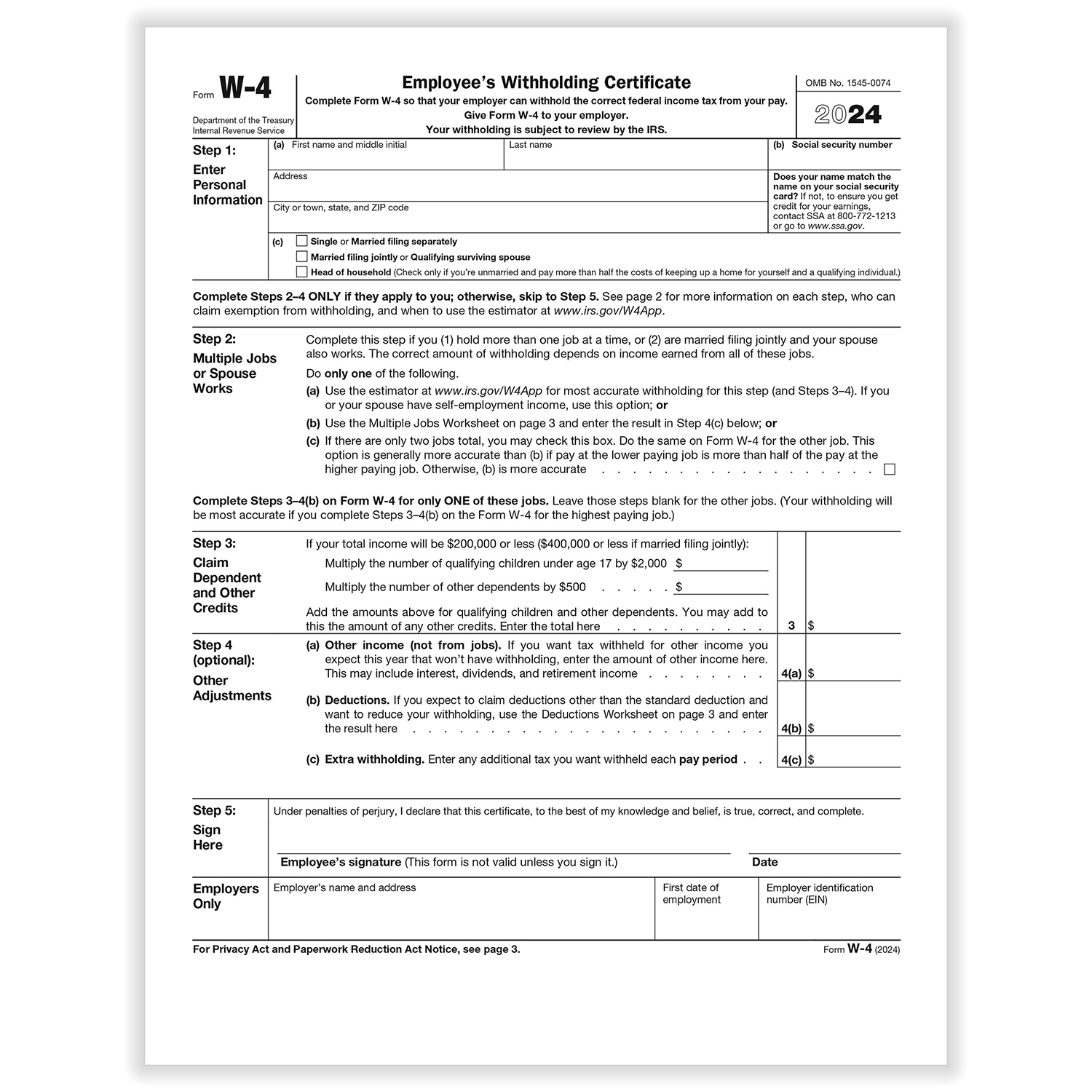

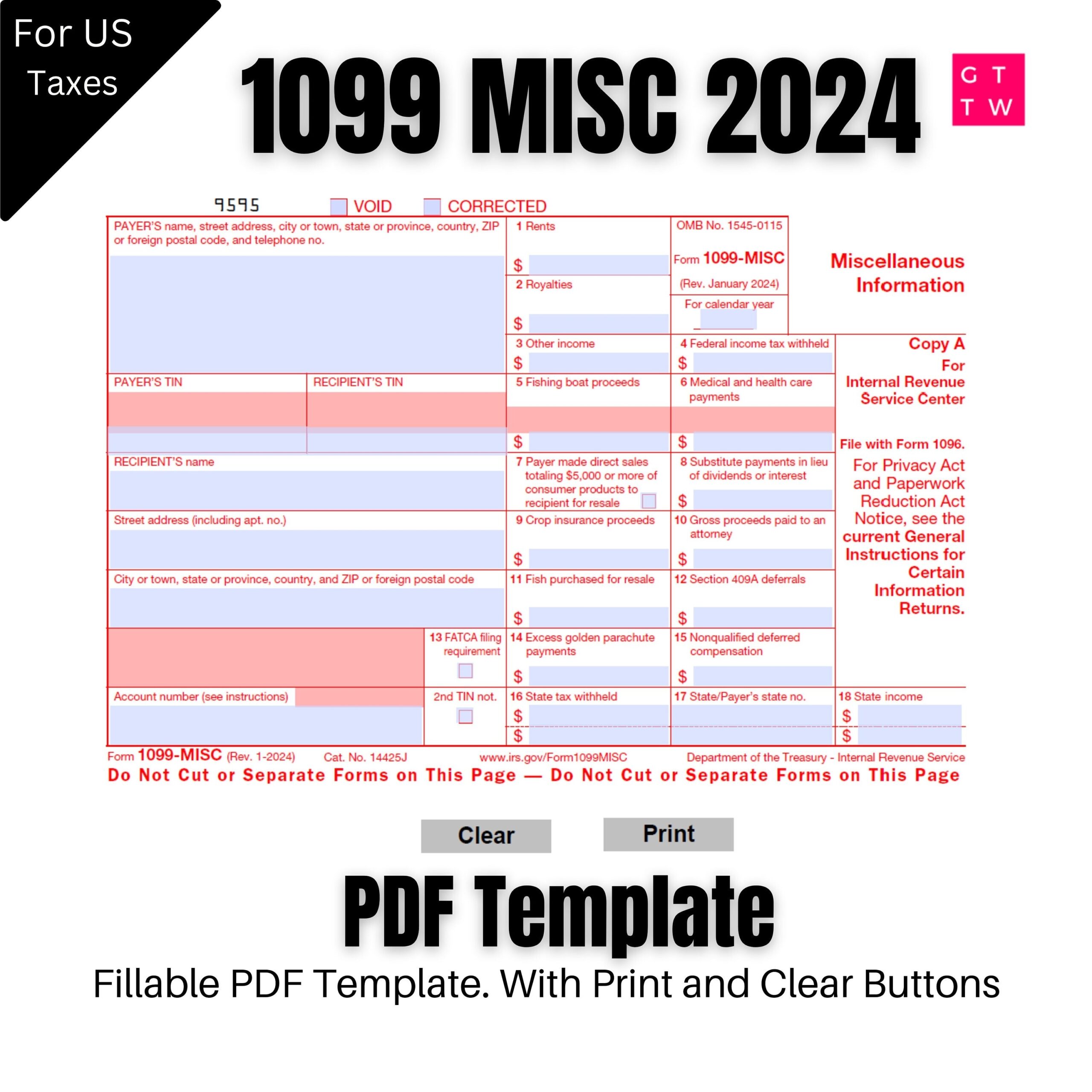

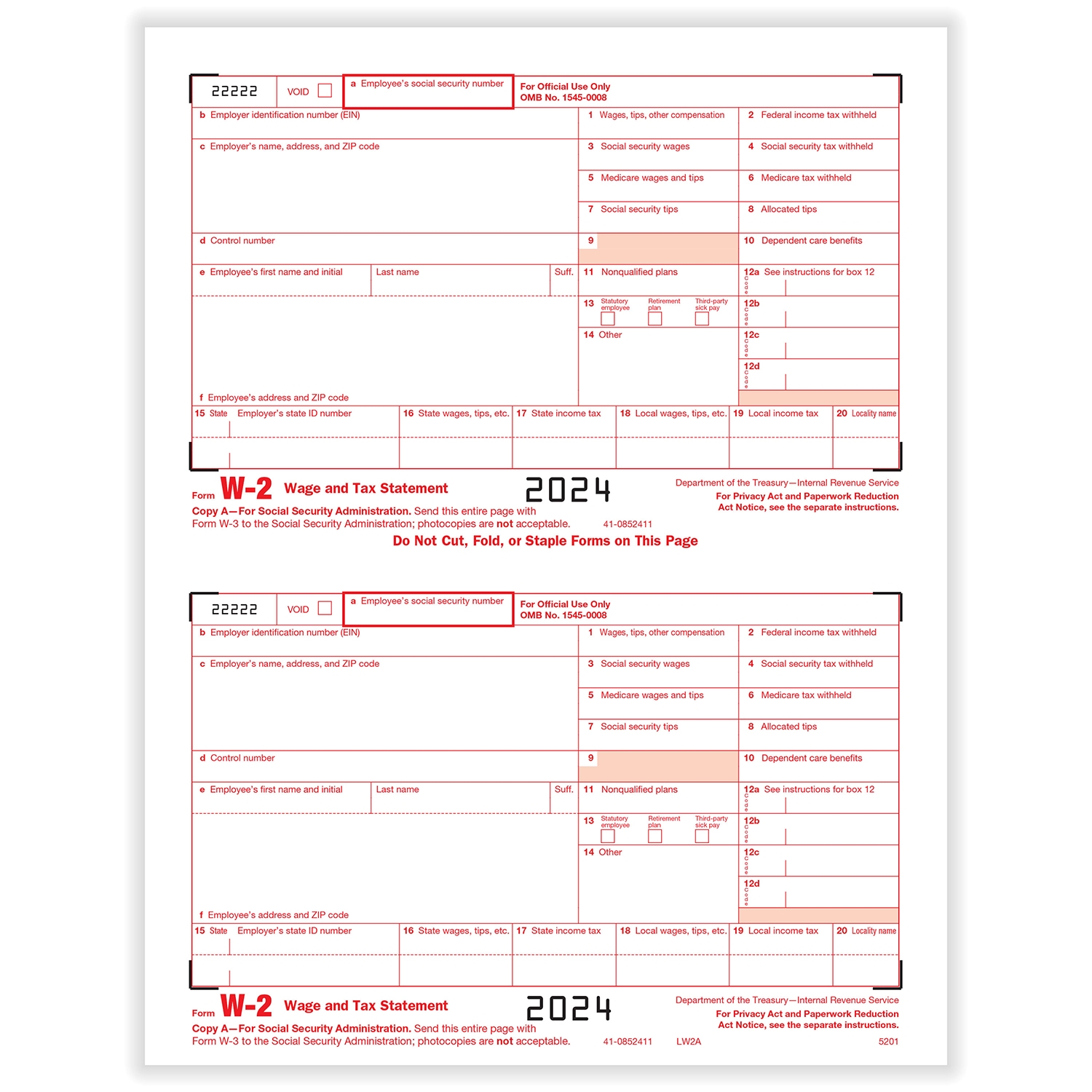

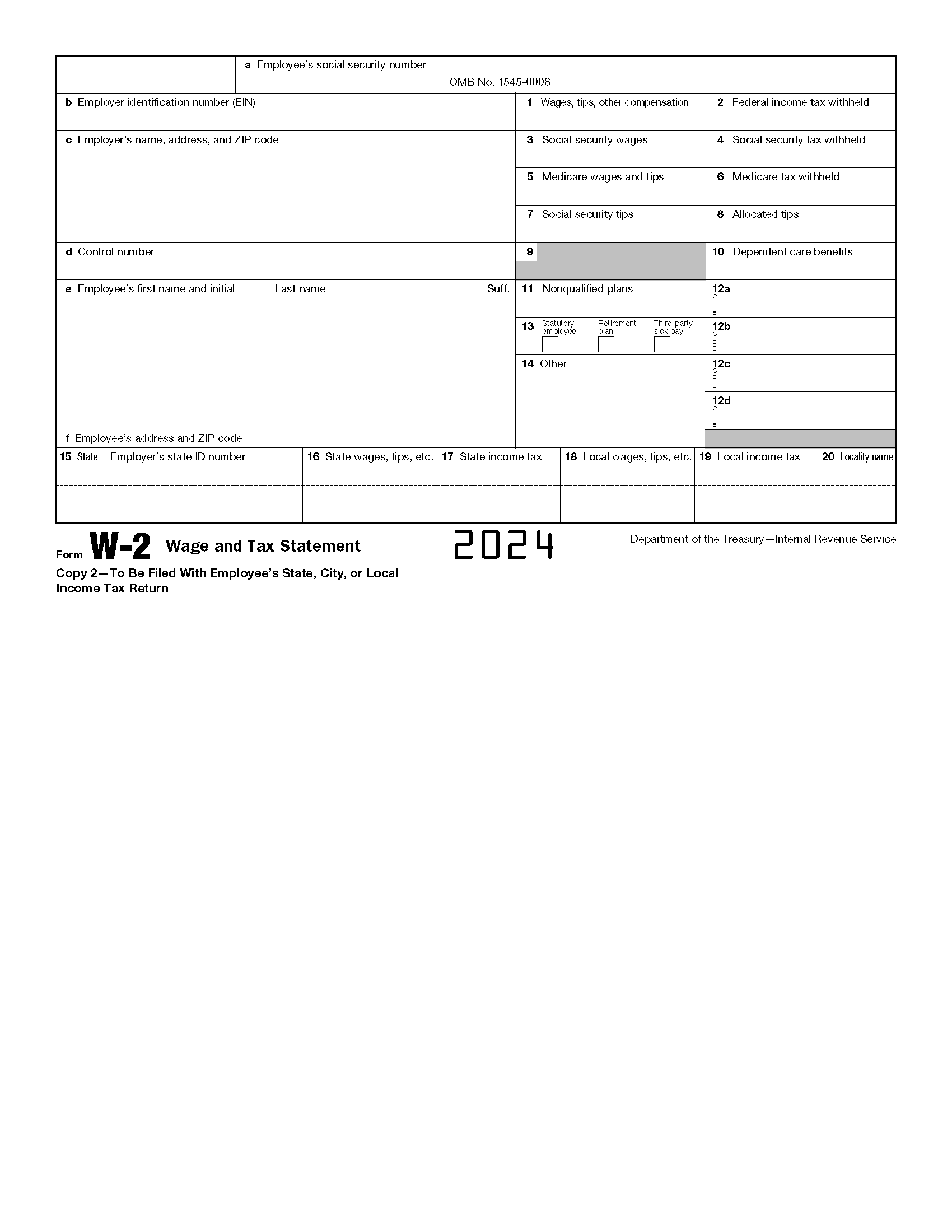

As tax season approaches, many individuals and businesses are beginning to gather their financial information in order to file their taxes with the IRS. One important aspect of this process is obtaining the necessary forms to report income, deductions, and other financial information. The IRS 2024 forms are essential documents that taxpayers will need to complete in order to accurately file their taxes for the year.

