When tax season rolls around, it’s important for individuals and businesses to have all the necessary forms in order to accurately report their income to the IRS. One such form that is commonly used is the IRS 1099 Printable Form. This form is used to report various types of income, such as freelance work, rental income, and interest earned on investments.

For those who receive income that is not reported on a W-2 form, the 1099 form is essential for accurately reporting this income to the IRS. It is important to fill out this form correctly to avoid any penalties or audits from the IRS. Luckily, the IRS provides a printable version of the 1099 form for individuals and businesses to easily access and fill out.

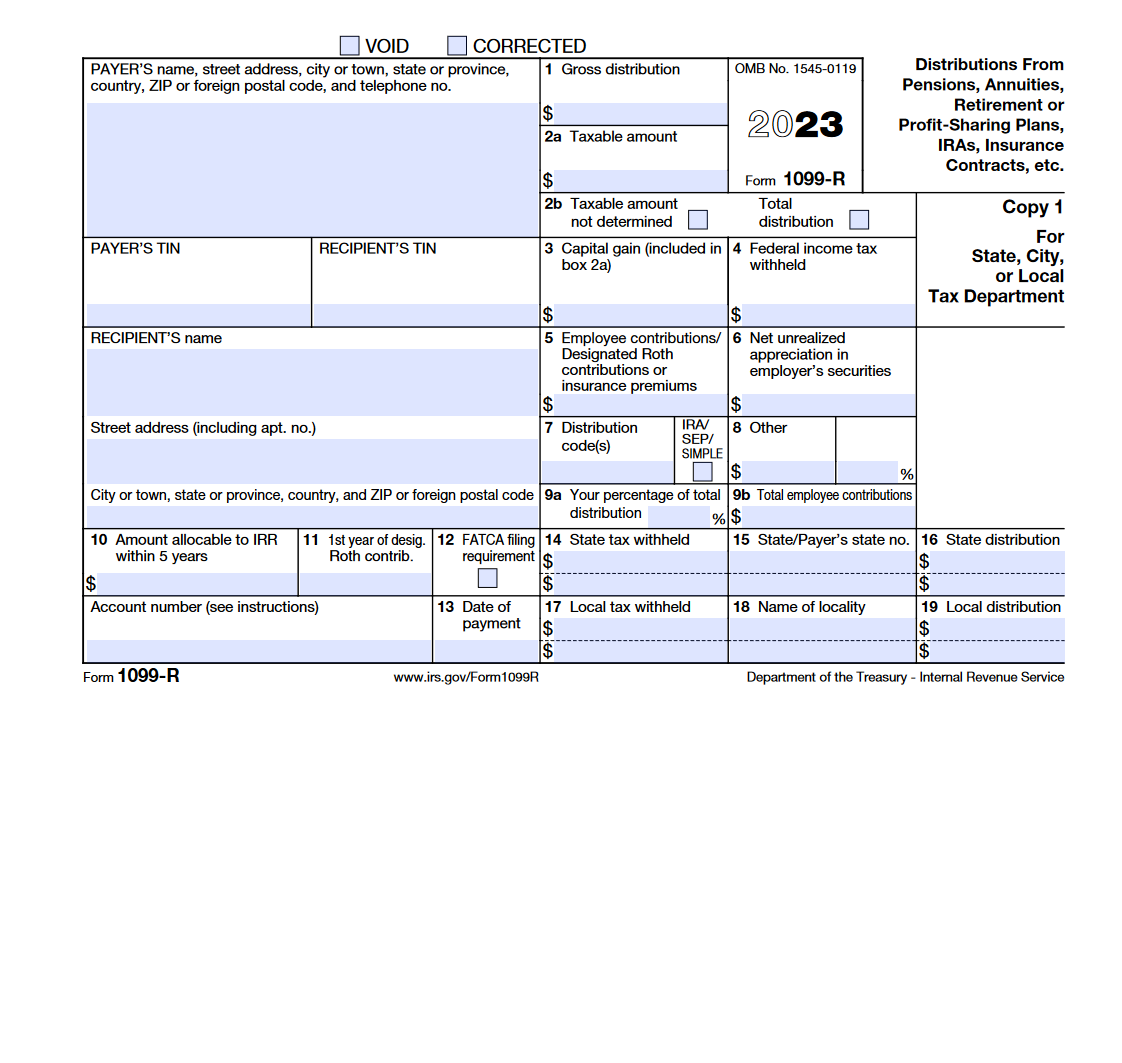

IRS 1099 Printable Form

When filling out the IRS 1099 Printable Form, individuals and businesses will need to provide information such as their name, address, and social security number. They will also need to report the type of income they are reporting, as well as the amount earned. The form is relatively straightforward and can be easily filled out with the necessary information.

It is important to note that there are different types of 1099 forms, such as the 1099-MISC for miscellaneous income, the 1099-INT for interest income, and the 1099-DIV for dividend income. Individuals and businesses will need to use the appropriate form depending on the type of income they are reporting to the IRS.

Once the form is filled out, individuals and businesses can either submit it electronically or mail it to the IRS. It is important to keep a copy of the form for your records in case of any discrepancies or audits in the future. By accurately reporting your income with the IRS 1099 Printable Form, you can ensure that you are in compliance with tax laws and avoid any potential penalties.

In conclusion, the IRS 1099 Printable Form is a crucial tool for individuals and businesses to accurately report their income to the IRS. By providing all the necessary information and using the appropriate form, you can ensure that you are in compliance with tax laws and avoid any potential penalties. Make sure to access the printable form from the IRS website and fill it out correctly to make tax season a breeze!