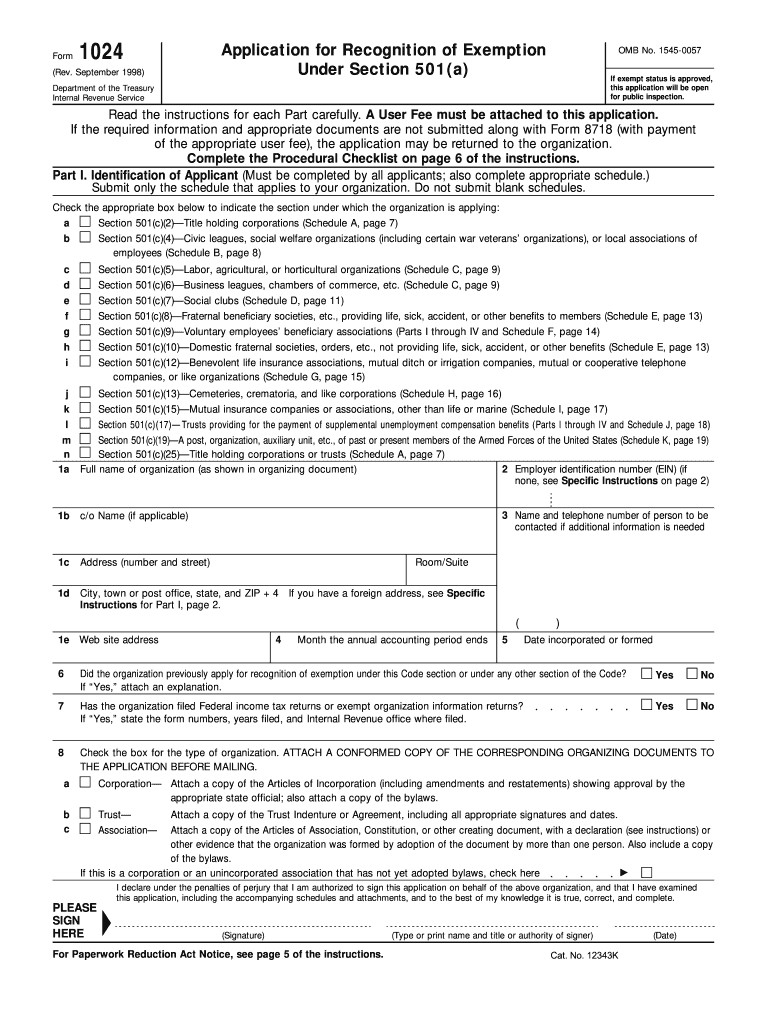

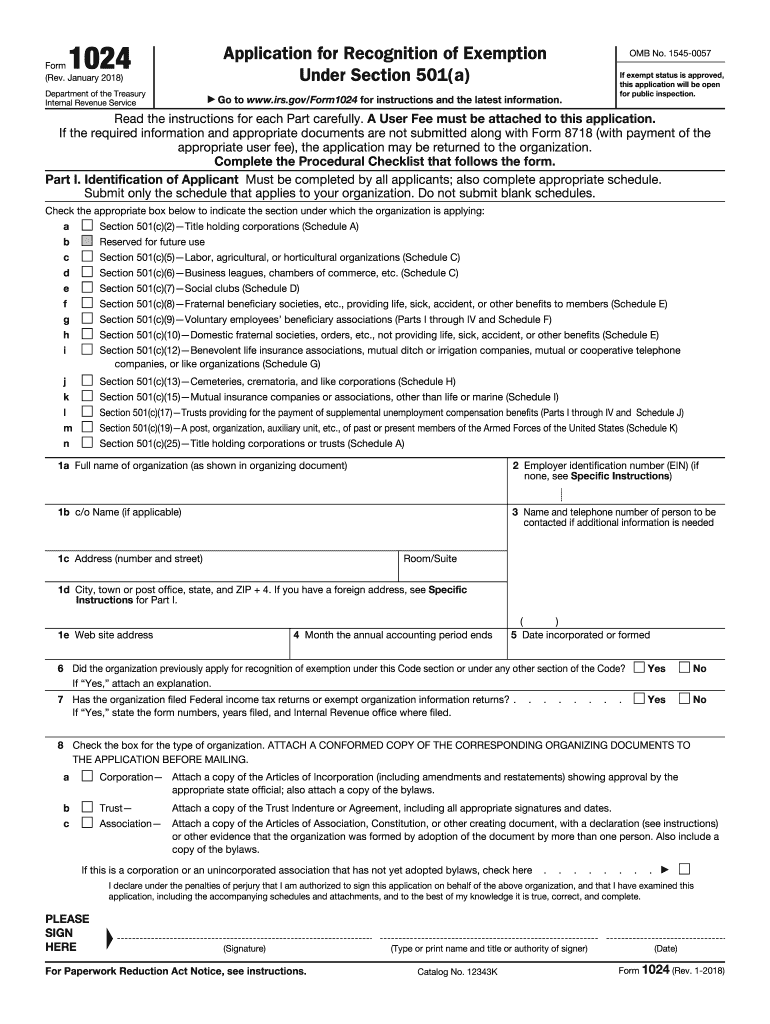

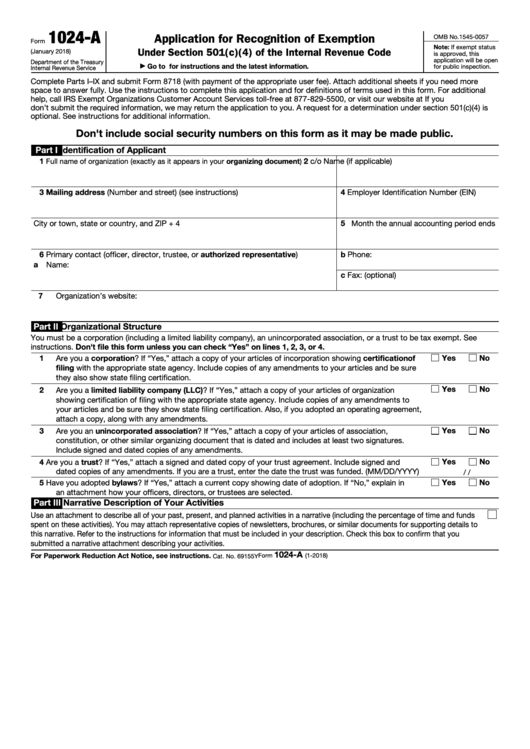

IRS Form 1024 is used by organizations seeking tax-exempt status under section 501(a) of the Internal Revenue Code. This form is specifically designed for organizations other than churches, integrated auxiliaries of churches, and conventions or associations of churches. By filling out Form 1024, these organizations can apply for recognition of exemption from federal income tax.

One of the key benefits of using IRS Form 1024 is that it allows organizations to apply for tax-exempt status without having to go through the more complex and time-consuming process of applying for recognition of exemption under section 501(c)(3) of the Internal Revenue Code. This can be particularly advantageous for organizations that may not meet all of the requirements for 501(c)(3) status but still qualify for tax-exempt status under a different section of the Code.