Fortunately, the IRS provides printable versions of these forms on their website, making it easy for taxpayers to access and fill out the necessary paperwork. The IRS 2024 forms cover a variety of tax-related topics, including income tax, deductions, credits, and more. These forms are designed to collect all of the information needed to calculate an individual or business’s tax liability for the year.

When using the IRS 2024 forms, it is important to carefully review each form and follow the instructions provided. It is crucial to accurately report all income, deductions, and credits in order to avoid any potential errors or discrepancies that could result in penalties or audits from the IRS. By utilizing the printable forms provided by the IRS, taxpayers can ensure that they are completing their taxes correctly and efficiently.

In addition to the printable forms, the IRS website also offers resources and guidance to help taxpayers navigate the tax filing process. This includes information on tax deadlines, filing requirements, and tips for maximizing deductions and credits. Taxpayers can also access online tools and calculators to help them estimate their tax liability and ensure they are maximizing their tax savings.

Overall, the IRS 2024 forms printable are an essential tool for taxpayers to accurately report their financial information and file their taxes with the IRS. By utilizing these forms and following the instructions provided, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential penalties or audits. As tax season approaches, be sure to visit the IRS website to access the necessary forms and resources to help you file your taxes successfully.

In conclusion, the IRS 2024 forms printable are a valuable resource for taxpayers to accurately report their financial information and file their taxes with the IRS. By utilizing these forms and following the instructions provided, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential penalties or audits. Make sure to visit the IRS website to access the necessary forms and resources to help you file your taxes successfully.

