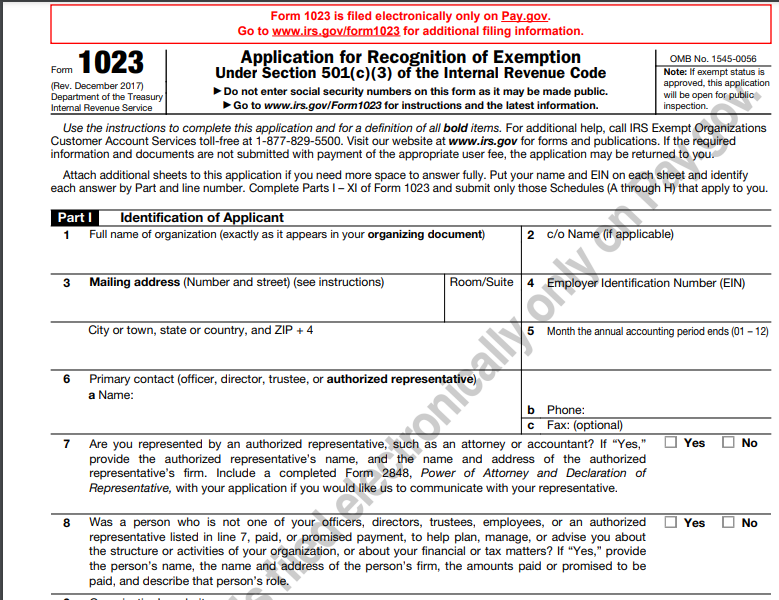

Applying for 501c3 status can be a lengthy and complex process, but having the right resources at your disposal can make it much easier. One important document you will need to complete is Form 1023, the application for recognition of exemption under section 501(c)(3) of the Internal Revenue Code. This form is essential for organizations seeking tax-exempt status from the IRS.

Form 1023 is a detailed document that requires information about your organization’s activities, finances, governance structure, and more. It is crucial to fill out this form accurately and completely to ensure that your application is processed efficiently.

