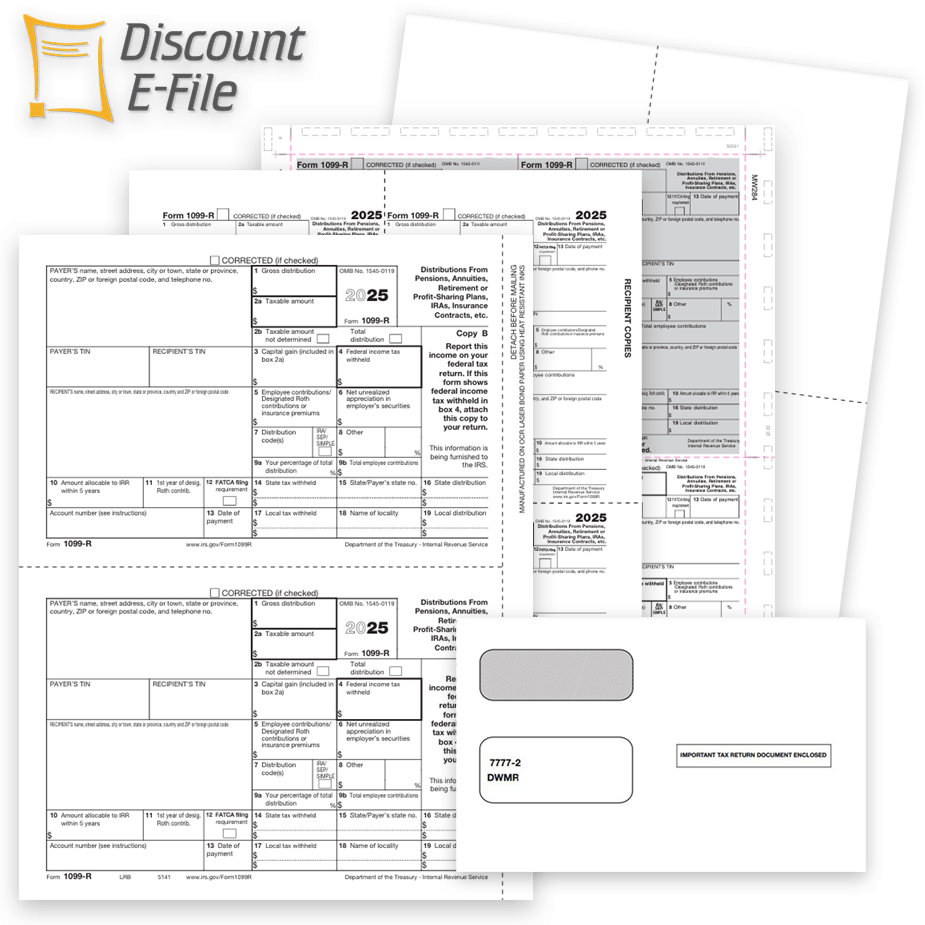

The IRS 2025 printable tax forms are a convenient way for taxpayers to file their taxes without the need for specialized software or online services. These forms can be easily accessed and printed from the IRS website, making the tax filing process simpler and more accessible for all taxpayers.

With the IRS 2025 printable tax forms, individuals can easily fill out their tax information and submit it to the IRS by mail or in person. These forms are designed to be user-friendly and include clear instructions for each section, making it easier for taxpayers to accurately report their income, deductions, and credits.

One of the advantages of using the IRS 2025 printable tax forms is that they are updated annually to reflect any changes in tax laws or regulations. This ensures that taxpayers are using the most current forms and are in compliance with the latest tax requirements.

Additionally, the IRS 2025 printable tax forms are available in both PDF and fillable formats, allowing taxpayers to choose the option that works best for them. The PDF forms can be printed and completed by hand, while the fillable forms can be completed online and then printed for submission.

Overall, the IRS 2025 printable tax forms provide a convenient and accessible option for taxpayers to file their taxes accurately and on time. By utilizing these forms, individuals can simplify the tax filing process and ensure that they are meeting their tax obligations in a timely manner.

In conclusion, the IRS 2025 printable tax forms offer taxpayers a user-friendly and updated option for filing their taxes. By utilizing these forms, individuals can easily report their tax information and submit it to the IRS without the need for specialized software or online services. This makes the tax filing process more accessible and convenient for all taxpayers.