Get and Print Irs 2024 Forms Printable

Payroll printable are ideal for companies that prefer paper documentation or need hard copies for audit purposes. Most forms include fields for employee name, date range, gross pay, taxes, and net pay—making them both complete and practical.

Take control of your payment tracking today with a trusted printable payroll template. Save time, reduce errors, and maintain clear records—all while keeping your financial logs clear.

1096 Form 2024 2024 1099 INT Tax Forms Kit 25 Pack IRS Approved With Self Seal Envelopes Works With QuickBooks 1099 Forms 2023

1096 Form 2024 2024 1099 INT Tax Forms Kit 25 Pack IRS Approved With Self Seal Envelopes Works With QuickBooks 1099 Forms 2023

W 2 Forms 2 Up Copy A Formstax

W 2 Forms 2 Up Copy A Formstax

Free IRS Form W 2 Wage And Tax Statement PDF EForms

Free IRS Form W 2 Wage And Tax Statement PDF EForms

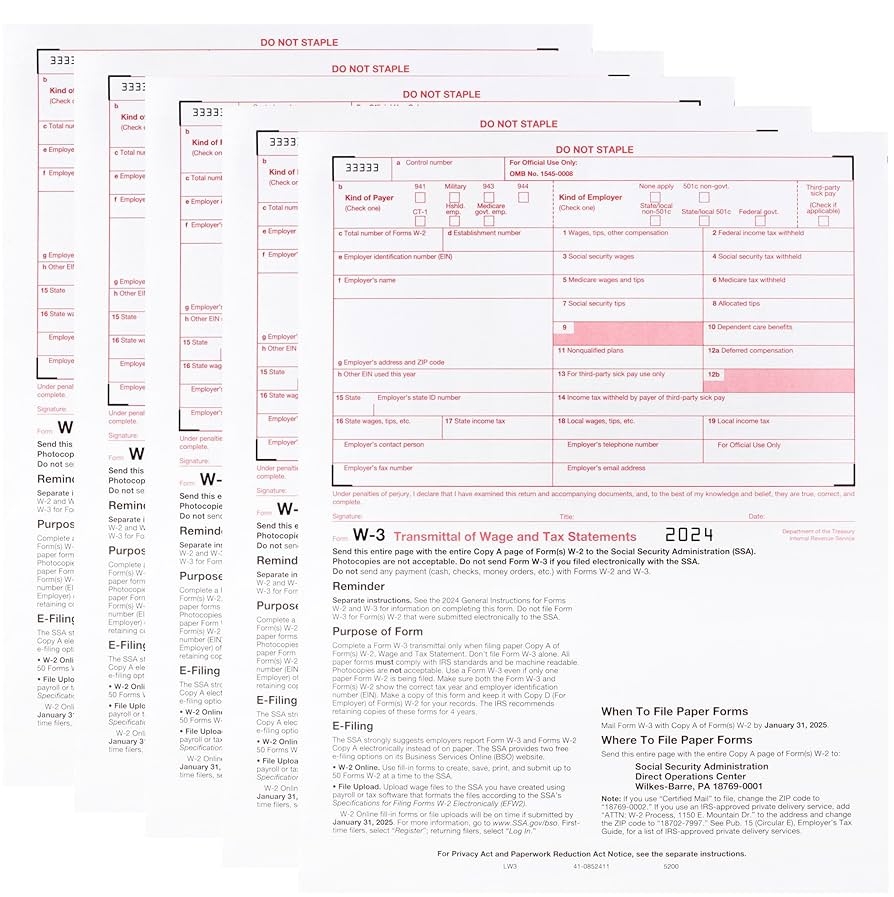

Free Printable 2024 W 3 Transmittal Forms Pack Of 10 IRS Approved Laser Forms For W 2 Submission Irs Forms 2024

Free Printable 2024 W 3 Transmittal Forms Pack Of 10 IRS Approved Laser Forms For W 2 Submission Irs Forms 2024

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Handling staff wages doesn’t have to be complicated. A payroll template offers a speedy, accurate, and straightforward method for tracking salaries, hours, and deductions—without the need for complicated tools.

Whether you’re a freelancer, HR professional, or independent contractor, using apayroll printable helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.