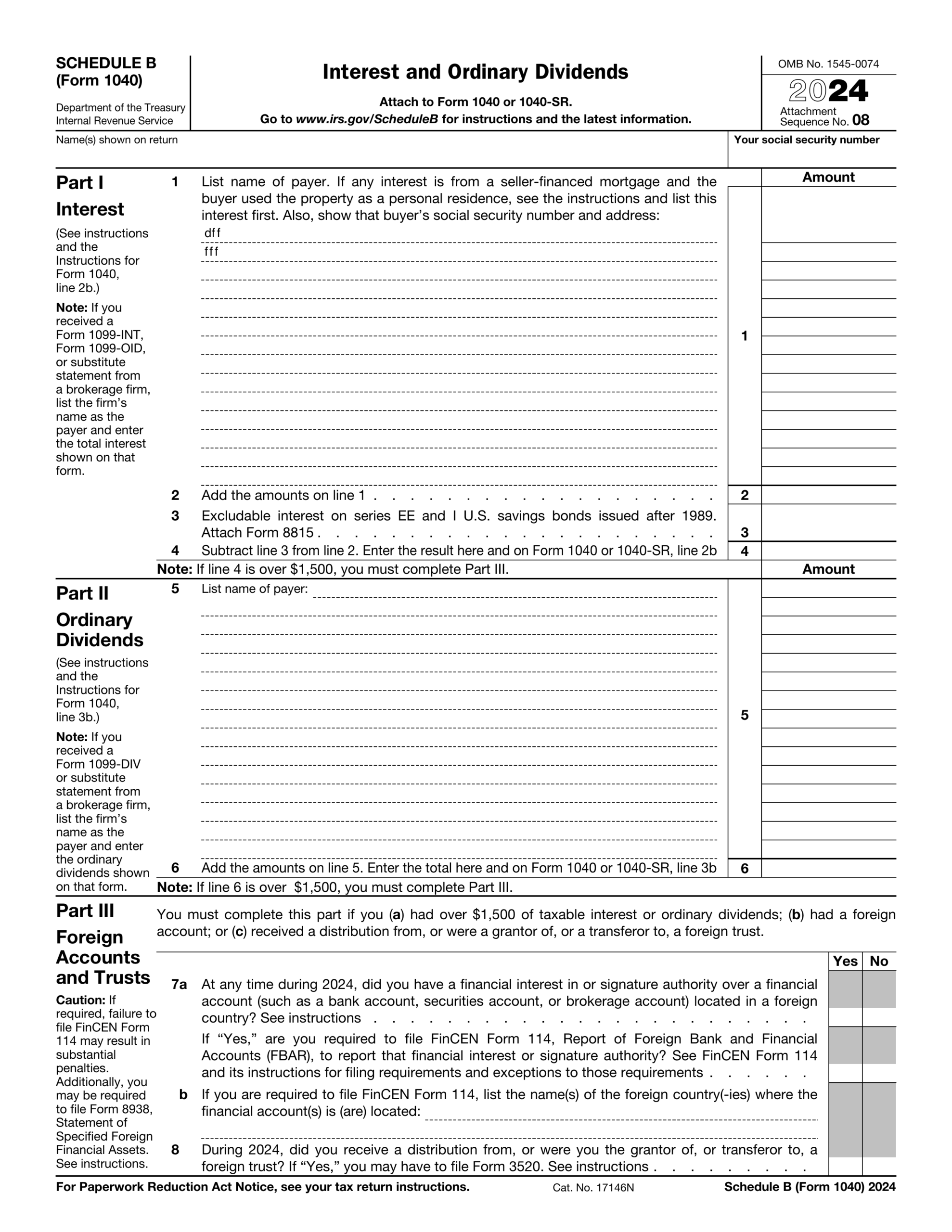

Irs Form 1040 Sr 2025 Printable Pdf

Irs Form 1040 Sr 2025 Printable Pdf

IRS Form 1040 SR 2025 Printable PDF

The IRS Form 1040 SR 2025 is available as a printable PDF on the official IRS website. This allows seniors to download and print the form from the comfort of their homes, eliminating the need to visit a tax professional or stand in line at a tax office. The PDF version of the form can be easily filled out electronically using a computer or printed out and completed by hand.

When filling out the IRS Form 1040 SR 2025, seniors should ensure that they have all necessary documents and information readily available, such as income statements, receipts for deductions, and any other relevant tax documents. It is crucial to double-check all entries and calculations to avoid errors that could delay the processing of their tax return.

Once the form is completed, seniors can either file their taxes electronically using tax preparation software or mail the physical form to the IRS. It is essential to keep a copy of the completed form for their records and to track the status of their tax return. By utilizing the IRS Form 1040 SR 2025, seniors can streamline the tax filing process and ensure that they are in compliance with tax laws.

In conclusion, the IRS Form 1040 SR 2025 Printable PDF is a valuable tool for senior citizens to report their income and deductions accurately. By utilizing this form, older adults can simplify the tax filing process and ensure that they are taking advantage of all available tax benefits. Stay informed about the latest updates and changes to tax forms to make the tax season as smooth as possible.