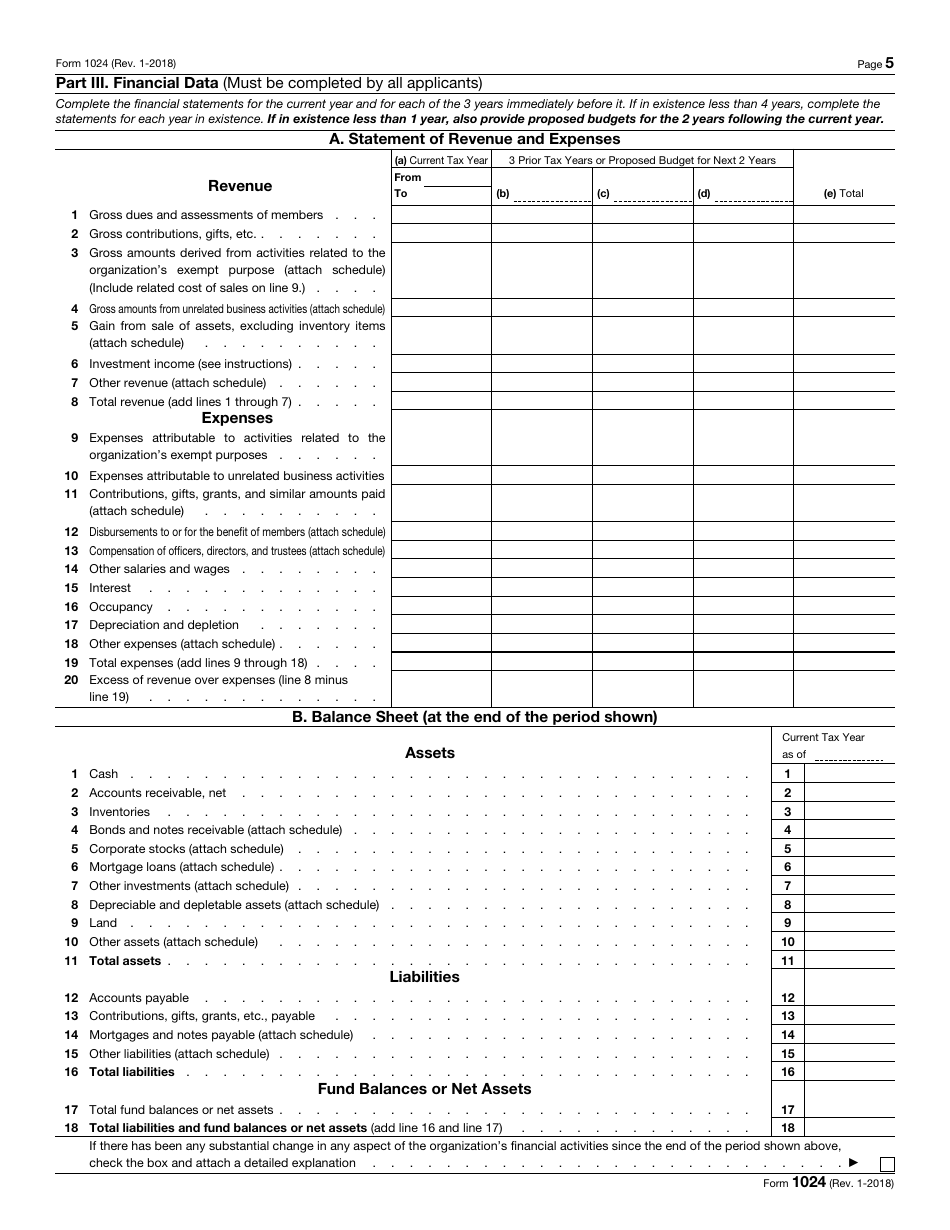

When completing IRS Form 1024, organizations will need to provide detailed information about their activities, governance structure, and financial operations. They will also need to include a copy of their organizing documents, such as articles of incorporation or association, as well as any amendments to these documents. Additionally, organizations will need to provide information about their sources of financial support and how they plan to generate revenue to support their exempt purpose.

Once organizations have completed and submitted IRS Form 1024, the IRS will review their application and determine whether they qualify for tax-exempt status under section 501(a) of the Internal Revenue Code. If approved, organizations will receive a determination letter from the IRS confirming their tax-exempt status. This letter will also specify the section of the Code under which the organization qualifies for exemption and any limitations on its activities.

In conclusion, IRS Form 1024 is a valuable tool for organizations seeking tax-exempt status under section 501(a) of the Internal Revenue Code. By providing detailed information about their activities and operations, organizations can streamline the application process and obtain the recognition they need to operate as a tax-exempt entity.

Download and Print Irs Form 1024 Printable

Payroll template are ideal for teams that prefer physical records or need physical copies for employee records. Most forms include fields for employee name, date range, total earnings, withholdings, and final salary—making them both complete and practical.

Begin streamlining your payment tracking today with a trusted printable payroll. Reduce admin effort, reduce errors, and maintain clear records—all while keeping your employee payment data organized.