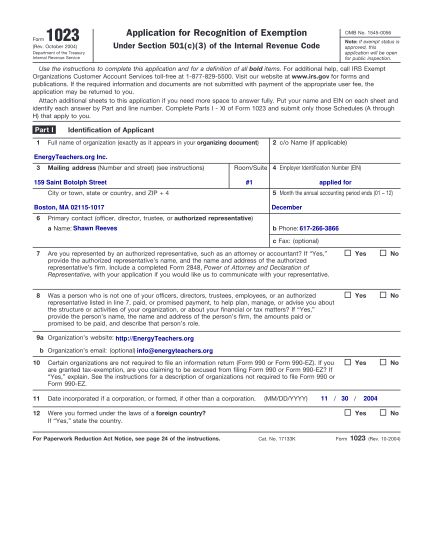

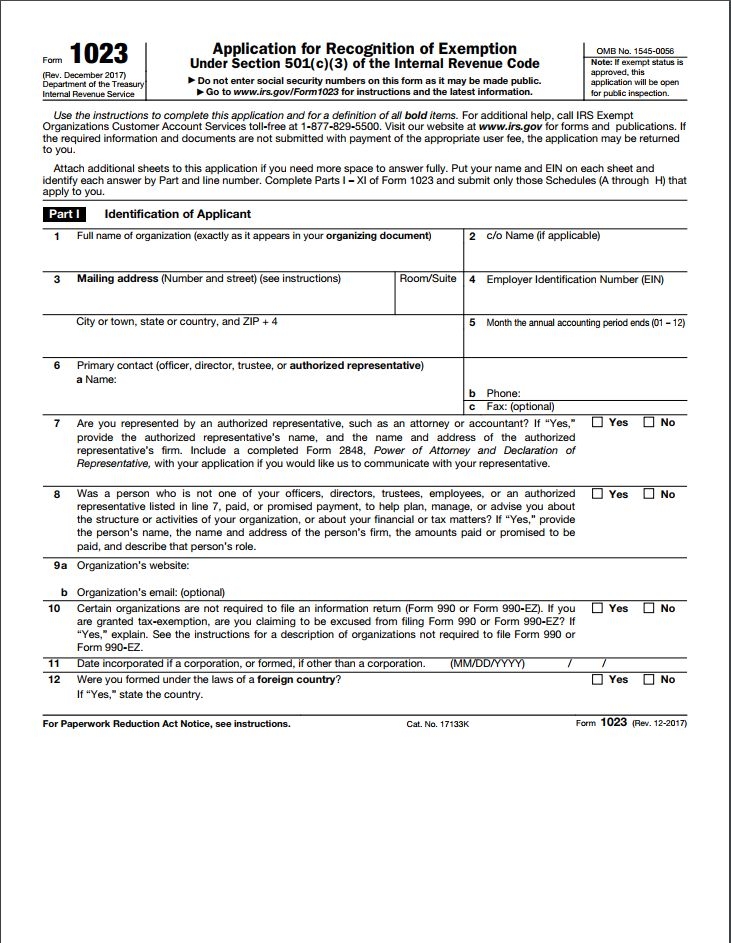

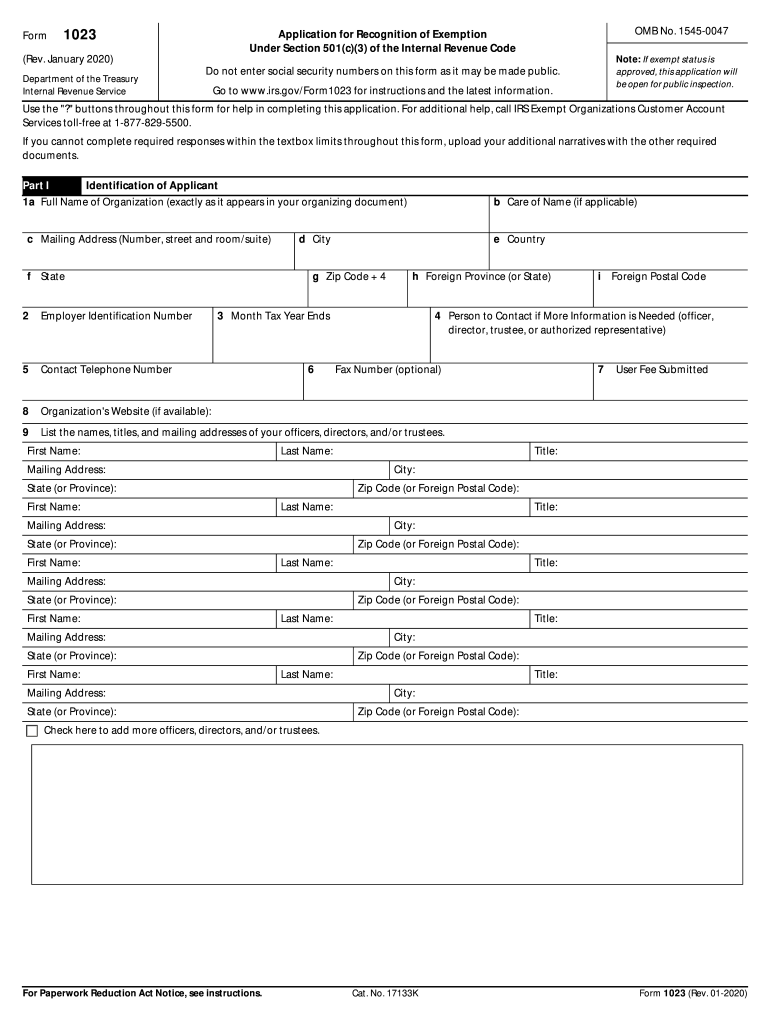

Irs 501c3 Application Form 1023 Printable

Irs 501c3 Application Form 1023 Printable

When applying for 501c3 status, it is important to have a printable version of Form 1023 on hand. This allows you to review the document, gather necessary information, and prepare your answers before submitting the application online or by mail. Having a printable version of the form can also serve as a helpful reference during the application process.

Before completing Form 1023, it is recommended to carefully review the instructions provided by the IRS. These instructions provide guidance on how to fill out each section of the form and what supporting documents may be required. By following the instructions closely, you can avoid delays in the application process and increase your chances of obtaining 501c3 status.

Once you have completed Form 1023, you can submit it to the IRS along with the required fee and any additional documentation requested. The IRS will review your application and determine whether your organization qualifies for tax-exempt status. If approved, you will receive a determination letter confirming your 501c3 status, allowing you to receive tax-deductible donations and other benefits.

In conclusion, having a printable version of IRS Form 1023 can be a valuable resource for organizations seeking 501c3 status. By carefully completing the form and following the instructions provided, you can streamline the application process and increase your chances of obtaining tax-exempt status from the IRS.

Download and Print Irs 501c3 Application Form 1023 Printable

Printable payroll are ideal for businesses that prefer paper documentation or need printed versions for staff files. Most forms include fields for staff name, date range, total earnings, taxes, and net pay—making them both detailed and easy to use.

Begin streamlining your payment tracking today with a trusted Irs 501c3 Application Form 1023 Printable. Reduce admin effort, reduce errors, and stay organized—all while keeping your financial logs professional.

Fillable Form 1023 Application For 501 C 3 Exemption

Fillable Form 1023 Application For 501 C 3 Exemption

2020 2025 Form IRS 1023 Fill Online Printable Fillable Blank PdfFiller

2020 2025 Form IRS 1023 Fill Online Printable Fillable Blank PdfFiller

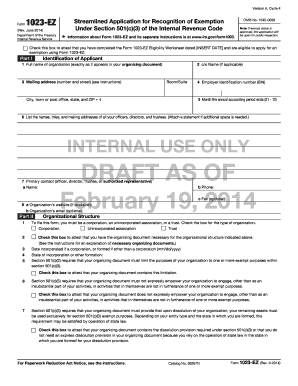

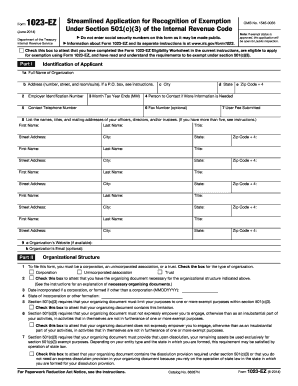

Form 1023 EZ Rev June 2014 Internal Revenue Code 501c3 Streamline

Form 1023 EZ Rev June 2014 Internal Revenue Code 501c3 Streamline

IRS Form 1023 Application For Recognition Of Exemption Under Section

IRS Form 1023 Application For Recognition Of Exemption Under Section

Irs Form 1023 Ez Templates Fillable Printable Samples For PDF Word

Irs Form 1023 Ez Templates Fillable Printable Samples For PDF Word

Handling staff wages doesn’t have to be difficult. A printable payroll form offers a speedy, reliable, and user-friendly method for tracking salaries, shifts, and withholdings—without the need for complicated tools.

Whether you’re a small business owner, administrator, or sole proprietor, using aprintable payroll helps ensure proper documentation. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.