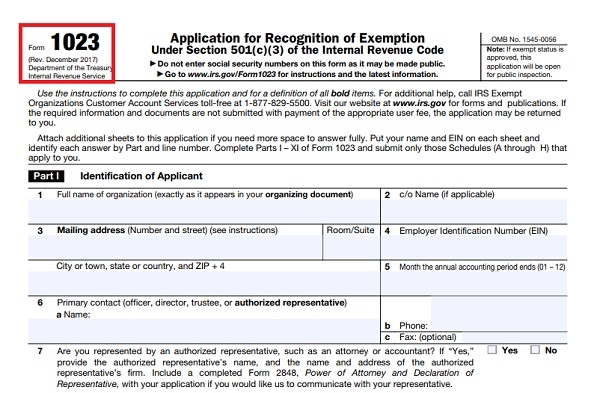

Applying for 501c3 status with the IRS can be a daunting task, but having the right resources can make the process much easier. One important document you will need is Form 1023, the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. This form is crucial for organizations seeking tax-exempt status, as it provides detailed information about the organization’s purpose, activities, and finances.

Form 1023 can be quite lengthy and complex, which is why having a printable PDF version can be incredibly helpful. With a printable PDF, you can easily fill out the form electronically or print it out and fill it in by hand. This can save you time and ensure that your application is neat and legible.

Irs 501c3 Application Form 1023 Printable Pdf

Irs 501c3 Application Form 1023 Printable Pdf

When filling out Form 1023, it’s important to carefully follow the instructions provided by the IRS. Be sure to provide all requested information and supporting documentation to avoid delays in the processing of your application. It’s also a good idea to consult with a tax professional or attorney to ensure that you are completing the form accurately and in compliance with IRS regulations.

Once you have completed Form 1023, you can submit it to the IRS along with the required fee. The IRS will review your application and may request additional information or clarification before granting tax-exempt status. It’s important to be patient during this process, as it can take several months for the IRS to make a determination.

Having a printable PDF version of Form 1023 can make the application process smoother and more efficient. By carefully completing the form and providing all necessary documentation, you can increase your chances of successfully obtaining 501c3 status for your organization. Remember to keep copies of all documents submitted to the IRS for your records.

Overall, Form 1023 is a critical document for organizations seeking tax-exempt status, and having a printable PDF version can simplify the application process. By following the instructions provided by the IRS and seeking assistance when needed, you can increase your chances of successfully obtaining 501c3 status for your organization.