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

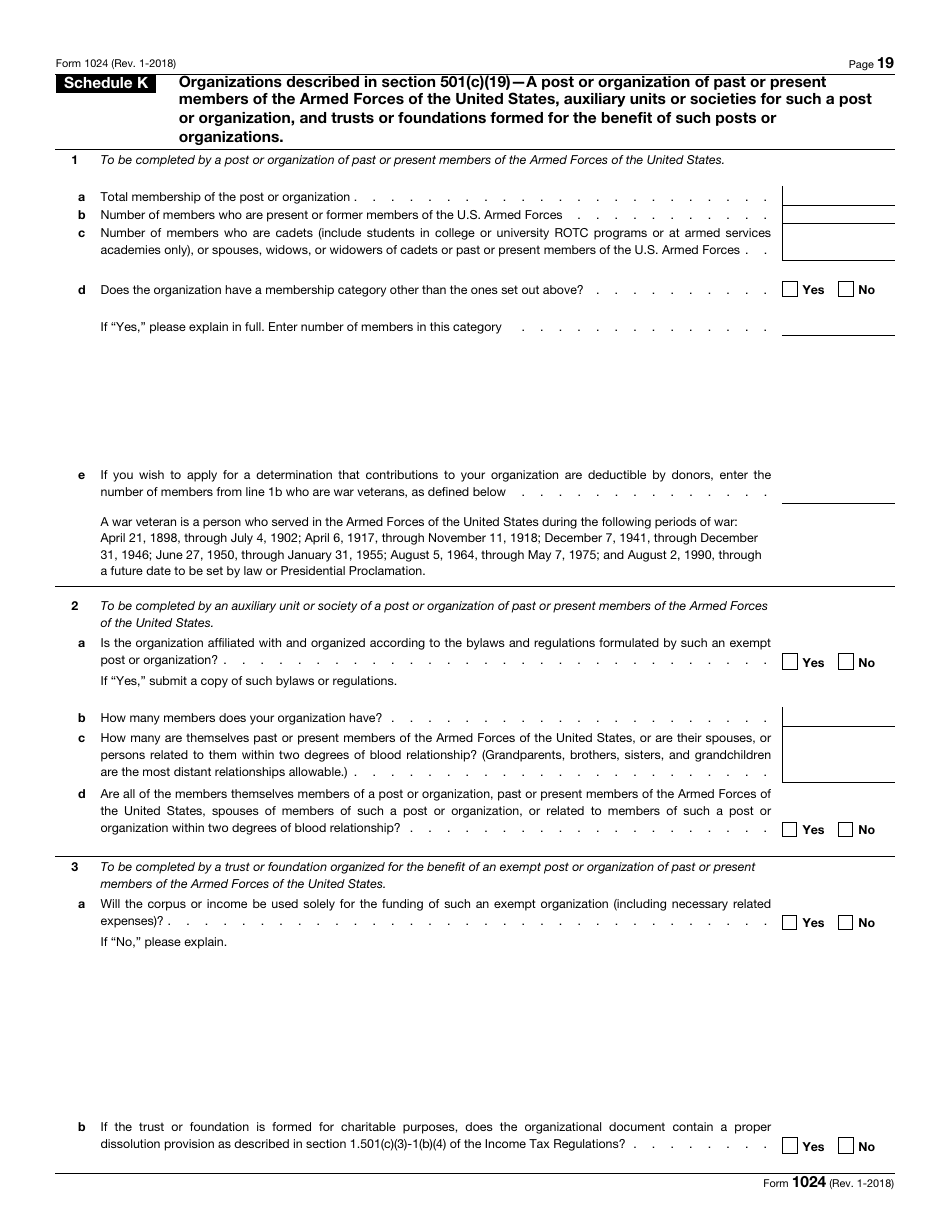

2018 2025 Form IRS 1024 Fill Online Printable Fillable Blank PdfFiller

2018 2025 Form IRS 1024 Fill Online Printable Fillable Blank PdfFiller

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

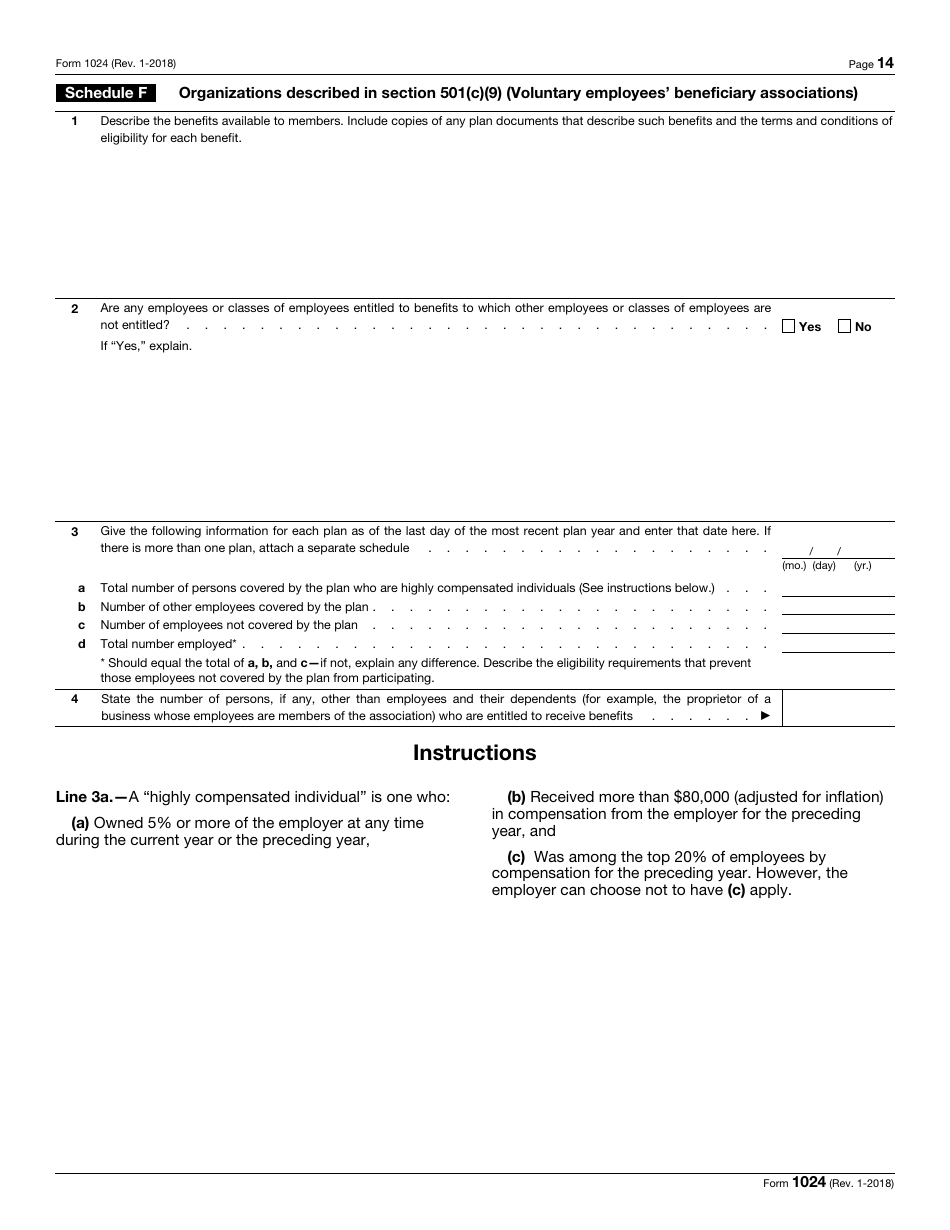

Irs Form 1024 Fillable Printable Forms Free Online

Irs Form 1024 Fillable Printable Forms Free Online

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

Handling payroll tasks doesn’t have to be overwhelming. A Irs Form 1024 Printable offers a fast, reliable, and user-friendly method for tracking employee pay, work time, and deductions—without the need for digital systems.

Whether you’re a freelancer, payroll manager, or sole proprietor, using aIrs Form 1024 Printable helps ensure proper documentation. Simply access the template, print it, and fill it out by hand or edit it digitally before printing.