Filing taxes can be a daunting task for many individuals and businesses. One important aspect of tax filing is making estimated tax payments throughout the year to avoid penalties and interest. The IRS provides a form for taxpayers to use when making these payments, known as the IRS Estimated Tax Payment Form 2025 Printable.

By using this form, taxpayers can easily calculate and submit their estimated tax payments for the year 2025. This form helps individuals and businesses stay on track with their tax obligations and avoid any surprises come tax season.

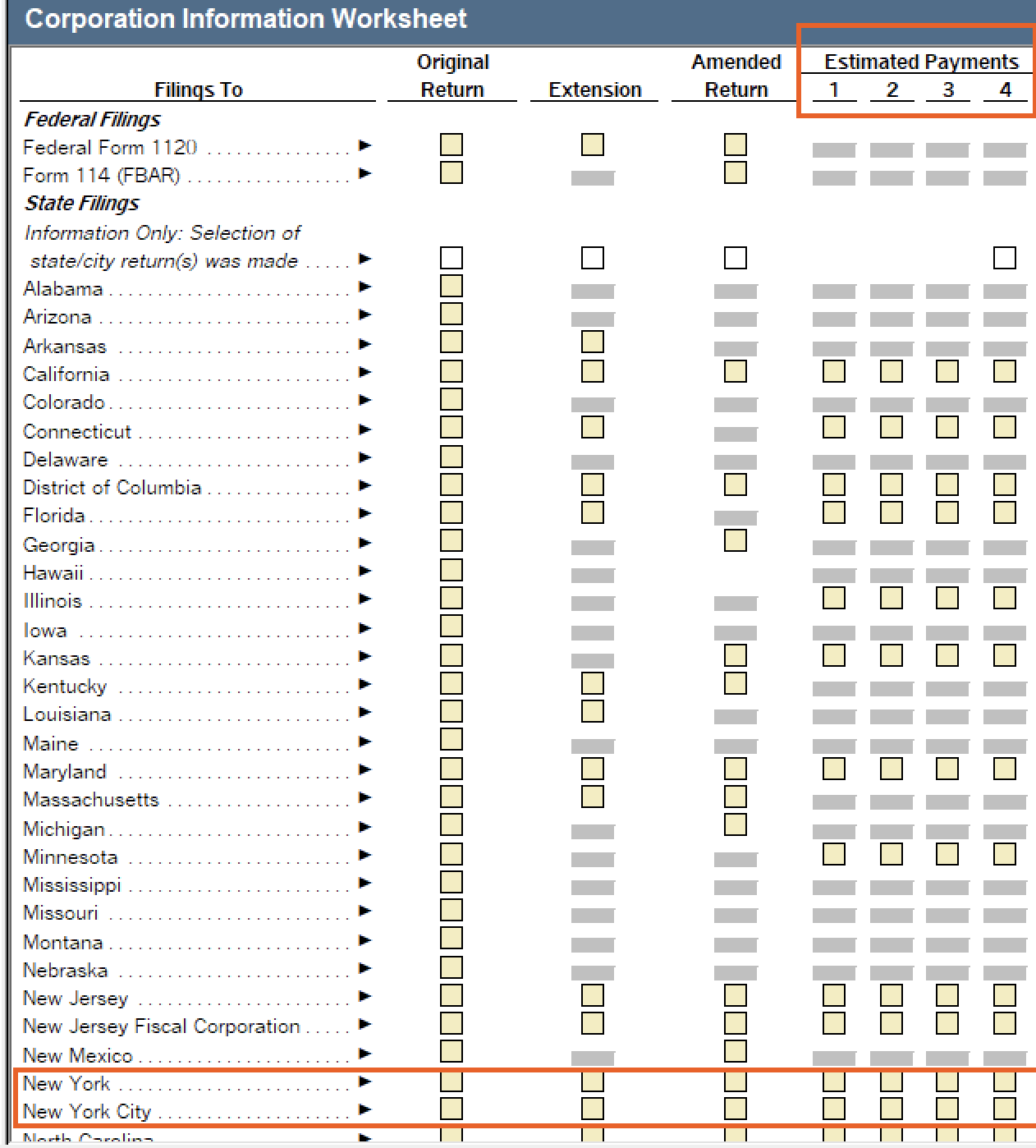

Irs Estimated Tax Payment Form 2025 Printable

Irs Estimated Tax Payment Form 2025 Printable

What is the IRS Estimated Tax Payment Form 2025 Printable?

The IRS Estimated Tax Payment Form 2025 Printable is a document provided by the IRS for taxpayers to calculate and submit their estimated tax payments for the year 2025. This form helps individuals and businesses stay organized and compliant with their tax obligations throughout the year.

When using this form, taxpayers will need to provide information such as their income, deductions, credits, and tax due. By accurately completing this form and submitting their estimated tax payments on time, taxpayers can avoid penalties and interest on any underpaid taxes.

It is important for taxpayers to review their tax situation regularly and make any necessary adjustments to their estimated tax payments to avoid any surprises at tax time. The IRS Estimated Tax Payment Form 2025 Printable makes it easy for taxpayers to stay on top of their tax obligations and ensure they are in compliance with the tax laws.

In conclusion, the IRS Estimated Tax Payment Form 2025 Printable is a valuable tool for taxpayers to use when making estimated tax payments throughout the year. By using this form, individuals and businesses can stay organized, avoid penalties and interest, and ensure they are in compliance with their tax obligations. It is important for taxpayers to review their tax situation regularly and make any necessary adjustments to their estimated tax payments to avoid any surprises come tax season.