When it comes to taxes, being prepared is key. The IRS Form 1040 ES is an important document that self-employed individuals and freelancers must use to estimate and pay their quarterly taxes. By staying organized and filling out this form accurately, you can avoid penalties and ensure that you are meeting your tax obligations.

For the year 2025, it is essential to have access to the printable version of IRS Form 1040 ES. This form allows you to calculate your quarterly tax payments based on your projected income for the year. By using this form, you can avoid any surprises come tax time and make sure you are setting aside enough money to cover your tax liabilities.

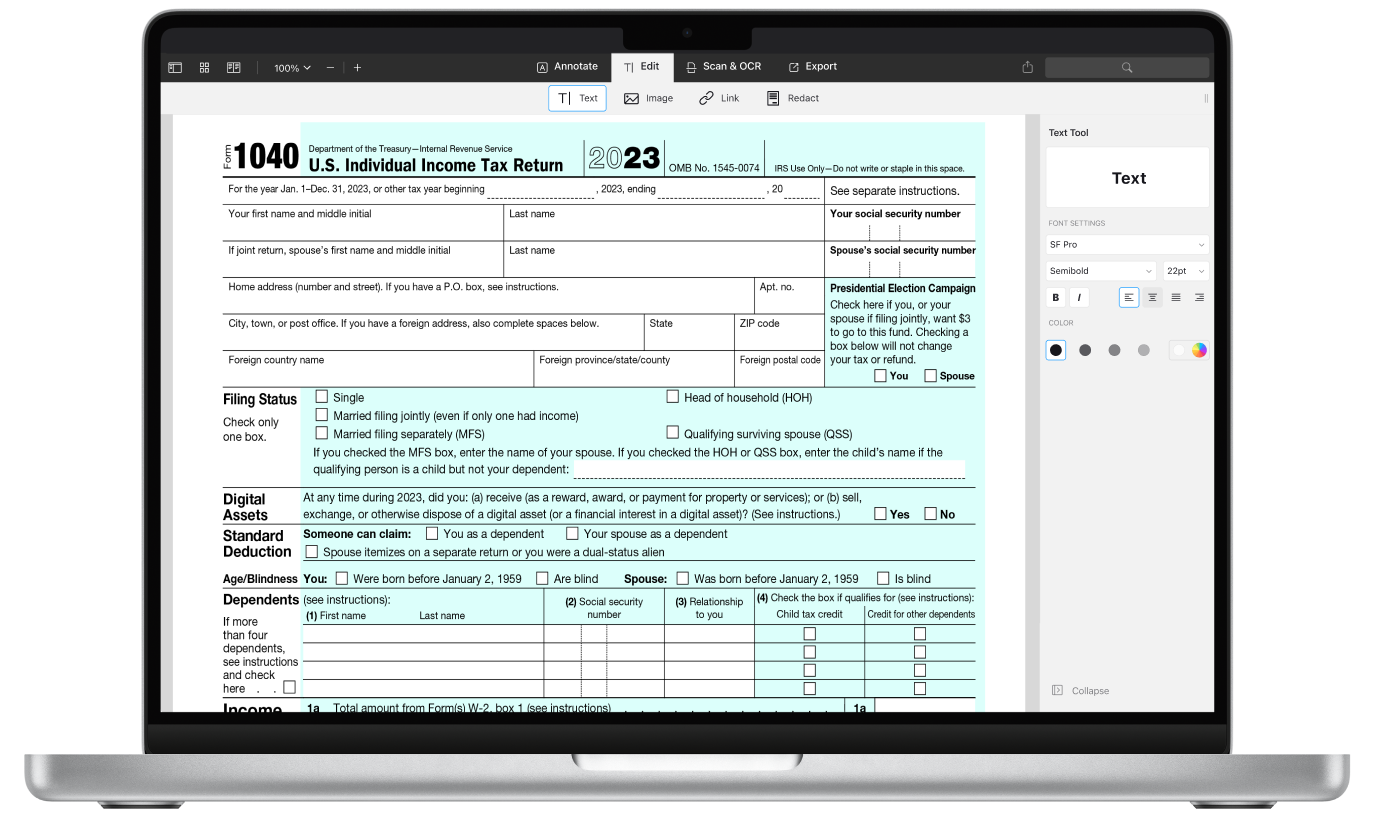

Irs Form 1040 Es 2025 Printable

Irs Form 1040 Es 2025 Printable

It is important to remember that the IRS Form 1040 ES is not just for self-employed individuals. If you have income from sources other than your regular job, such as rental income or investment gains, you may also need to make estimated tax payments using this form. By accurately reporting all of your income and deductions, you can ensure that you are paying the correct amount of taxes throughout the year.

When filling out the IRS Form 1040 ES, be sure to carefully follow the instructions provided by the IRS. You will need to provide information about your income, deductions, and credits to calculate your estimated tax liability. By accurately reporting this information, you can avoid underpayment penalties and make sure you are on track to meet your tax obligations for the year.

By using the printable version of IRS Form 1040 ES for 2025, you can stay organized and on top of your tax payments. This form is a valuable tool for self-employed individuals and others with income from multiple sources. By accurately estimating your tax liability and making quarterly payments, you can avoid penalties and ensure that you are in good standing with the IRS.

In conclusion, the IRS Form 1040 ES is an important document for self-employed individuals and others with income from various sources. By using the printable version of this form for 2025, you can stay organized and on track with your quarterly tax payments. By accurately reporting your income and deductions, you can avoid penalties and ensure that you are meeting your tax obligations throughout the year.