IRS Form 941 is a crucial document that employers use to report income taxes, social security tax, or Medicare tax withheld from employee’s paychecks. This form is typically filed quarterly to report these taxes to the IRS. It is essential for employers to accurately fill out this form to ensure compliance with tax laws and avoid any penalties or fines.

With the advancement of technology, the IRS has made it easier for employers to access and fill out Form 941 online. However, having a printable version of the form can still be beneficial for those who prefer to have a hard copy for their records or for easy reference. It is important to have the option to print out the form whenever needed.

IRS 941 Form 2025 Printable

The IRS 941 Form 2025 Printable is a version of the form that is easily accessible and can be printed from the IRS website. This form is specifically designed for the year 2025 and includes all the necessary fields for reporting income taxes, social security tax, and Medicare tax for each quarter of the year. Employers can simply download the form, fill it out manually, and submit it to the IRS as required.

Having the IRS 941 Form 2025 Printable on hand ensures that employers have a reliable and official document to report their tax obligations accurately. It also provides a convenient option for those who may not have access to online resources or prefer to have a physical copy of the form for their records.

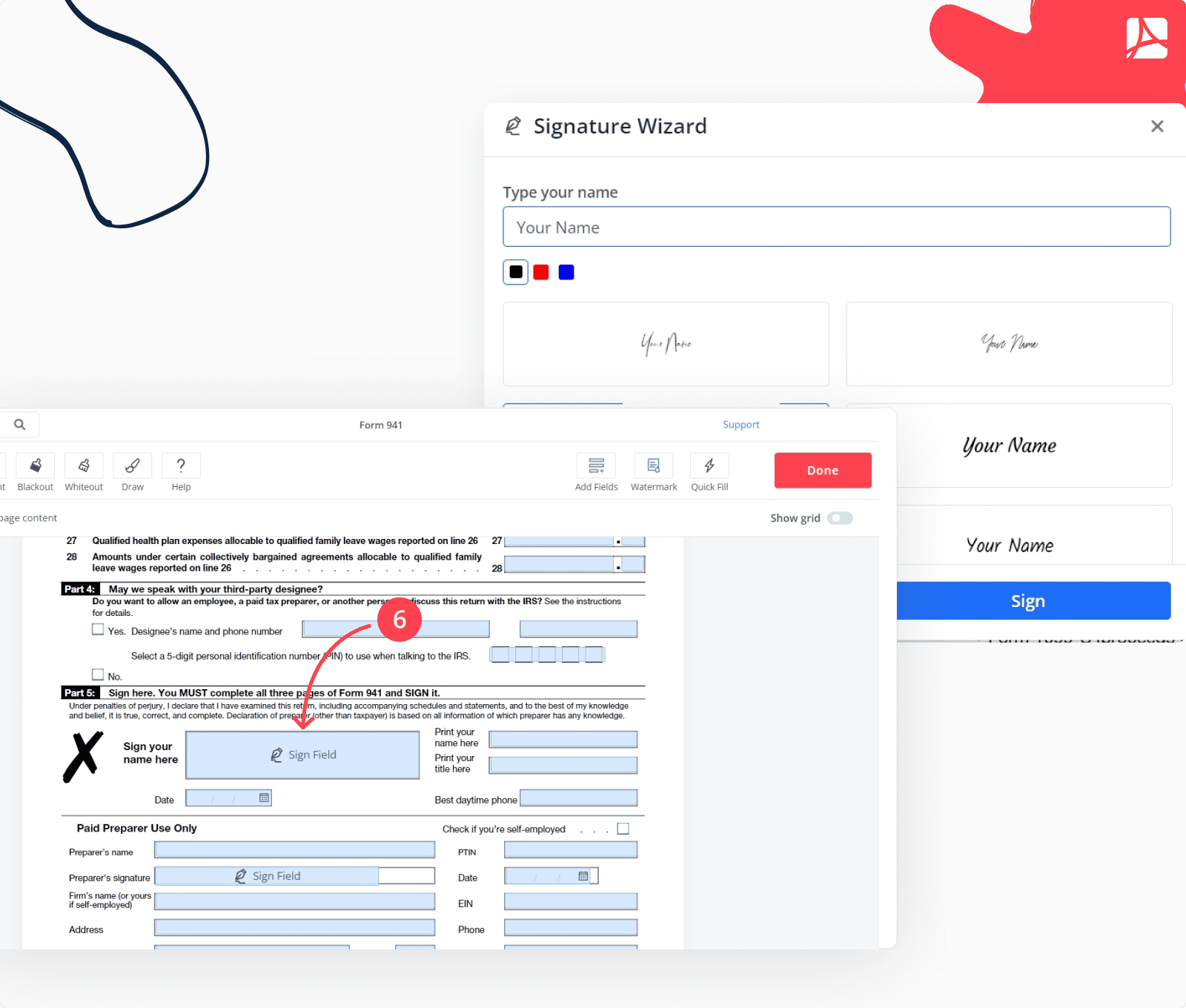

Employers should make sure to carefully review the instructions provided with the IRS 941 Form 2025 Printable to ensure that they are accurately reporting all the necessary information. Any errors or omissions on the form could result in penalties or fines from the IRS. By using the printable form, employers can easily track their tax obligations and stay compliant with tax laws.

In conclusion, the IRS 941 Form 2025 Printable is a valuable tool for employers to report their tax obligations accurately and efficiently. By having a printable version of the form, employers can easily access and fill out the necessary information for each quarter of the year. It is essential for employers to stay organized and compliant with tax laws, and the printable form provides a convenient option to do so.